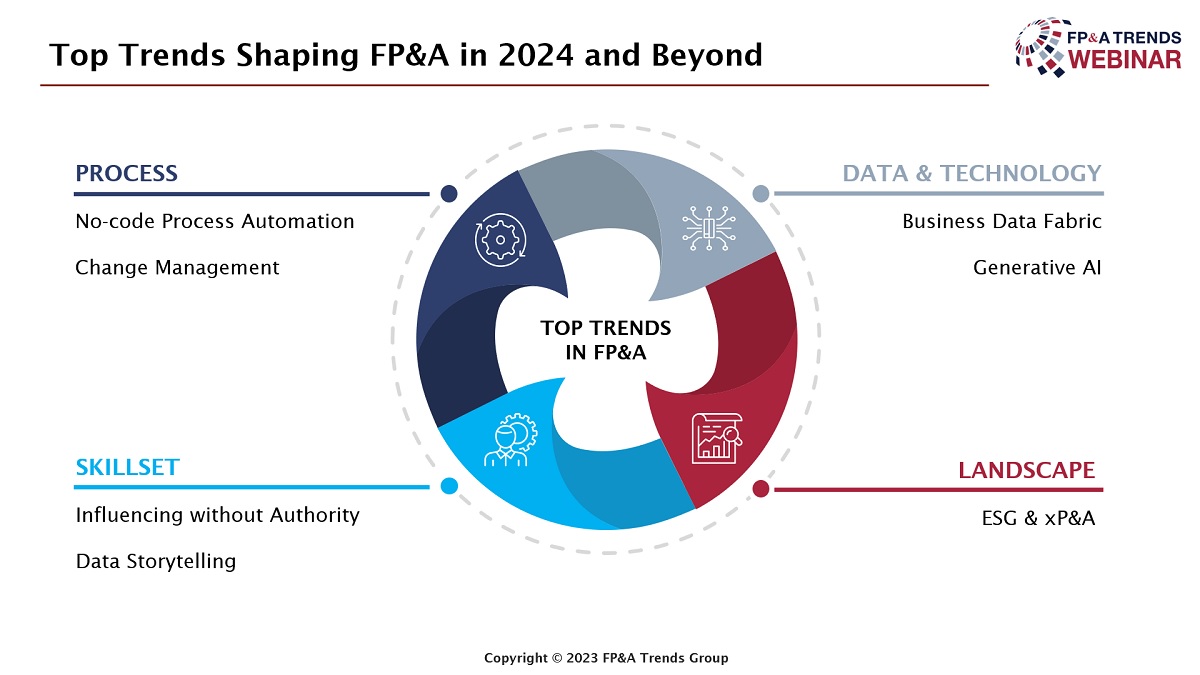

The Digital North American FP&A Board identified the top 10 trends shaping FP&A in 2021 and...

In this rapidly changing landscape, where every data point and strategic decision counts, we, as financial professionals, must not only adapt but stay ahead of the curve. The finance world is evolving at an unprecedented pace, and the need to anticipate emerging trends becomes even more critical as we step into 2024.

To answer key questions about the upcoming trends in Financial Planning and Analysis (FP&A), we hosted a digital event on the 6th of December, 2023. This article provides an overview of the topics and cases presented and discussed by the expert panellists at the “Top Trends Shaping FP&A in 2024 and Beyond” webinar, as well as the results of our polling questions.

Technology Trends to Look Out For

In his presentation, Pras Chatterjee, Senior Director, Planning & Analysis at SAP, highlighted key technology trends shaping the future of FP&A. Pras emphasised the critical role of becoming a data-driven organisation, leveraging Artificial Intelligence (AI) to navigate the complexities of data consumption.

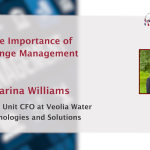

One standout recommendation is the adoption of a Business Data Fabric – a modern alternative to traditional data warehouses. Pras encouraged finance professionals to explore this innovative approach, which recognises that data exists everywhere, including external sources, and can be seamlessly integrated to enhance accessibility and real-time insights.

