FP&A must drive profitable business decisions. As companies increase investments in advanced analytics, CFOs and their...

The FP&A maturity journey requires the organisation to develop across all the facets: Leadership, Functional Skills, Business Partnership and Collaboration, Process, Data and Analytics, and Technology.

In the latest FP&A Trends Webinar, we looked at one of these facets: Data and Analytics and asked our panellists how we can get to the leading stage and start using Predictive and Prescriptive Analytics in our FP&A process.

This article provides an overview of the topics and cases presented and discussed by experts, as well as the results of interactive polls.

Stages of FP&A Analytics Maturity

Arslan Hafiz, FP&A Director International at AstraZeneca Rare Disease, shared with us how we can make a cultural shift from “What” to “Why” & “How”.

The reasons we are stuck in the early stages of maturity, such as descriptive and diagnostic analytics, are the vast amount of data available, interest in playing with numbers, and the excellent analytical skills of the FP&A teams.

To get out of that “data trap” and overcome paralysis by analysis, we need to realise that the past cannot be undone, we should learn from the past and improve our future.

The key to this transformation is understanding the real business drivers under financial performance and working with those drivers to affect our financial results. In a global pharmaceutical company, such as AstraZeneca, business drivers, such as the number of patients, are crucial inputs for financial planning and forecasting.

To make this transition from descriptive analytics to Predictive and Prescriptive Analytics, we need to apply the classic Pareto 80/20 rule, where we focus only 20% of our time and resources on what happened and why it happened and 80% on what will happen & how we can improve.

To keep backwards-looking and reactive processes within the 20% time limit, we must rely heavily on automation, delegation, and outsourcing.

Arslan has shared with us several collaboration lessons to get the most out of data analysis results.

Figure 1

How Mature Is Our Business Analysis?

During the webinar, participants from the FP&A industry took part in the survey and described their current state of business analytics maturity. The absolute majority of organisations (70%) still rely on descriptive and diagnostic analytics, while 30% of participants have already implemented Predictive or Prescriptive Analytics in their organisations.

Connected FP&A and Agile Scenario Management

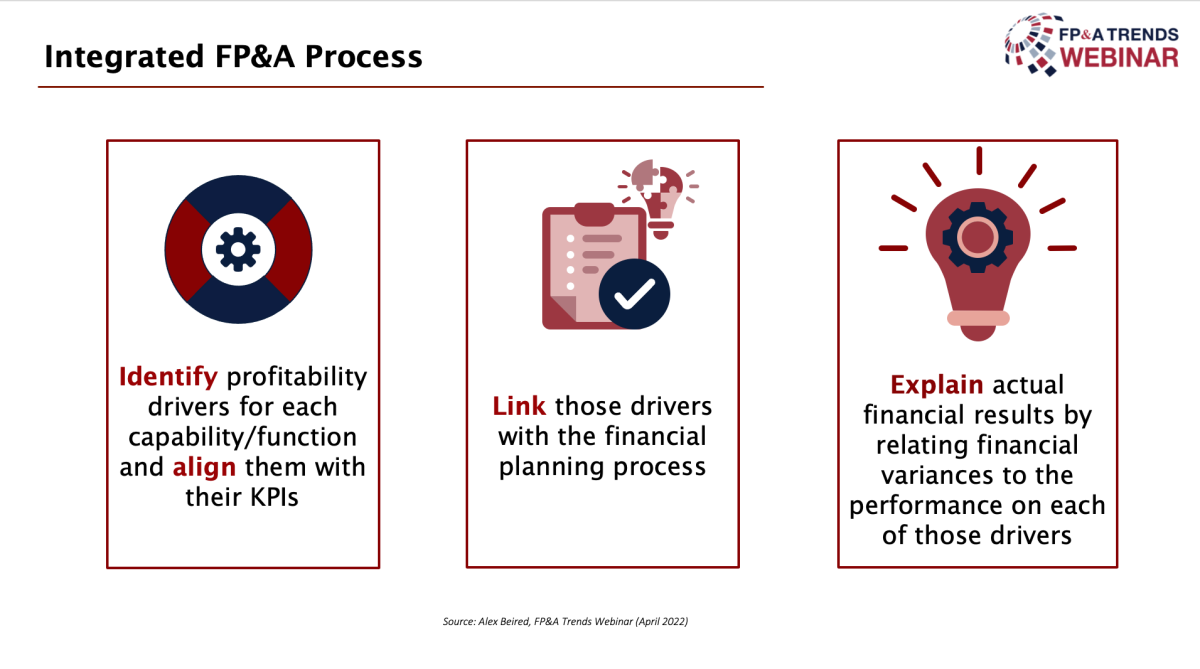

Alex Beired, Director Corporate FP&A at Owens Corning, walked us through the Integrated FP&A process and explained how important it was to get these steps right in a global construction business like Owens Corning.

