Discover how AI ML transformation is redefining FP&A with automated forecasts, performance driver insights, and intelligent...

Artificial Intelligence is rapidly reshaping the role of FP&A from automating routine reporting to enabling real-time scenario planning and forward-looking decision support. This evolution is empowering finance teams to shift from traditional analysis to becoming strategic business partners.

In this FP&A Trends webinar, based on insights from the 2025 FP&A Trends Research Paper, global finance leaders shared how they are adopting AI to drive agility, unlock value, and expand foresight. With case studies from VodafoneThree, the Financial Times, and EY’s ambitious “Client Zero” transformation, the session offered a practical and strategic view of AI’s growing impact on finance.

This article captures the key takeaways and lessons shared by FP&A leaders who are pioneering the future of intelligent finance.

Reimagining Finance: A Human-Centered Approach to AI and Innovation

Senior Finance Director at Financial Times Darren Joffe shared how the Financial Times is rethinking finance through a culture-first approach to innovation and AI adoption.

Opening with the striking insight that 53% of FP&A teams report no current use of AI, Darren framed the issue not as a tech gap but as a leadership opportunity. Finance teams, he argued, risk falling behind not due to a lack of capability but because they’re working in ways the world has moved on from.

Rather than wait for the “right time,” Darren leaned into innovation during the FT’s busiest period, while implementing three major systems, including a new ERP. He gave his team permission to question, experiment, and improve without needing top-down approval.

This sparked a wave of bottom-up change:

- Power Query training saved time and built confidence.

- ChatGPT was used to improve reporting, formulas, and communication.

- Teams self-organized to share ideas and run internal Lightning Talks.

One standout innovation: Tone of Voice GPT, trained on FT’s tone of voice, helps sharpen executive messages and saves 40% of rewrite time. Another team member built a Q&A tool from training manuals using natural language AI, reducing support time. Not all innovation was AI-driven; they even found ways to bypass ERP limitations with smart workarounds.

Figure 1

Darren’s key message is not to wait for perfect conditions. Start small, build trust, and make innovation everyone’s responsibility.

Polling insights

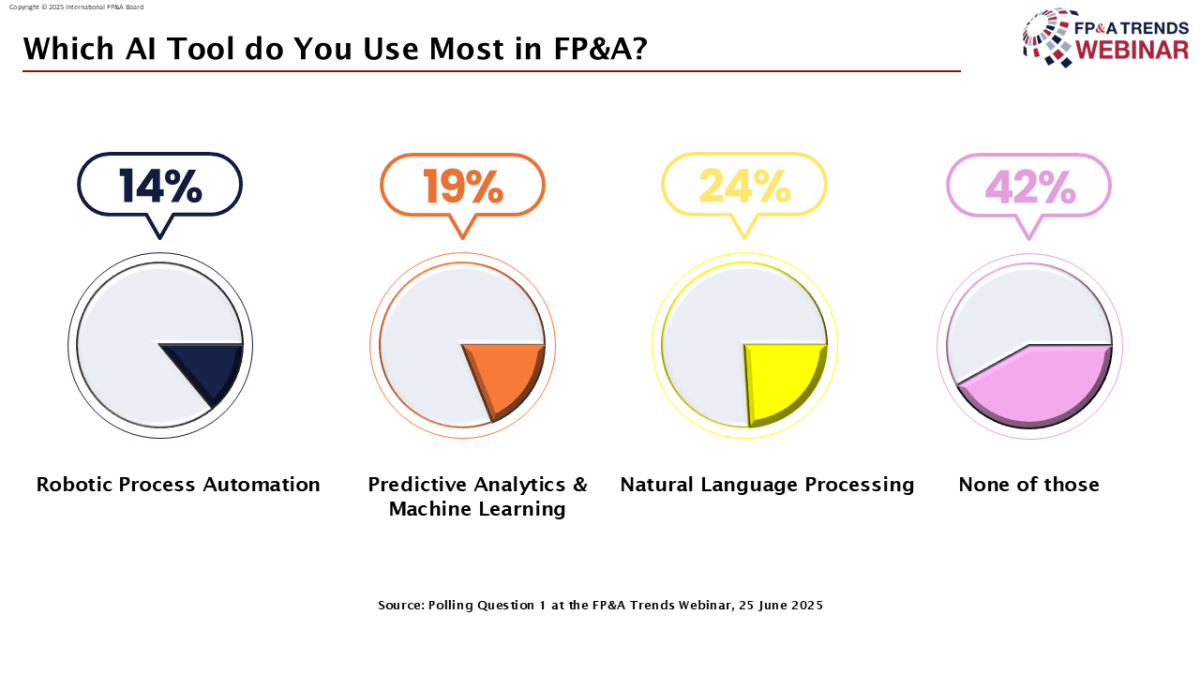

In our first poll, attendees were asked which AI tool they use most in FP&A. The results showed that 42% of respondents are not yet using any AI tools, while 24% reported using natural language processing, 19% use Predictive Analytics and Machine Learning, and 14% rely on Robotic Process Automation (RPA). As Darren Joffe noted, the high percentage of non-users highlights a significant opportunity for finance teams to begin exploring AI, starting with accessible tools like natural language processing, which has become an easy entry point for many.

