How can we ensure forecasts produced by different business units are combined into one single consistent...

Financial Planning and Analysis (FP&A) serves as a vital function in managing a company's value, evolving into a strategic partner that significantly impacts organisational performance and decision-making. However, this critical function encounters several challenges, which should be addressed to ensure top-notch performance in vulnerable times.

In response to these challenges, FP&A Trends Group hosted an insightful webinar on May 4, 2023. Senior finance practitioners and thought leaders shared their experiences and provided practical insights to overcome different hurdles the FP&A departments face. The discussions focused on navigating disruptions, enhancing the efficiency of the FP&A function, and capitalising on opportunities amid turbulent situations.

In this article, we are recollecting the key insights from this webinar and outlining the results of the polling questions.

Transforming Cost Forecasting with Activity Analysis

Nick Arzenton, Divisional Finance Director GDO – IBO at Orange Business, commenced by exploring the pivotal theme of activity forecasting and its integral connection to cost predictions. Orange Group was formerly known as France Telecom, a telecommunications giant with $42 billion in revenues. Nick narrowed the focus to the Global Delivery Operations (GDO) International.

GDO International, housing a workforce of 4500 individuals globally, engages in technical operations worldwide. Its activities, ranging from configurations to maintenance, shape the division's core operations. The spotlight was on the correlation between activities and workforce needs. GDO International leveraged this relationship to precisely forecast the personnel required, forming the basis for accurate cost forecasts.

The presenter addressed challenges in the traditional manual forecasting process driven by detailed customer revenue reports. While these reports were accurate for specific customers, this approach proved time-consuming and limited in replicability.

Revolutionising the Forecasting Process

GDO International's evolution involved the analysis of five years of historical data and identifying revenue streams linked to activities. Historical correlations were established, resulting in a faster and more accurate forecasting model that could enhance efficiency and frequency.

They initiated a new process to find a better solution for their forecasting. The revamped process yielded efficiency gains, cost-effectiveness, and a deeper understanding of the revenue-activity relationships. Challenges they encountered included the absence of a customer view and the need for mindset and process changes.

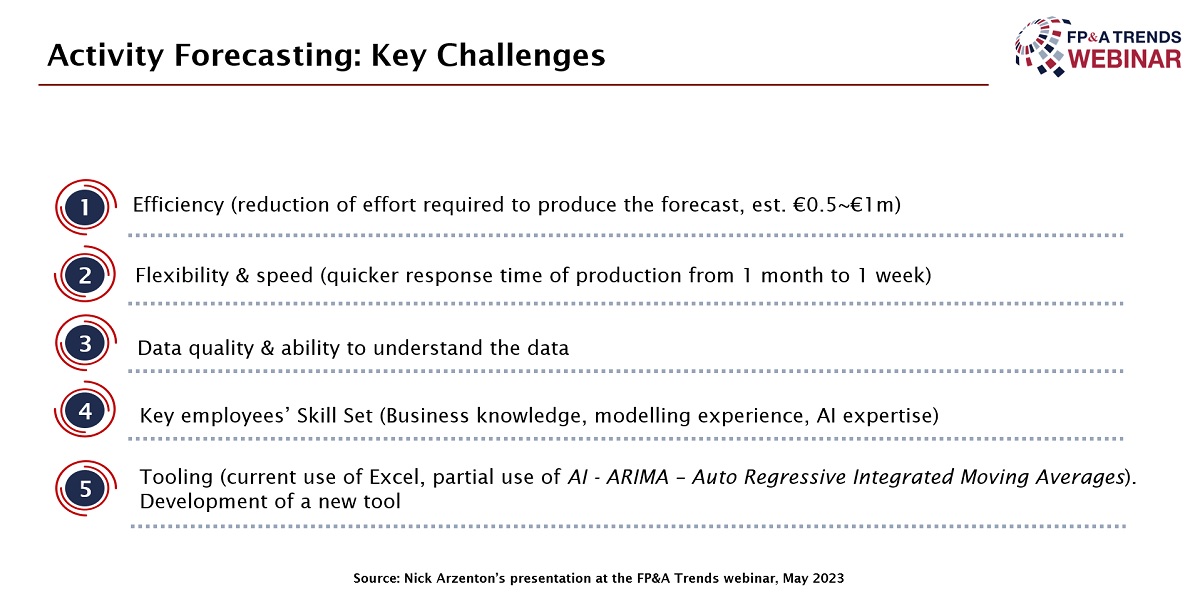

Figure 1

Nick highlighted Excel as the current tool used for forecasting, but they have been working on the development of a new tool. Technology remains a key requirement, addressing data quality challenges and emphasising efforts to enhance efficiency, flexibility, and speed.

