This article summarises the presentations and discussions during the recent Digital FP&A Circle on how Artificial Intelligence (AI) and Machine Learning (ML) have reduced the process burden, increased the speed of insights, and ultimately supported improved decision-making at Konica Minolta and Amazon.

This article summarises the presentations and discussions during the recent Digital FP&A Circle on how Artificial Intelligence (AI) and Machine Learning (ML) have reduced the process burden, increased the speed of insights, and ultimately supported improved decision-making at Konica Minolta and Amazon.

Introduction

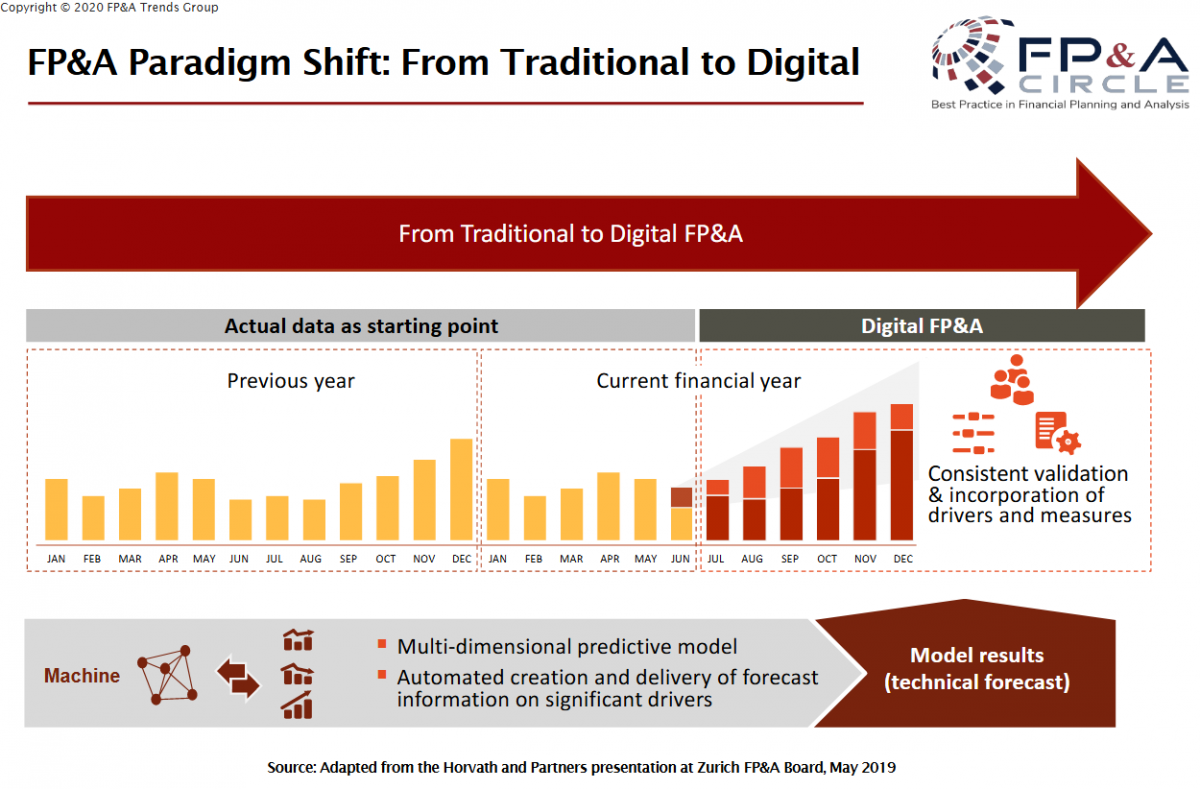

Our profession has moved on from spending six months creating a budget in spreadsheets. Technology allows us not only to increase the speed but also the depth of information (i.e., analyse more dimensions) and increase the sophistication (e.g., by using a larger number of drivers) of predictive models.

