One of the largest privately owned companies in the world, Cargill’s FP&A journey started around 6...

At the recent FP&A Trends Webinar, senior finance professionals from diverse backgrounds and experience shared their views on the subject of Skills of the Future and How to Build Best-in-Class FP&A Teams.

This article explores the following insights from the speakers' presentations:

- 7 important FP&A roles

- Building winning FP&A teams - A case study

- Finance Soft Skills Optimisation

- FP&A as a Storyteller

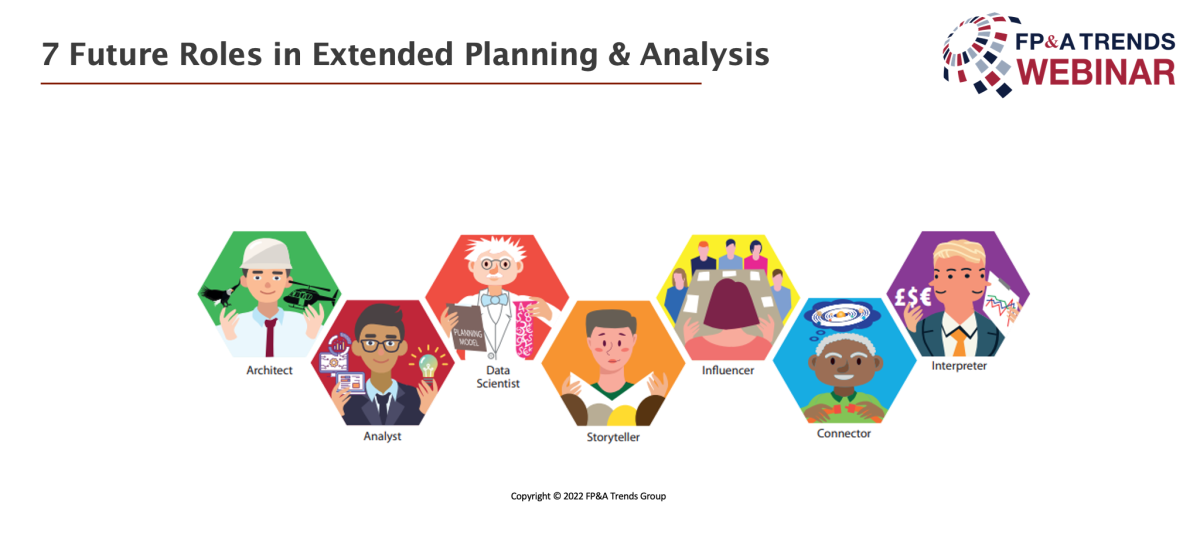

We started our discussion by looking at the 7 FP&A roles (Figure 1):

Figure 1

The Architect: is responsible for building the bridges between raw data, key business drivers, and driver-based models into actionable insights that help make business decisions.

The Analyst: produces accurate reports and spots trends and inconsistencies.

The Data Scientists: turns complex data into actionable insights, brings numbers to life and makes finance reports more useful, interesting, and engaging.

The Storyteller: builds a compelling story around the business performance (instead of just sharing a lot of numbers and data tables)

The Influencer: FP&A is not just number-crunching. The ability to influence is an equally important skill.

The Connector: connects the whole organisation in terms of different business units, functions, geographies etc. and works closely with cross-functional teams on various initiatives and projects.

The Interpreter: knows the business inside out and can interpret absolutely everything for everyone within the organisation.

