The Boston FP&A Board members came together at Spaces State Street on June 13, 2024, for a session dedicated to mastering modern FP&A Business Partnering. The meeting was a lively and engaging session with 31 senior subject matter experts and thought leaders from a very diverse group of global firms, such as State Street, Fannie Mae, Vertex, National Grid, Keolis, Sanofi, Astra Zeneca, and many others.

The meeting was sponsored by Board International in partnership with CFGI and International Workplace Group.

Figure 1: Boston FP&A Board №12 Participants, June 2024

Larysa Melnychuk, CEO and Founder of the FP&A Trends Group, welcomed the finance leaders and briefly outlined the history, mission, and goals of the International FP&A Board. She also revealed the output from recent gatherings and set the stage to create a safe environment where everyone would feel free to learn with this agenda:

From Insight to Impact: FP&A Business Partnering in Action

- Evolution of FP&A Business Partnering

- Transformation Journey: Skillsets and Attributes Required

- Moving to a Mature Business Partner State

- Sanofi Case: shared by Antoine Schaeffer, R&D Finance Transformation Lead at Sanofi

- Fannie Mae Case: shared by Caroline McAuliffe, Corporate FP&A and Shared Service BU CFO at Fannie Mae

- Group Work: Conclusions and Recommendations

As part of personal introductions, Larysa asked each attendee to share their biggest challenge in FP&A Business Partnering. The thoughtful responses fit into several broad categories:

- Relationships (between FP&A, General managers of the firm, and finance)

- Data (quality, timeliness, reliability)

- Corporate culture, trust, communication and collaboration

- FP&A Teams’ skillsets

- Technology

- Competing Priorities

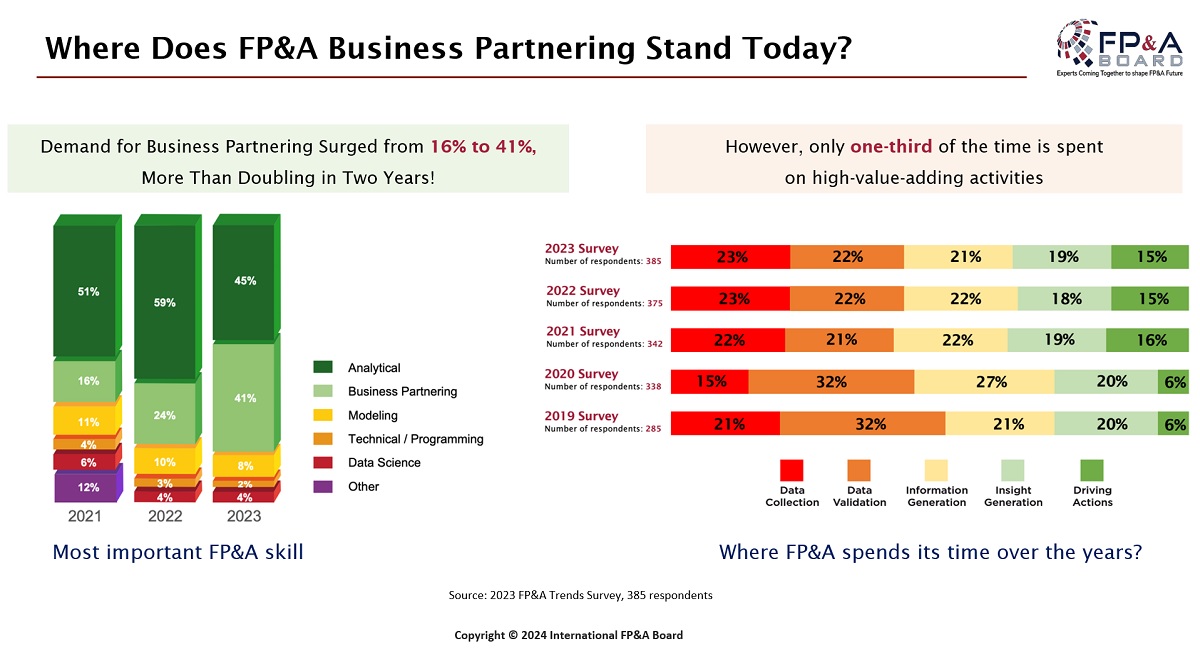

The forum also focused on discovering what causes these disconnections between teams in today’s business environment. Larysa showed the 2024 FP&A Trends Survey data and highlighted that the demand for FP&A Business Partnering over the last 3 years has dramatically increased. However, the time FP&A dedicates to this critical activity remains relatively small. The data shows that FP&A teams still devote as much as 45% of their time to low-value activities. Only 33% of the time is devoted to value-adding activities such as insight generation and driving actions.

Figure 2

We then explored how to address such an issue. To set a baseline, Larysa proposed the following definition:

“FP&A Business Partnering is about telling the story behind the numbers, pushing beyond the usual to spark better decisions and drive real change within the company.”

The discussion transitioned to how that vision can be achieved. The International FP&A Board underscored the importance of 5 primary roles within an FP&A team: Analyst, Architect, Data Scientist, Influencer and Storyteller. But how does an FP&A leader select and staff each of these roles?

