This article summarises the most interesting insights from a webinar exploring the winning formula for FP&A storytelling...

Storytelling with data has emerged as a critical skill that sets apart future Financial Planning and Analysis (FP&A) professionals. In an era of advanced analytics, dynamic dashboards, and impactful data visualisation, FP&A Storytelling has transformed into a blend of art and science. However, mastering this skill requires more than technical expertise. Inspired by Aristotle's modes of persuasion — Ethos, Logos, Pathos, and Kairos we will embark on an exciting journey and, together with our panellists, uncover the mystery beyond FP&A Storytelling.

Storytelling with data has emerged as a critical skill that sets apart future Financial Planning and Analysis (FP&A) professionals. In an era of advanced analytics, dynamic dashboards, and impactful data visualisation, FP&A Storytelling has transformed into a blend of art and science. However, mastering this skill requires more than technical expertise. Inspired by Aristotle's modes of persuasion — Ethos, Logos, Pathos, and Kairos we will embark on an exciting journey and, together with our panellists, uncover the mystery beyond FP&A Storytelling.

The Digital Middle Eastern FP&A Circle has attempted to answer key questions related to FP&A Storytelling.

This article provides an overview of the topics and cases presented and discussed by the expert panellists in the "Mastering the Art and Science of FP&A Storytelling" webinar, along with the results of our polling questions.

How Do We Approach Finding a Story in Business Data?

Most webinar audiences (35%) talk with relevant stakeholders only after seeing the issue. While another large portion of the audience (27%) analyses data breakdowns to locate the issue, 20% of the respondents proactively consult with stakeholders to foresee problems, and a remarkable 18% of the participants use driver-based monitoring tools to find root causes.

Figure 1

Story Goes First

In his presentation, Markus Pinter, Global Project Lead at Novartis, highlighted the significance of Storytelling in Financial Planning and Analysis (FP&A). Drawing from his personal experience, he emphasised how Storytelling can effectively communicate complex financial information in a relatable manner.

Markus stressed the importance of evoking emotions through Storytelling, as it helps bring financial facts and figures to life. By going beyond mere explanations of deviations or financial data, stories can provide a deeper understanding of the underlying reasons behind fluctuations. This approach is precious when presenting to senior management, as it helps them connect emotionally with the information presented.

However, Markus also acknowledged the potential disadvantages of Storytelling. If the story lacks excitement or becomes too lengthy, it can lead to passive audience participation or monotony. He suggested keeping stories simple and concise to overcome these challenges, following the rule of three to enhance memorability. Additionally, he recommended applying the 80/20 rule to focus on the most critical aspects while avoiding unnecessary details. Striking a balance between using Storytelling effectively and avoiding overuse is essential to maintain its impact and credibility.