Figure 1. The evolution of FP&A

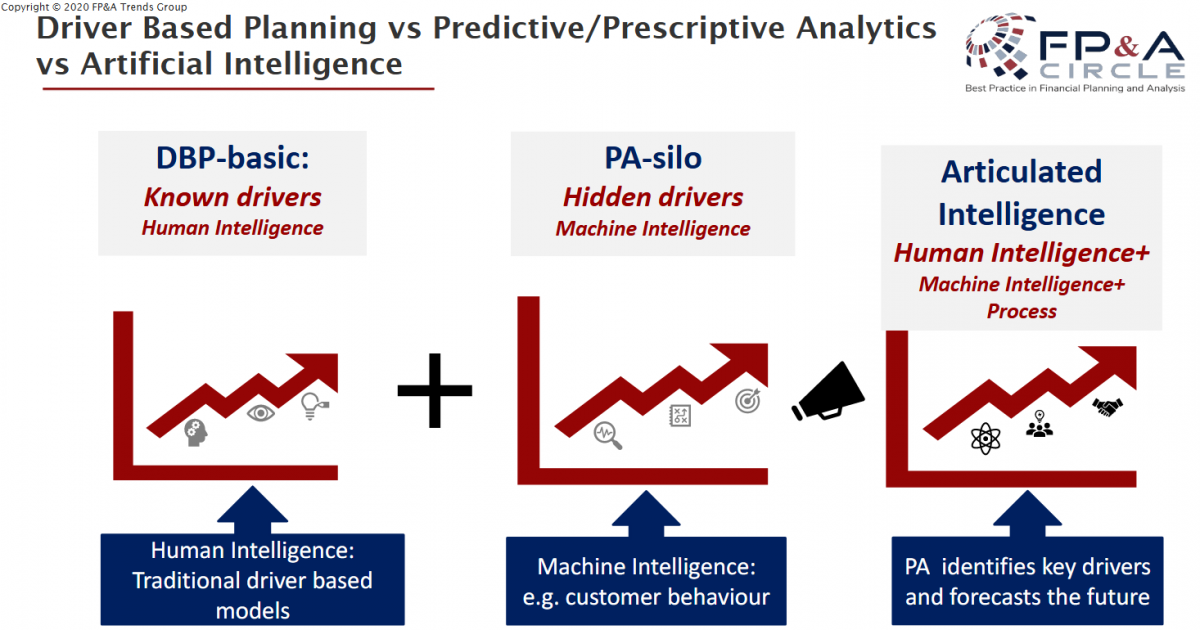

Within FP&A, we are good at using known drivers to build driver-based models for planning. There are also hidden drivers and patterns that we cannot see, which machines can uncover. This webinar proposed a term… ‘articulated intelligence’, where human intelligence is combined with machine intelligence to enhance the combined capabilities. Within the AI community, this is generally referred to as ‘augmented intelligence’.

Figure 2. Articulated Intelligence

This is an area that is maturing fast, but there are not many use cases in finance. Whilst we are starting to see more ML use cases, true AI is rare because firms are just starting on the journey.

CASE #1. Digital FP&A Transformation at Konica Minolta

By Igor Panivko, Managing Director at Konica Minolta (Ukraine and Caucasia)

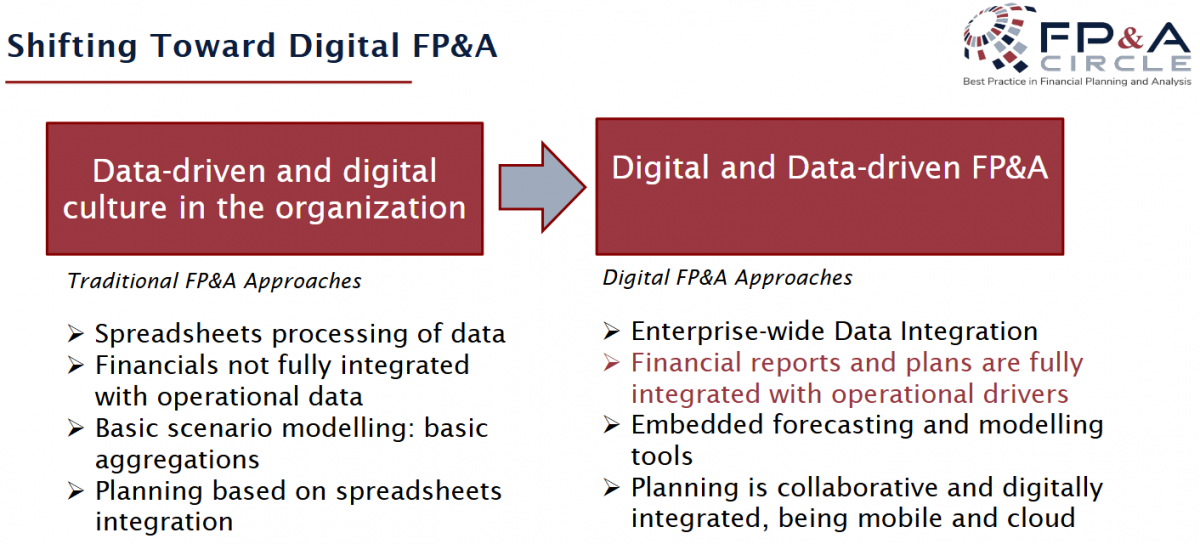

Igor is the rare breed of unicorns who combines business acumen with the ability to code as well. He joined the organisation ten years ago. His description of how FP&A worked then, is what we see in the majority of finance teams today… hundreds of interlinked spreadsheets for planning and reporting; each reporting cycle takes 5 to 7 days to complete; and resource constraints within the finance team.