Figure 2

Driving FP&A Transformation at Vodafone: From Data to Decisions

In her presentation, Gizelda Ekonomi, Senior Commercial Finance Manager at VodafoneThree, shared VodafoneThree’s finance transformation journey, illustrating how FP&A evolved from reactive reporting to proactive, insight-led decision-making.

She opened with three industry-wide challenges:

- Data overload with limited actionable insight

- Rising demand for real-time scenario planning in uncertain times

- AI is stuck in pilot mode with little execution follow-through

To overcome these, VodafoneThree focused on five foundational pillars:

Figure 3

1. Rewiring the Data Foundation

The team built a governed data strategy with defined ownership, product/customer taxonomies, and real-time pipelines into planning tools, ensuring quality and trust in the data used by FP&A.

2. Modular and Scalable Modelling

Instead of starting from scratch each time, Vodafone introduced a modular, driver-based model. This supported 15 micro-models across the business and cut reforecasting time from three weeks to four days.

3. Shifting from Planning to Prediction

By using AI to forecast regional revenue 90 days ahead, finance engaged stakeholders proactively, unlocking £10M in in-year revenue through faster commercial actions.

4. Embedding Finance in Business Workflows

Finance became embedded in processes like lead-to-cash and campaign performance tracking. This allowed real-time visibility into conversion rates and margin protection, elevating finance to a true co-pilot role.

5. Activating the Human + AI Operating Model

By automating low-value tasks, reporting effort dropped 60%, and forecasting sped up by 80%. Cross-functional agile squads (finance + data science) further enhanced insights and adaptability.

Gizelda's final thoughts were: “Are you designing your FP&A team for speed or foresight? Are you investing in systems or insight?”

Polling insights

In our webinar’s 2nd poll on the biggest barriers to AI adoption in finance, data quality issues topped the list (34%), followed by lack of skills and training (31%), resistance to change (25%), and accountability blur (9%).

Reflecting on the results, Gizelda Ekonomi noted they aligned closely with her experience at Vodafone, where success required strong data foundations, the right talent, and cross-functional alignment.

The key takeaway: AI adoption is less about technology and more about enabling people, processes, and quality data to work together effectively.

Figure 4

EY’s “Client Zero” Transformation: Embedding AI from the Inside Out

Derk-Jan van der Wal, Global Lead Partner at EY, presented EY’s internal transformation initiative, “Client Zero,” where the global professional services firm applied AI-driven change to its own operations before advising clients to do the same.

EY began this journey in 2017, with a bold vision to become “The most trusted AI-powered professional services organization in the world.”

Figure 5

Why EY Transformed:

- The scale of EY’s challenge was vast, unlocking insights from over 400,000 professionals globally.

- The goal was to harness this knowledge using AI, enhancing both internal operations and client service.

- The transformation extended beyond FP&A, touching every function of the business.

Key Components of the Transformation:

- EYQ: A ChatGPT-style internal AI platform, enabling users to tap into firmwide data and systems.

- 124,000+ unique users

- 83% AI literacy across the firm

- $1.4 billion investment in the EY.AI program

- Development of EY Fabric and integration of technology, people, and global ecosystem partners

- Strong focus on leadership, vision, and executive sponsorship

Impact on FP&A:

The transformation pushed FP&A beyond its traditional role into a more strategic position, focused on:

- Productivity enhancement through automation

- Insight generation using AI tools

- Real-time decision support in an increasingly uncertain business environment

Derk-Jan emphasized the urgency: “If FP&A doesn’t take this opportunity, other functions will—and you risk being left behind.”

EY’s View of the Future of FP&A:

- Defined five key FP&A roles required to succeed in the AI era, from data stewards to strategic business co-pilots

- Encouraged finance leaders to: Assess how those roles are already filled / Build cross-functional collaboration / Embrace a growth mindset and willingness to adapt

Final takeaway: Transformation is rarely linear or perfect, and that’s okay. Success depends on bold leadership, willingness to act amid uncertainty, a clear vision for the future of finance, and a culture ready to evolve how FP&A teams think, collaborate, and create value.

Conclusion

Gizelda Ekonomi emphasized the importance of engaging stakeholders early, introducing automation and AI conversations, and proactively shaping expectations beyond the finance team to build momentum and influence.

Darren Joffe reminded us that there’s no silver bullet. The path forward lies in taking action, enabling human-centred systems, and giving teams permission and agency to drive change from within.

Derk-Jan:

- Dare to dream big and focus on the value of transformation.

- Maintain a growth mindset throughout the journey.

- Accept turning points—transformation won’t be perfect, and adaptability is key.

Together, their insights reinforce that successful AI and finance transformation is not just about tools or technology; It is about leadership, mindset, and empowering people to shape change.

We especially thank EY, our sponsor, and all the speakers for their insights and leadership on the future of FP&A.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.