The 18th Geneva FP&A Board convened on 6 February 2025 at the stunning SPACES Quai de L’Île for an engaging session on modern FP&A Business Partnering. The event brought together 31 senior finance leaders from renowned global and local organisations such as Richemont, Bacardi, Hopital de La Tour, Lexmark, Novartis, PepsiCo, and many others.

The meeting was sponsored by Pigment in partnership with Michael Page, Page Executive and International Workplace Group.

Figure 1: Geneva FP&A Board №18, February 2025

Larysa Melnychuk, CEO of FP&A Trends Group and Founder of the International FP&A Board, chaired the meeting. She welcomed the finance leaders and briefly outlined the history, mission, and goals of the International FP&A Board. She also shared key takeaways from recent meetings and established a collaborative environment for knowledge exchange with this agenda:

- Evolution of FP&A Business Partnering

- Transformation Journey: Skillset and Attributes Required

- Moving to a Mature FP&A Business Partner State

- "Lexmark EMEA FP&A Journey to Business Partnering", the case study shared by Laurent Ferey, EMEA Finance Director at Lexmark

- Small groups work

- Conclusions and recommendations

At the start, participants shared the biggest barriers preventing FP&A from becoming a true business partner. Echoing insights from other International FP&A Board chapters, they highlighted Skills, Mindset, Culture, System and Technology. Geneva’s unique challenges included Capacity and Inclusion.

The Evolution of FP&A Business Partnering

Then, the session covered the evolving skill set and attributes of best-in-class FP&A Business Partners. Once focused solely on transactional tasks such as budgeting and forecasting, FP&A professionals have transformed into strategic advisors. Modern FP&A teams are more than financial analysts—they are business storytellers, influencers, and enablers of decision-making. They do not just report numbers; they craft narratives that drive action.

At the heart of this transformation is collaboration. FP&A must integrate strategic, financial, and operational plans to align with corporate goals. The best teams challenge assumptions, educate stakeholders, and analyse data for forward-looking insights.

Figure 2: Geneva FP&A Board №18, February 2025

The Impact of Technology on FP&A Business Partnering

Artificial Intelligence (AI) and modern technology were also hot topics, with participants discussing their role in enhancing FP&A’s impact.

The conversation delved into how AI can elevate FP&A’s impact. From automating routine tasks to enhancing forecasting accuracy, this technology can free up valuable time, allowing FP&A teams to focus on decision-making. Two key branches of AI in FP&A emerged:

- Machine Learning (ML) improves forecasting by identifying hidden patterns in data.

- Generative AI (GenAI) automates reports and enables finance teams to interact with data through natural language.

Figure 3

Geneva FP&A Board attendees were polled on their current use of AI in FP&A, revealing the following insights:

- 37% do not use AI

- 13% use AI to produce forecasts

- 17% use AI to automate parts of FP&A processes

- 10% use AI to analyse data patterns and trends in financial reports

- 23% use AI to provide summaries or insights for FP&A reports

Figure 4

Technology adoption emerged as a critical driver of FP&A success. Adopting Cloud Platforms and AI/ML enhances FP&A efficiency and forecasting accuracy. Organisations leveraging these technologies to achieve better forecasts, greater efficiency, and stronger strategic impact:

- Cloud Platforms: 31% of teams perform well (15% higher than non-users), and 61% rate forecasts as good or great (a 24% improvement).

- AI/ML: 35% of FP&A Teams excel (18% higher than those without AI/ML), and 65% rate their forecasts highly (25% premium).

