On 3 December, we had an interesting debate on why extended planning and analysis (xP&A) is...

The 2nd semi-annual FP&A board meeting in New York happened on October 4th, 2022. This time, the topic of the discussion was “Moving from FP&A to Extended Planning and Analysis (xP&A)”.

About 20 finance leaders gathered on a rainy day to listen to the presentation by Alessandro Cardito, Head of Finance - Americas Market Group at the LEGO Group, about an introduction to xP&A. Abdelrahman Selmy, Director of Supply Chain Finance at Unilever North America, followed by his presentation about the journey of his company towards xP&A.

The evening started with a discussion of the challenges that the FP&A leaders currently face. Among the issues that are on the mind of FP&A executives are:

- Scenario Planning due to volatility and uncertainty in the markets, inflation, challenges regarding recruitment of the right talent,

- the ways to efficiently approach cash management,

- the ways to handle and optimize processes around data.

Figure 1: The Participants of the FP&A Board in New York

xP&A Business Cases

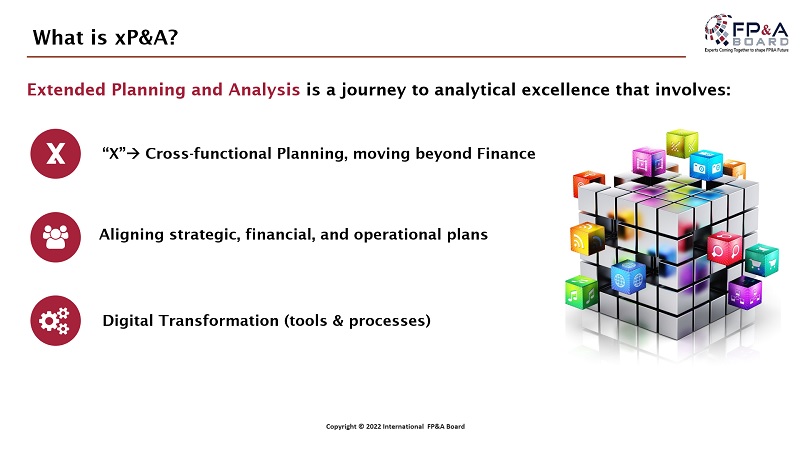

Alessandro presented the concept of Extended Planning and Analysis (xP&A) to the attendees. He shared that it is all about sensitivity now. From his experience, the decision makers find it very powerful when you, as an FP&A leader, can quantify by how much you change the assumptions for them.

By the end of this presentation, it was clear that moving away from the traditional FP&A can be beneficial in the long run for any company that plans its performance across short-term and long-term horizons.

Figure 2: The Integral Components of Extended Planning & Analysis

Alessandro also underscored that it is essential to be agile as Covid forced everyone to scenario plan whether they liked it or not. All businesses had to adapt to the new normal at that time. Thus, companies will need to adjust to xP&A, although the timing can differ for different companies.

The discussion later followed the business case presented by Abdelrahman Selmy from Unilever. Abdelrahman shared how he helped Unilever implement xP&A and the challenges and opportunities this process offered the company.

That journey started in 2017 when Unilever was going through restructuring, and Abdelrahman saw one of the whitepapers on the FP&A Trends board on this topic that he found helpful. Thus, he took this as a chance to change things for the better for Unilever. Initially, various departments worldwide built their forecasts in their individual Excel models. A few years later, with the xP&A approach, this process is a centralized Cloud-based, driver-based FP&A planning tool that offers maximum transparency and brings everyone across the world on the same page and at the same time.

As this was an insightful business case, the FP&A leaders actively asked questions and shared their experiences. Participants discussed technology that is needed based on the goals and size of the company, the FP&A goals that made sense, and the importance of communication through both top-down and bottom-up approaches to make sure all the changes are beneficial to the business and all key stakeholders are on board regarding the changes.

Group Practice

In the second part of the meeting, the participants were divided into two teams to discuss various facets of xP&A further, be it technology or people management.

The discussions were so engaging that the conversations ran over the allotted times. The conclusions were later summarized and presented to the whole group.

Conclusion

When xP&A is adopted, it provides many benefits through better alignment between finance and other business functions, a leaner structure, easier access to data, better collaboration, and optimized decision-making, among others.

The FP&A Trends is grateful to the participants and our sponsors who helped to make this event a success.

The event was sponsored by SAP and Michael Page.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.