As a spreadsheet fan, Igor maximised what he could get from them, creating some absolute beasts. Of course, while you can look at these complex Excel-based models with an element of pride, they are time-consuming, inefficient, and contain all sorts of data quality demons. Furthermore, you are limited in terms of what you can do. You cannot go very granular with the data. You do not have much scope to bring in operational data sets.

Figure 3. How FP&A changed at Konica Minolta

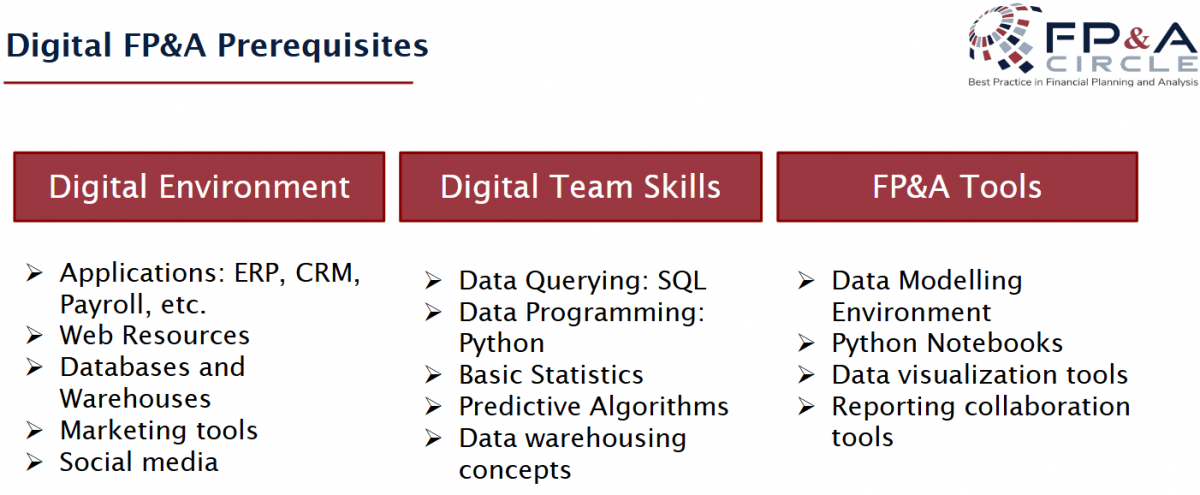

On their digital FP&A transformation journey, Konica Minolta replaced Vlookups and pivot tables with data models, star schemas, and SQL statements. Figure 4 shows what was implemented and embedded to achieve their FP&A vision.

Figure 4. Components of digital FP&A

Most mundane tasks were killed. Reports and forecasts across multiple markets are now available in real time. They can drill from the P&L into the operational drivers. They can also interrogate operational drivers to see the impact on the P&L. The team had time to become engaged in thinking processes and making decisions.

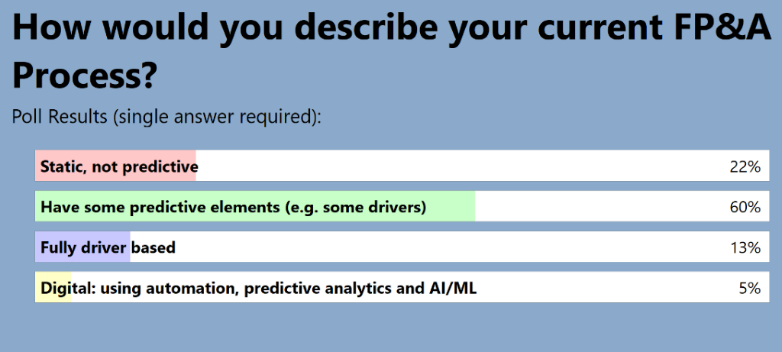

POLL #1: How would you describe your current FP&A process

Figure 5. Results from the first poll

These results are consistent with previous surveys conducted by the FP&A Trends Group across the globe. It is encouraging to see organisations moving towards fully automated processes.

