Strategic planning is mostly done with qualitative analysis. In this article, we will explore the use...

For the modern FP&A professional, Excel is an invaluable and versatile tool, but to provide best-in-class business partnering support, FP&A professionals must find ways to evolve Excel-based tools into more integrated solutions. In this FP&A Trends webinar, Larysa Melnychuk, CEO and Managing Director at FP&A Trends Group was joined by Jim Boswell, VP of Finance at FullSpeed Automotive, Tomasz Klimek, Head of FP&A at International Airlines Group, and Jonathan Yahalom, Head of FP&A Solutions at DataRails, to discuss strategies and best practices to transition from Excel to Integrated FP&A.

The discussion centred around three main topics:

Driver-Based Modeling (DBM)

Integrated FP&A Models and Processes

Unifying Process and Technology

1. Driver-Based Modelling (DBM)

Driver-Based Modeling is the basis for flexible and dynamic FP&A, and its purpose is to operationalise financials in a tangible way for the operators of the business. So, what exactly is DBM?

DBM starts with the systematic deconstruction of the business model into discrete components. These components, or operational “drivers,” are then managed by operations managers and monitored routinely. Financial budgets and forecasts are constructed using these operational drivers. This approach moves the organisation away from traditional budgeting practices, such as “last year-plus,” and creates integrated driver-based financials that are rooted in operations activities.

Some best practices for implementing DBM in your organisation:

Start now in Excel. You don’t have to wait for the perfect software solution. The Excel model can help inform an integrated software solution later when the process has matured.

Frame it up. First, ensure the DBM model is a 3-way model, starting with the income statement, then the balance sheet, and then the cash flow statement. Second, build comprehensive inputs and controls, also called global assumptions. These are assumptions like inflation and growth rates that comprise various scenarios, such as a bull case or a bear case, and need to flow through the rest of the model. Third, determine the smallest time period needed. Does your organisation operate at a monthly level? weekly? daily? The drivers you want to operationalise will help determine this.

Keep digging for drivers, and don’t forget to look externally. What economic indicators correlate strongly with your business? Open-source government forecasts can be used for this as well as icons gathered by vendors that can be purchased.

Strike a balance between simplicity and complexity. Focus on the 20% of drivers that explain 80% of the results. As you find time and additional resources, you can uncover more drivers as needed for precision.

Trend and layer. Utilize a base trend and layer on news and events that will change the outcome.

Create deeper explanations using these drivers. It’s not enough to say costs were higher this month. Put that in context. Volumes were high and costs per unit were down marginally, so profitability in fact improved.

Install a software solution. The ultimate best practice is establishing a software solution with a database behind it, which will enable better version control, a single source of truth, free up resources, and position your organisation for future enhancements in Artificial Intelligence (AI) and Machine Learning (ML).

2. Integrated FP&A Models and Processes

The simplest approach to deconstructing the business for operational drivers is to start with the largest revenue and cost categories. It helps to create a decomposition diagram so the organisation can decide which costs the business has the most control over the greatest influence. A good approach is to make this a cross-departmental exercise that involves people with lots of industry experience. Have a “painstorming” session to learn what doesn’t work but follow that up with a brainstorming session to create solutions.

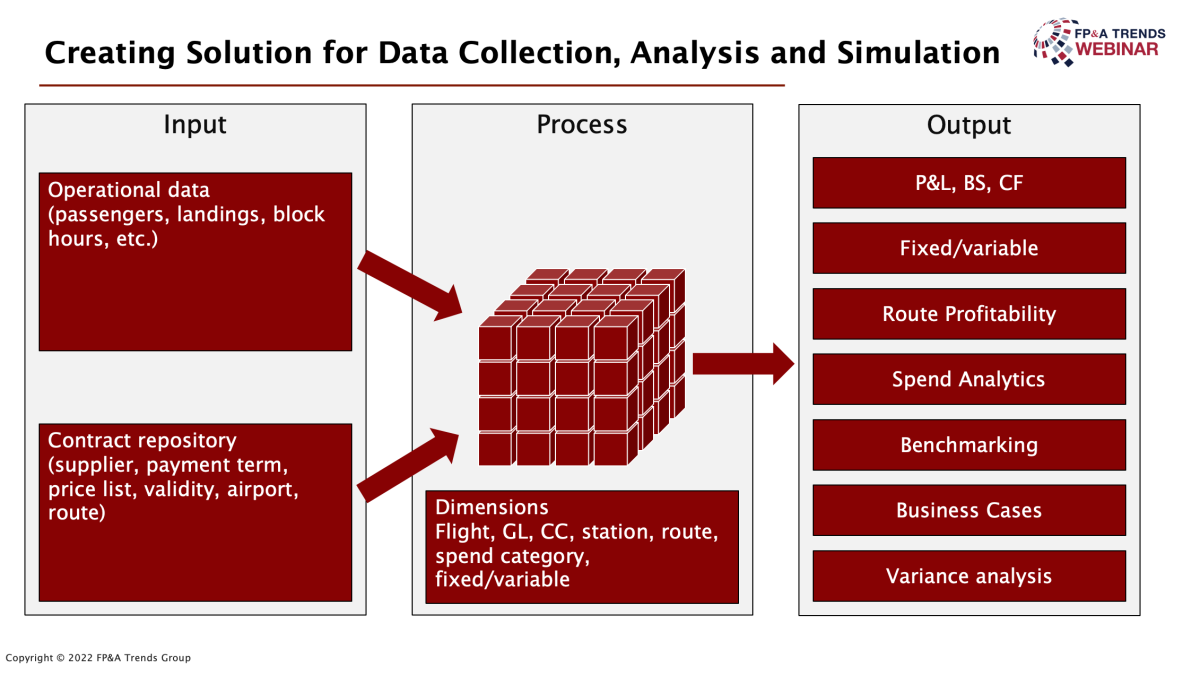

Once those drivers are identified, decide how they should be measured and how they directly influence costs. These drivers become the inputs in an integrated database solution.