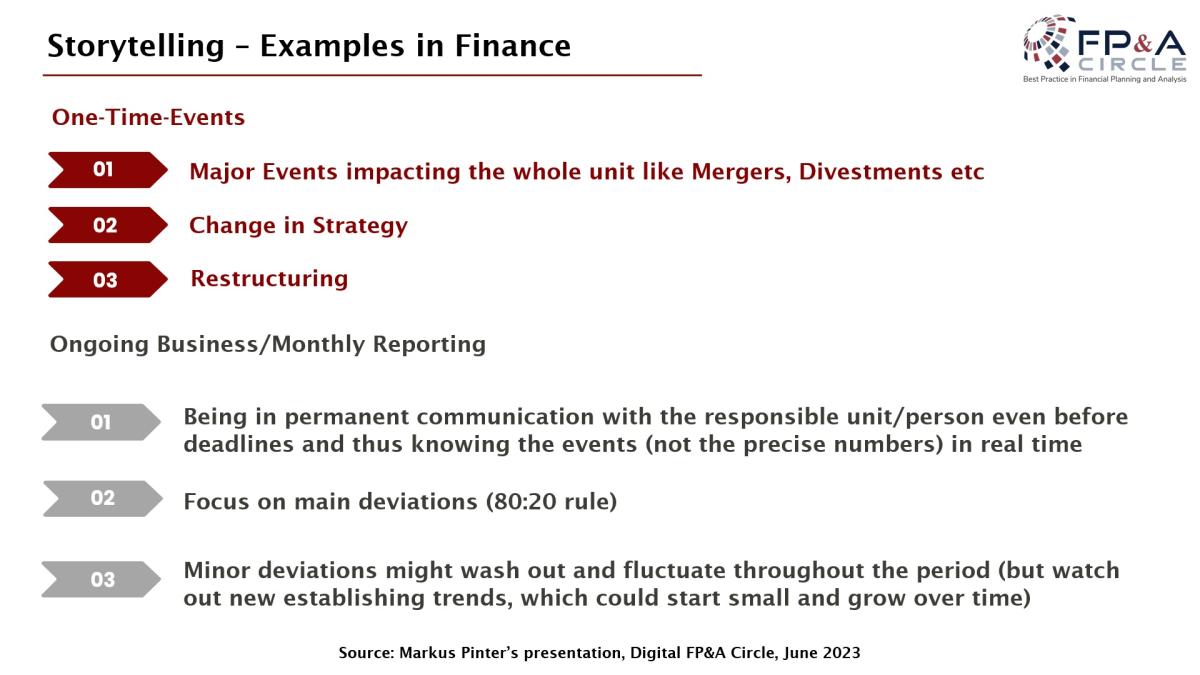

Markus identified specific scenarios where Storytelling is particularly relevant in FP&A. One-time events, such as mergers, divestments, or restructuring, provide opportunities to share experiences and lessons learned, aiding in navigating similar challenges in the present. Monthly reporting can also benefit from Storytelling by explaining deviations and anomalies through narratives highlighting the underlying business reasons.

Figure 2

Furthermore, Markus Pinter emphasised the importance of FP&A professionals acting as business partners. By maintaining continuous contact with the business units and understanding market dynamics and commercial strategies, FP&A practitioners can anticipate financial impacts and provide insights beyond numerical analysis.

The Power of Data in FP&A Storytelling

In a thought-provoking presentation, Petr Galík, Global Head of Data, Reporting & Analytics at Takeda Business Solutions, underscored the significance of purpose and integrity in the realm of data-driven decision-making. Inspired by Douglas Adams' famous novel, "The Hitchhiker's Guide to the Galaxy," Petr emphasised the trust people often place in data when seeking the meaning of life.

While acknowledging the prevailing belief that data holds profound truths or insights, Petr cautioned that data is simply information and lacks inherent truth or meaning. He stressed the need for professionals in FP&A to recognise that data is like language – it can convey both positive and negative narratives. Petr Galík illustrated this point by presenting examples of successful companies, such as Apple, Netflix, Tesla, and Airbnb, whose ground-breaking ventures were driven by strong vision rather than extensive data analysis.

Petr encouraged FP&A professionals to spend more time understanding the purpose behind their work. He emphasised the importance of asking questions and engaging with business leaders to grasp their intentions and expectations. FP&A practitioners can align their efforts with the overarching goals and make informed decisions by demonstrating genuine care for the company and its stakeholders.

Additionally, Petr stressed the importance of integrity in handling data. He emphasised that professionals must act ethically and avoid providing data to support directions they do not genuinely believe in. Upholding integrity is essential, and practitioners should refuse to manipulate data or present it misleadingly, as it undermines trust and compromises the credibility of FP&A professionals.

Figure 3

In conclusion, Peter Galík highlighted the necessity of understanding the purpose behind data analysis and decision-making in FP&A. By investing time in comprehending the intentions and expectations of business leaders, professionals can align their efforts effectively. Furthermore, acting with integrity and upholding ethical standards when handling data is crucial for maintaining trust and credibility. By incorporating these principles into their work, FP&A professionals can make meaningful contributions and drive organisational success.

Organisation Performance: Influence Your Audience with FP&A Storytelling

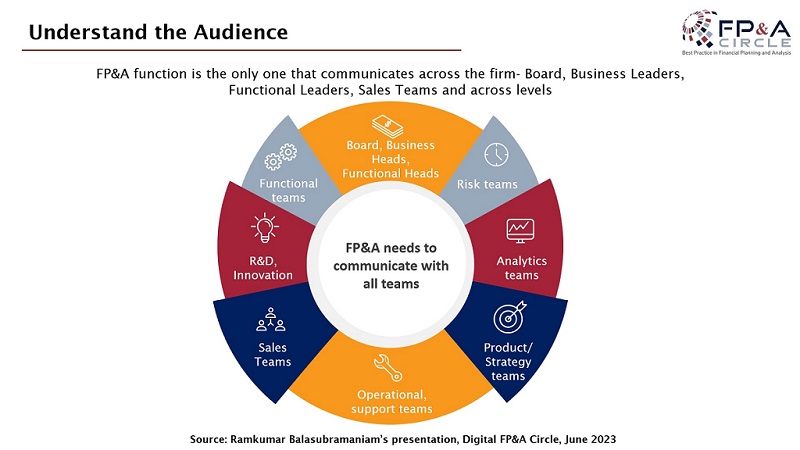

In his presentation, Ramkumar Balasubramaniam, CFO Middle East & Africa at Barclays, emphasised the importance of purpose-driven Storytelling in FP&A. He provided valuable insights on structuring a compelling story, starting with simplifying complex financial data and weaving it into the narrative. Understanding the audience's drivers, roles, expertise, and contributions to the organisation is crucial.

