The most important decision for top management is where the money goes. Capital allocation not only...

On March 25, 2021, about 550 FP&A practitioners from 70 countries around the globe gathered to discuss FP&A Role in Capital Planning: Getting Beyond the Traditional.

On March 25, 2021, about 550 FP&A practitioners from 70 countries around the globe gathered to discuss FP&A Role in Capital Planning: Getting Beyond the Traditional.

The discussion focused on the key steps needed to implement a continuous, collaborative and connected capital planning process and how technology can help in optimizing all phases of the Capital Investment life cycle.

The meeting was sponsored by Finario and the topic was explored by three experienced panelists:

Joao Almeida, CFO of Hub Terminals A.P. Moller-Maersk (Amsterdam)

Jonas Ekegren, Head of Business Capital Planning Lansforsakringar (Stockholm)

Jared Begun, VP at Finario (New York)

Capital planning process and integrated FP&A

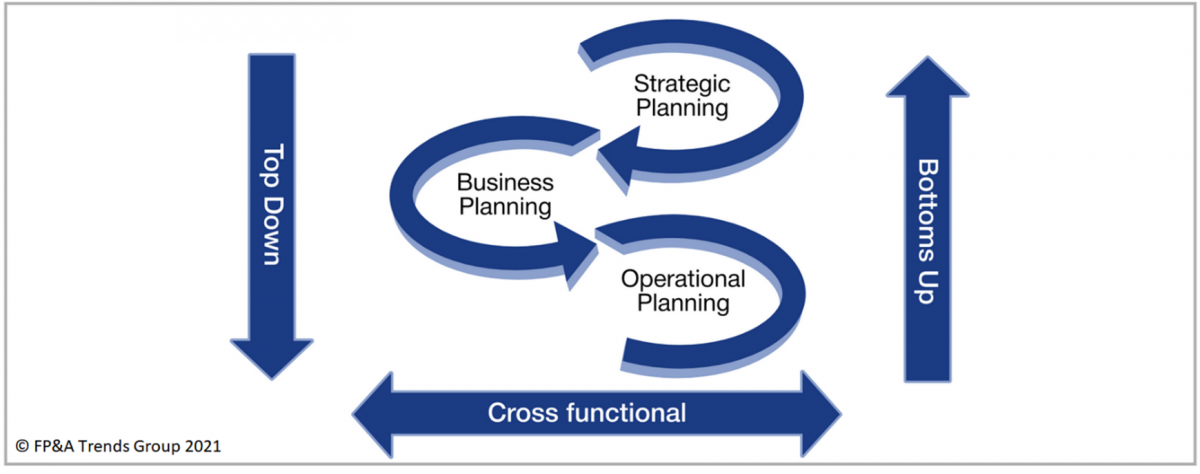

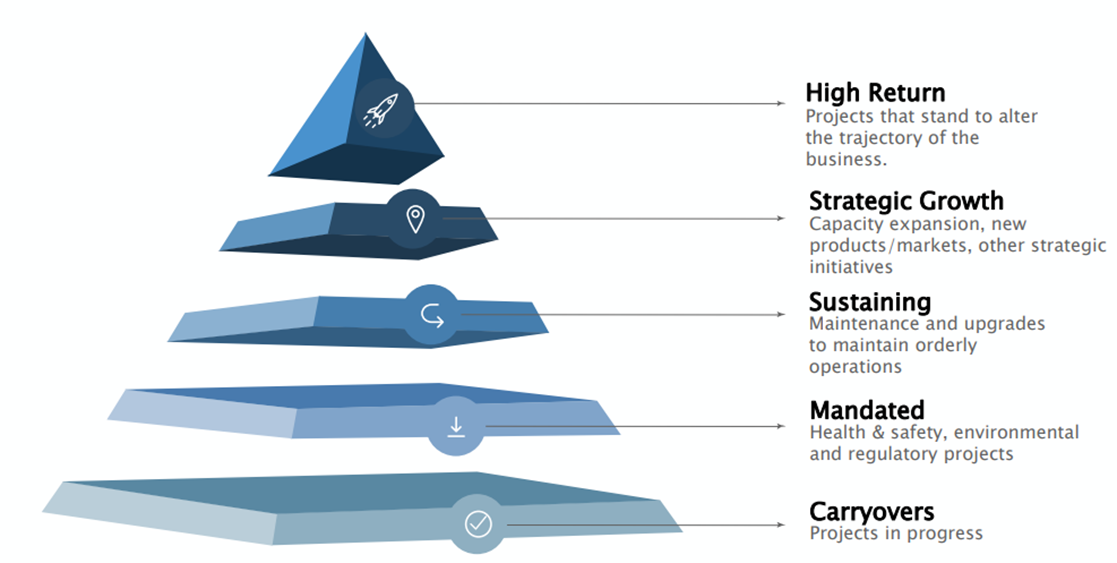

Capital planning, as a concept, is a plan for a company to acquire new assets or to improve the useful life of existing assets that is implemented over a period of more than one year. It is the process of tying capital investments to Strategic, Business and Operational Plans – a process called Extended P&A (xP&A), or Integrated FP&A, where all of these processes are connected.

This process has several challenges:

Limitations and Availability of Capital (dependent on financial institutions’ working hours)

Uncertainty due to long-term planning (black swans – events detrimental to long-term planning)

Data availability and quality (tech capabilities)

Collaboration and ability to evaluate and control (people factor)

Key Steps for Implementing a Continuous, Collaborative and Connected Capital Planning Process

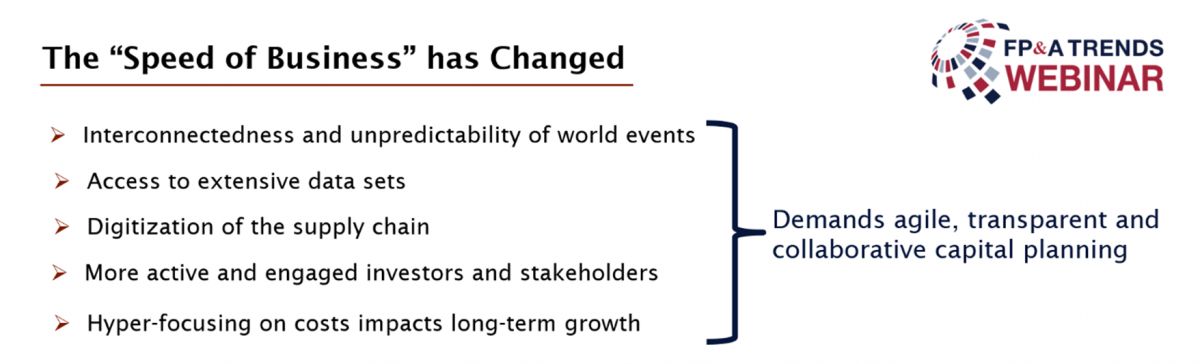

Joao Almeida started the discussion by sharing his experience in managing FP&A processes in capital intensive companies. Over the past 20 years, the world has changed rather rapidly which increased the demand for agile, transparent and collaborative capital planning processes across various sectors and company sizes.

