Michael gives an insightful presentation on FP&A Scenario Planning: Forecasting in the Uncertainty.

The quest for performance is a fundamental issue for companies and organisations, especially in an ever-changing economic and technological environment. To improve their financial performance, organisations must employ well-studied management strategies. In the field of FP&A specifically, several works have proposed to develop, implement and strengthen best practices.

The quest for performance is a fundamental issue for companies and organisations, especially in an ever-changing economic and technological environment. To improve their financial performance, organisations must employ well-studied management strategies. In the field of FP&A specifically, several works have proposed to develop, implement and strengthen best practices.

Uncertainty can take many forms. It can manifest in a natural disaster, the merger or acquisition of a competitor, geopolitical changes, or a global pandemic. In fact, the current Covid-19 crisis has challenged the forecasting models used, especially when it comes to predicting the evolution of a company's business in a highly uncertain environment.

Driver-based planning models enable companies to better understand the impact of variances in key business and value drivers on financial and operational KPIs. These models focus specifically on the drivers that have the greatest impact on business evolution.

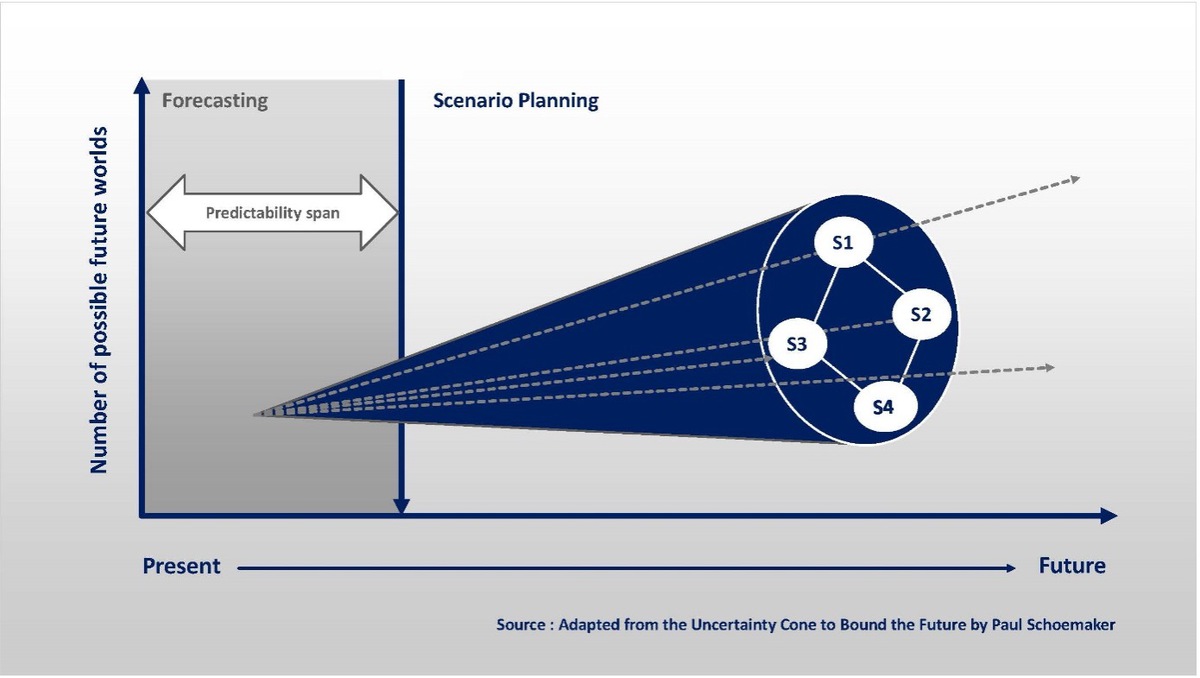

Figure 1. The Uncertainty Cone - Paul Schoemaker

This is the Cone of Uncertainty, proposed by Paul Schoemaker ( Figure 1). It is part of the research carried out in the field of analysis of the evolution of the company's environment. Schoemaker proposes that the environment has two parts: one that is predictable, and another that is not covered by predictability. The latter requires relying on different financial planning scenarios in order to address the challenges of uncertainty.

