P&L management focuses on the items included into P&L (profit and loss) report. It has become...

This article is part of the "P&L Management: from Bean Counting to Creating Value" series.

This article is part of the "P&L Management: from Bean Counting to Creating Value" series.

In this article, we will stay with the price and look at another example of how it could be successfully controlled. Price management is a very sensitive and complicated topic touching multiple business aspects including ethics. The ethic guidance can be taken from Peter Drucker, who warned against the abuses of market power, but stated in The Wall Street Journal in 1975: “It is not the business that earns a profit adequate to its genuine costs of capital, to the risks of tomorrow and to the needs of tomorrow’s worker and pensioner, that ‘rip off’ society. It is the business that fails to do so.”

In the fight for a fair price, it is difficult to avoid a negative experience, and one should be prepared to take significant risks up to losing business with some customers. This reveals one of the cornerstones of price management: you cannot take bold pricing decisions without a deep understanding of your business. Let’s consider the following example (Simon, 2015) to clarify what stands behind this phrase.

From business understanding to smart pricing: the BahnCard

The German railway corporation Deutsche Bahn (DB) was losing customers who preferred to drive a car as a cheaper alternative. A solution came from an insight that when drivers compare the cost for rail and car travel, they tend to consider only the cost of gasoline and ignore the car’s fixed cost (e.g., depreciation, insurance, service). As a response to this issue, the BahnCard was born.

Whoever had the card could purchase tickets at a discount of 50% off the regular price. Instead of one single price for a train trip, the price now had two components: the price for the ticket (variable) and the price of the BahnCard (fixed).

The card became an immediate hit. Within four months, DB had sold over one million cards, and the number reached four million in several years. Similar to a car, a customer made an investment (bear fixed costs) just once in a period and then used it paying only discounted price, which was lower than fuel cost. The card introduction allowed DB to not only reveal the hidden cost of cars and hence, to nudge customers to make a fair comparison, but also increased loyalty of customers driven by their desire to get maximum value from their investment.

Exploring the price drivers specific to your business

After getting into the guts of your business, you can start exploring price drivers. The next example is taken from the B2B environment, where the price is agreed in negotiations between parties and centralized price management becomes a challenging task. Sales managers in such a market often focus on closing a deal by all means and tend to provide deep discounts to win over the competition. Under these circumstances, Finance can take initiative and lead the effort to keep business profitability in focus.

In a B2B division of one big pharmaceutical company, it was done by initiating a project with an objective to ensure sustainable business profitability and create a coherent approach for deal pricing. The ownership of the project was within the company (I believe it should always be), but it was decided to involve consultants to draw on their expertise and add legitimacy to a new solution.

Having started with an explicit depiction of overall forces prevailing in the industry, the project team then searched for factors that determine the outcome of negotiations with a customer and identified four main drivers:

Negotiation skills of salespeople.

Degree of preparedness to the negotiations, which includes an understanding of the current market and future price expectation, a role of the company’s product in the customer’s value chain as well as getting known a counterpart of the future negotiations, their alternatives and interests.

Price guidance (going-in, target, and walk-away prices) and incentives of salespeople to follow the guidance.

Insecurity of salespeople in tough pricing negotiations due to their fear to lose a customer.

Building a sustainable solution

Having identified these issues, the project team came up with a plan for how to address them. One of the steps was to organize a negotiation training. The training equipped salespeople not only with a technique to overcome ‘roadblocks’ on their way to the desired result but also allowed them to understand the psychology of bargaining like price anchoring.

Forcing people to prepare for negotiations was critical for deal success. Therefore, this part was divided into two:

a solution for simple and less important deals

a solution for complicated and important deals.

For simple and less important deals, the company developed a tool integrated into their CRM system. The tool ‘askes’ a sales manager for input parameters of each deal, which forces the manager to collect all relevant market and customer information. Based on these parameters and historical data, the tool calculates an unadjusted goal price. The price adjustment is done based on the market price trend information, which comes from product managers.