Figure 5

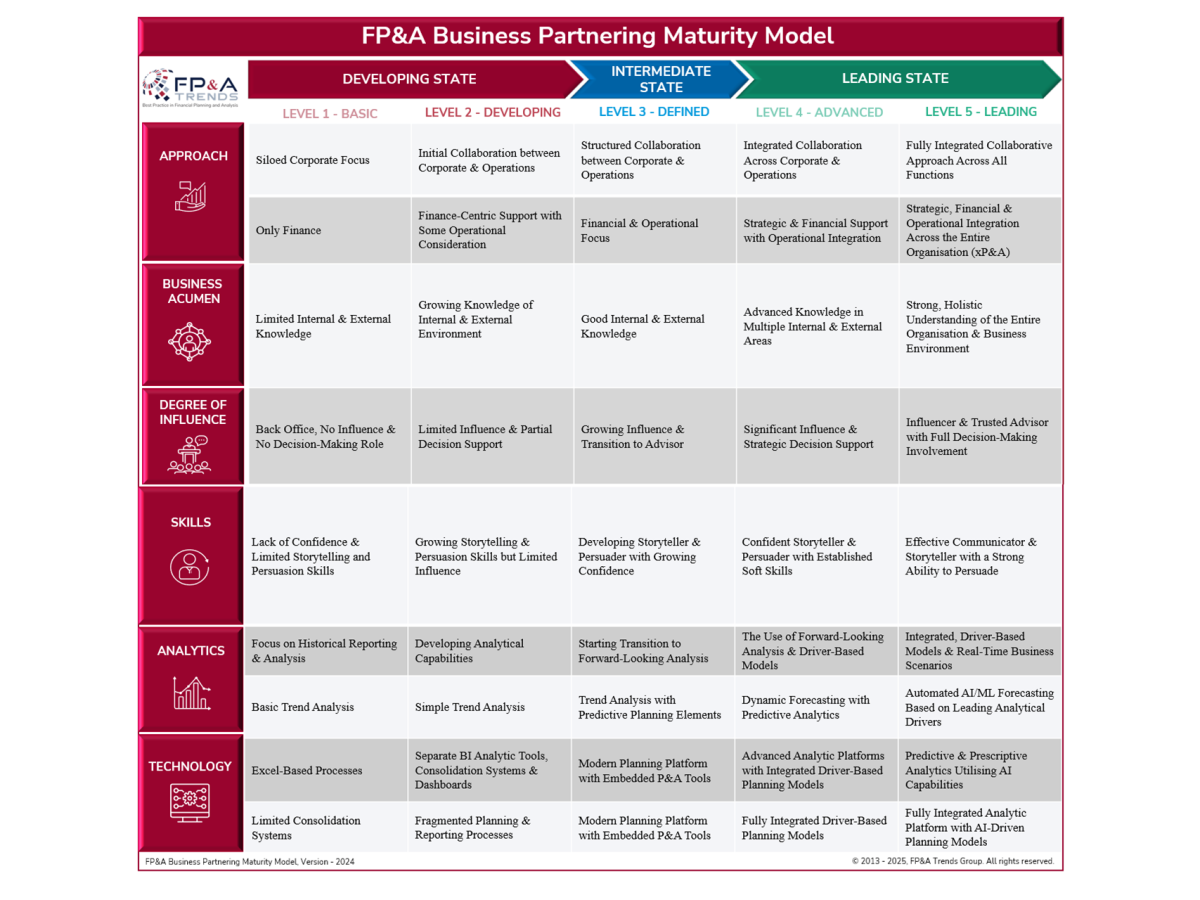

Mastering FP&A Business Partnering: Maturity Model and Case Study

Most importantly, the forum explored how to move to a mature state using the FP&A Trends Business Partnering Maturity Model. It showed the journey from basic financial support to a strategic role that drives organisational transformation. This framework enables FP&A teams to assess their current position and chart a path toward becoming trusted advisors. With the right blend of technology, processes, skills, and mindset, FP&A teams can move beyond insights to deliver real business impact.

Figure 6

After a short break, the Board welcomed Laurent Ferey, EMEA Finance Director at Lexmark. He shared his compelling case study and provided valuable insights into moving to the best-in-class FP&A Business Partnering.

Figure 7: Laurent Ferey shares his experience at Geneva FP&A Board №18, February 2025

Group work, Conclusions and Recommendations

The FP&A Board members were split into groups to discuss best practices to tackle three essential blocks of effective FP&A Business Partnering: framework, skills and capabilities, and technology.

Figure 8: Group Work, Geneva FP&A Board, February 2025

Group 1: Establishing the Framework

The first group discussed implementing the best-in-class FP&A Business Partnering Framework and moving their organisations from transactional to strategic. Their key success factors included:

- Clean and well-structured data.

- Advanced IT infrastructure.

- Simple and stable processes.

- Leadership that goes beyond task management to drive vision.

- Upskilling in business acumen and communication.

Trust, curiosity, and continuous improvement were identified as fundamental elements in transforming FP&A into a strategic powerhouse.

Group 2: Developing Team Excellence

The second group debated how FP&A teams can develop the skills needed for effective FP&A Business Partnering. The key insights included:

- The importance of trust and role rotation to broaden expertise and strengthen relationships.

- The role of culture and leadership in shaping FP&A’s strategic influence.

- The impact of KPIs, incentives, and mentorship on performance and development.

- The necessity of aligning FP&A goals with broader business objectives to enhance decision-making influence.

Group 3: Enhancing with Modern Technology

The third group examined how modern technology can help FP&A generate more insights needed for Business Partnering. Discussions centred on:

- Build vs. Buy: Investing in custom solutions versus off-the-shelf software.

- Adoption vs. Adaptation: Ensuring clear use cases to drive implementation.

- Price vs. Value: Evaluating cost-effectiveness beyond initial expenses.

- Integration vs. Incremental Rollout: Balancing efficiency with risk mitigation.

Figure 9: Group Work, Geneva FP&A Board, February 2025

The meeting concluded with informal networking over light refreshments, where participants exchanged insights and experiences in a relaxed setting.