This series of articles focuses on blowing up this stereotype by demonstrating how Finance in general...

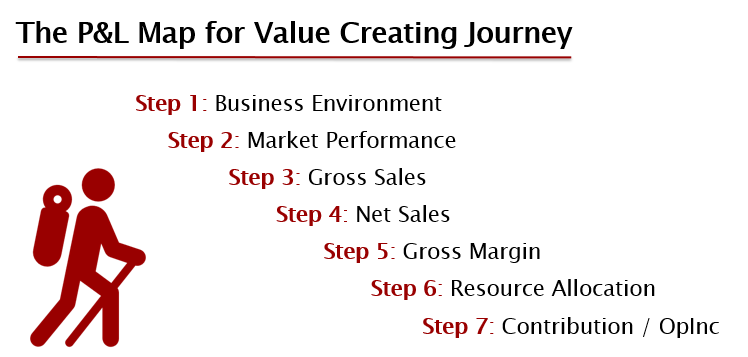

“The “P&L Management: from Bean Counting to Value-Creating” article series focuses on demonstrating how Finance can shed light on the most important business drivers, revive, revitalize figures and make them tell a story, creating value for a company. Using P&L as a map for the journey (see picture below) the first article explored two first steps as pre-P&L analysis, and now we are ready to dive into financial waters.

“The “P&L Management: from Bean Counting to Value-Creating” article series focuses on demonstrating how Finance can shed light on the most important business drivers, revive, revitalize figures and make them tell a story, creating value for a company. Using P&L as a map for the journey (see picture below) the first article explored two first steps as pre-P&L analysis, and now we are ready to dive into financial waters.

Considering the first key performance indicator (KPI) of managerial reporting, Gross Sales, it is instrumental to split it into two components:

The Volume of sold goods (that we discuss later in the article devoted to Resource Allocation)

The Price (that will be discussed in this article).

Image 1. The P&L Map for value-creating journey

Pricing as a Derivative of Strategy

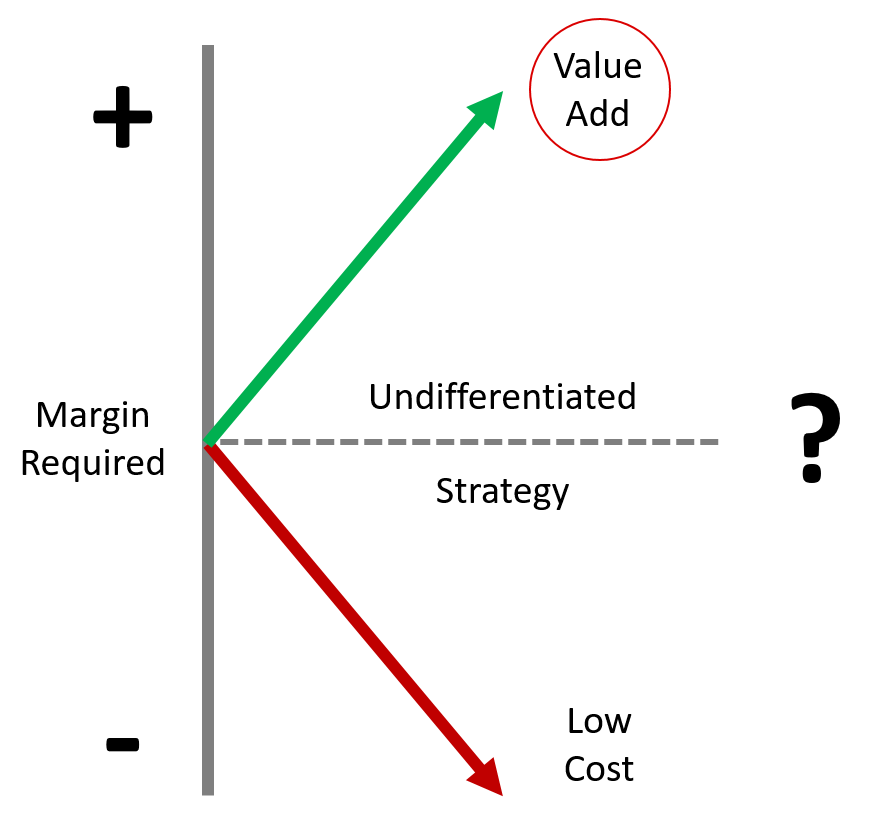

Taking Porter’s theory on Competitive advantage as a starting point (Porter, 1998), a company can consider price either to be defined by the market and focus mostly on cost leadership to secure its margins or price as a variable that reflects product value.

