In this article, Michael Huthwaite shares three steps to consider when implementing ZBB. Modern ZBB is not...

Traditionally, Zero-Based Budgeting has been a routine exercise to control and cut costs. However, in the wake of today's unprecedented challenges, simply controlling costs won't suffice. It is where a Zero-Based concept re-emerges as a tool for strategic resource allocation. Beyond the mere routine, the Zero-Based approach encourages us to dive deeper into the core of our projects and initiatives. It empowers us to identify the underlying drivers that generate business value and prioritise them. As we transition from Zero-Based Budgeting to Zero-Based FP&A, we transcend from cost-centric thinking to a holistic approach that aligns our financial strategies with the heartbeats of our organisation's mission.

FP&A Trends Webinar has attempted to answer key questions related to the modern era of Zero-Based Budgeting.

This article provides an overview of the topics and cases presented and discussed by the expert panellists in the "A New Age of Zero-Based Budgeting" webinar, as well as the results of our polling questions.

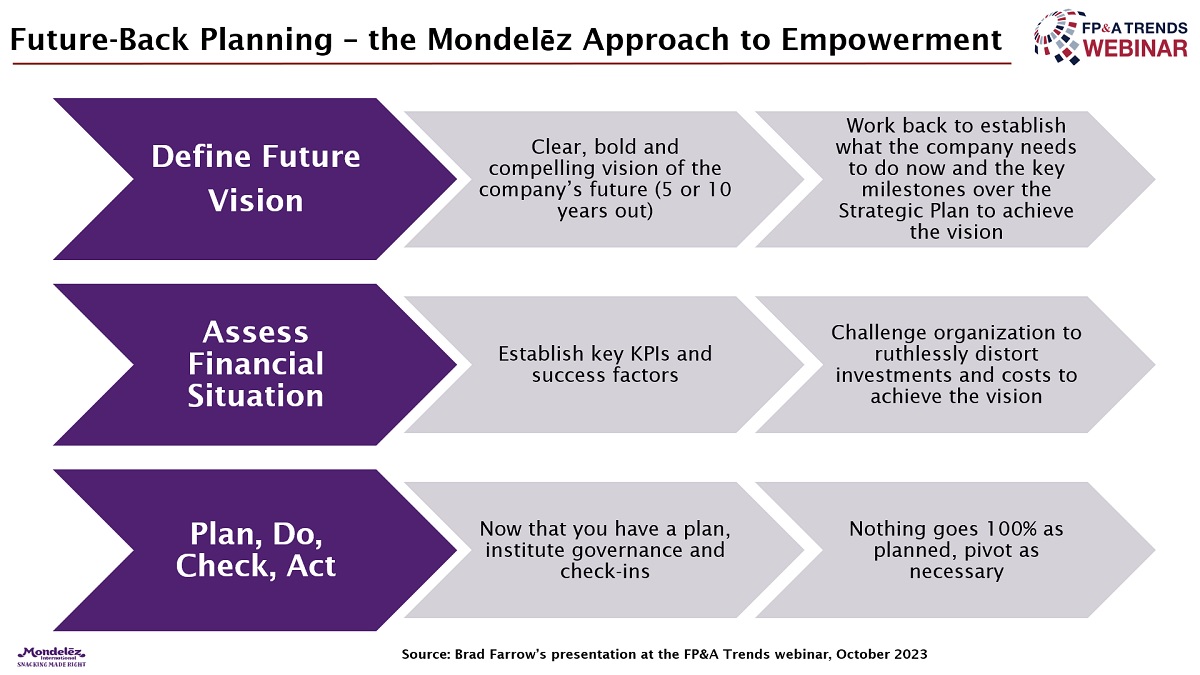

Mondelez Case Study: Future-Back Planning

In his insightful presentation, Brad Farrow, Commercial Finance Director at Mondelez, delved into the evolution of budgeting methodologies, shedding light on the strengths and limitations of conventional Financial Planning and Analysis (FP&A) techniques. Brad acknowledged the time-honoured traditions of budgeting, emphasising the importance of cost transparency and accountability fostered by methods like Zero-Based Budgeting (ZBB). He highlighted the benefits of scrutinising every expense, promoting efficiency, resource reallocation, and fostering a focus on value creation and performance measurement.