Building Winning FP&A Teams

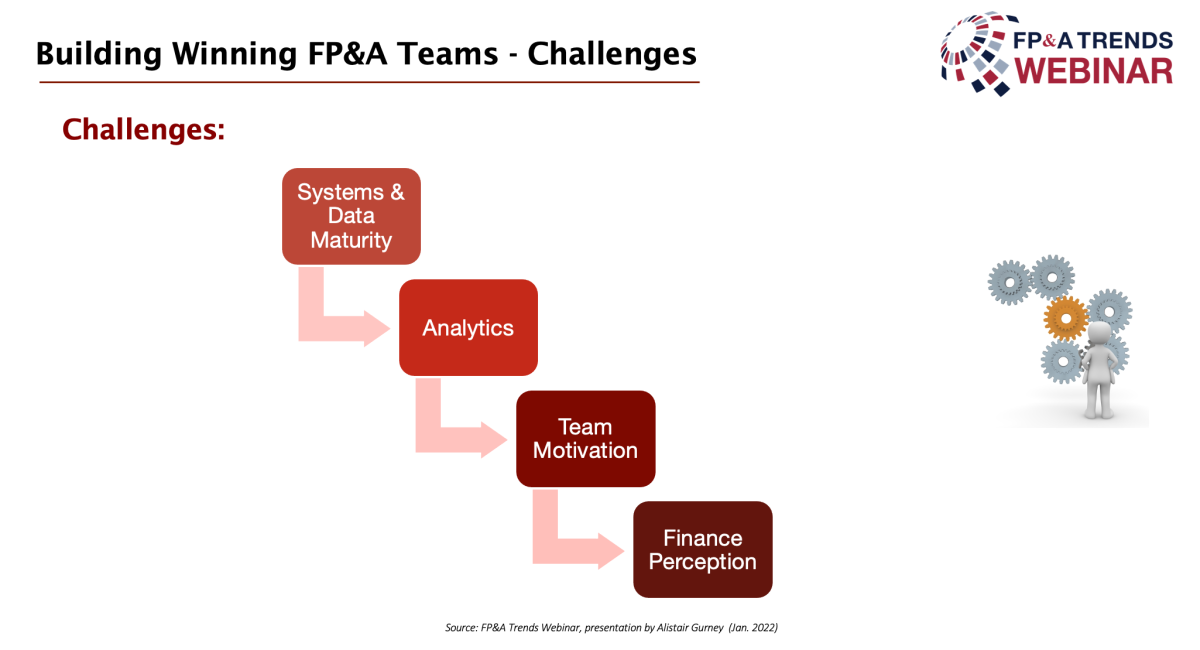

At the webinar, Alistair Gurney, Group FP&A Director, Unit4., walked us through a few key challenges in building winning FP&A Teams:

Systems & Data & Maturity: Given the advanced technology capabilities we have today. Yet many finance teams lean on manual processes to analyse their data.

Analytics: The finance function requires more analysis and a deeper understanding of business performance.

Team Motivation: This includes knowing what the team wants, what they are good at, and why they are or are not motivated.

Finance Perception: In many organisations perception of the finance team is very negative. Many employees are unable to explain what the finance department does, what value they add, or how they impact the work everyone does. This leads to little trust.

Figure 2

The key skills to overcome challenges and build effective FP&A teams include:

● Great Business Partnering relationships underpinned by reliable information

● Business-friendly processes

● Improvement in reporting facts and narratives and

● Leveraging more data

Finance Soft Skills Optimisation

Valerie Martin, Director of Finance at Autodesk, shared her experience in finance soft skills optimisation.

Things are changing rapidly on

FP&A moving to a multi-skilled and multi-faced decision-making role

Middle management today has the tools to self-serve and find insights. More information is available, and decisions are made quickly on the spot.

Future of work trends

FP&A is being pulled into different types of decision-making. In some of these areas, finance is not used to doing traditional finance. These are the topics that the Board of Directors are interested in. For Example, ESG sustainability, diversity, human capital, risk management etc.

The shift in Finance roles

From the above future of work trends on work. Diversity is at the top of the mind. This brings in a competitive edge as everybody has different perspectives and opinions. Working in a diverse environment requires a lot of focus on soft skills.