Case #2. Applying machine learning to revenue forecasting at Amazon

By Anton Malmygim, Head of FP&A, BI, and Cost Out Initiatives at Amazon

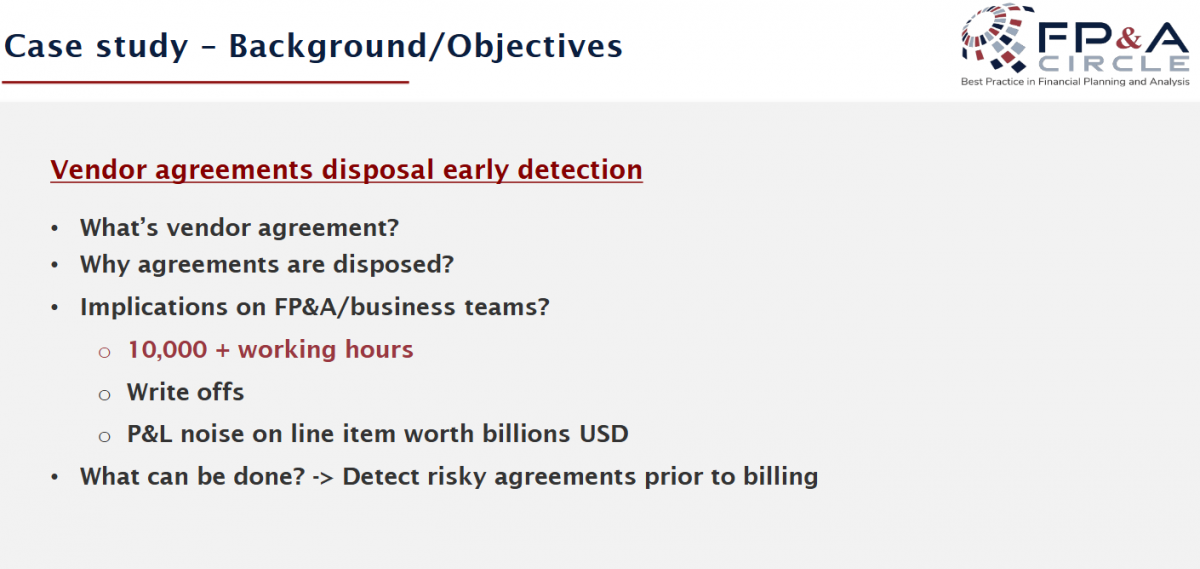

Amazon has a large number of vendor agreements. These agreements are continually ‘disposed’ and superseded by new agreements. Disposals create more than 10,000 hours of rework in finance, as well as P&L noise through e.g. accrual reversals.

Figure 6. Disposed vendor agreements context

These agreements are a major portion of the P&L. By applying machine learning techniques, Amazon started to detect ‘risk’ agreements prior to billing. They did not have any hypotheses about what is driving disposals. When they analysed the correlations, they did not find any strong correlations between any of the variables.

