Traditional planning methods are well known for extracting insights and steering business decisions in short-term and...

It has been a while since we had the chance to gather in person and engage in a meaningful conversation about best FP&A practices and opportunities to impact the organisations significantly.

It has been a while since we had the chance to gather in person and engage in a meaningful conversation about best FP&A practices and opportunities to impact the organisations significantly.

No matter the industry, we all have one thing in common: to get better at what we do and contribute to the success of the organisations we support. In essence, it is a Think Tank for FP&A leaders to discuss best practices in FP&A and has an open discussion on what it takes to become the Best-In-Class FP&A.

Figure 1: The attendees of the San Francisco FP&A Board in October 2022

The forum was moderated by Fernando Schreiner, Director of Financial Planning & Analysis at Gensler. The topic of our discussion was ‘Moving from FP&A to Extended Planning and Analysis (xP&A)’. Although the concept is not new, it has not been an easy journey for most organisations.

In today’s ever-changing business environment, FP&A organisations need to look for effective ways to automate and scale their processes, manage data and deliver valuable insights, upskill and improve the storytelling capabilities of their finance professionals. The leaders constantly try to balance business needs with resource constraints, system limitations and data quality issues. There is a growing demand for a shift in the FP&A role from a reporting and planning function to a business advisor and thought leader.

What is Extended Planning and Analysis (xP&A), and How To Implement It?

Extended Planning and Analysis is a journey to analytical excellence. The group’s discussion focused on the key elements of xP&A that include:

- “X” - a Cross-functional Planning, moving beyond Finance;

- Aligning strategic, financial, and operational plans;

- Digital Transformation (along with tools required & processes).

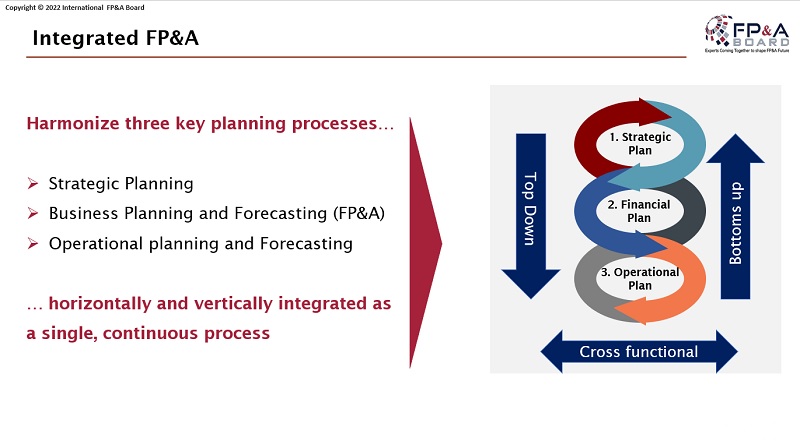

The group discussed ideas on implementing xP&A and the importance of including scenario management in FP&A practice. Extended planning and analysis require harmonisation of the key planning processes into one continuous firmwide process.

Figure 2: The Integration of Strategic, Operational and Financial Plans

- Strategic Planning;

- Business Planning and Forecasting (FP&A);

- Operational Planning and Forecasting.

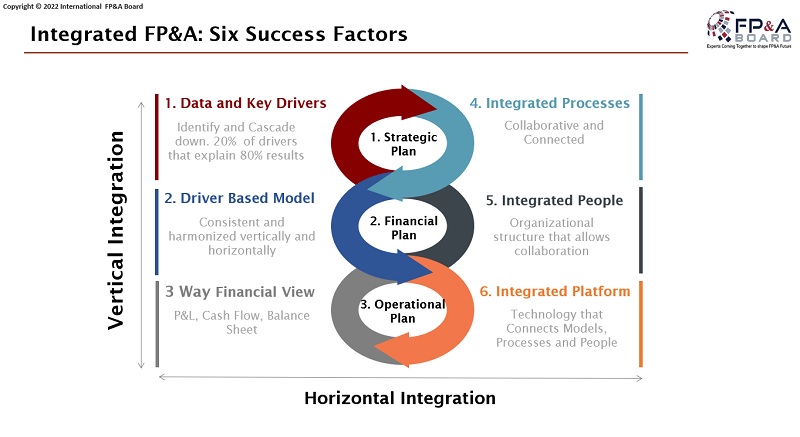

Integrated FP&A: Key 6 Success Factors

To achieve an Integrated FP&A, organisations and their leaders need to focus on key success factors outlined below.