In the latter case, Porter argues that the company should choose a strategy focused on Differentiation, striving for adding value to consumers. It doesn’t mean that by choosing one strategy a company can forget about the other component, e.g. sticking to Differentiation, and neglecting the costs. It is rather about being consistent whenever the company is making strategic choices. When pursuing a Differentiation strategy, the company can’t compromise product value, even when it is engaged in cost reduction initiatives.

Image 2. Two strategies to drive profitability: to grow value or to reduce cost

Hexal Case Study: Finding a Solution between Differentiation and Focus on Cost

One of the antibiotics for children of Hexal, Germany had colourful packaging showing funny bacteria with perforated contour. Taking a medicine a child “killed” one bacterium by making a hole in the packaging with a pencil. In addition, the medicine has a convenient dosage device, which allowed preparing a precise dose of medicine.

All these features increased the value for consumers and underlined the image of Hexal as a quality producer that takes care of its customers. When Germany introduced a tender system for medicine, the competition unfolded around price and companies with a lower cost of production got an edge. In other words, what a competitive advantage of Hexal product was turned out to be a disadvantage as the cost of attractive packaging was higher than of competitor’s products. In order to address this challenge, Hexal kept pursuing a modified differentiation strategy, but span off a new company to compete on price.

Value-Based Pricing

Having committed to the strategy of Differentiation, the next challenge is to estimate product value for the customer, expressed in their willingness to pay, and measured by the price. A company can accept one of the three typical price-setting methods:

Cost-plus pricing is the simplest one but done from the internal perspective and hence ignores the market.

Competition-oriented pricing corrects the previous method’s drawback. However, in this case, the company “delegates” one of the most important decisions to its rivals.

Value-based pricing shifts the focus on the customer. It is the most challenging, but potentially the most rewarding price-setting method.

The reward of applying a value-based approach can be manifold:

A better understanding of what customers value and how they make a product choice.

A clear picture of the advantages and drawbacks of your own product versus competition from the customer perspective.

Accumulated expertise on critical success factors should not only be left within the marketing department but saturate the work of all parts of the organization and form their objectives. E.g., getting an insight that an online customer values on-time delivery over its speed, the Supply Chain department should strive for excellence on deliveries in the agreed timeframe rather than put all efforts into reducing the time between purchase and delivery.

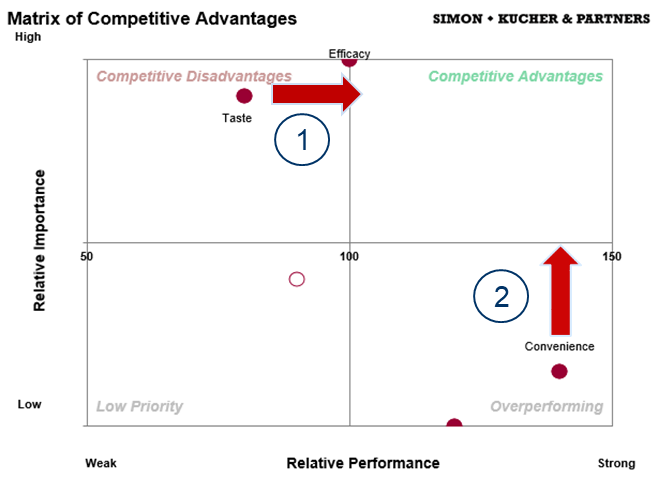

Although most of the insights on product value come from market research, it is worth using a systematic way to structure this information in order to measure the product value and here Finance can play an important role. An example of such a structured approach can be demonstrated with help of a tool that allows comparing competing products from the customer perspective (e.g., for OTC products in the example below). First, factors affecting consumer choice (efficacy, taste and convenience) are graded by their importance in the consumer's eyes. Then both the company’s product and its rivals are measured on these factors (see image 3). The taste of the product is quite important for the customer (scoring second after efficacy), but the company’s product lags behind its main competitor. On the other hand, the product is more convenient in application than competing analogues, but it is not understood and appreciated by consumers. Hence, the company can either work on improving the product taste or focus on communicating to consumers the importance of factors where it already has an edge (convenience).

