Takeshi Murakami, Group Controller at Microsoft, shares an interesting case study on leveraging AI/ML in decision-making. Microsoft...

No one wants to consciously make a bad decision!

No one wants to consciously make a bad decision!

The quality of a decision is a question about what data or lack of data the decisions are made on. So, let’s discuss what is a Data-Driven Decision and what is not, but also how do we make Fair Decisions.

Biased Decisions and Their Implications on the Business

Decisions are sadly often driven by:

- Gut feeling is a decision based on a, well, feelings.

- Single case example is a decision on a single or a few cases that happened and the assumption is made it will probably happen again.

- Already defined up front expectations is a situation when a business leader asks for a model that shows the desired result and afterwards it is up to Finance or Operations to manipulate a model to arrive on that result.

Common for all of the above decisions are they are non-data driven and biased. Humans have personal and political pressures that pull at them. As such, humans are biased towards something, so as long as there are human feelings involved in decisions they will be biased. The key to making a decision unbiased is to find a method where humans have minimal influence on the outcome.

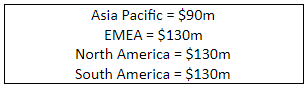

A situation almost every Finance professional has been involved is as follows: A business is in the middle of a budget process and has been asked by corporate to increase its budget by $100m. North America, EMEA, and South America all have made an initial budget submission of $130m each, whereas Asia Pacific initially has submitted $90m:

So how to allocate the corporate budget challenge of $100m more among the four regions? In 99% of the cases, one of the three methods below is used.

- We think each region has equal opportunity (gut feeling) so we add $25m to each region.

- Asia Pacific sometimes sandbag (single case example) so that is probably the case again this year. As such, they get the majority of the $100m, say $55m and the remaining $45m is split equally between the other three regions with $15m each.

- Finance starts to ‘scrub’ each region’s models to allocate the $100m out to each region based on predefined assumptions (already defined upfront)

None of the above methods are data-driven or “fair”, and even worse, they could all have fatal implication on the business leaders in one or more of the four regions. A business leader could get fired for not making the number next year; e.g. we give Asia Pacific another $55m on top of $90m already submitted could cost the Asia Pacific business leader his job the following year. Same could be said for the other two methods.

Data-Driven Decisions and the “Fair Challenge” Concept

But how does Finance help the business allocate the $100m between the regions . . . so there is the best probability of achievement? We call this the “Fair Challenge” that is the answer; i.e. to provide analytics insight to support the business with techniques used for a data-driven and fair decision.

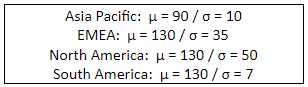

In the table below, we start by calculating the standard deviation of sales for each region, then use that to define the targets where each region has the same probability of making its numbers . . . what we refer to as the “fair challenge”:

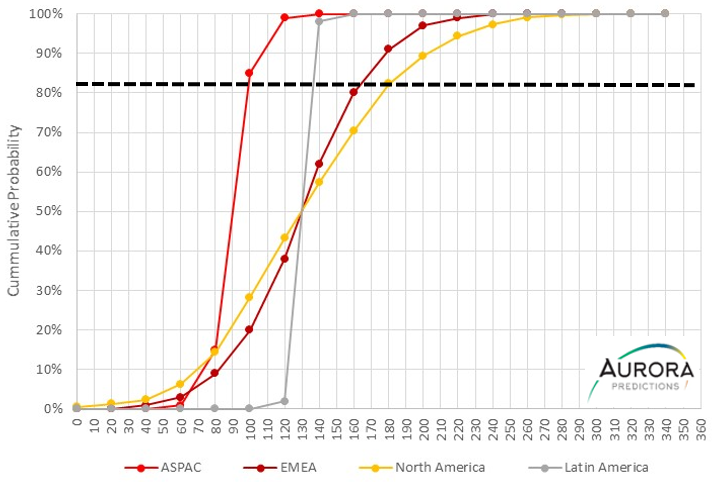

Knowing the expected values (μ) but also the standard deviation (σ) enables Finance to provide insight. As seen on the chart below, the cumulative probability is 82%, meaning at 82% the entire $100m additional budget challenge is distributed fairly between each region; i.e. each region has 18% probability of making their numbers the following year.

Accordingly, the distribution of the $100 is now fair and based on each region having the same probability of achieving their allocation although each has a different allocation.

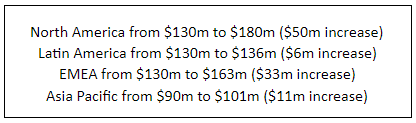

As such, Finance recommends the following distribution of the $100m:

Using the fair challenge concept allow business leaders to treat all regions equally without being biased. But more important, it also helps the regional leaders keep their job (everything else being equal)!

The Power of Fair Analytics

Had the $100m been equally split in $25m chunks between each region, the Latin America and Asia Pacific leader would be at high risk of failure (as they both have minimal upside opportunities illustrated from their probability curves).

Latin America only has 1% chance of adding another $25m on top of their initial submission of $130m, and Asia Pacific has a 5% chance of adding another $25m to their initial submission of $90m.

The power of Fair Analytics goes beyond job security. It fosters collaboration, fairness, and job satisfaction – not to mention better decisions – Data-Driven Decisions!

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.