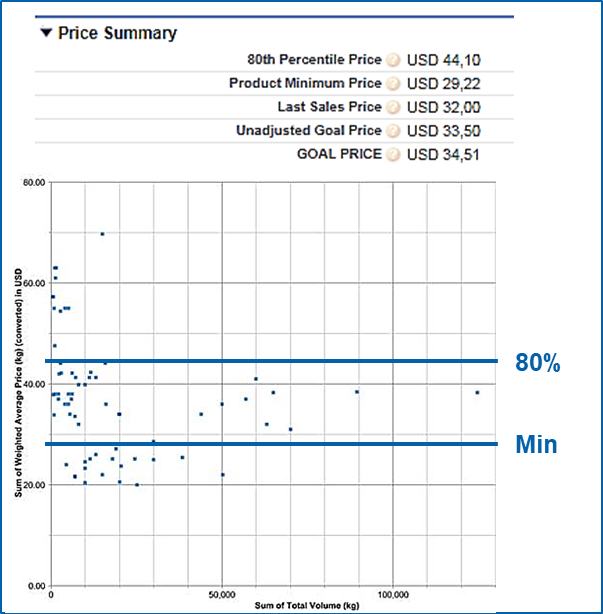

An example of a pricing tool with coordinates selling volume (kg) vs. price (USD)

The example above presents the outcome of the tool application. For each price group, the tool calculates a minimum price and 80th percentile point (calculated dynamically based on historical data) in order to find out in which range a price for a new deal gets:

Below minimum price

Between min price and 80th percentile

Above 80th percentile

A different algorithm for price recommendation is triggered depending on the range of the initially calculated deal price. E.g., the tool won’t recommend a price below a minimum one, but a sales manager can overrule the recommendation and go with such a price providing a proper justification and getting management approval.

As a result of implementing such a tool, a company gets threefold benefits:

The tool forces salespeople to prepare for each deal by collecting relevant market and customer information.

It promotes self-benchmarking as price comparison is graphically presented and sales managers can compare their own results with similar deals done by their peers.

The company receives metrics to evaluate salespeople skills to achieve the Goal price.

When products are less similar and differ by several attributes, the attribute-based pricing method was used to expand a comparison base by including products with different attributes into one price pool. E.g., the price for a pack size of 10 can be included in a price pool for a pack size 20. The price for pack 10 is multiplied by two and adjusted by applying a volume discount (recommended in the range of 10-20%). This adjusted price can be used to increase a comparison pool of a pack size 20.

For complicated and important deals, the company looked for ways to boost the confidence of salesmen in negotiations and ensure their high preparedness level. It was done via a new procedure that was called the Deal Decision Board.

At the Board, a salesperson has to present a deal, its objectives, and a strategy to achieve them. The Board consists of key members of the leadership team with a task to challenge presenters, check their preparedness, and then share responsibility for each decision. The Board has been operating for more than 3 years and has demonstrated its robustness and effectiveness. It became not only a means to prepare salespeople for tough negotiations and boost their confidence, but also a platform to share the best practice and to train newcomers.

The benefit of such a project lasts several years because the application of tools and procedures on a regular basis not only improves the skills, motivation, and confidence of sales managers but also changes the mindset of the organization. As a result, this B2B division has never had a problem achieving profit targets for the next three years after the project closure steadily improving business profitability.

Conclusion

Summing up, in the industries where a price is determined by the market or agreed in negotiations between parties, price management is a challenging task. Finance can lead the effort to keep business profitability in focus by initiating a project to develop a coherent approach to guide sales organization. A help from consultants can be useful as they provide not only expertise and fresh ideas, but also add legitimacy to a developed solution. The work starts with a deep dive into the business in order to understand price drivers. Having obtained this information, a project team can come up with a plan on how to address issues that hinder the organization to achieve a fair price. Implementation and use of pricing tools and procedures can produce results that last over years steadily improving business profitability.

In the next article, we will look deeper into business marginality and how finance can strive to improve it.

Bibliography

Simon, H. (2015). Confessions of the Pricing Man. Springer.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.