Figure 2

A strong foundation of every planning process involves sitting down with business stakeholders and identifying key profitability drivers. It is crucial to explain to the business how those drivers affect our financial performance and choose which ones to focus on in our financial modelling.

The second important step is to link those drivers to our financial performance within automated models. We want these models to do the forecasting work for us once it's set up. Only by leveraging technology can we achieve efficiency and scalability in our forecasting process. After that, we can see what will happen and what may happen to our financial performance if we adjust or change those inputs.

Understanding those business drives allows us to provide insight into our past or future performance when talking to our business stakeholders. Explaining actual financial results by relating financial variances to the performance of each of those drivers and telling the story of your business data has become a key FP&A skill these days.

After data entry, data processing, and Scenario Planning are automated, the key finance competency is interpreting and acting on that insight.

You can only reach the leading stage of FP&A maturity in terms of Analytics if you understand your profitability drivers, link them to your financial performance, leverage available technology to prepare multiple scenarios, and have a discussion with key stakeholders in your business on how to manage those scenarios.

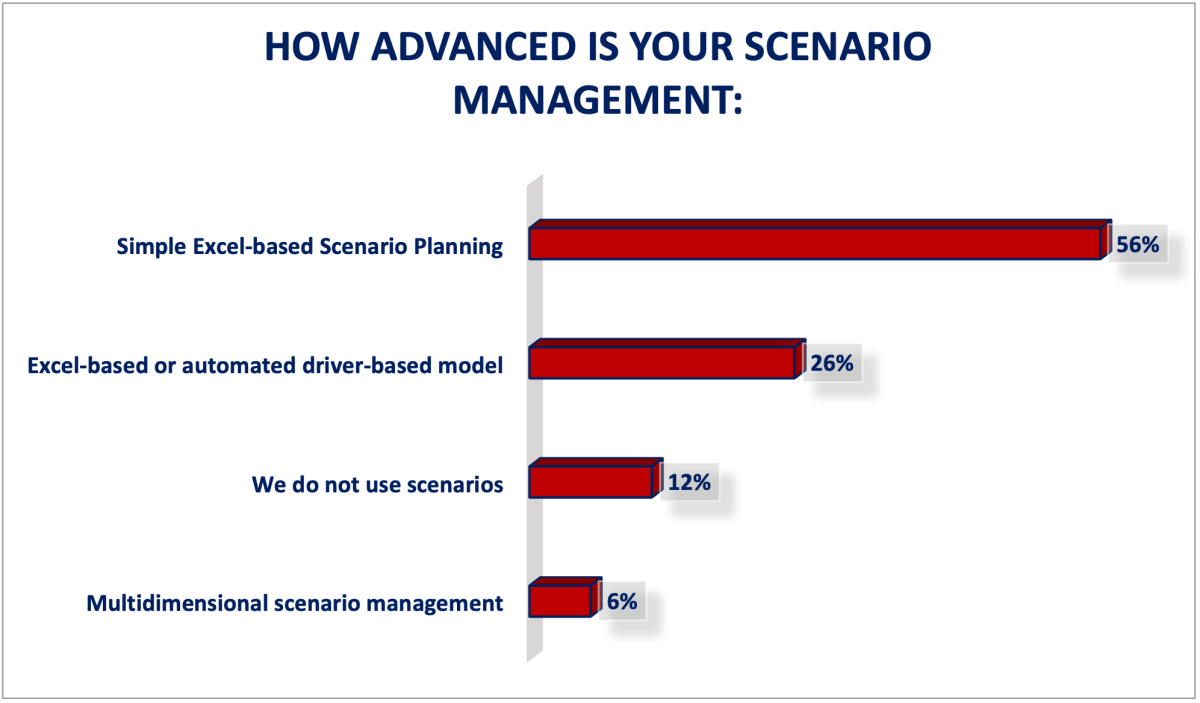

Scenario Management Insights

The absolute majority of survey participants (56%) use Excel as their primary tool for Scenario Planning. Our last speaker of the event addressed scenario management and the technology aspect in his presentation.