2020 brought a lot of uncertainty to the business environment. Some industries were affected heavily, including logistics, travel and hospitality, where demand dropped by up to 80%. If you understand the root causes of forecasting challenges, the forecast accuracy of a portfolio improves significantly. Businesses can build capital planning capabilities through focused attention to the combination of the following:

It is important to audit the processes which will enable a continuous learning cycle. Through the learning process, companies should be attentive to the typical implementation obstacles, as usually, around 70% of projects do not meet their initial objectives irrespective of scope, nature or industry. As there are no organizations that are alike, unfortunately, a single template cannot be replicated and adopted. Moreover, cultural aspects should also be taken into consideration, as they are a key to understanding the appetite for change in the organization.

According to Jonas Ekegren’s presentation, there are some other steps that should be taken into consideration:

focus on unblocking organizational barriers to change, as buy-ins at all levels are crucial for the long-term success of any sustained initiative. Centralized rigid approaches actually slow down embedding change capabilities.

level the differences as all business units should be able to compete for capital. Smaller business units often get the shorter end of the stick as they do not often get the share of capital expenditures that bigger units attract.

build robust financial models that are able to provide nimble scenario capabilities.

get people to cooperate and to support your plans. If you do not have processes and people, technology would not really do much. Integration among various functions is the most important factor.

review the plan both quarterly and annually, since an annual review is no longer solely sufficient in the new environment.