However, Brad pointed out the constraints of traditional approaches. The challenges outlined include resource-intensive processes, lack of flexibility, and short-term focus. To address these issues, he advocated for a forward-thinking approach exemplified by Mondelez. This approach revolves around 'future-back planning,' a visionary strategy focusing on a 10 to 15-year outlook. By setting clear priorities and empowering business leaders to make strategic choices aligned with the vision, this method encourages smarter spending rather than mere cost-cutting.

Figure 1

Farrow emphasised the importance of defining key performance indicators (KPIs) and aligning them with the organisation's goals. The approach, encompassing a continuous improvement model (plan, do, check, act), ensures adaptability and root cause analysis, promoting flexibility and long-term planning. By fostering engagement, clear KPIs, and multi-year planning, this innovative approach not only mitigates the limitations of traditional budgeting but also propels organisations toward strategic growth. Farrow's insightful presentation challenges financial professionals to embrace this transformative paradigm, empowering businesses to make informed decisions and achieve sustainable success.

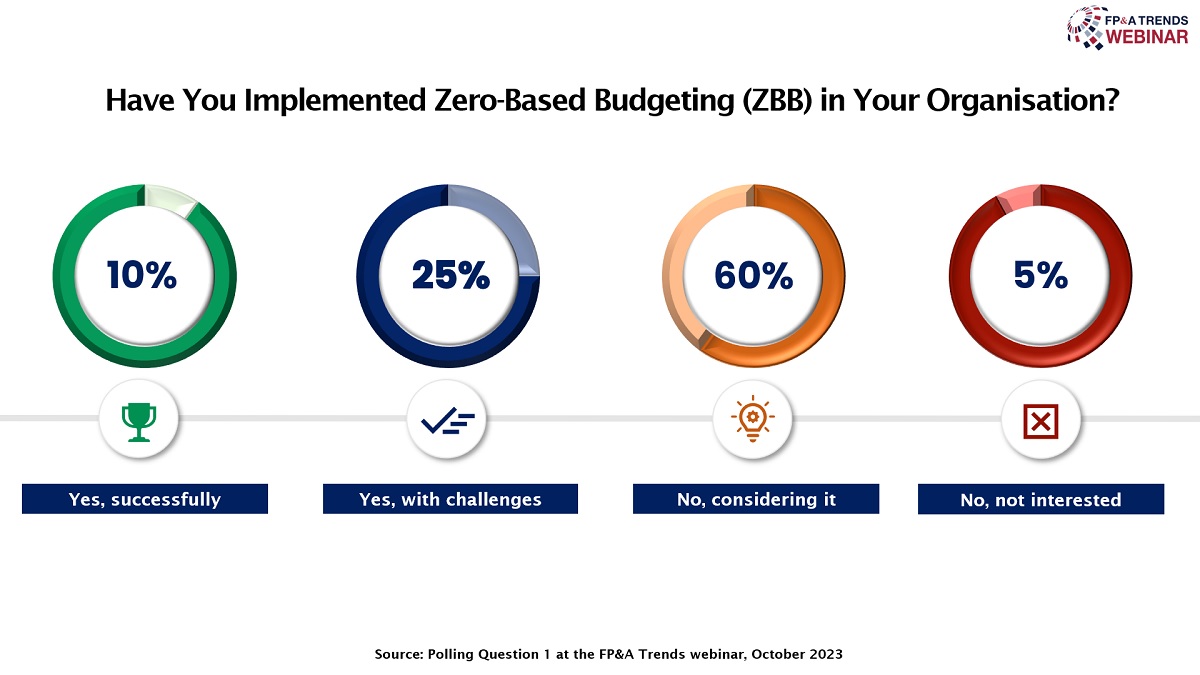

How Many of Us Have Implemented ZBB?

Most of the webinar audience (60%) considers implementing ZBB, while another large portion (25%) has already implemented it with some challenges. Another 10% have implemented ZBB without any major challenges. The remaining 5% have no plans to implement ZBB in the near future.