Figure 3: Six Factors Required for Vertical and Horizontal Integration

From FP&A to Integrated FP&A – Strategy Study

Glenn Snyder, VP – Financial Planning & Analysis at Mobileum, shared his insights and practical experience on FP&A teams’ importance in getting to know the business and being effective thought partners and advisors. This shift in the organisational mindset and focus on FP&A delivering value-add services is foundational for the integrated FP&A framework.

Small Group Session: What Are the Practical Steps for xP&A Implementation?

The forum continued with small group discussions on data/models and people/culture topics. During breakout sessions, we openly discussed our thoughts and ideas about practical steps. Below are some key concepts that came out of our discussions.

Data and Models

As FP&A teams transition from traditional financial oversight functions to extended financial planning and analysis, creating a scalable framework that enables leveraging data to drive better decision-making and insights is crucial. Successful organisations establish data governance councils and driver-based planning frameworks for elevating FP&A planning and data management capabilities.

Data management and governance – FP&A leaders need to recognise the importance of implementing data strategy and get involved. Sometimes Finance leaders find themselves in the best position to create and facilitate Data Governance Council responsible for setting data strategy, developing consistent definitions and taking measures to ensure data integrity.

Driver-Based Financial Planning – enables process scalability and effective scenario planning while promoting accountability and a sense of ownership among business leaders. When the organisation embraces the Driver-Based Financial Planning framework, it better positions FP&A teams to become more efficient and forward-thinking. They are more likely to leverage Artificial Intelligence (AI) and Predictive Analytics to drive insights for the organisations further.

Figure 4: Networking during the San Francisco FP&A Board

People and Culture

Successful FP&A teams recognise the importance of effective partnering and diversity of skills and perspectives. Teams that exhibit intellectual curiosity and flexibility of thought process enable their leaders to focus on identifying initiatives that help deliver greater value to the organisation. Teams need to build a culture of trust and personal accountability. When people feel supported by their managers and get the “Air Cover” they need to be creative and entrepreneurial, they perform at a higher level and are more likely to achieve their strategic goals.

When managers devote sufficient time to effective coaching, it raises competence levels and trust within their organisation. The ultimate goal is for FP&A teams to gain trust and show business leaders the value of partnering with FP&A. It requires FP&A teams to get a deeper understanding of the business and its performance drivers. Investment in FP&A training and development by implementing rotation programs and leveraging cross-training opportunities becomes increasingly important in the transition to extended financial planning and analysis model.

Lessons Learned and Takeaways

It was my first FP&A Trends Board meeting, and I did not know what to expect. I was excited to find out. I looked around the room as we all gathered on the 10th floor of the beautiful downtown San Francisco building. I saw thirty passionate senior-level FP&A professionals who sought knowledge and were ready to share their experiences with like-minded leaders.

Moving from traditional FP&A to extended planning and analysis is an evolved process requiring integrating FP&A key processes with business operations. The examples include building integrated systems and planning processes that synchronise strategic, financial and operational processes and implementing organisational structures that allow better cross-functional collaboration.

FP&A Board discussion was an excellent opportunity for Finance leaders to share their experiences and ideas on achieving best practices in our journey to a better and more effective FP&A.

Sharing perspectives helped us better assess our teams’ current and desired state and the necessary steps to transition to integrated planning and analysis.

Although we all wished we had more time to continue our discussions, we also enjoyed the networking opportunity over good food and a glass of wine. I am thankful for the opportunity to attend the San Francisco FP&A Trends board meeting and look forward to the next ones. It is great to get back to our meetings in person!

We want to thank SAP for sponsoring this event.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.