What Are the Challenges We Face in Planning and Forecasting?

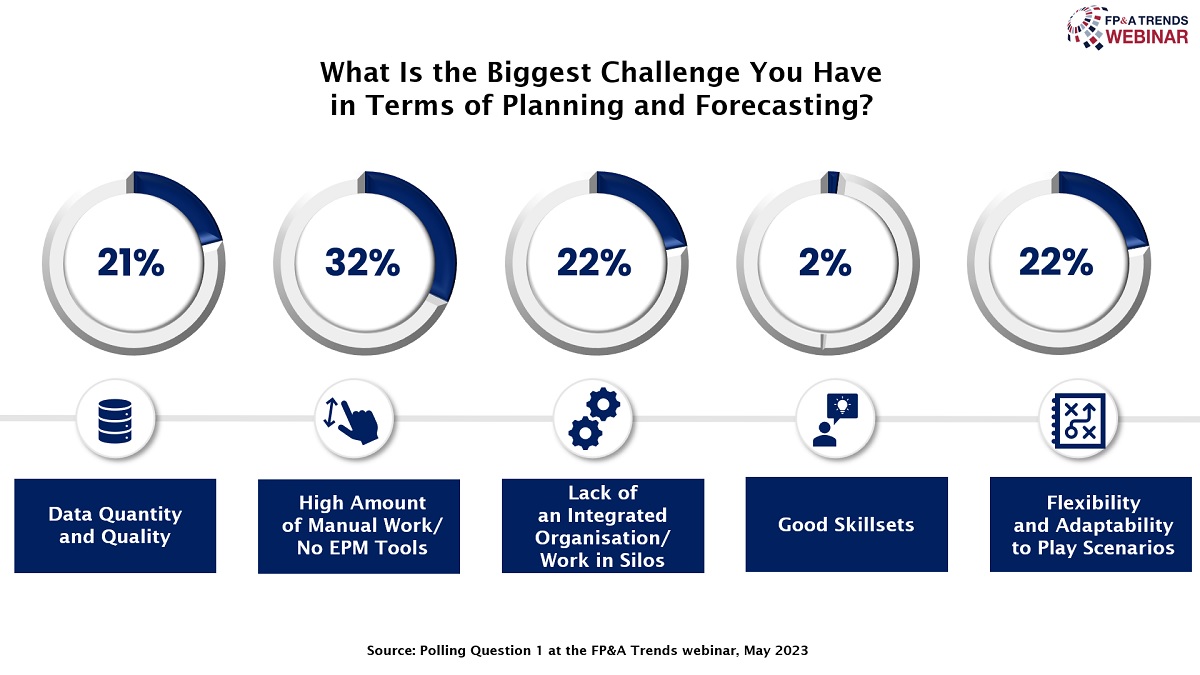

During the webinar, we launched a polling question about the biggest challenges in planning and forecasting. According to our audience, a high amount of manual work or a lack of EPM tools is a significant concern for 32% of the respondents. Flexibility and adaptability to play scenarios on demand and working in silos is another challenge that FP&A teams face: each gained 22% of the votes. Data quantity and quality are also on the list, with 21% of votes.

Figure 2

Navigating Challenges in a Scale-Up World

The second presentation, given by Prodromos Siapkas, Finance Director at sennder, addressed the challenges in business integration and scaling operations, emphasising their relevance across diverse entities.

Understanding the Landscape

Acknowledging the dynamic business environment, the speaker underscored the importance of understanding rapid innovations, market fluctuations, and external factors. These challenges necessitate navigating a fast-paced, ever-evolving landscape.