Stephan Oehler, EVP Finance, Strategy & Performance at Keolis, shared that they had implemented a staffing model with a focus on one of these roles for team members, creating better focus and specialization. Some other people thought that all FP&A team members needed to be able to exhibit all five roles. However, finding a person with such a diverse skill set is almost impossible. For different organizations, some roles may be more important than others. For instance, an FP&A department head might be primarily focused on influencing and storytelling but still needs to understand how foundational data was gathered. Conversely, a Data Scientist would likely also need to be able to story around the source, quality, and vintage of the data with their peers. There is no single solution, and every organization has to define what works best for them.

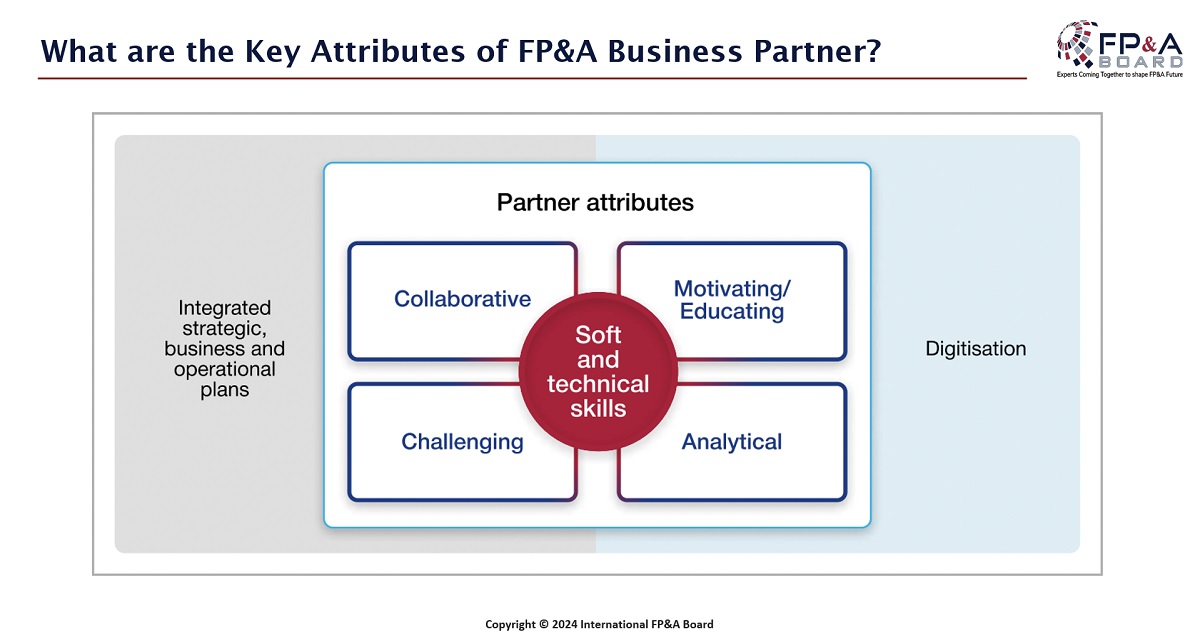

The International FP&A Board members also learned about the essential attributes of a modern FP&A Business Partner, depicted in the figure below.

