Utilising modern technology like Artificial Intelligence and Machine Learning solutions in their Rolling Forecasts has enabled...

The main criticism of the traditional budget is that it does not react to what is actually happening in the business during the year. But a Rolling Forecast solves that problem, helping companies to continuously plan (forecast) over a set time horizon.

The main criticism of the traditional budget is that it does not react to what is actually happening in the business during the year. But a Rolling Forecast solves that problem, helping companies to continuously plan (forecast) over a set time horizon.

On 21 September 2021, we had an interesting discussion on how to move from a traditional budgeting process to Rolling Forecasts, and the key success factors when doing this. Senior finance professionals from diverse backgrounds and experience shared their views on the subject.

The panel of experts included:

Ahmed Ezzat, CFO at MFQ Companies.

Anand Joslin, Finance Director at Accor

Nevine White, VP Accounting at Hargray Communications

Andreas Simon, Director MEA at Jedox

This article is based on the insights from the webinar and speakers' presentations.

What is a Rolling Forecast?

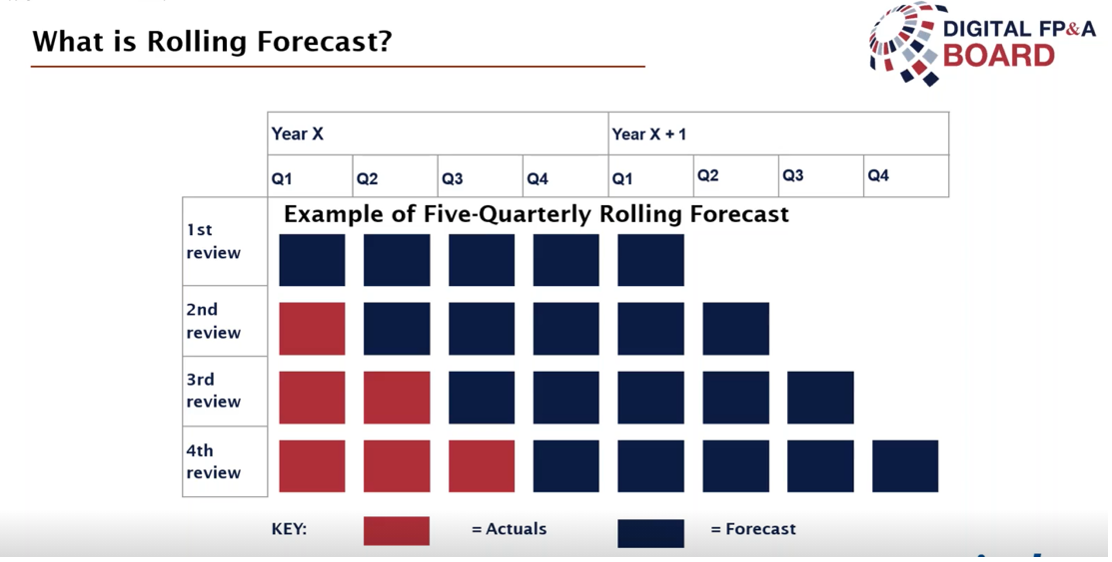

Rolling Forecasts provide a continuous forecast over a specific time horizon (usually 12–24 months). They move the actuals forward each month on a rolling basis, making it easier for decision-makers to see what's happening in real time.

Here is an example of a five-quarter Rolling Forecast (Figure 1). The red boxes are actual, and the blue ones are the forecasts. If you look at the second review, the first quarter has gone red, which means it is actual, and there are 5 quarters of forecast (with a new forecast quarter added).

Figure 1

From Traditional Budgeting to Rolling Forecast

At the webinar, Ahmed Ezzat, CFO at MFQ Companies, walked us through how his organisation moved from traditional budgeting to Rolling Forecast, and the key reasons for making that change.

The traditional budget is outdated and does not focus on value creation. Value creation is unique to every company, but most of its drivers are common across industries. At MFQ Companies, value creation was the most important reason for adopting the Rolling Forecast.

