What are the key success factors for implementing an effective and efficient Zero-Based Budgeting (ZBB) process...

This is the first article in a two-part series dedicated to Zero-Based FP&A.

This is the first article in a two-part series dedicated to Zero-Based FP&A.

In the first article, we will explore the concepts of Zero-Based Budgeting and Zero-Based FP&A. The second article will explore key steps for the successful implementation of Zero-Based FP&A.

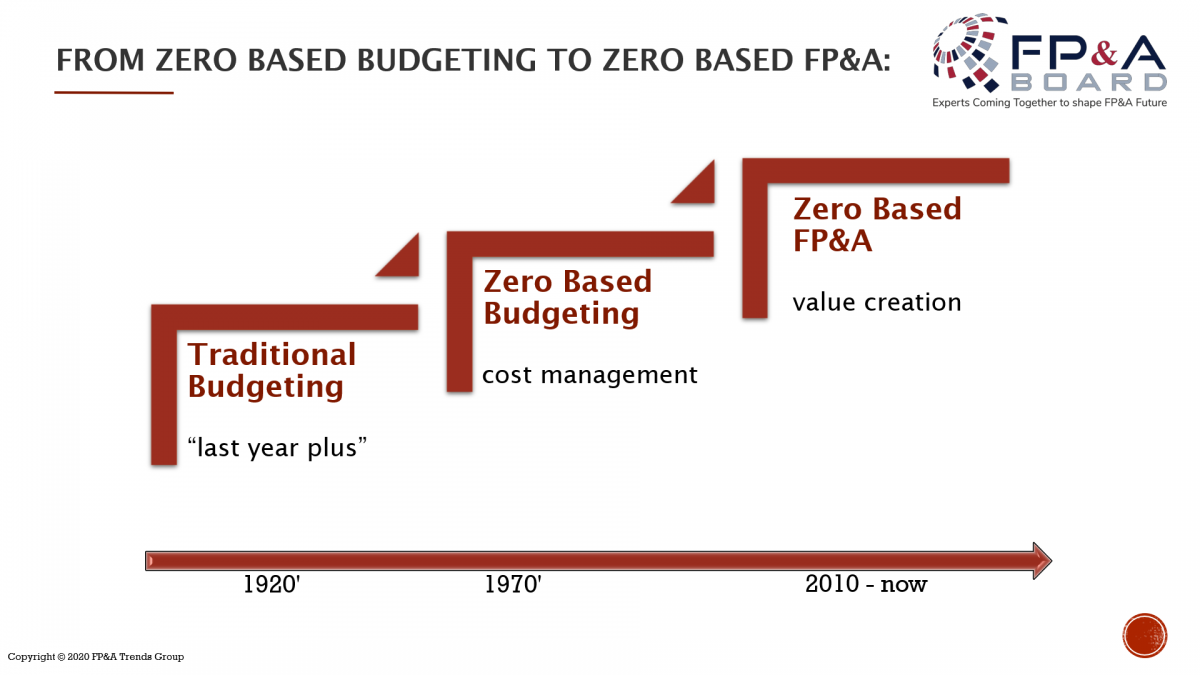

Zero-Based Budgeting Evolution

The concept of Zero-Based Budgeting (ZBB) is not a recent one. It was created by a Texas Instruments engineer fifty years ago. At that time, traditional budgeting had already revealed its weaknesses and new planning, and forecasting approaches were needed.

In the 1970s, ZBB emerged as a modern alternative to traditional budgeting for planning and managing expenses. It has been used not only by businesses but by government organisations as well. For example, Jimmy Carter, the 39th president of the USA, was a big proponent of the ZBB concept, famously using it before and after his election.

The reason for such popularity was due to its contemporary outlook on the budgeting process. Forgetting about the historical cost, ZBB looks at each expense line from scratch or “zero bases”. As accurately defined by Deloitte, ZBB is “a budgeting process that allocates funding based on program efficiency and necessity rather than budget history”.

In the 1980s and 1990s, the concept became less popular and was considered too time-consuming and ineffective. Many complained that it easily demotivated staff if not managed within a strict and careful change management framework.

Many of us in FP&A have noticed the renaissance of ZBB in the last 5-10 years. The main reasons for the arrival of the new age of Zero-Based Budgeting are as follows:

- Easier to manage. The emergence of new generation planning technologies has made it easy to manage. Automated routine and flexible, collaborative platforms remove one of the most significant drawbacks of ZBB, as it is now not as time-consuming as before.