The FP&A Solutions in an Era of Uncertainty:

- Driver-Based Planning

Driver-based planning is a financial planning and management approach that identifies an organisation's key business drivers. It uses mathematical models that allow managers to run scenarios based on these drivers, which helps to understand the impact on projected business results.

Driver-based planning aims to focus efforts on the factors most critical to the organisation's success. It, therefore, uses more advanced mathematical formulas, which model the relationship between independent and dependent variables. Models can be created with spreadsheets, or with more advanced data modelling software applications.

Business drivers vary from industry to industry. Drivers used to measure the level of activity include Market Share, Sales Volumes in Units, Number of Orders, Average Sales Price per Unit. With these business drivers, managers can save a lot of time and effort in creating and updating their financial forecasts. As a result, they can react more quickly in times of accelerated change.

- Continuous Planning and Rolling Forecast

Implementing a continuous planning process enables decision-makers to assess the company's financial performance with more timely, reliable and accurate information. This agile forecasting tool improves performance through employee engagement and participation in achieving goals, while also supporting increased accountability.

Continuous planning helps managers react more quickly to potential problems. This innovative forecasting practice is based on making regular modifications in response to changes in the environment. Finance teams are not systematically tasked with an extensive re-forecasting process, but only need to make small adjustments. With more accurate and up-to-date data, managers can react more quickly and effectively to internal and external challenges.

Unlike annual plans, Rolling Forecasts are therefore a useful management tool and are not subject to the problem of traditional plans. With the rolling forecast method, companies develop a forecasting process over a rolling period (e.g. 12 to 18 months). The forecasts are updated on a monthly or quarterly basis, focusing on the most important variables "Key Performance Drivers". In addition, the resulting forecast data is more up-to-date and reliable, providing the organisation with more complete information. This facilitates better decision-making.

In the words of Nancy Geofroy, Principal Executive Advisor at Gartner: "A successful Rolling Forecast implementation provides better visibility on future results, and therefore allows managers to make the right operational and strategic decisions."

- Modern Flexible FP&A Systems

The finance team cannot be agile with a manual Financial Planning and Analysis (FP&A) process. Following a survey conducted by The Digital Nordic & Benelux FP&A Board in September 2021, "48% of respondents consider their current FP&A Scenario Planning process to be traditional, while only 5% of respondents say they have an FP&A Scenario Planning process that responds in real-time and multidimensional."

To react in real-time, managers need to be able to synthesise information from all data sources, discover trends, and provide insights more quickly. Practitioners emphasised the need for the FP&A team to have staff with data analysis skills, as well as technical skills in finance and accounting. In addition, a dynamic and modern solution is necessary for the agile transformation of FP&A processes.

Overall, companies that want to improve the effectiveness of their planning systems should place FP&A development at the top of the organisational priority list.

Conclusion

According to Pericles (500BC), "The key is not to predict the future but to prepare for it.''

This quotation reveals the value of preparation, even in times of uncertainty. In this respect, continuous and driver-based methods save a lot of time and effort when it comes to budgeting and financial planning. Automation also improves managers’ efficiency when creating and updating forecasts.

Unlike traditional management methods, Financial Planning and Analysis solutions are a new way to manage your business rationally. With the FP&A systems in place, business processes become more accurate and agile, preparing your company for the challenges and uncertainties of today's economic climate.

References

- https://www.ey.com/en_gl/innovation-financial-services/how-fis-can-apply-driver-based-planning-for-more-agile-management

- https://www.gartner.com/smarterwithgartner/3-steps-to-implement-rolling-forecasts

- https://www.ey.com/en_be/strategy-transactions/how-scenario-planning-can-create-clarity-in-the-midst-of-uncertainty

- https://fpa-trends.com/article/five-common-fpa-problems-and-how-solve-them

- https://www.bcg.com/publications/2020/budgeting-in-an-age-of-uncertainty

- https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/planning-for-uncertainty-performance-management-under-covid-19

- https://www.gartner.com/en/documents/3990212/near-term-budgeting-strategies-in-the-covid-19-era

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.