These design sessions should also focus on the desired outputs. Some examples are financial statements, fixed/variable analysis, variance analysis, business cases, dashboards, etc. Thinking through these outputs and then working backwards will guide the organisation when designing these processes. And while designing the model, consider not only the implementation costs but also the resources needed to maintain and operate the model.

Figure 1

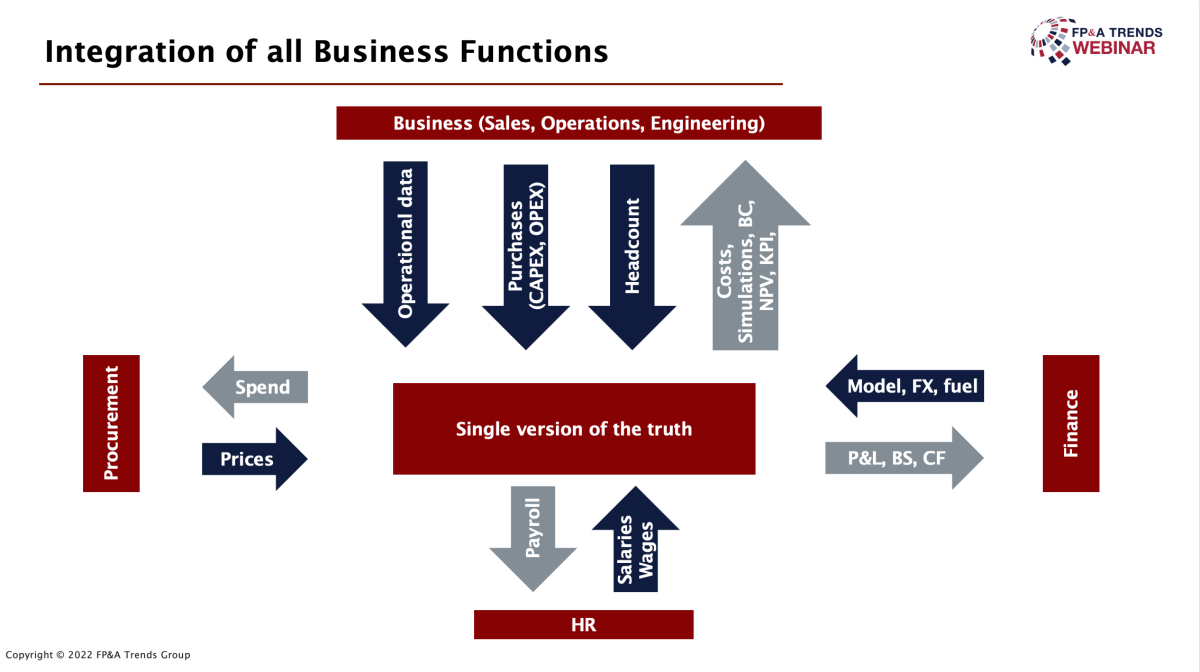

An effective model should integrate all business functions, such as procurement, business operations, HR, and Finance, so inputs and outputs utilised by those functions contribute to and we sourced from a central database.

Figure 2

Once the model is built and utilised, the organisation moves into the continuous improvement stage. In this stage, the organisation asks itself: How do we refine the model? How do we improve correlation and causality? What analytics (such as variance analysis) can be automated? Whether this can be done in-house or through an external business solutions provider will depend on the capabilities and resources of the organisation.

3. Unifying Process and Technology

In most companies relying on Excel-based solutions, Excel is doing everything: it functions as the database, the calculation engine, and the analytical tool, sometimes all within one workbook. This approach is resource-intensive and eventually becomes unsustainable. And while Excel is an excellent tool for spreadsheets, financial modelling, and provides FP&A with much-needed agility, it’s not effective for sophisticated FP&A processes such as data consolidation, repetitive reporting processes, drill-downs, and comparison analysis (such as scenario comparisons). A technology solution is needed to unlock additional power.

To have the best of both solutions, the current processes that were built using the “Start Now in Excel” approach can be deconstructed and subsequently reconstructed using an integrated technology solution.

How this approach works: First, remove databases from Excel and move those into the cloud. Next, move all data mappings, scenarios, and drivers out of Excel and build those into the technology solution. What’s kept are the calculations that spreadsheets do well.

This unification process elevates the strengths of each solution while reducing complexity, providing the organisation with an integrated FP&A solution.

Summary

The first step in implementing a Driver-Based Model is to start now in Excel, identifying the 20% of operational drivers that explain 80% of the financial variances. This first step establishes the framework for an integrated, technology-based solution.

As the model develops and data flow is integrated cross-functionally, it will naturally and necessarily increase in complexity.

To unify these processes with a technology solution, the current processes can be deconstructed and then reconstructed using an integrated approach, allowing technology solutions to handle the weaknesses of Excel-based processes (databases, global assumptions, Scenarios Planning) and keeping all the desirable aspects of Excel (financial modelling, ad hoc reporting, analytics).

We would like to thank our global sponsor, DataRails, for their great support with this FP&A Trends Webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.