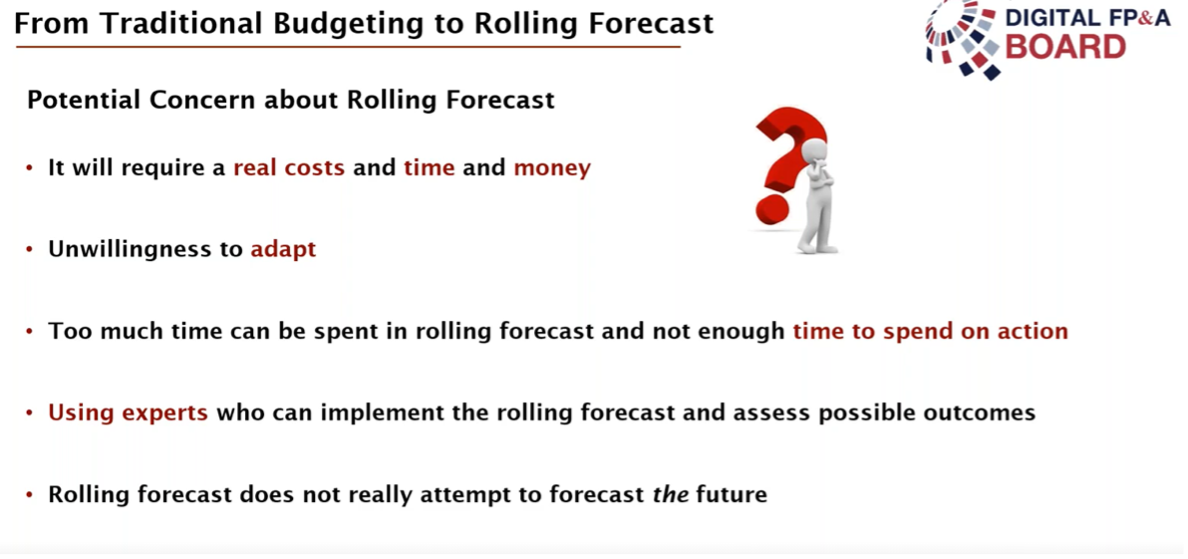

There were several concerns during implementation. People were resistant to change, especially when that change was related to their work. They were concerned about the time it would take to implement, and about the cost versus the benefit.(Figure 2)

Figure 2

At the webinar, we also conducted a quick poll to ascertain how the participants' companies are currently approaching the forecasting process.

Almost half of the participants responded that they were still following the traditional budget process. About 38% were doing a hybrid forecast (both traditional and Rolling Forecast).

Despite the current challenges, organisations are moving forward, taking the right steps, and thinking about the business value that Rolling Forecasts can add.

Key Success Factors for Rolling Forecast

After the discussion on transitioning from traditional budgeting to a Rolling Forecast, we heard from Anand Joslin, Cluster Director of Finance - Grand Mercure and Ibis Styles Dubai Airport, Accor. Anand shared his valuable experience on the key success factors and best practices that helped his company successfully implement the Rolling Forecast.

The 3 key factors to which Anand attributed the success were people, technology and process. Executive sponsorship, stakeholder buy-in and realigning the culture are important people-related factors in implementing the Rolling Forecast. Technology is another crucial element. Collaboration and sharing data among teams is essential. Even after the right people and technology are secured, though, a cumbersome process makes the implementation highly unlikely to succeed. The process must be simple and easy to maintain, driver-based, agile, and quick to adapt to the changing environment.

We asked our participants how long their current forecasting process is. The key takeaway was that almost half of the participants take more than eight days to implement or to create a Rolling Forecast. That is surely something that can be improved upon, on both the process and technology sides.