Figure 1

Pras also highlighted the significance of Gen AI, urging businesses to explore AI-enabled solutions for better decision-making. With a focus on trust in data sources, Pras suggested integrating AI use cases on top of a robust Business Data Fabric foundation. This approach facilitates natural language queries, simplifies day-to-day tasks, and supports automation, ultimately optimising finance processes.

The presentation further delved into the rising importance of Environmental, Social, and Governance (ESG) reporting in finance. Pras stressed that ESG reporting not only aligns with evolving stakeholder expectations but also positions organisations as leaders in sustainability. Finance teams can enhance relationships with employees, investors, and customers, fostering brand loyalty and building a more sustainable future by embracing ESG reporting.

How Confident Are We in Our Data Quality?

Most webinar audience (60%) stated that their data quality is generally good, with occasional issues, while another large portion of the audience (27%) has concerns about data accuracy. The remaining two options, “Significant doubts about data accuracy” and “Data is consistently accurate and reliable”, gained 7% and 6% of votes, respectively.

Figure 2

Strategic Partnership Skillset

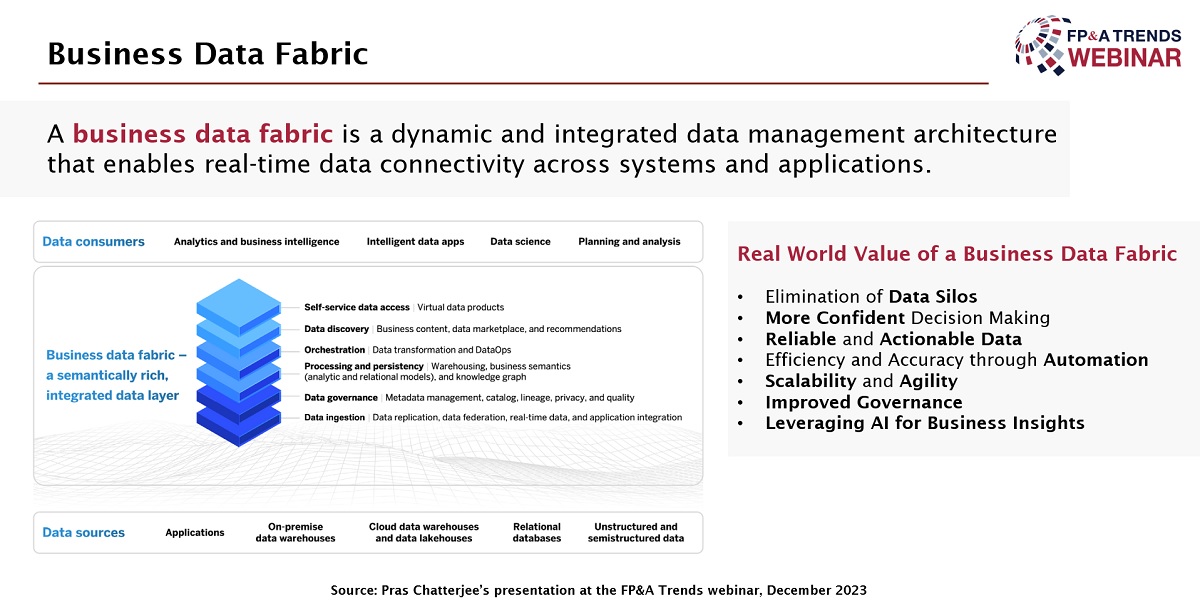

In her recent presentation, Svetlana Sigalova, Vice President, FP&A at Moderna, discussed a notable trend in the biotech and pharma industry – shifting from traditional transactional support to strategic Business Partnering. The distinction lies in moving beyond mere number crunching and standalone reports towards becoming a valued collaborator in decision-making across the entire organisation.

The evolution from transactional to strategic Business Partnering involves active participation in discussions beyond finance topics, such as R&D portfolios and commercial leadership decisions. Svetlana emphasised the rising expectations within her industry, where finance professionals are now required to act as one-stop consultants. It entails understanding the business case, aligning with stakeholders, and supporting decision execution.

