Karina Williams, Business Unit CFO at Veolia Water Technologies and Solutions, shares her practical insights and...

“Lead change, don’t manage it.”

Peter Drucker

Organisations are feeling the impacts of inflation and the increasing cost base of providing their products and services. Passing the cost increases onto customers is not an option and absorbing it is not financially sustainable either. Strategically freeing up capital to invest in long-term growth opportunities is also on the agenda of many executives.

This leads to cost-cutting programs for many organisations, but research has shown that in the first year less than 50% achieved the target cost savings, and only 11% achieved sustained cost reductions into the third year1.

Commonly cited obstacles to success include setting unrealistic targets, lack of solid tracking and reporting, lack of dedicated leadership and ineffective Change Management2.

The management of change relates just as much to the behavioural changes required, as to the process and systems changes required to embed longer-term improvements for ongoing efficiencies and productivity, particularly during organisational growth.

Change Management and FP&A

FP&A is an important cog in the wheels of successful change, driving improved financial awareness and accountability throughout the business. By clearly communicating the impact of inefficiency on productivity, FP&A ensures that everyone recognises the importance of performance improvements. This visibility ultimately leads to longer-term, sustained cost efficiencies.

The aim is to shift the mindset of business managers and break down silos. Cost reductions can’t happen in isolation and need a whole-of-organisation approach. Initiatives may require managers to give up resources or stop projects to enable another department to succeed. This is often where cost optimisation initiatives fail – when managers are not aware of the downstream impacts of their decisions and actions.

In this article, I explore how FP&A professionals can lead change to break down the silos through relating our strengths to a well-known eight-stage change framework by John P. Kotter.

What is Required for Cost Optimisation Success?

Firstly, it is worth reinforcing why FP&A should be at the heart of enabling and driving a sustainable cost optimisation program.

Gartner suggest sustainable cost optimisation is based on five key pillars3:

- Financial transparency

- Targets and benchmarks

- Accountability of business units and individuals

- Managing demand and supply of costs

- Leveraging savings to drive enterprise strategy.

FP&A’s Role in These Pillars of Success

When considering these pillars, it is clear that FP&A is central to the success of any cost optimisation program. This is because we have the following attributes:

- A holistic view of operations and broad business knowledge.

- Convergence of financial and non-financial data and business information.

- Ability to derive insights and suggest action.

- Deep understanding of revenue and cost drivers that impact business strategy.

- Strong relationships and networks within the business.

- Ability to demonstrate the benefits of change and the impacts of not changing.

Where we have the greatest impact, is using our ability to work with and across business functions to break down silos and improve the awareness of upstream and downstream impacts of inefficient resource use.

Change is a whole of organisational endeavour, and FP&A can play a significant role in enabling and embedding the changes instigated through a cost optimisation program.

The Role of FP&A in the Eight-Stage Process of Creating a Major Change

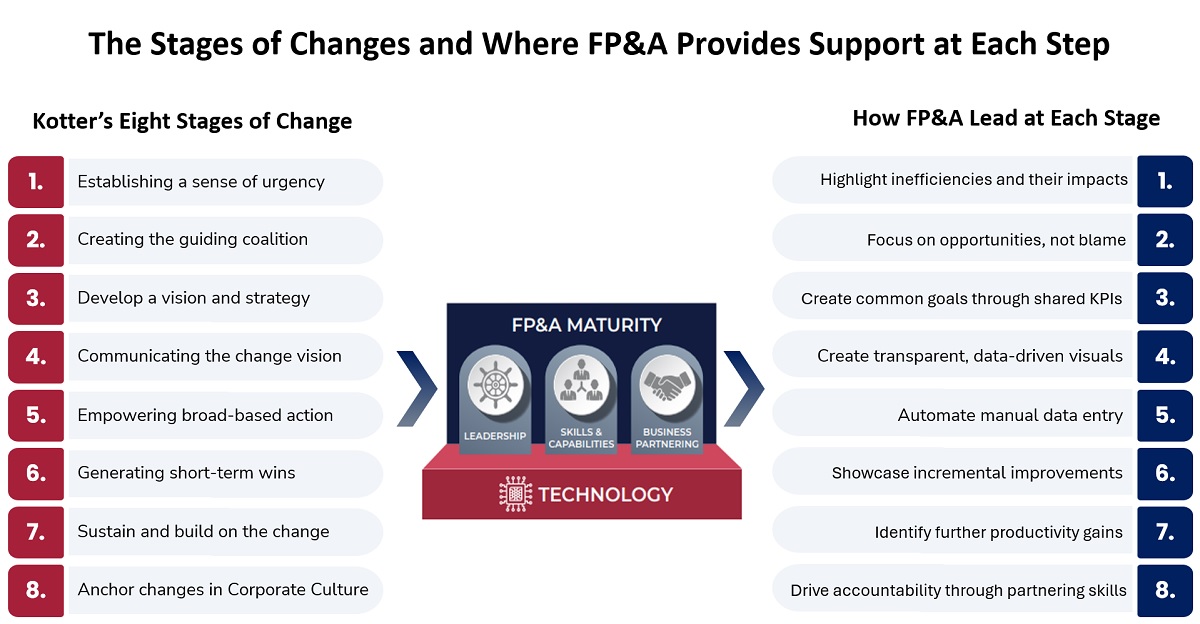

An eight-stage methodology to deliver lasting change was developed by John P. Kotter and is a useful model to illustrate where FP&A’s leadership, business knowledge and partnering and digital capability can lead and support change at each step.