Figure 3

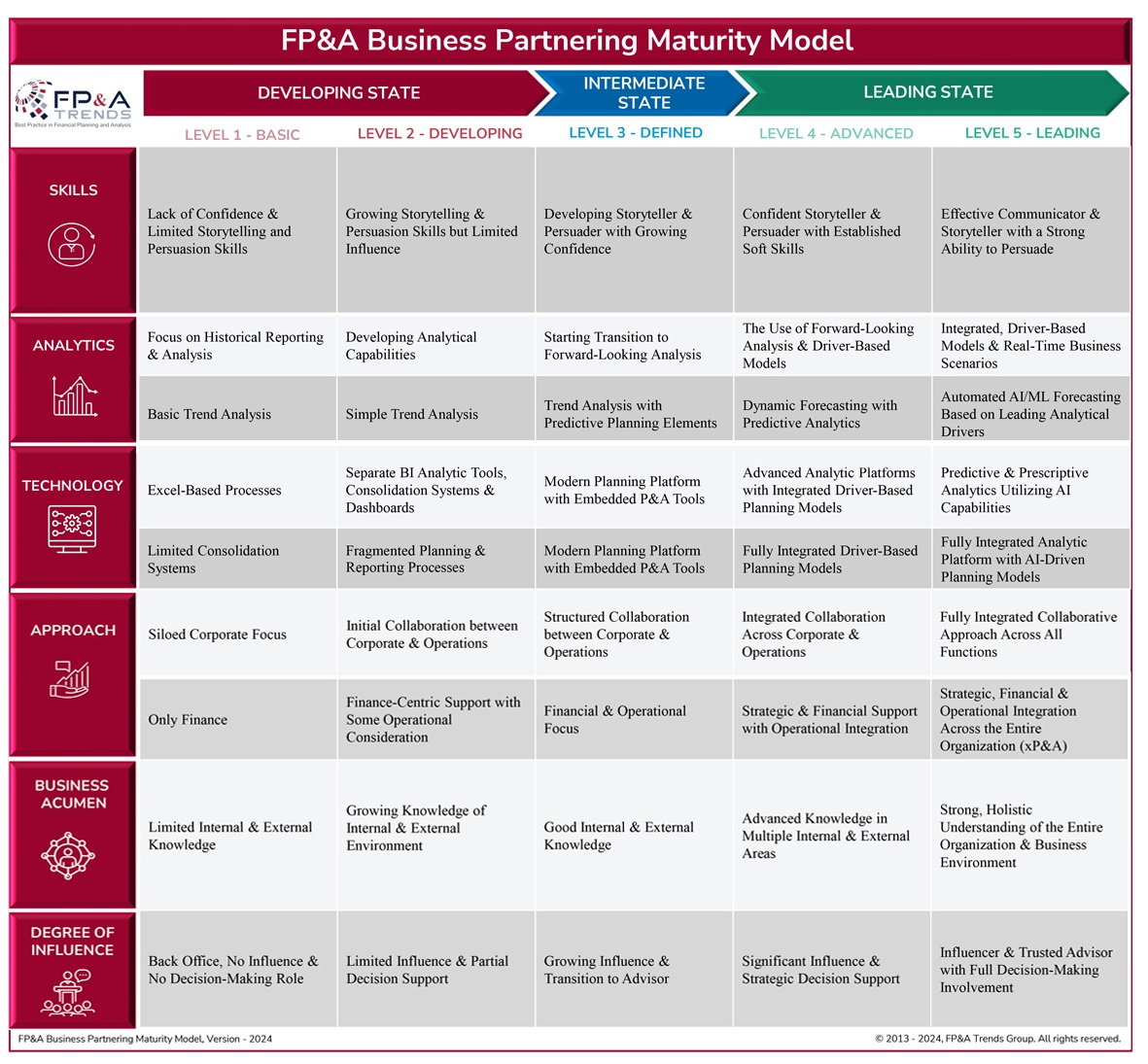

Larysa also shared the FP&A Business Partnering Maturity Model, developed by FP&A Trends Group. This tool can help you tailor your path to the leading state of FP&A Business Partnering Maturity and become a better partner to your colleagues.

Figure 4

The group found this depiction valuable and shared where each of their respective organizations stood on this continuum. A few organizations had progressed to the “Advanced” state, but most of the firms represented in our group were at level 3 or lower.

Case Studies

Figure 5: Caroline McAuliffe at the Boston FP&A Board №12, June 2024

Larysa Melnychuk also gave the floor to Antoine Schaeffer, R&D Finance Transformation Lead at Sanofi, who delivered an excellent presentation on the topic. Caroline McAuliffe, Corporate FP&A and Shared Service BU CFO at Fannie Mae, shared her insights with the audience after Antoine’s presentation. Both speakers shared their insights on establishing the best-in-class Business Partnering.

Group Work Insights

Figure 6: Group work, Boston FP&A Board №12, June 2024

Establishing the Framework

This subgroup identified some key components of constructing the best-in-class FP&A Business Partnering function, which broadly fit into these categories:

- Team and organizational structure, as well as individual team member capabilities

- Established and trusted processes

- Clear vision and goals

- Application of technology

- Communication, influence, and social networking

- Openness to input from FP&A teams, flexibility, and C-level sponsorship

Figure 7: Group work, Boston FP&A Board №12, June 2024

Developing Team Excellence

This subgroup noted that individual skills required in FP&A will shift from “hard” or data-intensive skills to “soft” or social skills as these are becoming more important. According to the members of this group, critical business skills for implementing best-in-class Partnering are:

- A good understanding of Key Performance Indicators (KPIs) and Business Drivers

- Ability to understand data and tell a story with that data. However, data should be transparent and easily accessible for everyone handling data.

- Having a high emotional intelligence and a powerful business social network

- Being technologically-savvy

- Developing a flexible and adaptive approach

- Developing critical thinking and team diversity

- Focusing on individuals’ strengths

- Investing in cross-functional training of your teams

Enhancing with Modern Technology

This subgroup identified technology considerations for a best-in-class FP&A Business Partnering function:

- Assuring alignment with corporate objectives

- Understanding data needs and what business issues precipitated the current decision

- Identifying the scope, content, and source of data needed

- Developing a strategy to compensate for data gaps (data democratization)

- Appropriate dedication of people, systems and expertise

If applied properly, these factors can help organizations boost their efficiency and build trust among different stakeholders.

Conclusion

The session generated rich discussions on the soft skills required for a mature FP&A department. Clearly, data alone is not adequate to truly move a business forward. We agreed that the importance of being able to turn data into recommendations and then also have the network reach to socialize those recommendations and gain acceptance was equal to the ability to generate that data. However, being a good Business Partner is not only about data; it is about developing interpersonal skills and building lasting relationships.