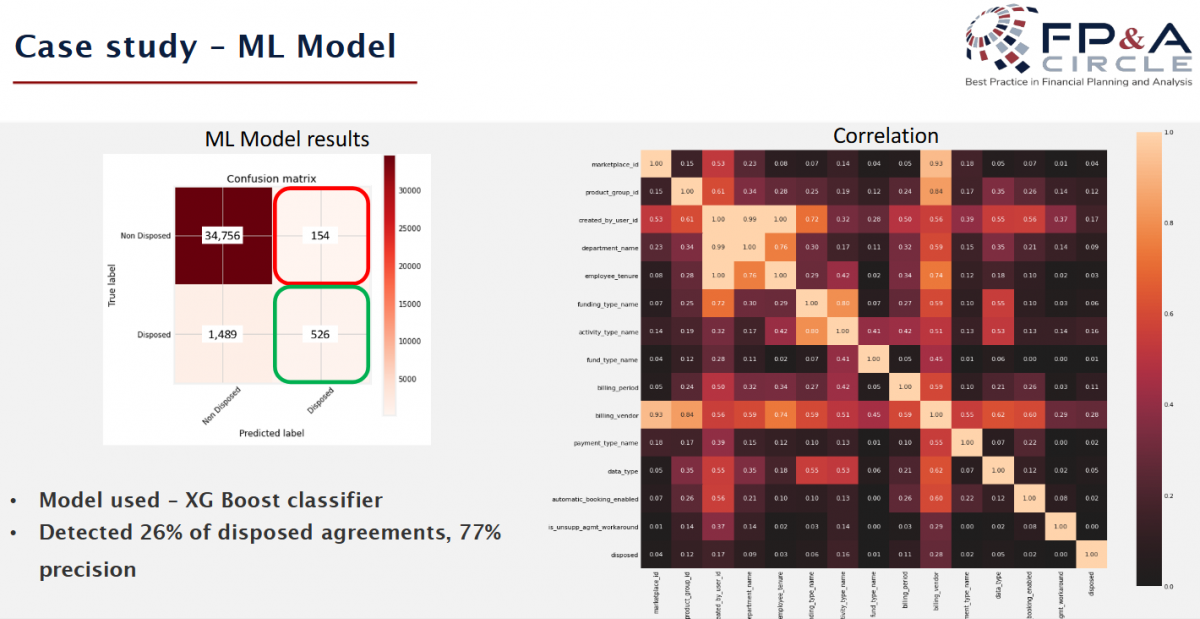

Figure 7. Classification model

The team used an out-of-the-box ML model – XG Boost classifier to crunch data relating to past agreements. This detected 26% of agreements, with a high probability of being disposed of. Whilst 26% may not sound like a high number, it still saved significant time. ML also improves as it is fed more data, so over time, this percentage will increase – the team expect this to increase to around 60%.

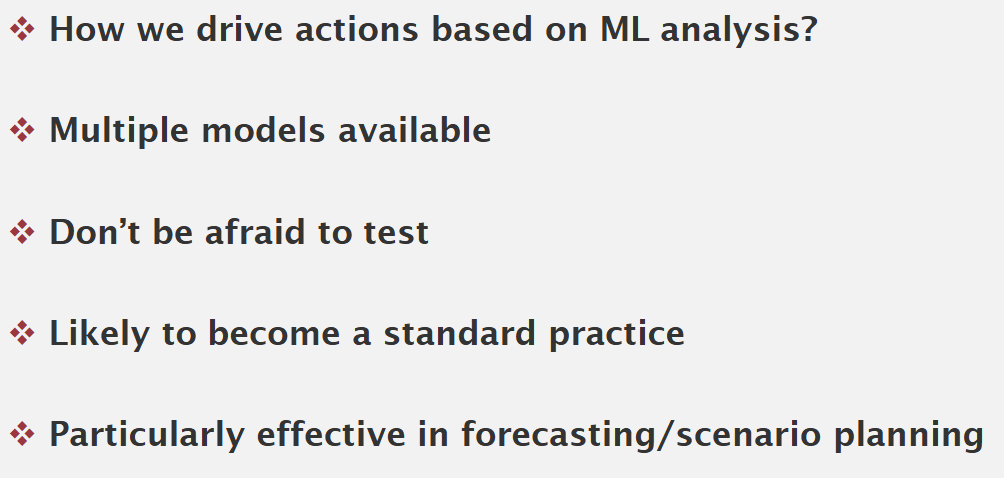

Figure 8. Conclusions from implementing ML at Amazon

Getting started with ML does not cost much. There are a lot of applications readily available. However, you need to invest time to learn. Where once SQL was considered rare in finance, it is now commonplace. Similarly, ML will become a standard requirement in future FP&A roles.

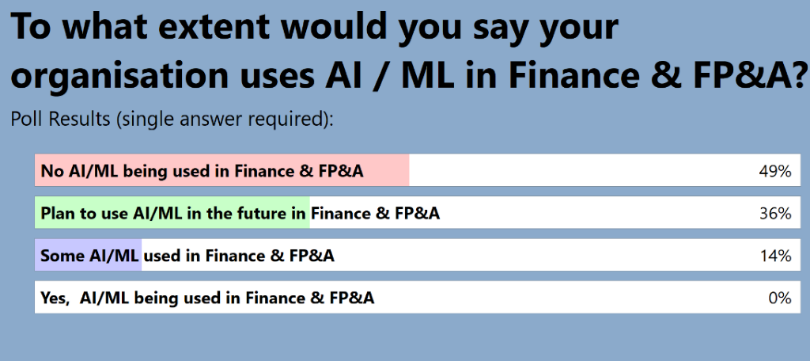

Poll #2: To what extent does your organisation use AI/ ML within finance & FP&A?