Organisations are now urged to adopt an integrated Financial and Economic Model Analysis (FEMA), combining processes and scaling up operations. The focus lies on technology implementation, efficient collaboration infrastructure, and dynamic binding between technology and processes.

Balancing Technology and Processes

Successful integration requires aligning technology with well-defined processes. A proposed four-phase budgeting process emphasises predicting needs, cross-functional action plans, and aligning desktop operations with financial goals.

Mindset Shift and Collaboration

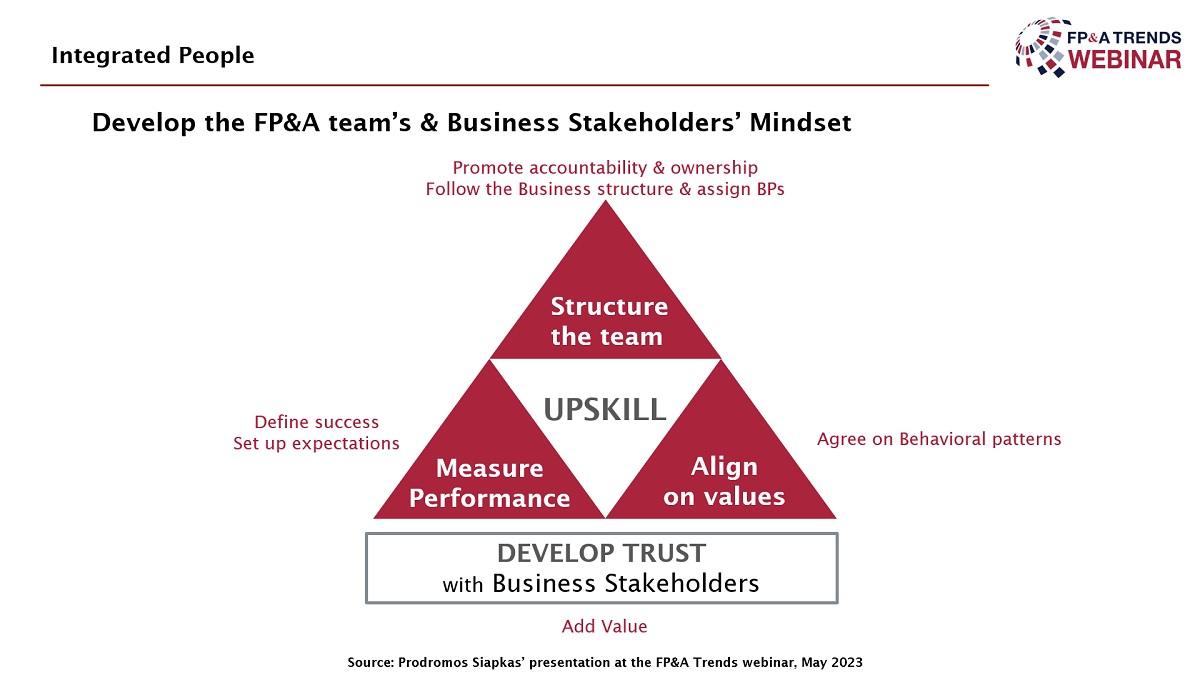

The presentation underscored the significance of a mindset shift, urging the development of willing-to-collaborate teams aligned with business objectives. Key steps included establishing ownership, defining success, and setting clear expectations. Trust-building and aligning behavioural patterns are pivotal for successful daily operations.

Figure 3

In conclusion, Prodromos highlighted the journey toward a more integrated business model, drawing parallels with venture-capital businesses. He emphasised the need to integrate processes and people, presenting a holistic approach to effectively navigate business integration and scaling challenges.

What Hinders the Shift to Integrated FP&A?

Right after hearing Prodromos’ insights, we asked our audience about the biggest barriers on their journey to Integrated FP&A. 37% of the respondents lack properly integrated processes, while 28% lack support from leadership. 32% of the webinar attendees consider the lack of an integrated platform as the main challenge.

Figure 4

Unlocking Collaborative Financial Performance Management

In the final presentation, Justin Merritt, VP at Planful, advocated for transforming Financial Performance Management (FPM) into a collaborative team effort, breaking away from its traditional association with finance and accounting.