Once the audience is identified, tailoring the story to resonate with them becomes essential. Ramkumar stressed the significance of speaking the audience’s language, using terms and concepts they understand and find relatable. Additionally, he emphasised the need to provide insights and ideas that result in tangible outputs.

Ramkumar illustrated his points with an example from the banking sector, highlighting the multiple stakeholders FP&A professionals must engage with. These stakeholders range from board members and business heads to functional teams, risk teams, and frontline employees. Understanding each stakeholder's unique motivations and roles enables FP&A professionals to communicate effectively.

To explain his point, Ramkumar suggested leveraging the BCG Matrix and considering return on capital. By analysing different businesses or segments within the organisation, FP&A professionals can identify areas for improvement, such as reducing capital consumption, cutting costs, or investing in high-return opportunities. By following the steps and addressing audiences differently while delivering the same organisational goal, the puzzle pieces of a successful FP&A story will come together.

Figure 4

In conclusion, Ramkumar emphasised the importance of purpose, audience understanding, tailored communication, and delivering tangible outcomes in FP&A Storytelling. By diligently following these steps and addressing audiences differently, FP&A professionals can deliver the same goal for the organisation.

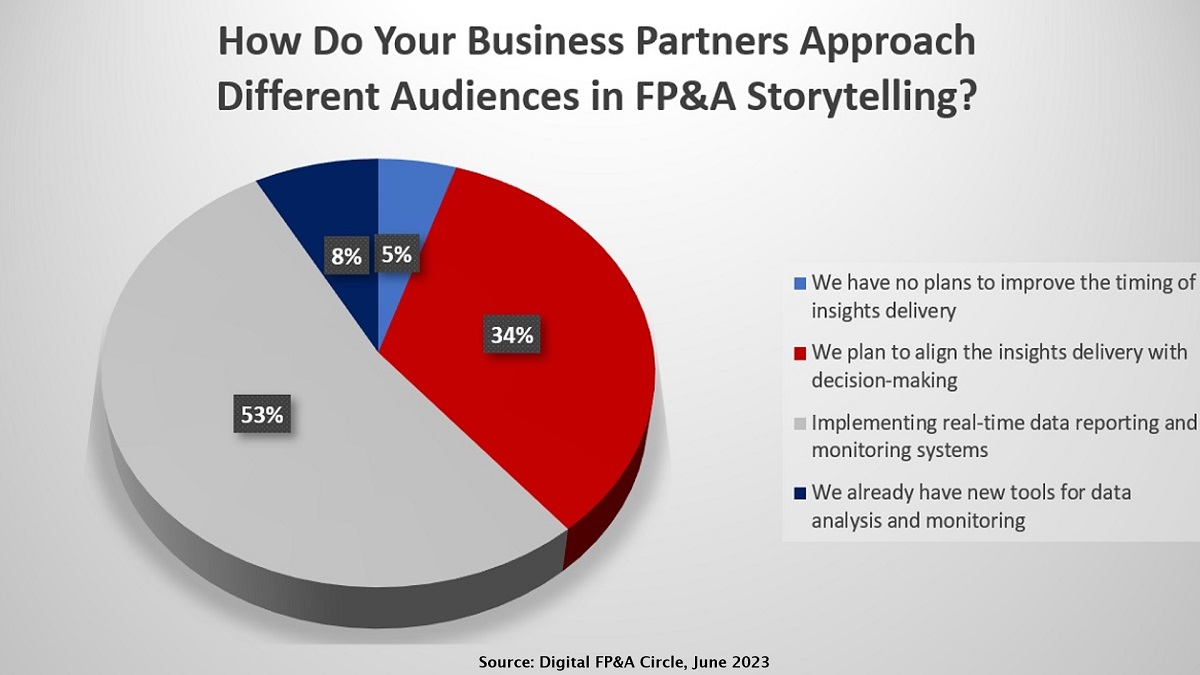

How Do We Plan to Improve the Timing of Data Insights Delivery?

53% of our audience plans to implement real-time data reporting and monitoring systems. 34% plan to align the delivery of the insights with decision-making moments. The rest of the audience doesn’t plan any changes in this area either because they already have modern data analysis and monitoring tools or they do not feel the need to improve the timing of data insights delivery in their organisation.