Figure 9. Results from the second poll

Best Practices: Moving towards AI in FP&A

By Saurabh Jain, VP Performance Controlling at Siemens Healthineers

How AI and ML is a subset of data science? And how is it increasingly a core part of digital transformation?

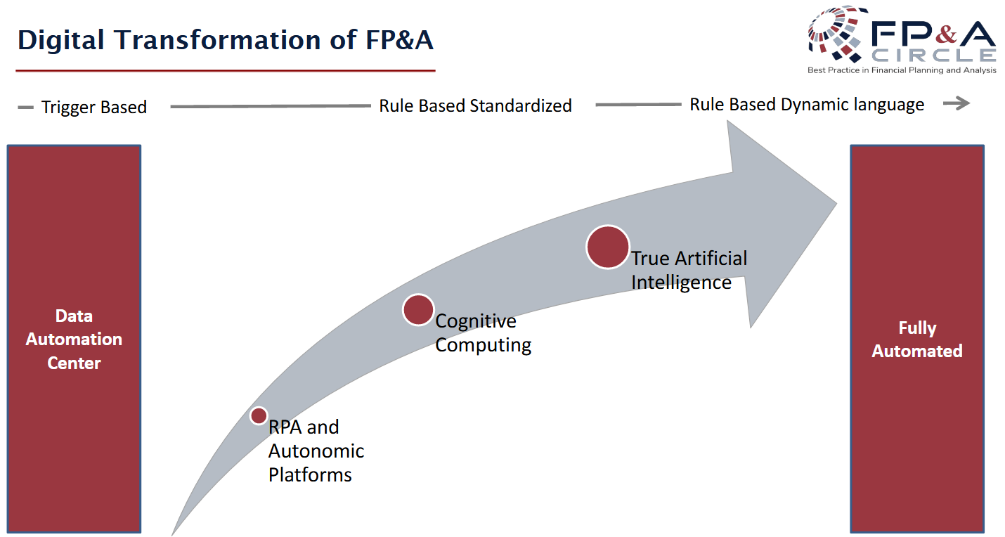

Figure 10. Results from the second poll

At present, we are perfectly in the middle of the above diagram. We are evolving from the trigger-based data automation centre to a gradual improvement of robotics (macro on steroids), cognitive computing (leveraging of machine intelligence) to dynamic self-learning AI to fully automate tasks.

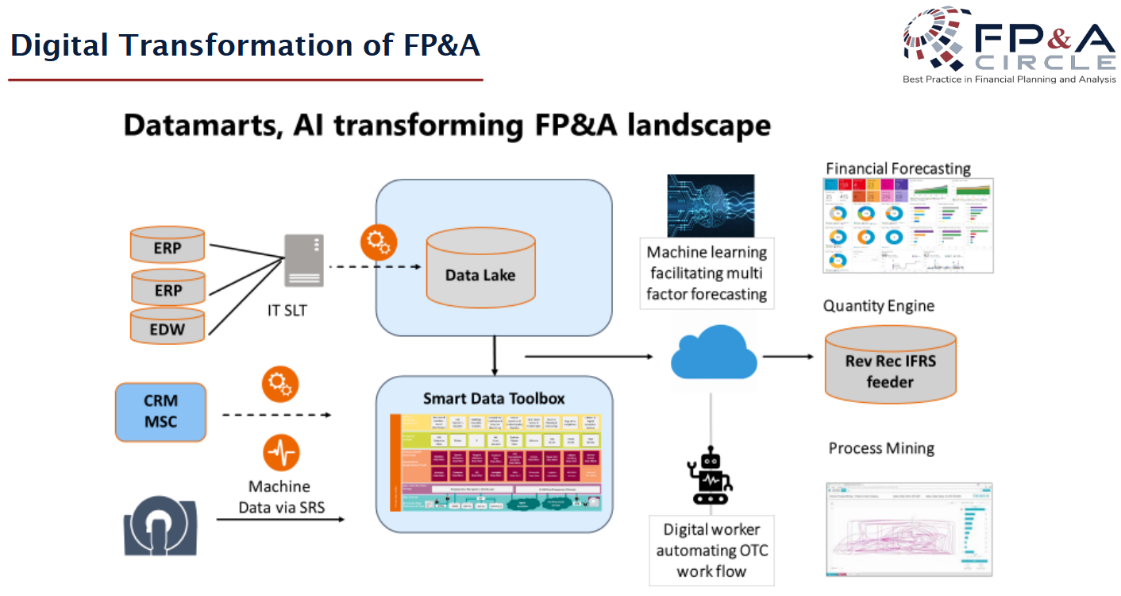

Figure 11. FP&A architecture with AI incorporated

Historically, finance has always ingested data from multiple transaction systems. Now, you also need to bring in data more contextual data. For example, for a medical technology provider, data sets such as healthcare expenditure and disease states can be used to enrich the data and allow granular user-based analytics – customer preferences, patient utilisation and outcomes.