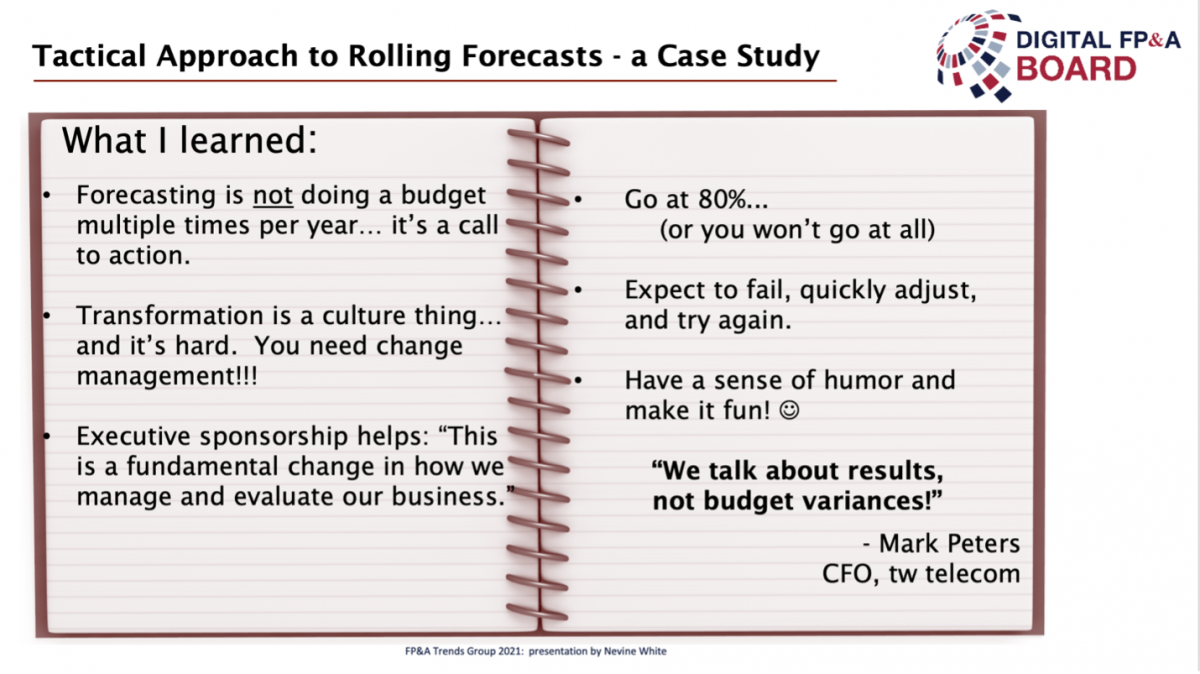

Nevine White spoke during the next part of the webinar. The VP Accounting at Hargray Communications shared the following insights from her experience at her former company TW Telecom (now Century Link) (Figure 3)

Forecasting is not budgeting multiple times a year, but rather having a call to action informing the leadership that they need to engage and change when the forecast is updated.

Executive sponsorship is fundamental to making the change happen.

Transformation is difficult, as is getting people to change their minds and adopt the new process. Implementing a change management support structure is therefore vital.

Progression and not perfection is key. We need to implement, expect to fail quickly, adjust and try again. If we just plan and analyse it to be perfect, it’s never going to happen.

Figure 3

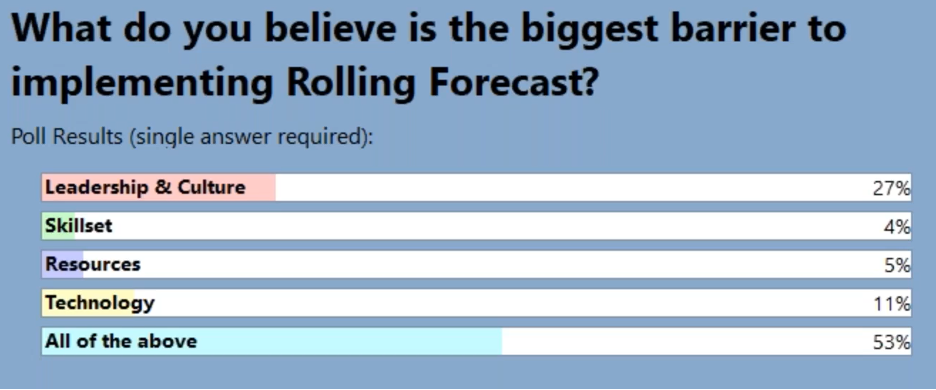

For 27% of the participants, the biggest barrier to implementing the Rolling Forecast is leadership and culture. 11% voted for technology, 5% for resources and 4% for skillsets. The majority (53%) said all of the above. (Figure 4)

