As the year slowly draws to a close, CFOs also start their annual haggling over costly...

The concept of Zero-Based Budgeting (ZBB) is by no means new. It has been around for almost 50 years and has been used by many commercial and non-commercial organisations whose overriding objectives are to shed unnecessary expenses.

The concept of Zero-Based Budgeting (ZBB) is by no means new. It has been around for almost 50 years and has been used by many commercial and non-commercial organisations whose overriding objectives are to shed unnecessary expenses.

Over the last ten years, as organisations were swept into a more dynamic world of black swans and perfect storms, the traditional budgeting process has become increasingly more obsolete and widely criticised.

Nevertheless, as many businesses are still not ready to completely abandon traditional budgeting, ZBB has become a great intermediary that helps not only to “justify the expenses” but also to understand the business’ key drivers and develop an analytical and participative planning process. This is a great enabler for a driver-based modelling and planning process, underpins modern and agile FP&A today.

What is Zero-Based Budgeting?

This is the method of developing a plan from scratch or “zero base” by examining every cost or P&L/BS. Previous years’ budgets are not considered as every item of the plan needs to be justified in relation to the current year.

Pros and Cons

The International FP&A Board has debated on this subject in many different places around the globe.

Here are some of the advantages and disadvantages that senior finance leaders have identified:

Pros:

- Facilitates outside-the-box thinking;

- Great for transparency and rationalisation;

- Helps with granularity;

- Better visibility on cost and business drivers;

- Not stuck to legacy, forward-looking view;

- A proven method for cost ownership and cost control

Cons:

- It is a very time-consuming process;

- Accountability could be a problem;

- It could be perceived as demotivational and intimidating;

- The benchmark could be an issue;

- It needs huge support from the top;

- The bottom-up process could be overridden by the top-down one

21st-century ZBB: What is new?

In recent years, ZBB has expanded its horizons beyond simple cost base analysis. Its focus now is on helping to identify overall business drivers. This is an excellent method to use when developing a Driver Based Planning model. It encourages collaborative business planning and business partnering.

It could be a great start to organisational, analytical transformation, the first step on the journey to the value-adding Rolling Forecast, and the going “Beyond Budgeting”.

What is needed for the successful implementation of a ZBB process?

According to McKinsey research, of the 238 companies that announced cost-reduction programs between 2003 and 2014, only 26 per cent were able to sustain the reductions for four years. And only 17 per cent of the 238 were able to grow at the same time.

Finance leaders from the International FP&A Board identified the following critical steps needed for the successful implementation of a ZBB process:

- Sponsorship from the top;

- Business Buy-In. The ZBB process is an overall business process. It could be led by FP&A but will involve the whole organisation;

- Data availability and standardisation are important;

- Excel is not the system to use for ZBB. Overall visibility and participation are essential throughout the process, and a more flexible approach can help make it happen;

- The process can be very time-consuming. Therefore, a “hybrid” approach will help add the most value: systematically starting from the highest cost and revenue lines

ZBB and Other FP&A Methods and Techniques

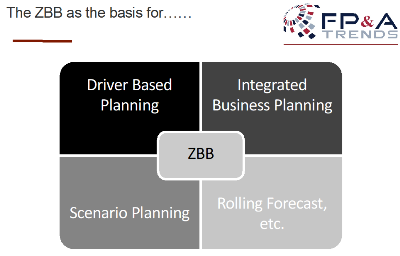

For the best results, ZBB could be used in combination and as an enabler for different modern FP&A processes, as demonstrated in the below figure. Namely, this is a good starting for understanding the key business drivers and harmonising planning processes across an organisation. This is a great enabler for the value-adding Scenario Planning process and analytical Rolling Forecast.

ZBB Mini Case Study from a Fortune 100 company

At one of the London FP&A Board meetings, a case study from a Fortune 100 company’s implementation of a ZBB process was shared.

The following challenges were identified at the beginning of the process:

- Inconsistent Costs Classification;

- “Miscellaneous” accounts had significant spend in them;

- The name of the account was not reflective of the costs in it

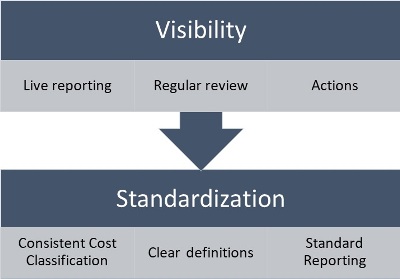

From the words of the ZBB Director, “Starting with ZBB in such an environment is unlikely to be effective in the long run. ZBB needs visibility and standardisation. “

In other words, there are two critical success factors for a value-adding ZBB process (see figure below):

1. Visibility, namely

- Live to report;

- Regular Reviews;

- Actions

2. Standardisation, namely

- Consistent Cost Classification;

- Clear Definitions;

- Standard Reporting

The company that implemented the process achieved a cost-saving of around 25%.

ZBB has been considered part of the organisational DNA and has been used regularly at different critical parts of the business.

There were some lessons learnt by the ZBB project team that was shared with the Board as following:

- Implementing ZBB is tough, but sustaining it is much harder;

- Without senior management supporting it and setting a good example, it will not yield full results;

- It’s an excellent method to create a lean organisation, but finding the right balance between cuts and investment is not easy;

- Most staff do not like ZBB, and it may lead to increased attrition

Some closing thoughts

Siva Raj Jeyarajah, Executive VP at Maybank, recently shared his valuable ZBB experience with the FP&A Board in Kuala Lumpur, Malaysia. His insights make a great conclusion to this article:

“ZBB is an excellent way to recalibrate and reassess the resources you have for the better alignment with the strategy in being profitable and sustainable.

However, the process may become a tedious and very time-consuming exercise if performed annually. As the result, it may become counterproductive and not value-adding.

Thus, it becomes more important to still practice ZBB at a smaller scale in parts of the organisation that warrants it. For example, we practice ZBB in key areas which are very sensitive to the environment and very critical to business, namely in Capital Expenditures and Marketing budgets.

Other areas can still run on the traditional process, but at some point, they will need to be reassessed through ZBB as well. In current times, where markets and business environments are extremely violative and fragile, this should be done within a 3 to 5-year cycle. Smaller businesses, especially those digitally inclined, should do ZBB much more frequently.

Now doing ZBB cannot just be an academic exercise. That’s the easy part. The most challenging part is the commitment from the Board and the process to make tough decisions and executing them. This should be institutionalised so that the entire process delivers the right outcome.”

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.