Figure 5

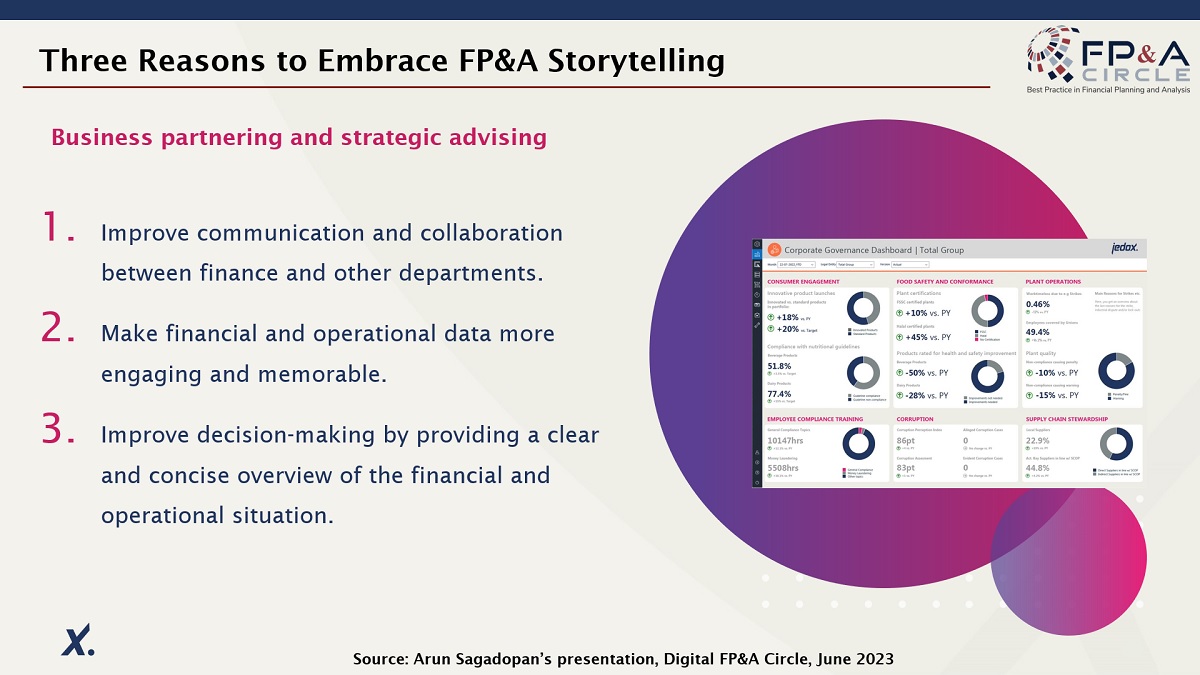

The Importance of Technology in Leveraging FP&A Storytelling

In his presentation on the importance of technology in FP&A Storytelling Arun Sadagopan, Regional Sales Director at Jedox, highlights a real-life example to demonstrate the power of Storytelling in convincing management during the forecasting process.

This example underscores the importance of collaboration and Storytelling techniques to communicate complex financial data effectively. Arun emphasises that a structured approach to information gathering and analysis is crucial. By integrating data from various sources, identifying outliers, and structuring it to support the desired narrative, FP&A professionals can create meaningful dashboards that provide an overall view of the company's health.

Moreover, Arun discusses the role of technology in enabling effective Storytelling. Automated data collection and analysis tools help reduce time spent on mundane tasks, allowing finance teams to focus on data interpretation and decision-making. Artificial Intelligence (AI) and natural language processing (NLP) technologies further enhance Storytelling capabilities by generating narratives and providing context behind the data. These advancements have democratised AI, making it accessible to finance professionals across departments.

Figure 6

Overall, Arun's presentation emphasises the importance of Storytelling in FP&A, showcasing how collaboration, structured information, and technological advancements can enhance data-driven narratives. By embracing these practices, financial professionals can make more accurate decisions and deliver engaging and memorable presentations to stakeholders.

Conclusions

The "Mastering the Art and Science of FP&A Storytelling" webinar offered valuable insights for FP&A professionals. The panellists emphasised the significance of Storytelling in FP&A, highlighting the need to evoke emotions and connect with audiences. Understanding the purpose behind data analysis, acting with integrity, tailoring narratives to resonate with stakeholders, and leveraging technology were key takeaways. By incorporating these principles, FP&A professionals can enhance their Storytelling skills and contribute meaningfully to their organisations' success.

To watch the full webinar recording, please check out this link.

We would like to thank our global sponsor Jedox for their tremendous support with this Digital FP&A Circle.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.