Figure 1: The stages of changes and where FP&A provides support at each step

1. Establishing a sense of urgency

Change doesn’t happen if people don’t think it is relevant to them or if it is someone else’s problem to solve.

This is a fantastic opportunity for FP&A to use effective storytelling, by making it relevant for the audience and thereby prompt action.

Through effective use of Rolling Forecasts and scenarios, create awareness and a compelling case for improved cost disciplines. Forecasts built on driver-based models demonstrate the financial sustainability impacts of ongoing productivity and efficiency issues and how it will affect the ability to compete or grow.

An example is to demonstrate how a business case for innovative technology could be funded by improving labour productivity and removing double handling from cross-department processes in the organisation.

2. Create the guiding coalition

A lone voice will struggle to instigate change. Your reports, no matter how compelling, will not gain momentum alone.

Spend time building trust, particularly in the data and what it is suggesting.

By using relationships and networks, FP&A can bring influential people together and find champions to create the momentum to deliver the changes required to improve inefficient processes.

3. Form a Strategic Vision

Many businesses operate as silos, particularly where managers have their own Key Performance Indicators (KPIs) and targets to deliver, which may be linked to bonuses. They will focus on that rather than a shared vision or common goal.

FP&A can provide visibility of the cost of cross-department friction points; the communication or process issues that create inefficiencies downstream across multiple departments.

By developing shared KPIs and measures, business owners can take a more holistic view, rather than just focusing on their own cost reduction plan, which may inadvertently drive more cost and inefficiency into another team.

4. Communicating the change vision

Staff need to understand how they can make a difference, and that it is not only targeted at them.

FP&A can play a vital role in focusing on the “why” and the benefits of collaboration and change.

When messaging about cost cutting, finance staff are often seen as the bearers of unwelcome news, therefore, it is important to send the message that ‘we are here to help you.’ We really want to understand how to make people’s jobs more effective and value-adding rather than apportion blame or wield the stick to show what is wrong.

Make the messages clear and relevant through data-driven and fact-based information. Demonstrate the trends and develop benchmarks to show the comparisons. And help them trust the data.

5. Enable action by removing barriers

Any cost reduction or optimisation strategy will be perceived by many as job cuts. This will slow down any initiative to improve processes.

FP&A can build trust by sharing skills and ideas to help colleagues in other departments. For example, sharing data skills like automating data extracts into spreadsheets used for routine tasks in their roles. Repetitive ‘cut and paste’ activity is a common issue and an easy productivity improvement that makes their jobs easier.

By spending time with your Business Partners and helping with smaller incremental changes, you will build relationships and trust.

6. Generate short-term wins

Improving processes and implementing new systems or ways of working can take time, particularly if staff resist the change. Momentum and motivation will reduce.

FP&A can utilise analysis and trends to identify a portfolio of quick cost-reduction wins. These could be cost-out initiatives like rationalising training expenditure, IT applications and licenses or travel and accommodation costs.

7. Consolidating gains and producing more change

Once wins are established, it is important to not lose momentum. Keep the changes and improvements coming through technology and continuous improvement. Innovative change to underlying processes and systems is a way to embed the disciplines that will lead to sustained improved productivity and efficiency.

The cost savings and improved productivity, demonstrated through FP&A-developed metrics and measures, can be used to justify investment into digitally-enabled processes and capabilities.

8. Anchoring new approaches in the culture

Treat cost optimisation as an ongoing discipline, not a one-off discrete project.

FP&A teams can improve financial understanding and accountability in the business through the strength of Business Partnering.

Elevate Business Partner interactions from being finance-driven or ‘push’ conversations into business partner-led ‘pull’ conversations where your insights are prompting questions about how you can further help.

Shift business responses from “Your data is wrong” to “I can see our labour hours are increasing. Can you help me understand if outsourcing would be cost-effective?”

Summary

FP&A is best placed to understand where productivity and efficiency are being eroded in the organisation and initiate changes needed to improve performance and reduce costs.

When it comes to cost-out exercises or looking for opportunities to improve efficiency, don’t wait for others in the business to make the change. And don’t expect the budget owners to lead it.

FP&A can lead this change and demonstrate the value you bring and enable your Business Partners to implement the changes.

References:

Gartner. “7 Cost Reduction Mistakes to Avoid.” Accessed November 29, 2024.

https://www.gartner.com/smarterwithgartner/7-cost-reduction-mistakes-to-avoid

Deloitte. “Strategic Cost Transformation.” Accessed November 29, 2024.

https://www.deloitte.com/ch/en/services/consulting/perspectives/strategic-cost-transformation.html

Gartner. “Cost Optimisation Insights.” Accessed November 29, 2024.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.