In this article, I will discuss the challenges finance teams face in Asia Pacific and some...

What does winning as an FP&A Team mean? FP&A teams differ from other teams in that they do not actually compete against other FP&A teams, so that winning won’t be shown on a scoreboard. FP&A teams collectively support a bigger team, the whole organisation. Organisational winning occurs when the organisation out-performs its competitors, servicing its customers with superior products and services. The FP&A team can play a key role for the organisation when it provides its business leader with timely and relevant information to be used in strategic decision making.

What does winning as an FP&A Team mean? FP&A teams differ from other teams in that they do not actually compete against other FP&A teams, so that winning won’t be shown on a scoreboard. FP&A teams collectively support a bigger team, the whole organisation. Organisational winning occurs when the organisation out-performs its competitors, servicing its customers with superior products and services. The FP&A team can play a key role for the organisation when it provides its business leader with timely and relevant information to be used in strategic decision making.

A common problem for the FP&A team occurs when the information provided is not used or valued in the decision-making process. Setting up the FP&A team correctly will help alleviate this problem and optimise your FP&A team’s influence. This article will examine how Gallagher has set up its FP&A team to win.

Integrated FP&A Teams at Gallagher

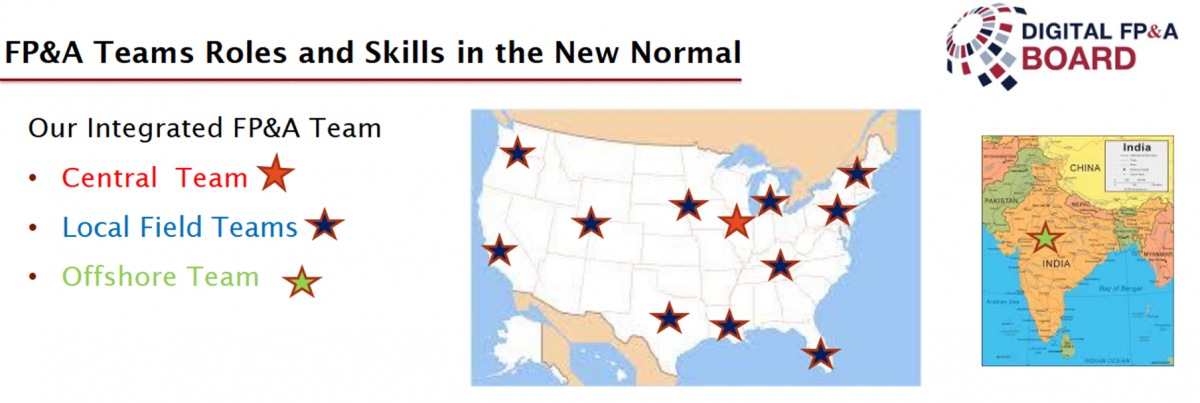

One of the challenges of running FP&A in a large organisation is there are numerous smaller teams FP&A helps win within the organisation. At Gallagher, our corporate management leaders look at trends in the data centrally with a high materiality level. They are looking at a portfolio of businesses comprised of different locations, different products, and different industries across the entire organisation. Comparing and contrasting various aspects of the business helps identify success stories and opportunities for improvement. We have a central team of analysts that support our Corporate Leaders. Central team members are highly dependent upon big data to perform their responsibilities.

We also have local leaders in the field supporting branches in different geographical locations. FP&A team members in the field know the business they support like the back of their hands, transaction by transaction. Local FP&A team members are more likely to make their recommendations using a practice called “thin-slicing”. Thin-slicing is a term used in psychology and philosophy to describe the ability to find patterns in events based only on “thin slices,” or narrow windows, of experience. Field analysts identify transactions that they believe are representative of trends to “thin slice” stories that explain the P&L numbers and persuade their local leaders.

The offshore team in India supplies standard reports across our operations. The offshore team supports both the Central FP&A team and the Local FP&A team, providing additional manpower that can distribute reports and perform numerous repetitive tasks quickly and efficiently, including data mining.

