Driver-based planning is a key topic for any FP&A team today. But what is not always...

There are a few steps how we can build a driver-based model for our business. I would like to describe the process using aviation as an example.

Decomposition of the business model

The first step in building a driver-based model is the decomposition of the business model. The easiest way would be to start with Income Statement (revenues and costs); however, we should not forget about the Balance Sheet and Cash Flow effects.

I would recommend using the Pareto approach (20% of causes explain 80% of results). So going through P&L lines, we could pick up the biggest categories of revenues and costs and then if time, funds, and resources allow digging into details. We should always remember that benefits should outweigh the costs so that whatever we will build will be desirable, feasible and viable.

Apart from biggest categories we could also focus on

Controllable revenue and costs – areas business can shape

Low hanging fruits – areas that give the biggest opportunities to improve performance

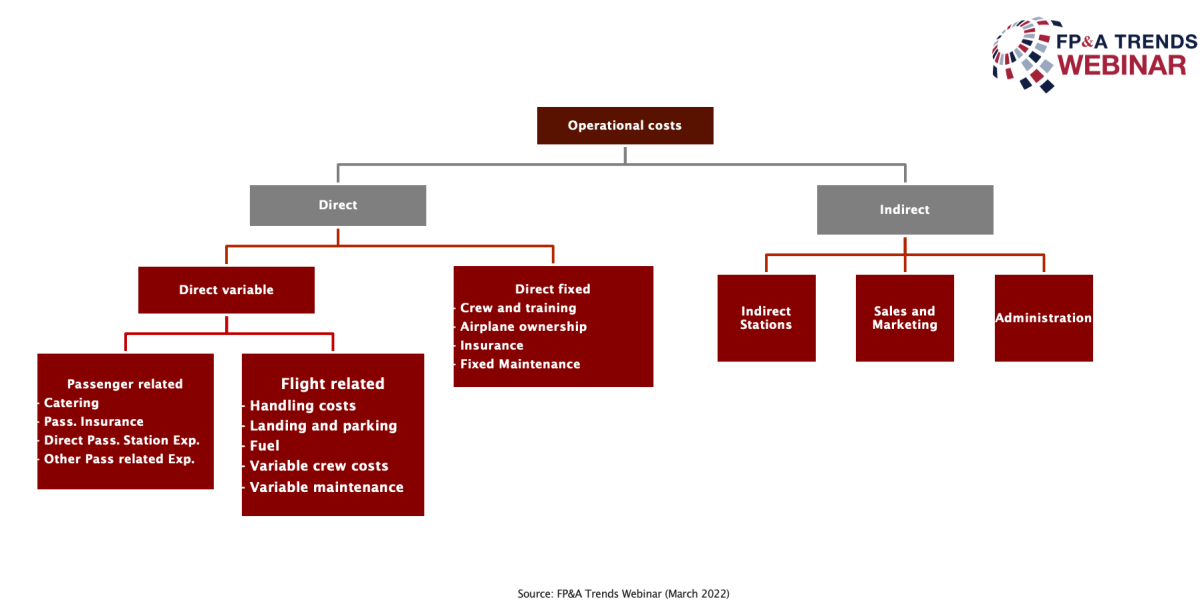

Below is the cost structure, typical for the aviation business. We will focus on the direct variable costs.

Figure 1

Identification of cost drivers

The process of setting the drivers should be cross-departmental and perhaps also using some external knowledge that is available on the market e.g., in aviation, there is the general assumption that the main long-term revenue drivers are

- GDP growth (traffic grows twice faster than GDP)

- Level of protectionism (so-called open skies policies applied by specific countries)

I would recommend a design thinking process to establish drivers for specific areas of the business. Cross-departmental meetings could

identify the best drivers and

agree on the process of collecting the operational data (who and when is to deliver them to the model).

The drivers often might become KPIs and/or part of the balanced scorecard for the business, helping to interpret the results and automate the reporting.

Below are the examples of drivers that could be used to model the direct variable costs in aviation:

- Number of passengers (by class) – Catering, Fast track, Baggage

- Number of landings – Airport charges, Engineering (landing gears)

- Flying time – Fuel, Engineering (engines)

- Flying distance – ATS charges

- Block time – Payroll (pilot crew, cabin crew)

- Fleet type – Fuel, Engineering, Crew training

- Route types (short-haul, long haul) – Crew Accommodation

Creating solutions for data collection, analysis, and simulation

Once we have the drivers, we need to build a technical solution. My advice would be to start at the end, so focus on the output (reports, analysis, what decisions will be made based on that model), then work backwards on how to automate the process and minimise the effort involved in using the solutions. Simplifying, we need to answer two questions what? (Effectiveness) and how? (Efficiency). Process optimisation will be key. We should think not only about the implementation costs but also about the operating costs of this model (life cycle costing) – how many people will be involved, how often for how long.