Figure 3

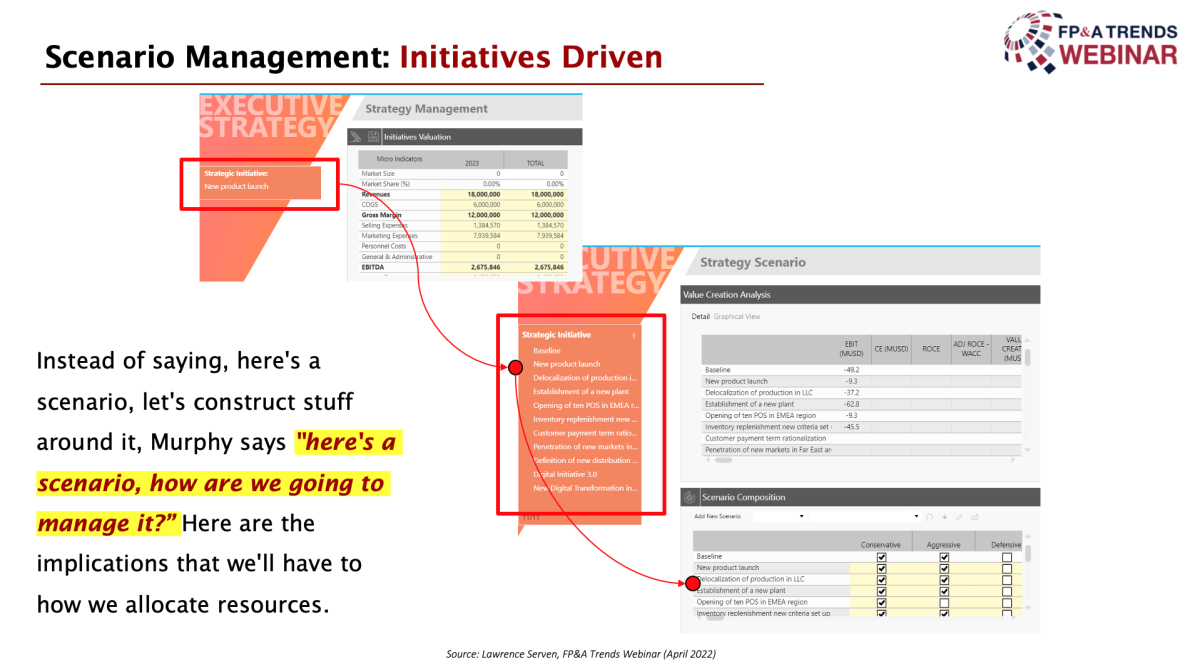

FP&A Thought Leader and Author Lawrence Serven, Regional Director at Board International, explained why we should focus on scenario management rather than Scenario Planning and how initiative-based scenario management works.

You can't have proper scenario management with 4000 scenarios, you need to focus on a handful which is likely and have the biggest magnitude.

The way to manage scenarios is to bring in initiatives as a response to a scenario and quantify a total P&L impact for every initiative.

When the whole list of the initiatives is ready, we can mix and match and decide which initiatives will be executed in response to scenarios A, B or C.

This is a quite technically demanding exercise and shouldn’t be performed in Excel or any other tool with manual data entry. Besides that, there is another requirement to the system, where you perform your initiative-based scenario management, and that is “Interlocking views”.

Figure 4

This is a quite technically demanding exercise and shouldn’t be performed in Excel or any other tool with manual data entry. Besides that, there is another requirement to the system, where you perform your initiative-based scenario management, and that is “Interlocking views”.

There are several ways we can look at the business: geographically (by regions and states), hierarchically (by divisions and products), and along with the organisational structure (by vice presidents and sales representatives). Interlocking views mean that all combinations are synchronised, and updates in one “view” are synchronised & automatically reflected in another.

There are some other system recommendations for scenario management. Lawrence has not shared with us an exhaustive list but rather a starting point:

Must accommodate at least semi-detailed Initiative Planning

Point & Click Include/Exclude from any Scenario P&L

Accommodate change by any perspective (e.g., Top of the House, Lowest Level, By Region, By Category, By Salesperson, By Customer, by Business Unit, et.al.)

Straight-Through processing of Strategy right through Budgeting

Conclusions

We are living in volatile times, it is very difficult to predict what is going to happen, and there is a big appetite for agile management. It is a perfect opportunity for us to demonstrate that the finance community can transform FP&A Processes through Advanced Analytics and serve as true strategic partners for the business.

We would like to thank our global sponsor Board International for their great support with this FP&A Trends Webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.