Effective storytelling is essential to this transformation, where financial data is translated into compelling narratives driving decision-making. This involves moving from mere reporting to critical analysis and crafting narratives that resonate with diverse stakeholders. Svetlana underscored the need to tailor messages to various audiences, ensuring that the insights generated are understood and endorsed across functions.

Figure 3

Moreover, Svetlana emphasised the importance of influencing within the scope of the FP&A’s role. This involves guiding the strategic direction of business partners, cultivating collaborative relationships, and leveraging financial expertise to steer senior executives toward decisions aligned with company objectives. The presentation highlighted the crucial role of emotional intelligence, strategic networking in navigating complex environments and influencing decisions even without formal authority.

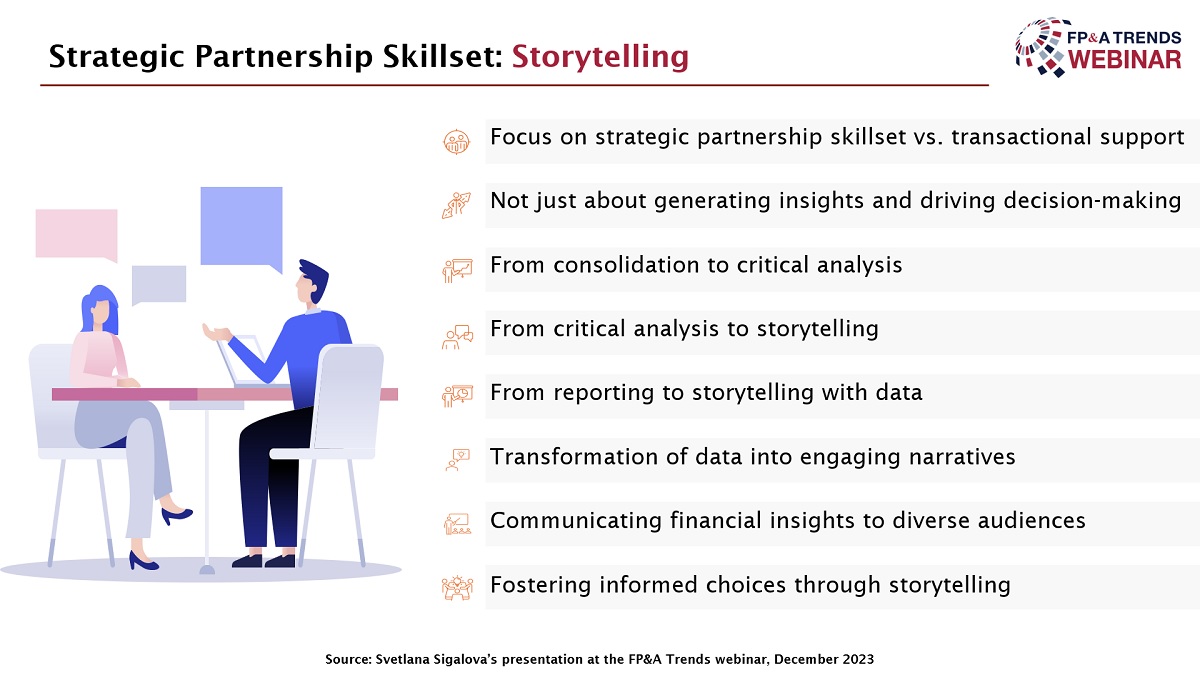

Which FP&A Skill Is the Most Important in 2024?

30% of our audience believes that collaborative decision-making is the most important skill for FP&A in 2024. Another 28% voted for data storytelling, 22% for data analysis and data science, and the remaining 20% for influencing without authority.