Users access curated/ governed data that is sourced from a data lake. Saurabh described three use cases from his experience…

Using ML to ingest over 5000 data elements and perform calculations to identify performance drivers and predict revenues

Run supervised learning algorithms across historical data to predict patient behaviours.

Perform process mining to identify optimisation opportunities within the order-to-cash cycles, improve the cash position, and cash flow projections

Saurabh's learnings

Over the last ten years, there is now less time spent on running queries, cleaning, checking and mapping data.

More time is being spent on data governance and data processes.

In the past, FP&A has lacked business understanding. They need to know the influences and drivers, in order to be able to apply the insights.

You need data governance to provide data of sufficient quality. Incrementally build processes and management capability based on YOUR business needs and size. Data governance should be ‘one size fits all’.

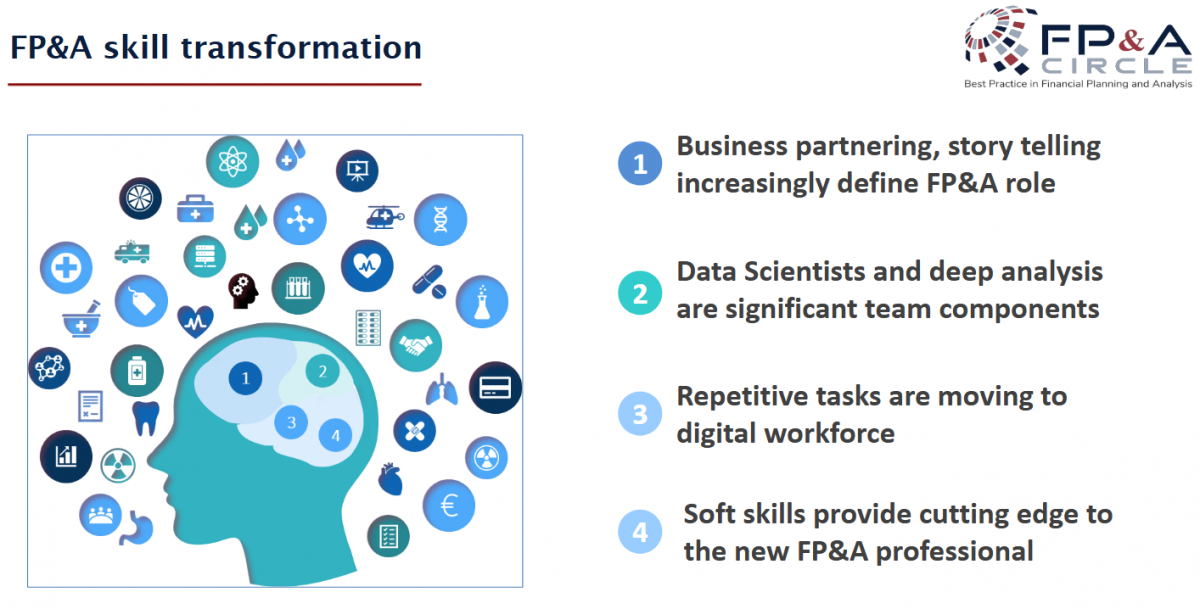

Figure 12. Implications for the FP&A team

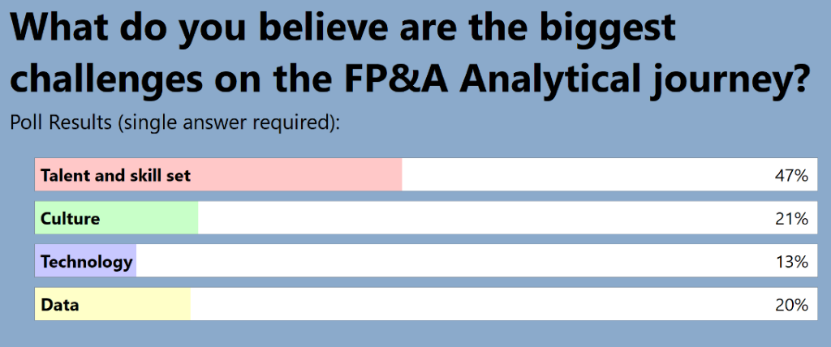

Poll #3: Challenges on the FP&A analytical journey

Figure 13. Results from the third poll

Respondents recognised that we need a transformation of talent. However, I would have picked data higher. Data availability and data quality are significant barriers to making this happen.

