Today, the tools that are being offered are smart enough that with a few inputs and financial...

In the last years, the digital transformation had an accelerated impact not only on improving customer experience but also on financial planning and analysis (FP&A) processes. This article gives insights into an innovative finance investment controlling project recently created at Zalando. The project is a digital platform and process called internally “Investment App” developed in an agile approach, to supervise large capital expenditures across Zalando business units.

In the last years, the digital transformation had an accelerated impact not only on improving customer experience but also on financial planning and analysis (FP&A) processes. This article gives insights into an innovative finance investment controlling project recently created at Zalando. The project is a digital platform and process called internally “Investment App” developed in an agile approach, to supervise large capital expenditures across Zalando business units.

Starting point: reasons to introduce this new digital solution

In FP&A activities, investment controlling requires collaboration and coordination across several teams in various areas such as Accounting, Treasury, Finance Controlling, Procurement, Technology, Operations, or Corporate Governance.

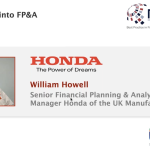

As part of the mission of improving transparency, systems, governance, and putting financial intelligence in the centre of the decision-making processes, the Finance Controlling team initiated a first internal assessment to identify key stakeholders of the investment process, the status-quo of systems and processes used to control investments and the main challenges the involved parties were facing.

In this initial process, the team focused on key stakeholders responsible for large investments with a volume of at least 10€ million in the last year, while the full scope was circa 500€ million. In a series of interviews, the team learned about the existing processes, systems, and people who are involved during the whole capital assets lifecycle. As the whole area of investments had seen recent growth, it was not surprising to identify improvement needs in a variety of areas.

Approach: project setup and execution

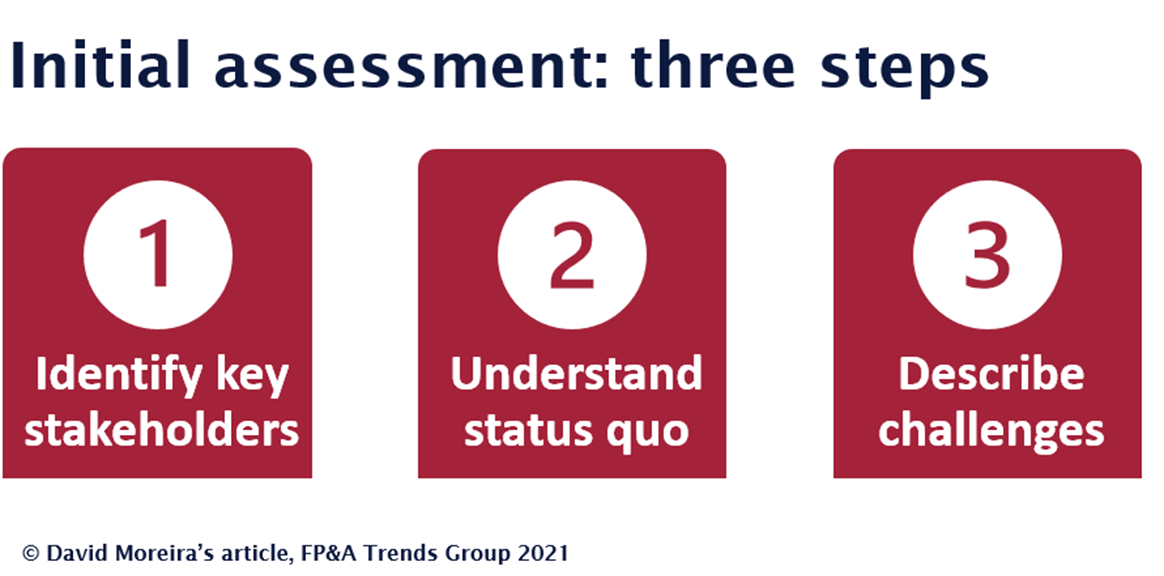

After having buy-in from the Finance leadership team, we started the execution of this finance transformation project. To this end, we applied an approach called the “4Ds” product management framework. The 4Ds consist of a four-step methodology that integrates the discovery, definition, design, and delivery phases. Building on these four phases we went into the company-wide rollout and change management of the project.

Discovery: collecting information about the status quo

First, we engaged in a round of one-to-one discussions with senior managers responsible for large capital investments in the areas of technology, logistics infrastructure, and corporate real estate. These interviews allowed us to collect information about the existing processes, teams, and systems involved in the approval of large investments. The core roles contributing during this phase were Finance Controlling, senior business executives, tech teams, and construction site managers.

Definition: prioritising the identified issues

After having discovered the specific customer needs, we prioritised them together with the Finance leadership team. This helped to clearly define which problems this new digital solution was solving. The final problem definition was co-created by Finance Controlling and the Finance Product Owner in the technology team.

Design: choosing the best solution

In the design phase, we aimed to find the optimal solution for the digital platform. We screened and tested several options internally and externally. The process of choosing the best solution took about three months - a somewhat cumbersome and lengthy process. During the testing activities, we were addressing the following questions:

- Is there any existing internal system with an approval workflow that we could adapt?

- What are the upfront and maintenance costs, and how long is the expected execution timeline of either solution?

- Does the solution provide a simple UX/UI with an approval flow allowing the integration of a RACI matrix?