Figure 2

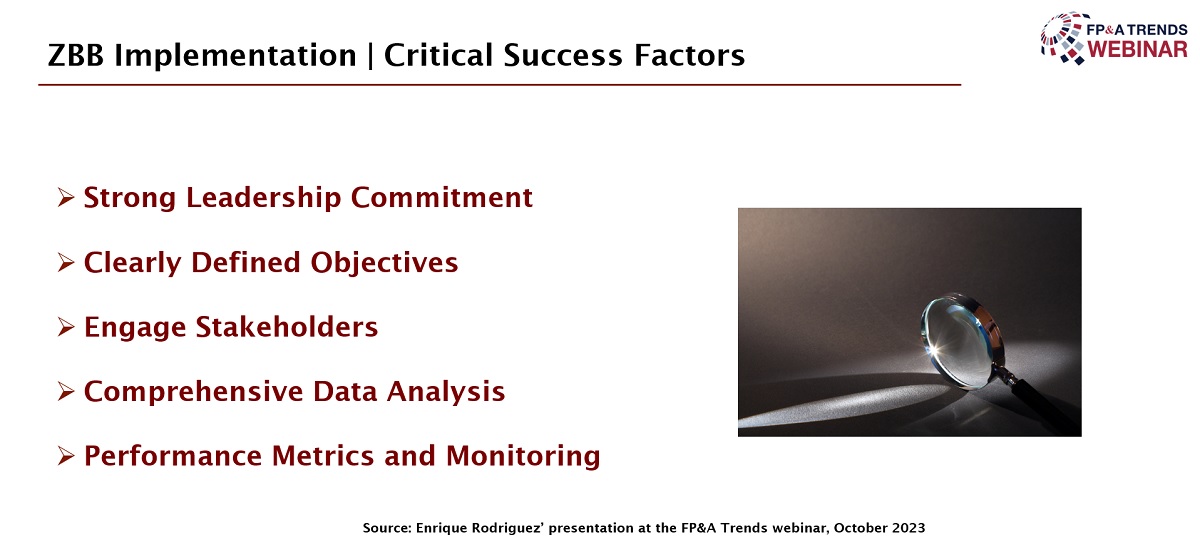

Zero-Based Budgeting: Critical Success Factors

In his comprehensive presentation, Enrique Rodriguez, Finance Director - Headquarters & Procurement at Walgreens Boots Alliance, emphasised the difficulties of implementing Zero-Based Budgeting (ZBB) in the realm of FP&A. Enrique dissected the pros and cons, providing valuable insights for the audience.

Starting on a positive note, Enrique underscored the paramount importance of cost control as a major advantage of ZBB. He emphasised how ZBB facilitates the elimination of unnecessary expenses, ensuring accountability and empowering financial professionals to question hidden costs effectively. Resource allocation, another key area, was highlighted, emphasising its critical role in strategically directing resources toward high-impact areas.

Transparency emerged as a significant advantage, offering clear visibility into spending and enhancing accountability. However, Enrique candidly addressed the challenges. He noted the resource-intensive nature of ZBB, requiring substantial time and effort for robust implementation. Resistance to change and the myopic focus on short-term cost reduction were acknowledged hurdles. The complexity of implementation, particularly in larger organisations, was also highlighted.

To navigate these challenges, Enrique outlined critical success factors. Strong leadership commitment, clearly defined objectives, stakeholder engagement, comprehensive data analysis, and the development of key performance indicators were emphasised. These factors, he argued, are essential for a successful ZBB implementation.

Figure 3

In conclusion, Enrique emphasised ZBB's power in controlling costs, allocating resources efficiently, and enhancing financial transparency. While acknowledging the challenges, he stressed that with meticulous planning and commitment, ZBB offers substantial short-term and long-term benefits, providing organisations the flexibility to adapt to changing market conditions and achieve long-term financial strategies. His insights serve as a valuable guide for financial professionals aiming to implement ZBB effectively in their FP&A processes.