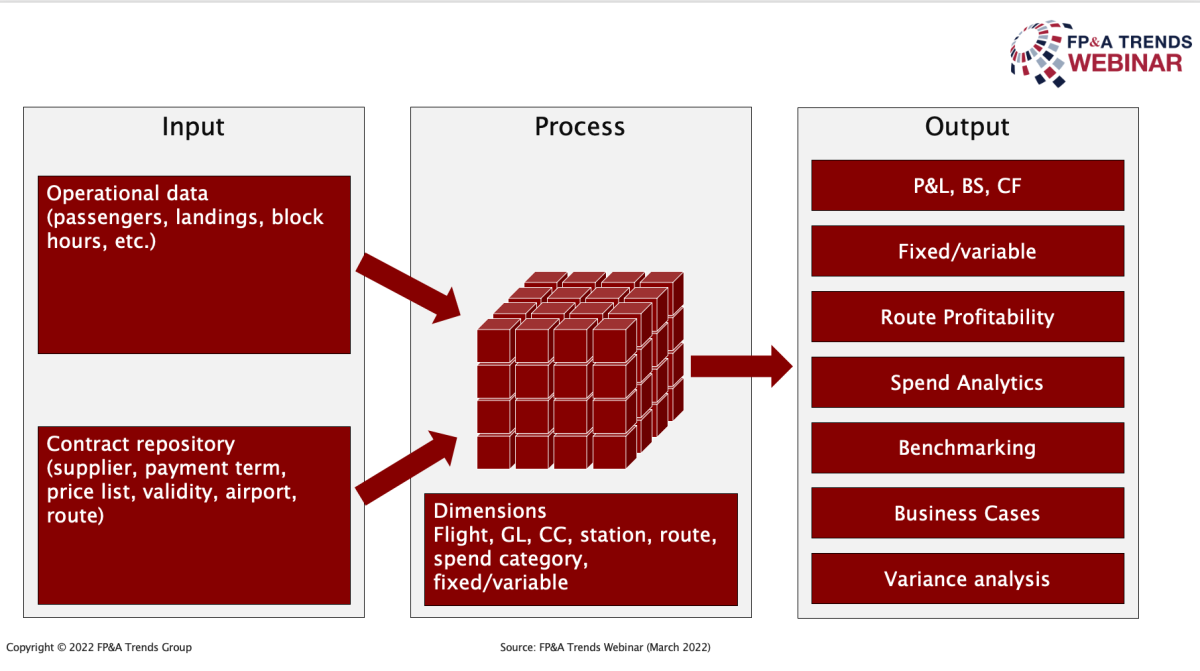

The picture below shows the solution for third-party suppliers’ variable costs.

Figure 2

Let’s not forget about visualisation and self-service tolls in the output area so that businesses can operate the system on their own (self-service capabilities).

Few topics to consider when choosing and implementing the technology:

I would recommend building such a model as much as possible in-house. Current low-code or even no-code solutions are allowing analysts to build and then use such models with minimal support from external consultants

When choosing the technology, take into account its agility. Especially when your business goes through major transformation (e.g., digitalisation) and you will need to update the way the model works frequently

The agile approach in building such a technical model means that we can build part of the solution and test it even within a week. The whole model (build) should not take more than a few weeks. It will most probably take more time to build the concept than the technical solution. Therefore, spend enough time analysing what you want to achieve

Different tools are available on the market that should meet the requirements of smaller and bigger companies

Required granularity (not all solutions might be able to deliver it with the required performance)

A real-time approach might limit the choice of technologies

Integration of all business functions

Change management is important not only within finance but also in other functions. The division of responsibilities between finance and business, as agreed during the design thinking sessions, should be implemented.

The integrated approach enables to connect of all functions, entering the drivers only once (right first time) and achieving the single version of the truth.

Figure 3

Blue arrows show the data (drivers) entered by specific functions; violet is showing the output/reports these functions might get in exchange.

Technological progress makes it possible to use Machine Learning and Artificial Intelligence in setting the best drivers and using them in forecasts and simulations. It is the next quantum leap that might happen in building driver-based models in the future.

Summary

So, the article described the methodology of creating a driver-based model on the example of an aviation company. It focused on the key steps and explains the different areas that need to be considered in order to successfully implement an automated, integrated driver-based model.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.