- Which type of solution provides a better fit? An external turnkey solution or an internal self-generated software?

After thorough testing, all options were summarised in a decision tree with the respective cost drivers, and a recommendation to buy/not buy/develop for each solution.

Delivery: using an agile approach

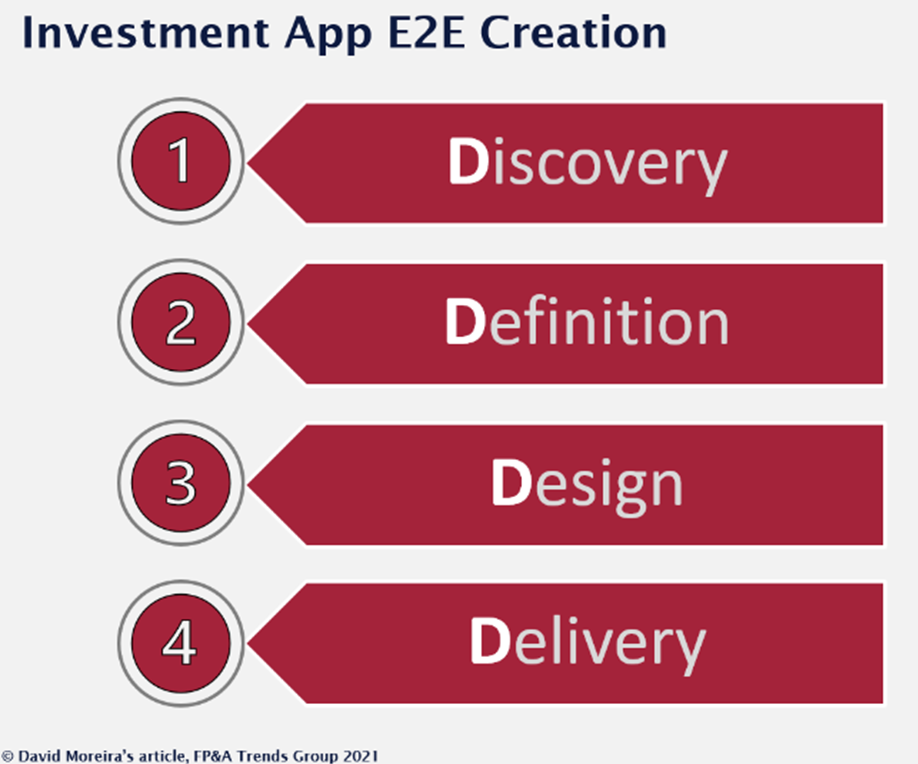

The working plan and timeline were broken down into several working packages, or sprints. The main tech contributors assigned to the project were full-stack, backend, and experts in coding workflows. Having the work planned by sprints, we embedded the work plan in a project management system to allow a collaborative approach between all involved parties.

We took a “radical” approach to agility in developing the app. This meant that we did not spend a significant amount of time creating detailed designs and wireframes. Instead, we focused on creating a high-level user flow diagram, a few mock-up pages, and quickly started the software development.

Our agile approach also assumed that we first would create a minimum viable product (MVP). With this approach, we assured that customers get a feel for the solution early on. Furthermore, after collecting feedback from stakeholders we could quickly create a backlog of enhancements and improve the app in loops. The MVP development took around six months. During this period, we held weekly meetings to: (i) check on the tasks done during the previous week, (ii) solve any bottlenecks, and (iii) align on the tasks to come.

When we finished the MVP, we proceeded by going through a thorough user story testing. The purpose was to give clear guidance to the test users and to create a history of bugs and enhancements needed to have the MVP app fully functional. During this phase, the user group was mainly composed of stakeholders from teams across the organisation that would work with the app in the future.

At the end of the testing, and once we were able to correct most of the relevant technical bugs, we invited a wider number of people for the pilot of the app. The pilot test lasted 60 days and once it was finished, we officially announced that the rollout and go-live of the app were ready to start.

Rollout: supporting the change and adoption

For the rollout phase we prepared a number of preliminary steps to support change management and adoption:

- invited the large group of pilot testers to become the early adopters of the final version.

- leveraged the good feedback that we received from these users to engage other teams.

- started a roadshow across other business and administrative areas to create awareness and engagement.

- introduced the benefits of the app during the related company training to also spread the word company-wide.

- presented the app to a cross-functional leadership team during their weekly meetings and also to the CFO to strengthen the message via this senior round of executives.

Conclusion: digitalisation as an opportunity for Controlling

Nowadays, for finance and FP&A executives to live up to their purpose and to meet the internal customer needs, they have to not only advance their own competencies but also drive initiatives with the right technological tools. Considering the impact of digitalisation, finance teams are nowadays exploring new ways of working and tech expertise to be properly equipped to solve the current problems.

Companies are trying to build an FP&A function that embraces technology innovation and brings efficiency and effectiveness. This requires FP&A professionals to work on complementary skills and competencies that are important for driving the change. In Zalando, the newly developed investment controlling project enabled large-project investments to be successfully evaluated, profitable, and create value for internal and external stakeholders.

In summary, this transformation project significantly optimised the management of investments with increased transparency to mitigate risks, the speed to quickly adjust to the strategy when required, and a lean process to streamline processes in a digital approval workflow.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.