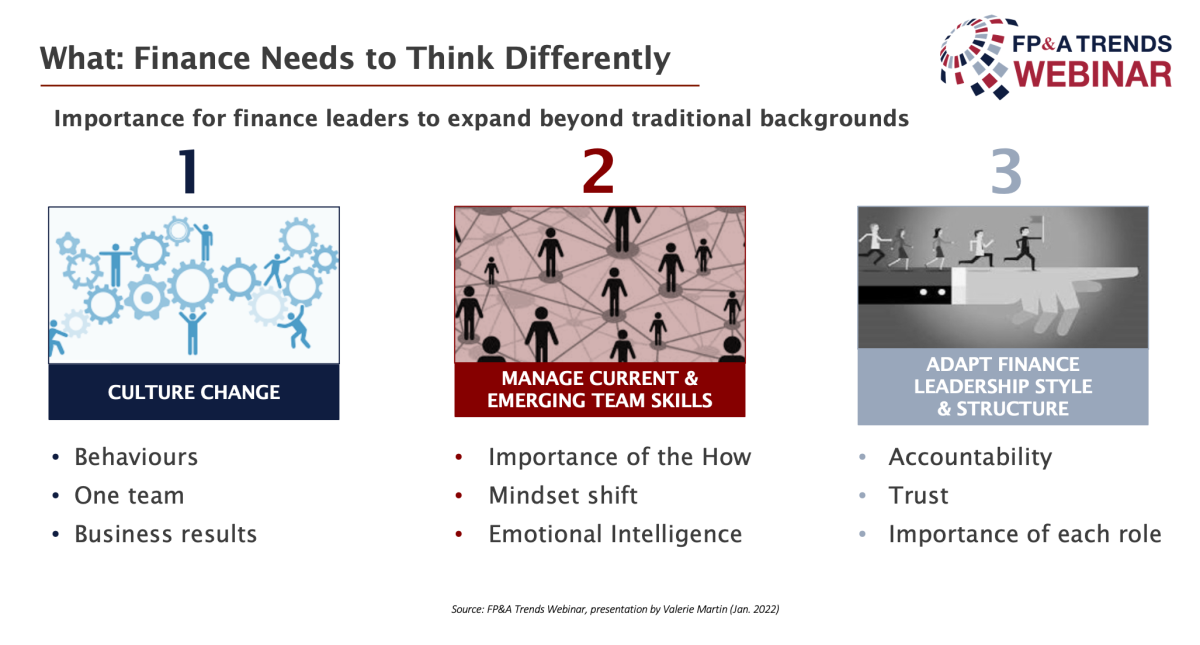

What: Finance Needs to Think Differently

Figure 3

Let's look at three different lenses: Culture Change, Manage Current and Emerging team skillsets and Adapt Finance Leadership Style and structure.

Next, let's look at some tips and tricks that Valarie experienced in her role at Autodesk.

1. Culture Change

Key Questions: Deciding what behaviours you want to drive? Do we work in finance in different silos, or do we work on projects across multiple teams and functions? How do we look at business results?

Having a top-down behaviour guide where performance is driven through different behaviours. This helps drive an environment of curiosity, be innovative, do things differently, be impactful and spend time in the right ways.

The performance is tied to this behaviour guide. A reward and recognition program on a quarterly basis, showing examples of employees being innovative, asking questions, being courageous, practising soft skills, versus traditional performance like accuracy, timeliness and precision.

Other ideas included doing belonging workshops, training on decision making and feedback skills (practising giving and receiving feedback)

2. Manage Current and Emerging team skillsets

Key Questions: Do we look at the What versus the How? How do we drive our mindset change? It's not working harder but focusing more on different things with different lenses. How do we bring EQ or emotional intelligence and related soft skills to the ground? And how do we drive that in our teams?

On hiring new talent. Apart from what the candidate knows, has studied, and the technical skills he or she possesses. Focus is on what's culture they're going to add to the team, or could they bring a different point and cover your blind spots.

It's a question of shifting your mindset. Having the curiosity to understand the business, building relationships and being more creative.

3. Adapt Finance Leadership Style and structure

Key Questions: How do we drive accountability, not only in our teams but across the board in the organisation? How do you build trust? How do we bring the importance of each role? All of us can have an impact, driving decisions and making FP&A as one of the most important people in the room.

Breaking down silos. Focussing on accountability based on a project versus a team. Creating psychological safety with our teams where you encourage risk-taking, celebrate mistakes and learn from those mistakes.