Best Practices: Looking to the future of digital FP&A

By Sascha Alber, Head of FP&A at Unit4

Sascha described a business trip from Munich to London over a year ago. When arriving at passport control, he used the e-gates. The identification confirmation process took seconds, even though he was sporting a beard, that was not present in his passport photo. This was much faster than the ‘human gate’ that he encountered on his return. This is AI in action.

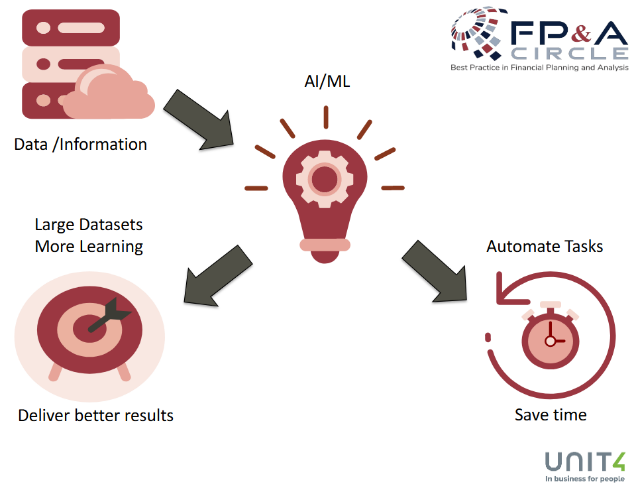

Figure 14. How AI and ML work

Sascha also shared one project example – a company wanted to predict the personnel costs and hours for a gas station – how many people and for how many hours. The factors include locations, prices, day of the week etc. The AI learns from the data, understands patterns and predicts the future based on assumptions.

What do you need to consider when implementing AI in your project?

Data availability and data quality are the key elements.

More data does not always help. The data from beyond two years ago distorts predictions.

Data does not need to be perfect, it should be good enough. Speed to insight and agility are now more critical and provide the ability to react quickly.

Technology is becoming more user-friendly. You no longer need a data science PhD to operate. AI built into applications will do the work for you e.g. to identify the drivers and predict outcomes. Furthermore, as AI learns over time, the accuracy will improve. This will give you more capacity to focus on the insights from data and the business context.

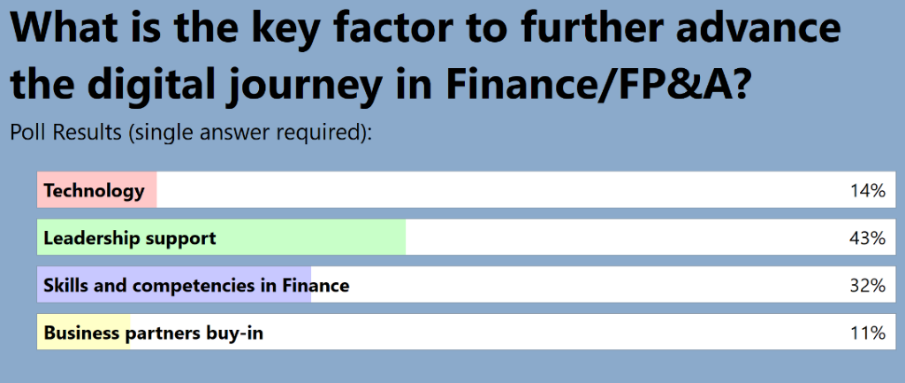

Poll #4: What is the key factor in advancing the digital finance/ FP&A journey?

Figure 15. Results from the fourth poll

Conclusions

The current business climate requires FP&A to provide a greater depth of analytics, faster. Current technologies allow us to do this and much more – uncover hidden business drivers and model multiple scenarios and forecasts in real-time.

We, as FP&A, need to evolve our skills, learn how we can utilise these new technologies, and combine them with our existing business skills. However, we do not need to become experts. We just need to know enough and be able to manage the experts.

The future is about combining human intelligence with machine intelligence.

We would like to thank our global sponsors and partners Unit4 and Michael Page, for their tremendous support with this Digital FP&A Circle.

To watch the full recording of the session, click here.

Views expressed in this article are the authors’ own and do not reflect those of the FP&A Trends Group, their employers, nor their clients