Figure 4

Change Management and Cooperation

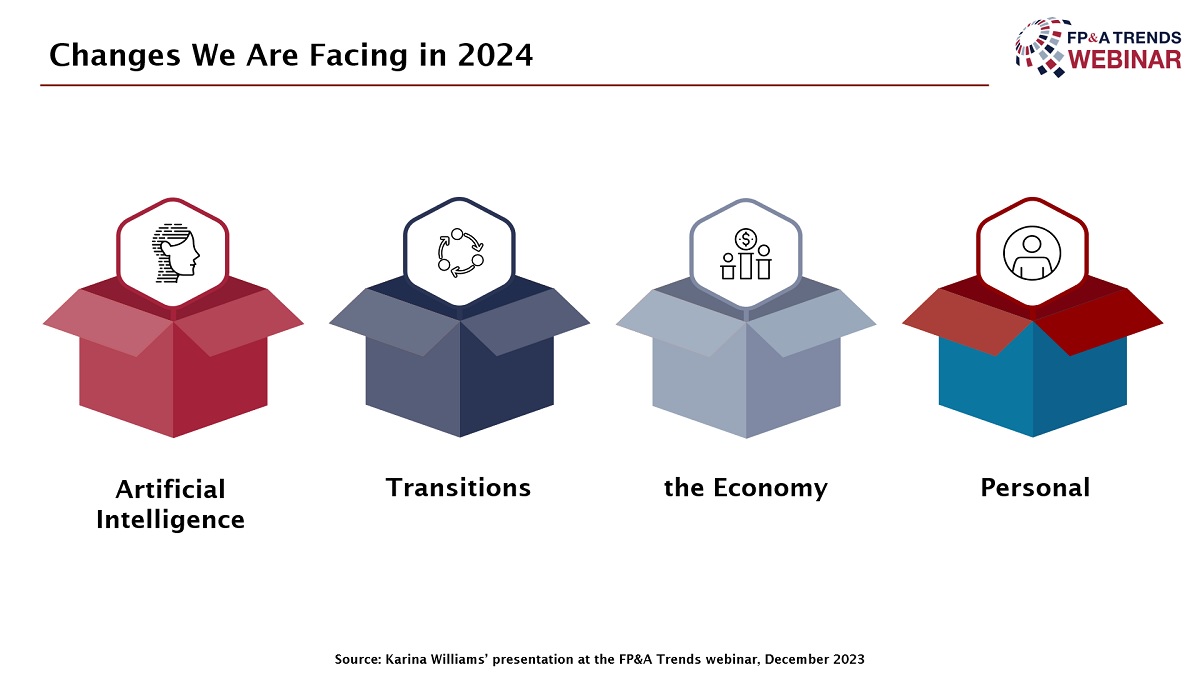

Karina Williams, Business Unit CFO at Veolia Water Technologies and Solutions, delved into the dynamics of change in the Financial Planning and Analysis (FP&A) field, focusing on the implications and strategies for managing transformation in the coming years. She acknowledged the multifaceted nature of change, encompassing generative AI, AI adoption, automation, and shifts in workforce thinking. Karina emphasised the need for strategic Business Partnering, citing the impending economic changes that will impact job roles and personal lives.

Figure 5

She also outlined the positive and challenging aspects of change, highlighting the excitement and opportunity it brings, along with the uncertainty and distraction it may introduce. Drawing from her experiences with organisational transitions and tool implementations, Karina shared valuable lessons in her presentation.

She stressed the importance of communication, addressing concerns, and transforming team members into allies during organisational changes. In the context of tool implementation, she underscored the significance of early information, consistency, and validating fears to ease the nervousness associated with system changes.

Furthermore, Karina emphasised the pivotal role of business partners in navigating change, urging collaboration, early engagement, and validating concerns. In summary, her insights provided a comprehensive approach to effectively leading teams and business partners through the complexities of change in the evolving landscape of FP&A.

Conclusions

Figure 6

The FP&A Trends webinar has cast a spotlight on the emerging trends that will shape our journey, and as the saying goes, luck favours the prepared mind.

Armed with insights from industry leaders like Pras Chatterjee, Svetlana Sigalova, and Karina Williams, financial professionals have a compass to guide them through the complexities of the evolving financial world. Whether embracing cutting-edge technologies, becoming strategic business partners, or mastering the art of Change Management, the tools for success are at our disposal.

In the landscape of 2024, preparedness is not just an advantage; it’s the key to a smoother ride. Let the trends be your guide, and may your journey through 2024 be not just successful but truly transformative.

To watch the full webinar recording, please check out this link.

This webinar was proudly sponsored by SAP.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.