Figure 4

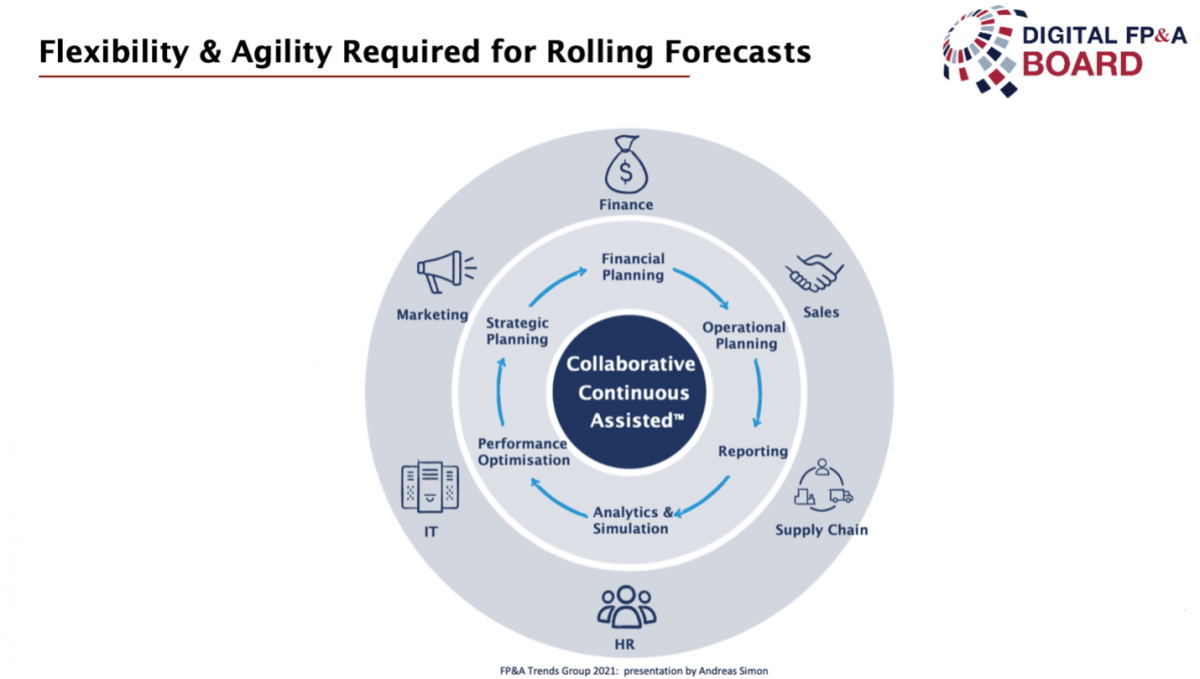

In the final part of the webinar, we heard from Andreas Simon, Director MEA at Jedox. Andreas discussed the role of technology in Rolling Forecasts, focusing on some of the key factors required for them to be efficient.

Figure 5

For effective collaboration, it’s important to integrate the finance data with data from different departments (like sales, procurement, supply chain, HR and so on). This helps to understand the impact of different activities on the business result.

Agility and speed are important to get the Rolling Forecasts done promptly without compromising on accuracy. This enables better decision support.

Flexibility of the platform is crucial to combining planning and forecasting functions with data and processes of the different business teams.

Conclusions and Recommendations

While the Rolling Forecast is an important tool for modern organisations, we see that they are at different stages in their journey towards implementing it. A significant part of them are still limited by reliance on traditional budgeting processes. Overall, it is encouraging to see that adoption of Rolling Forecasts is increasing.

The key takeaways are:

The Rolling Forecast is not a measurement tool but a management tool that creates value.

Successful implementation of a Rolling Forecast is not just a finance function, but rather requires collaboration from all departments involved.

Progression and not perfection is key. We need to implement, expect to fail quickly, adjust and try again.

The executive sponsorship is fundamental, as is a change management support structure to make Rolling Forecast gel within the organisation.

The Rolling Forecast can transform the way we manage our business. It helps leaders get better visibility into the future and make faster, more accurate decisions.

We would like to thank our global sponsor Jedox for great support with this Digital FP&A Board.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.