- Alternative solution. The growing unpopularity of the Traditional Budgeting process in the environment of quick change and uncertainty has made organisations consider alternatives such as ZBB.

- The new way of forecasting. At the time of growing uncertainty, it is not always possible to forecast the future on historical data. Planning and forecasting from “scratch” may become a more reasonable approach for those organisations where history cannot describe the future anymore.

- Cost Management solutions have become more popular, especially during the period of slower growth after the global crisis of 2008.

- Growing usage. Many consulting organisations and IT vendors have started to develop their service propositions around ZBB. 300 global organisations currently use ZBB (as per the 2019 Accenture survey) with varying degrees of success. More than 90% of surveyed firms used it for cost-cutting purposes and saved on average $280 million per year.

- Emphasis on value drivers. From the experience of the International FP&A Board, a handful of organisations have started experimenting with ZBB by going beyond the “cost-cutting “ mentality and looking at the value drivers for not just expense basis. The baby steps towards Driver-Based FP&A (where the Zero-Based approach applied not only to expenses but to the whole or some FP&A process) have started to be taken.

From Zero-Based Budgeting to Zero-Based Everything

During times of significant change and uncertainty, traditional budgeting has become increasingly less “fit for purpose”. When, in March 2020, the COVID-19 outbreak closed international borders and economies, the world was left with many dead budgets and unrealistic forecasts. At times like this, it has become even more clear that planning and forecasting should be much more adaptable and agile than before.

The word “Budget” is not associated with flexibility and dynamics. Zero-Based Budgeting has started to be evolved to “Zero-Based Everything”:

A quick search amongst the major consultancies shows offerings that include Zero-Based Redesign (Bain), Zero-Based Supply Chain (Accenture), Zero-Based Mindset (Accenture), Zero-Based Marketing (McKinsey), Zero-Based Productivity (McKinsey), etc.

As it was famously quoted by Albert Einstein, “we cannot solve our problems with the same thinking we used when we created them”. In FP&A, we cannot solve our inefficiencies by “cost-cutting” and “cost management” that are associated with the traditional ZBB.

Though the concept of ZBB is becoming more popular, it has some historical limitations. At the International FP&A Board, we have developed a Zero-Based FP&A (ZB FP&A) concept that allows a fresh look into the entire planning and forecasting process.

What is Zero-Based FP&A (ZB FP&A)?

In contrast to ZBB, Zero-Based FP&A entails applying the Zero-Based concept to the overall planning and forecasting framework. Most importantly, it helps to identify the underlying business and value drivers for those “Independent Packages” that are subject to the Zero-Based examination. Therefore, the exercise is not solely applicable to expense items but also to other lines of the three accounting statements (P&L, Balance Sheet, and Cash Flow).

In other words, Zero-Based FP&A helps to remove unnecessary “fat” from traditional plans and forecasts and to enhance the understanding of key business and value drivers. This is an exercise that is managed by FP&A but relates to the entire organisation.

Implementing ZB FP&A involves both analytical and business partnering techniques, namely:

- Interviewing and collaborating with key business stakeholders (cost centres and profit centre owners.)

- Researching the key business drivers using analytical methods.

- Educating key business stakeholders on key drivers, models, and forecasting techniques.

- Managing and maintaining the process of Zero-Based FP&A, if necessary. In some cases repeating this process regularly is not needed: when the drivers are identified, they can be maintained through analytical methods alone.

In one of my corporate FP&A roles, we managed to create a flexible planning process relatively quickly by following the above techniques. It has been a great success as the process has allowed us to undertake organisational restructure extremely effectively, as well as saving unnecessary job cuts. We have achieved this by removing historical inefficiencies that, for many years, were hidden in traditional budget allowances.

Conclusion

After travelling the world and collaborating with thousands of senior members of the International FP&A Board, we have discovered various approaches to ZBB, along with its benefits and drawbacks.

In the current changing environment, Zero-Based Budgeting transforms into a wider framework of Zero-Based FP&A. This is a concept in which ZBB principles are applied to not only expenses but also to other areas of the FP&A process. Consequently, it encourages a culture of business partnering and value creation, as well as rigorous evaluation of key business drivers. Therefore, it supports the analytical transformation journey.

In the second article, we will dive deeper into the ten steps required to implement Zero-Based FP&A successfully. To read the second article, please click here.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.