5 Key Roles in FP&A

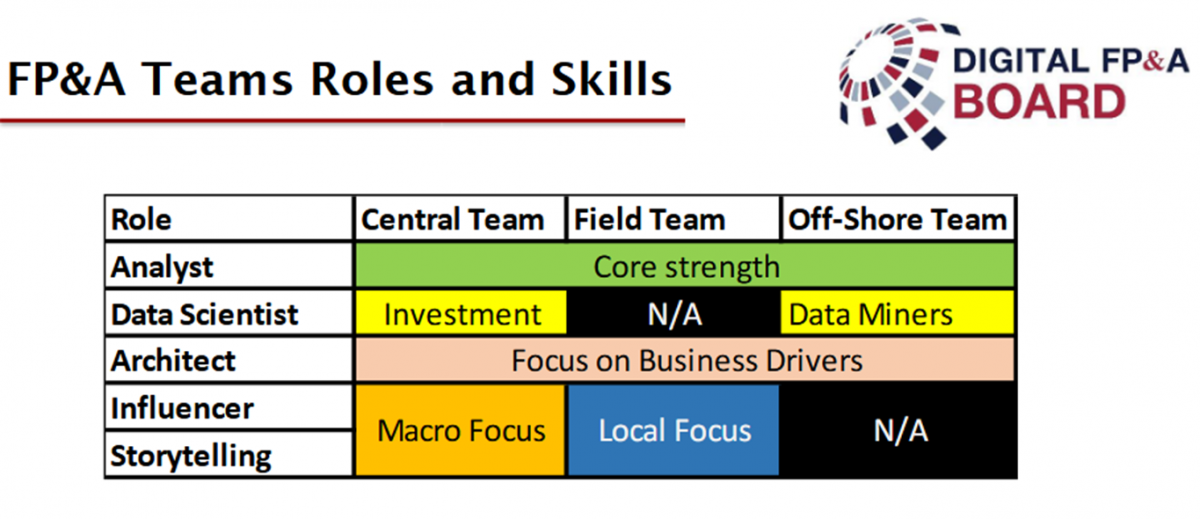

Setting up both the local and central FP&A teams is critical to being a more persuasive FP&A total unit. Equally essential is understanding the team roles.

Analyst: All FP&A team members must be able to analyse numbers. The FP&A team analyses numbers in monthly results for annual budgets and strategic plans. However, statistics can be used to support both sides of an argument, and we find that the same information can be interpreted very differently depending on the audience. Corporate and local management often have competing agendas that drive differences, so it’s critical the Analyst know the audience.

- Analyst role beware: The Analyst can have their data used against them. For example, $1 million in raises sounds like a lot from a $ perspective, and therefore it may not appear raises are necessary. However, if $1 million is less than 1% in raises, the information is perceived much differently.

Data Scientist: As volumes of data become bigger and bigger, the simple Excel spreadsheet is no longer enough to be able to understand how to interpret data. The Data Scientist has the ability to harness data from large databases, run algorithms and perform derivatives to test hypotheses using the scientific method. The scientific method includes developing hypotheses, testing with data, drawing conclusions and retesting to evolve our original hypothesis. It lets us become a true learning organisation as we learn from trials.

- Data Scientist Beware: Data Scientists have access to volumes of data. If they present the data without simplifying to focus on key trends, it is likely the end-user may disregard the data. The Data Scientist needs to partner with the Storyteller to explain how the data is relevant to upcoming decisions.

Architect: Robert Cialdini, a famous social psychologist, noted that what’s focal is causal. That means whatever we focus on is deemed to be more critical in terms of obtaining superior results. As financial analysts, we have the power of pen and can design reports to help branch managers focus their attention. Suppose we concentrate them on line items within the P&L instead of business drivers like new business per producer. In that case, we spend more time talking about P&L as opposed to revenue-generating activities and business drivers. Since local and divisional leaders are often focused on different things, the financial analyst’s responsibility is to focus on the common ground that brings the sides together.

- Architect Beware: The Architect may be encouraged to design reports to focus on things that are not business drivers. The Architect needs to make sure they are partnering with the Analyst and the Storyteller to make sure the report focuses on business drivers. It is presented in a way the business understands.

Influencer: The key to influencing is usually more centred on empathy than it is on knowledge. As Stephen Covey’s habit #4 states – seek first to understand and then to be understood. We need to understand our branch manager needs so we can present data that meets their needs and influences their decision making. While we have standard reports, we also have customised reports designed to meet specific needs.

- Influencer beware: The Influencer is frustrated when they cannot get the attention of the business. The Influencer needs to partner with the Analyst to determine business drivers and the Storyteller to come up with stories that help influence.

Storyteller: It’s critical we can story tell to help others visualise our recommendations. We can say their precise metrics to a branch manager; however, those metrics by themselves are ambiguous and confusing. For example, we could show that we have 2200 employees on staff. We can turn this into a story with statistics identifying trends. For instance, we have 2200 operational employees on the team, down from 2300 last year due to the hiring freeze reducing their costs from 12.1% to 11.5%. We need to hire 100 employees back but believe this will only bring the ratio to 11.8% as we have obtained synergy savings from the growth. The local analyst can add anecdotes from the field explaining how we lost a customer because we were short-staffed or how adding an additional employee helped grow a business.

- Storyteller beware: The Storyteller needs to partner with the Analyst and Influencer to ensure the stories are supported by the data and reach the influencers.

Key Takeaway

Winning as an FP&A team is so much than just delivering the numbers and forecasts. The great FP&A teams know how their business leaders want to see the data to make decisions, as well as know the time to present to make decisions. Setting up your team with influence with local decisions makers matters. Additionally, understanding the five key roles – Analyst, Data Scientist, Architect, Influencer, and Storyteller – will help your toolbox in the ability to be persuasive in our presentations. We win when the organisations win and value us as a key to their success!

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.