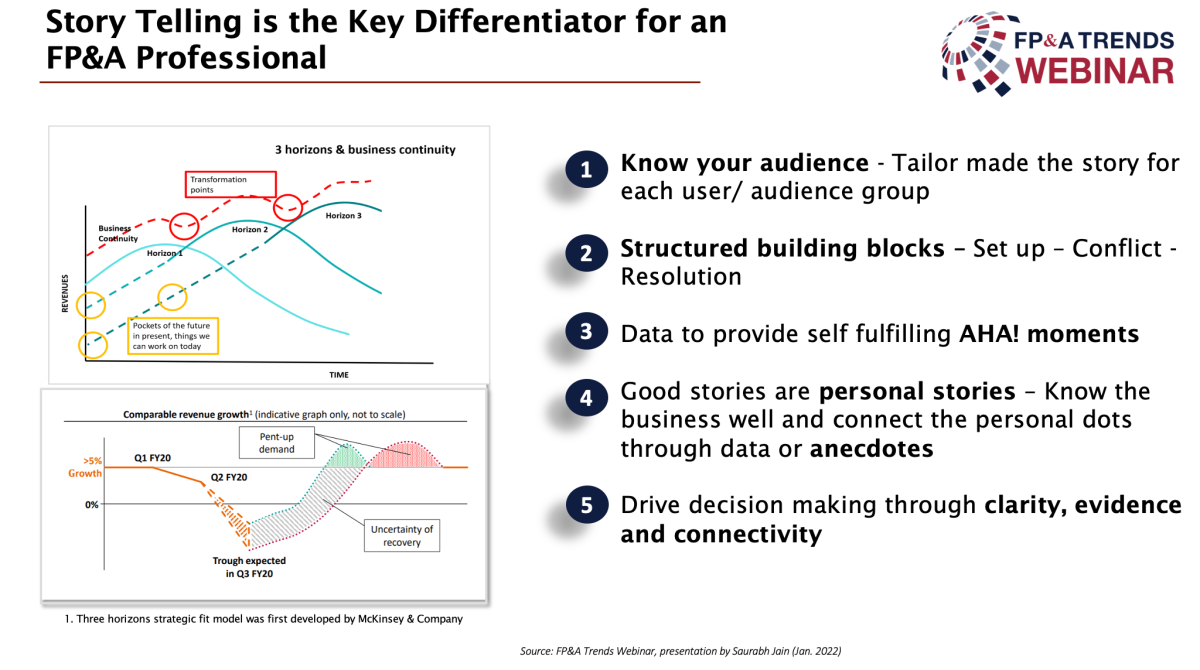

Figure 4

FP&A As a Storyteller

Saurabh Jain spoke during the next part of the webinar. VP Business Performance Controlling at Siemens Healthineers shared the following insights from his experience.

In many organisations, FP&A is mainly driving and reporting. However, there is very little insight sharing. Lack of collaboration, lack of engagement, lack of focus on critical priorities, and not being able to drive Business Partnering are common FP&A challenges.

Figure 5

Looking at a couple of real-life examples, Saurabh re-emphasised the following principles of storytelling.

Know your audience. There is no cookie-cutter approach to storytelling. You have to tailor the story for each user audience.

Like a good novel, there is a structured approach to storytelling. There is a setup, a conflict and a solution.

Ideally, the Aha! a moment or the discovery process should be arrived at by the audience themselves.

Good stories are personal stories. If you know your business very well and can connect the dots through either data or anecdotes. The stories are powerful and long-lasting.

And finally, storytelling is not a fruitless exercise. This should drive decision-making through clarity, evidence and connectivity.

With a conscious effort, data could be turned into insight for further use in decision-making.

Conclusions and Recommendations

The key takeaways from the session are:

Communicating and controlling your narrative. Setting the agenda and assessing the way people look at your team. Having positive feedback loops, being more empathetic and building good relationships.

Change your mindset. Not work harder, but differently. Focus on how and observe how people are doing around you.

Be courageous, try new things and don't be afraid to speak up, share suggestions, and make mistakes. Work on how you receive feedback and how you give feedback.

Make automation your friend. Data processing, visualisation, and connecting multiple dots will become a routine, where robots will take over. What will differentiate a human is an interpersonal sensitivity, storytelling and defining the meaning behind it.

We would like to thank our global sponsor, Unit4, for their great support with this FP&A Trends Webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.