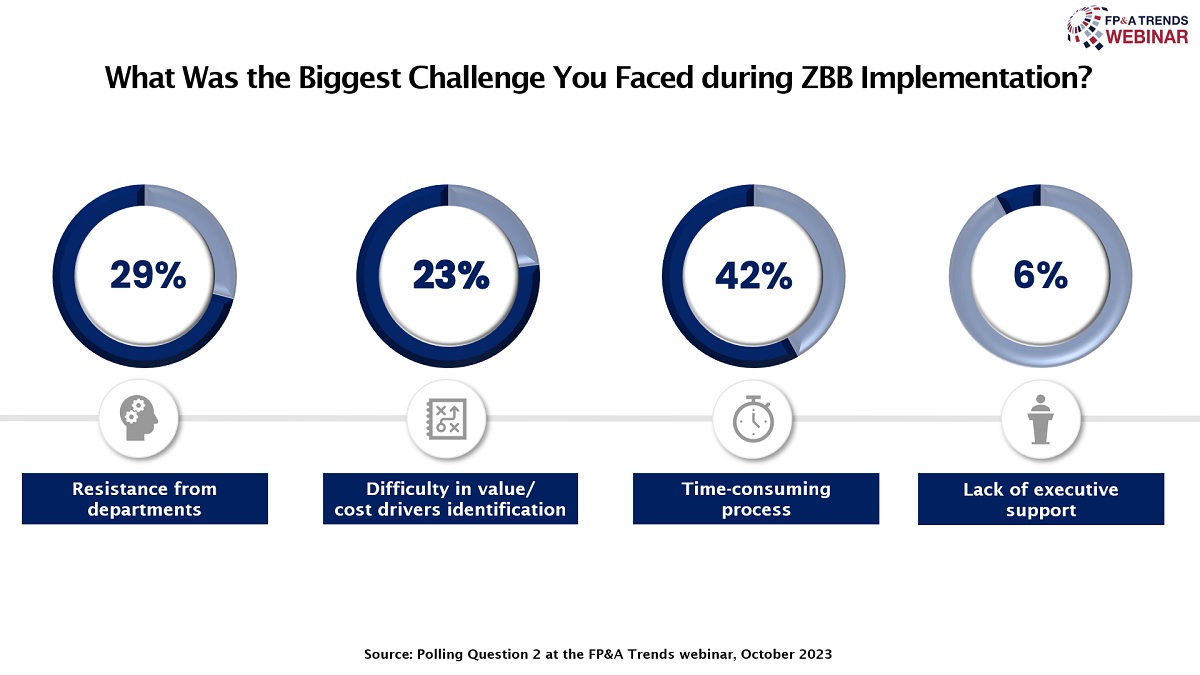

The Biggest Challenges During ZBB Implementation

42% of our audience name the time-consuming nature of ZBB as the biggest challenge. 29% believe that resistance from departments is the main obstacle, while another 23% find it difficult to identify Value/Cost Drivers and the remaining 6% face a lack of executive support.

Figure 4

ZBB Technology Enablers

In his thought-provoking presentation, Greg Volpe, Product Marketing Director at Workday, addressed the evolving landscape of Financial Planning and Analysis (FP&A) within the context of technology. He aptly highlighted the shifting global markets marked by unpredictability, economic uncertainty, and industry disruption. As business drivers and assumptions constantly change, traditional budgeting approaches relying on outdated methods and technology are no longer as effective.

Greg pointed out that this backdrop has prompted organisations to consider embracing Zero-Based Budgeting (ZBB). As Enrique and Brad emphasised, ZBB's key strength lies in its adaptability to changing market conditions. It provides a fresh perspective on budgeting, allowing organisations to reassess and reallocate resources effectively.

However, Greg acknowledged the challenges associated with ZBB, particularly the perception that it can be cumbersome and time-consuming due to reliance on outdated technology. In many instances, organisations are slow to invest in modern planning technology, which exacerbates these challenges.

He presented compelling survey data indicating that executives understand the importance of flexible and adaptive planning tools, yet a significant number of organisations still rely on manual processes and outdated technology.

The value proposition of ZBB was also articulated, including its ability to leverage up-to-date business drivers, drive company-wide collaboration, support full financial planning, and enable continuous planning. These benefits, Greg emphasised, can be further enhanced through investment in modern planning technology.