The Role of Modern Technology in Optimizing All Phases of the Capital Investment Life Cycle

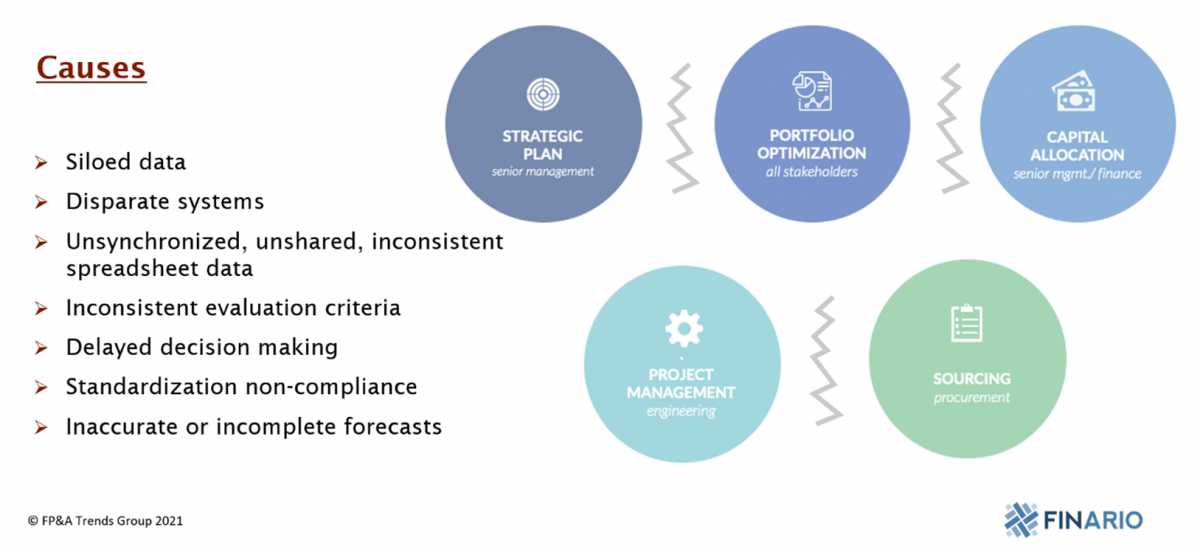

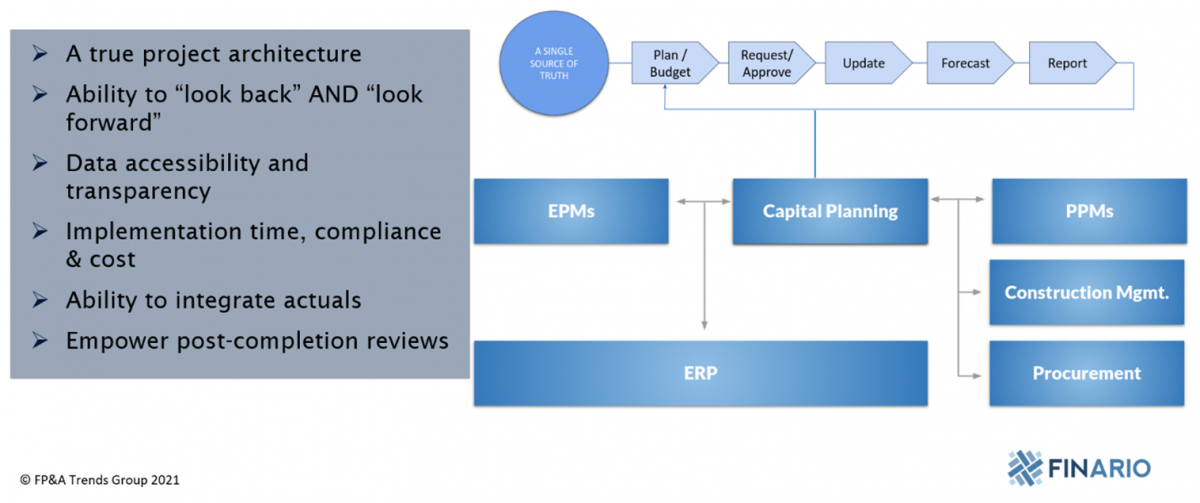

Jared Begun steered the conversation into how technology can help FP&A professionals. Unfortunately, in many organizations, capital planning is often a disconnected process. A good start to fixing this issue is to first brainstorm and address those potential “disconnects”:

