This blog discusses the importance of improving your digital IQ, a term used by PWC for...

Economic uncertainty, intense competition, and continuous technological disruption present new challenges for companies and their FP&A teams. To survive and thrive, organisations must become “super agile,” i.e., make and execute decisions at market speed. This puts pressure on FP&A to rearchitect the enterprise planning process by integrating business and financial planning activities.

Economic uncertainty, intense competition, and continuous technological disruption present new challenges for companies and their FP&A teams. To survive and thrive, organisations must become “super agile,” i.e., make and execute decisions at market speed. This puts pressure on FP&A to rearchitect the enterprise planning process by integrating business and financial planning activities.

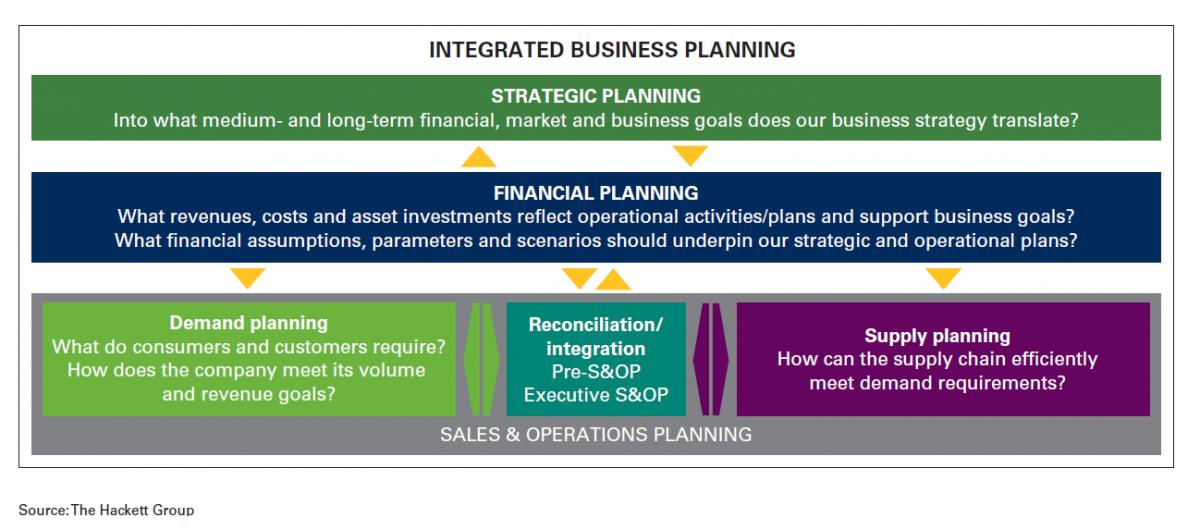

Integrated business planning (IBP) is not a new concept. Yet it’s still hard to find organisations that have fully embraced it because their efforts have been hampered by the proliferation of legacy systems and data silos. IBP is characterised by aligned planning processes and calendars, full integration of cross-functional data, and cross-functional and business collaboration. In many organisations, sales and operations planning (S&OP) has evolved separately from financial planning. IBP’s goal is to merge the two and produce a holistic plan that considers overall growth and profitability objectives (see Fig. below).

Identify an IBP Champion

When a company decides to integrate the two, a question arises: Who should be the ultimate owner of IBP, finance or the business? The S&OP process has typically been driven by business units, whereas financial planning is handled by FP&A, which leads annual and strategic planning, forecasting, performance management and business analysis. Some elements to help make a choice:

- One of the issues many companies face is that their S&OP teams are not adept at translating supply and demand plans into monetary terms due to a lack of understanding about the financial drivers of each service or product. On the other hand, finance leaders may lack operational expertise.

- Executives work under different planning horizons: S&OP runs on a monthly cadence, often with a short-term, quarter-end focus. In contrast, leading FP&A organisations forecast quarterly and take a much longer-term, rolling view (i.e., beyond year-end).

- Finally, the two processes rely on different data and metrics.

In practice, IBP frequently becomes a finance charter because FP&A is the centre for analysing corporate performance and has robust forecasting capabilities. To become an effective IBP leader, FP&A must not only expand its view but also adjust its processes to align them with those of S&OP functions. In addition, it must translate operational metrics into financial ones.

Leveraging New Technologies

For many years, even companies with robust operational and financial planning capabilities muddled through IBP using a patchwork of spreadsheets and manual labour. Today, finance is accelerating the adoption of smart automation solutions that can bridge functionality gaps and enable new capabilities, e.g., next-gen ERPs, RPA, cloud-based dedicated planning and analytics and data and visualisation solutions). FP&A can construct a robust technology platform that allows access to operational and financial data, harmonises KPI definitions and synchronises planning schedules.

The Hackett Group’s 2020 Key Issues Study provides evidence of the finance function’s aggressive digitisation plans. Finance respondents projected:

- A 26% growth in the adoption of data visualisation tools

- A 24% rise in RPA deployment

- A 20% surge in next-generation, cloud-based core finance applications

- An 18% uptick in adoption of advanced analytics solutions

Other contributors to the rapid maturation of IBP include the advent of new data management platforms and technologies, as well as the standardisation of master data. Until recently, different parts of the company kept different sets of data in isolated source systems. Data definitions and KPI calculations were incongruent, and data management governance models were decentralised.

New master data management (MDM) tools are helping companies overcome this problem. In addition, the rising adoption of modern data-management platforms enables companies to create single repositories of real-time data more easily. Today, digitally-enabled organisations are implementing data architectures such as data lakes and data marts, which permit the fluid collection of data from multiple internal and external sources.

Three Steps for Digitising IBP

The transition to an integrated business planning model does not happen overnight because it requires broad-based participation. Here are some critical steps for those considering adopting this best practice:

- Obtain senior management buy-in IBP is an enterprise-wide initiative that requires new forms of collaboration among different parts of the organisation. It must be sponsored by senior management, which should fully understand the relevance and value of the process and commit to executing IBP-driven decisions.

- Just get started: It’s easy to delay the rollout of an initiative with such expansive consequences or to wait until the organisation adopts the “right” enabling technology. However, IBP is just as much about process and mindset as it is about systems. Even if spreadsheets still reign at the beginning of the integration process, there is much that companies can do to break down silos and synchronise planning processes. Holding off means losing time and opportunities for improvement.

- Leverage and integrate existing meetings when possible: An excessive number of meetings can overwhelm managers and make them less productive. Instead, take advantage of existing scheduled meetings and incorporate IBP into the agenda, making it integral to day-to-day operations. If finance is leading the process, the shift will require a change in its process management. It must join S&OP monthly planning meetings if it is to be effective in driving decisions.

Establishing an IBP process relies on the synchronisation of existing planning efforts. That means aligning calendars and devising a common taxonomy to bridge the gap between S&OP and financial planning. Once the processes are aligned, IBP leaders can turn their attention to improving process quality and accuracy.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.