He called for a paradigm shift, treating FPM as a "team sport." All stakeholders influencing spending decisions should be encouraged to participate, integrating strategy, objectives, and financial elements across all business areas.

Collaborative FPM offers enhanced accountability, automated processes, and improved collaboration with contextual information. Native collaboration capabilities within tools facilitate communication in different workforces, especially in remote and global setups.

Challenges and Solutions: Identified challenges in achieving collaborative FPM include strong reliance on spreadsheets, manual processes, data security risks, and hindering user participation. The negative impact of scattered version control and reactive reporting on overall efficiency was also emphasised.

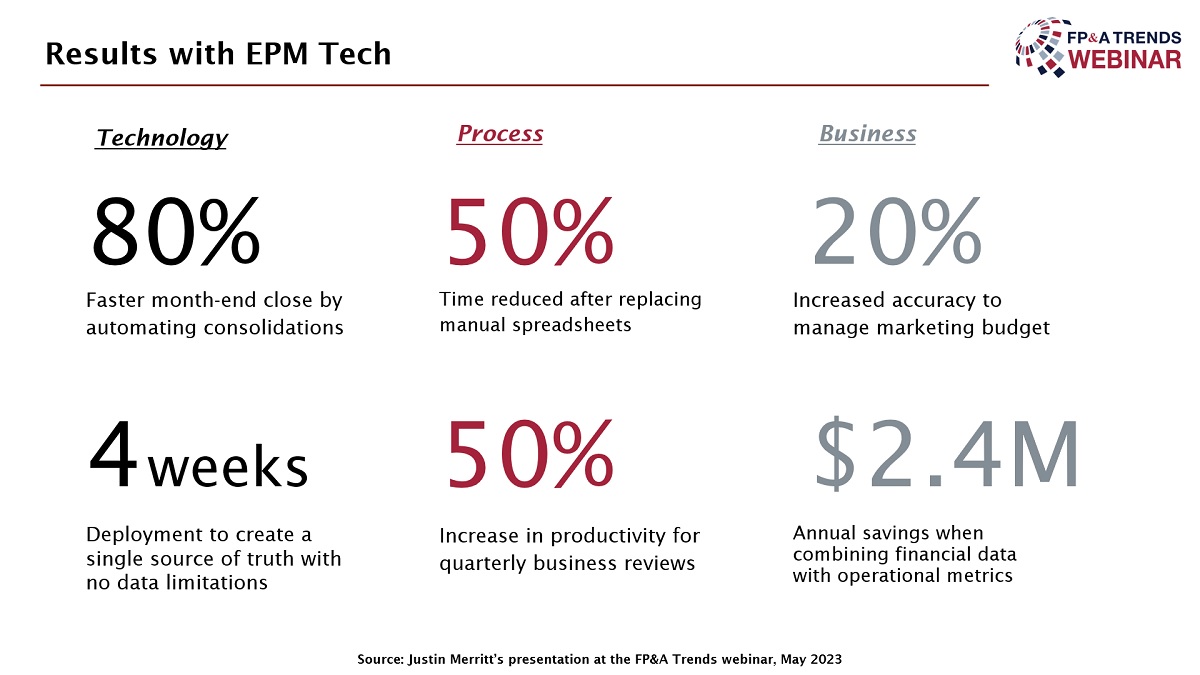

Technology as a Solution: Justin’s presentation concluded with the need for technology investment to overcome FPM challenges. Swift implementations can reduce month-end close process time by up to 80%, leading to improved accuracy, increased productivity, and better decision-making. The positive impact of technology can be seen in providing transparency and freeing up time for strategic activities.

All in all, we need to encourage a shift in perspective, promoting collaborative efforts in FPM. Integrating technology and a team-oriented approach emerge as crucial strategies for enhancing efficiency, accuracy, and overall business impact in financial performance management.

Figure 5

Justin shared these stats to highlight the importance of technology in meeting these key challenges.

Conclusions

In conclusion, we discussed challenges around data, skillsets, flexibility and adaptability, the importance of agile planning processes, forecasting issues and what technology can offer FP&A teams to handle such hurdles.

This webinar was proudly sponsored by Planful.

To watch the full webinar recording, please follow this link.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.