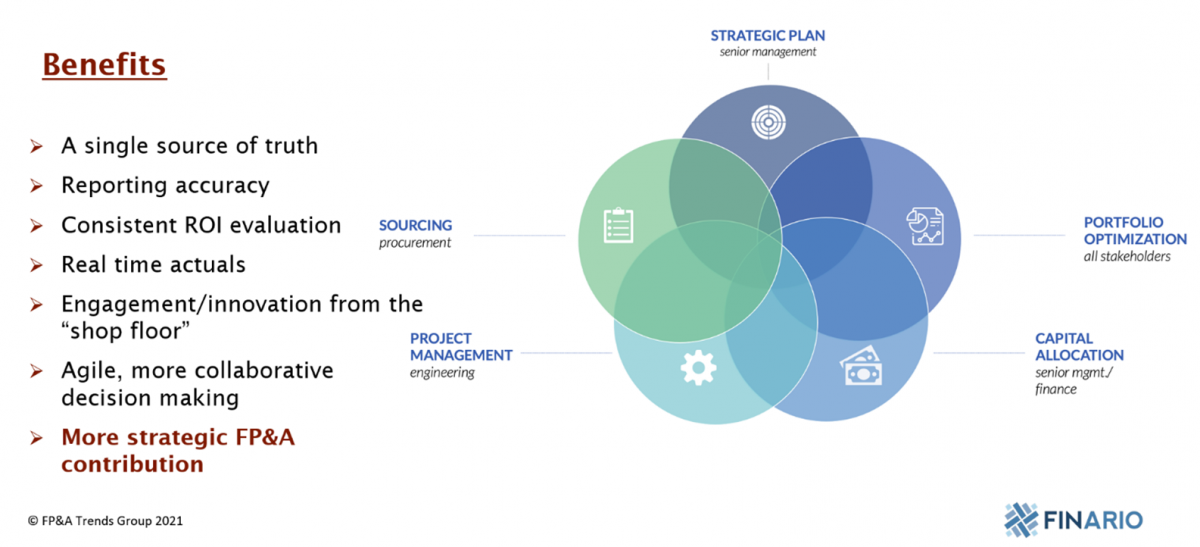

The benefits of a unified process were discussed, as well as the ways to help connect all phases seamlessly.

Automation helps to move to an integrated capital planning process. To implement an integrated approach, you need to reach out to the right decision-maker, provide them with the right data to make the proper capital allocation decision, all while leveraging the right technology. It is also imperative to get ideas from all areas of an organization.

Both traditional and modern systems have real-time data, and pulling that data into one integrated solutions system helps senior managers to make thoughtful capital allocation decisions. The goal of capital allocation is to route cash flows to the projects with the highest potential. You need to understand your cash position to be able to make decisions that ultimately maximize ROI.

Having integrated solutions helps to prioritize that capital. It is important to build the forecasting muscle of the organization and to understand that what worked in the past will not necessarily work in the future. The whole process should be flexible and associated data needs to be presented in the right way for it to be useful.

Conclusion

At the end of the meeting, participants were asked to share which capital budgeting and forecasting tool they were relying on the most and the results were not surprising: 76% were still relying heavily on Excel while 24% relied on either internally-built or custom ERP solutions. Moreover, participants were also asked to characterize the Capital planning process at their organizations. 1/3 described their processes as disjointed and inefficient; while 2/3 of the participants shared that their organizations are on the right track when it comes to FP&A processes.

Thus, most companies rely on investments in technology to make their systems more user-friendly and more efficient in helping the capital planning processes of their organizations. When this process is done right, it can reap a lot of rewards for the organization.

We would like to thank our global sponsor Finario for great support with this FP&A Trends Webinar.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.