Image 3. An example of weighing the company’s product attributes from the consumer perspective

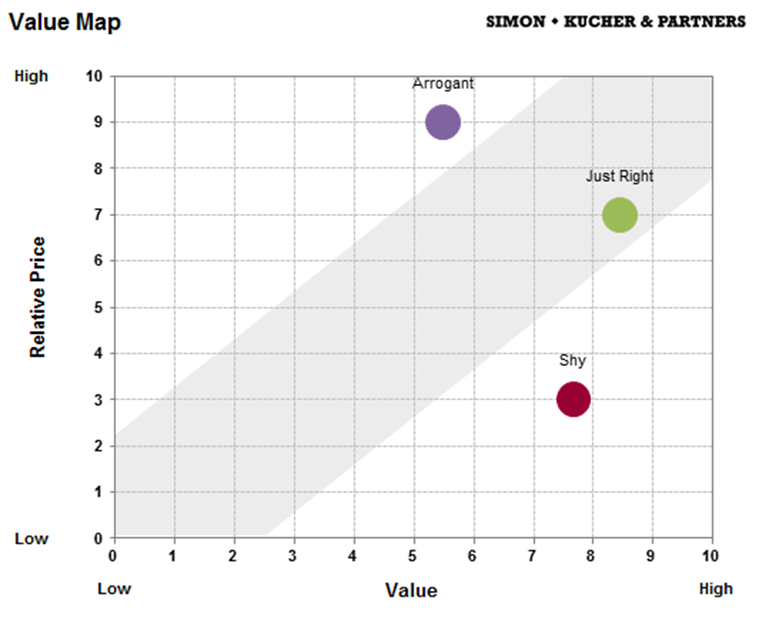

Having understood the product value (a sum of multiplications of product’s score on each factor by its importance), a company can further “weigh it” by comparing the value with the price and analyze its value-price proposition versus competition in the Value Map view of the tool (see image 4 below). In the coordinate system “Relative price - Value”, a product can be located in three positions vs. competition:

Balance corridor: price and value are balanced, e.g. a high value corresponds to a high price (product “Just Right”)

Overpriced: price is too high for a product with relatively low value (“Arrogant”)

Underpriced: product value is higher than its price (“Shy”).

Image 4. An outcome of value-price comparison of competing products from the consumer perspective.

Although position 3 looks ideal, it is not always the case, as a price is also an attribute of value. For example, Mercedes offered at the price of Hyundai not only would look suspicious but would also lose some of its image and perceived value. Dan Ariely describes a case when patients were treated with the same placebo tablet but taken from two bowls with different price tags explicitly presented. Patients who received a “more expensive” tablet reported a two times stronger effect compared to those who got a “cheaper” treatment [Ariely, 2010].

On the other hand, if carefully thought through and correctly communicated to consumers, the strategy where perceived product value is higher than the set price is a direct way to success. For example, Lee Iacocca [Iacocca Novak, 1986] gives an example of an application of this strategy, when Ford launched its first Mustang model. According to a marketing research, consumers perceived the car to be 1,000 dollars more expensive than its set price. The company resisted the temptation to increase the price, and the car became a legend.

Conclusion

All in all, Price is a strong lever of the company performance, which is often underestimated. Having mastered price management skills, the company gets a strong boost not only on top but also and mainly on the bottom line.

However, more important is the focus of all departments on value creation for customers. Finance can organize and systemize information on perceived value and hence actively contribute to strategy development. If a company succeeds in its efforts and delivers the highest customer value keeping its cost under control, it will get a strong competitive edge.

In the next article, we will stay with the current topic and look at how price can be managed in the industries where a value-based pricing approach is not applicable.

Bibliography

Ariely, D. (2010). Predictably Irrational: The Hidden Forces That Shape Our Decisions. New York: HarperCollins Publishers.

Iacocca, L., & Novak, W. J. (1986). Iacocca: An Autobiography. Bantam.

Porter, M. E. (1998). Competitive Advantage: Creating and Sustaining Superior Performance. Free Press.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.