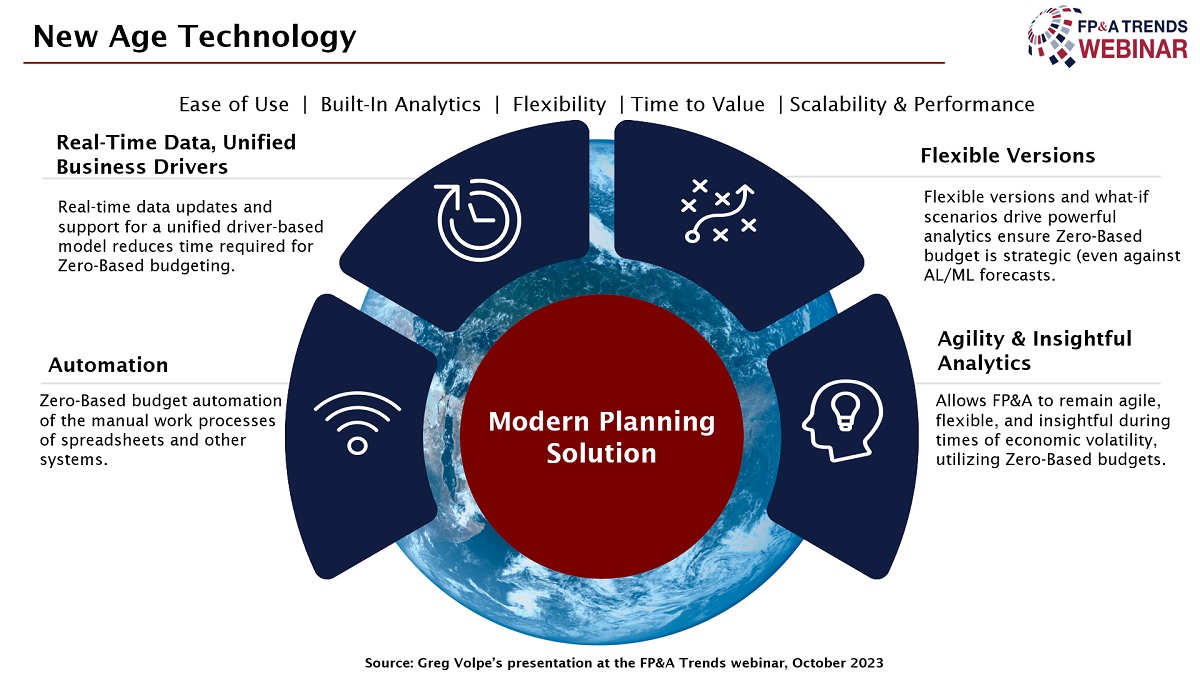

He then delineated the characteristics of new-age planning technology, stressing the importance of a cloud-based unified platform that supports real-time data updates, automation, flexible scenarios, and ease of use. Customer examples illustrated the tangible benefits of migrating to modern cloud-based planning solutions, improving the accuracy and flexibility of budgeting and planning.

Figure 5

In conclusion, Greg underscored the significance of combining a thoughtful ZBB approach with modern planning technology to achieve more accurate and real-time Financial Planning and Analysis. His presentation offers valuable insights for FP&A professionals seeking to navigate the evolving budgeting landscape in today's dynamic world.

Conclusions

While once perceived as cumbersome and time-consuming, ZBB's implementation is more feasible now than ever. The hurdles that were significant decades ago have been significantly mitigated by modern technology and innovative methodologies. Embracing ZBB today is not just a choice; it's a strategic imperative.

Considering the insights shared by industry experts like Brad Farrow, Enrique Rodriguez, and Greg Volpe, the advantages of ZBB far outweigh the challenges. With advanced planning technologies and a thoughtful approach, organisations can navigate ZBB implementation with relative ease. The benefits of cost control, resource allocation, and enhanced financial transparency offered by ZBB are invaluable in today's volatile market conditions.

To watch the full webinar recording, please check out this link.

We are grateful to Workday for sponsoring this event.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.