FP&A has an impact on the organisational structure, enhanced by the possibilities of new technologies. Where...

The Financial Planning and Analysis (FP&A) function plays a critical role in driving organisational performance. However, a major challenge lies in determining the optimal structural approach, in particular, the degree of centralisation within the organisation. This decision is not merely a structural choice — it significantly impacts process efficiency, resource allocation and organisational agility. Striking the right balance between centralised and decentralised models is both complex and crucial. Missteps in this decision can lead to inefficiencies, reduced agility and difficulties in reallocating resources to meet evolving demands.

Central FP&A Function: Challenges, Limitations and Benefits

Organisations aiming for operational efficiencies and cost optimisation often implement centralised solutions for core finance functions such as treasury, basic accounting and FP&A. In many cases, treasury and basic accounting functions are outsourced, while controlling and FP&A are retained internally. This reallocation shifts finance resources from local teams to a global structure.

A hybrid organisational structure like a matrix model can help balance centralisation with local flexibility. In this structure, finance resources are shared between global and local teams, allowing for both centralised oversight and decentralised decision-making when necessary.

While centralised models bring significant benefits, they also introduce challenges that require careful management:

- Ownership and Data Management: Clear ownership of data is essential for ensuring efficient data management. However, global teams often lack familiarity with local specifics and language, while local teams may have no access to advanced FP&A methodologies or sufficient resources.

- Legacy Processes: Organisational changes can lead local teams to adhere to outdated practices, creating confusion, inefficiencies and hindering progress.

- Communication and Coordination: Establishing effective communication channels is critical to bridging the gap between local and global teams.

Addressing these challenges requires a structured approach, which is explained further in the following example.

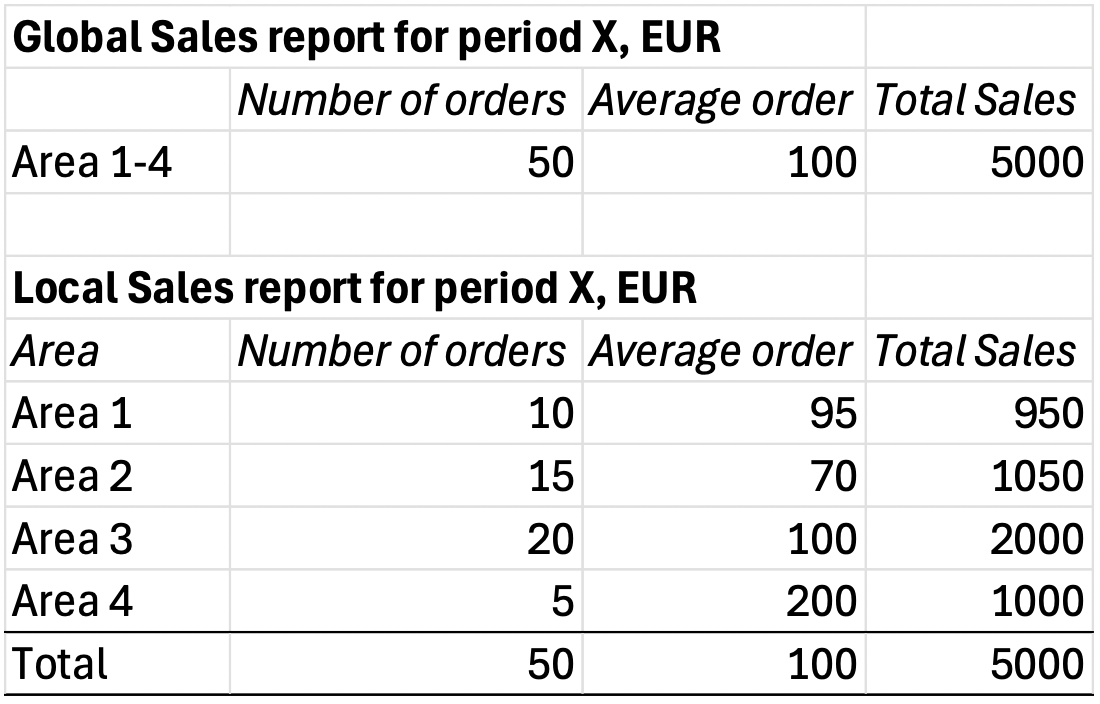

Illustrative Example: Inefficient Sales Reporting

Centralised Sales Reporting: A global sales report is created from a central data warehouse. The report is standardised, providing uniform detail and structure for all business units.

Local Management Needs: Local business units often require specific levels of detail or unique data groupings that are not captured in the global report (e.g., geographical area split).

Figure 1. Monthly Sales Report Example

Manual Workaround: When global reports fail to meet local needs, local management requests the required details from their teams. These local teams, unable to find relevant information in the global reports, continue to manually prepare reports using outdated methods, resulting in wasted time and increased complexity.

Proposed Solution:

1. Feasibility Study: Conduct a feasibility study to gather input from local management about their reporting requirements, focusing on understanding the need for different levels of detail or specific data groupings. Ensure that the local teams' input is collected in a structured way to address the most relevant concerns and avoid redundant requests.

2. Flexible Global Reports: Enhance the global report structure to accommodate the varying needs of the different business units, allowing for flexibility in the level of detail and grouping of data. This could involve introducing drill-down options, filters, or additional levels of granularity that cater to local requirements without disrupting the global reporting framework.

3. Agreement on Reporting Needs: Establish an agreement with local management on the appropriate level of detail to be included in the global reports, considering factors such as data complexity, business priorities and report performance. If certain data points are not essential for analysis at the global level, these can be excluded from the global report, with an understanding that they can be provided in a different format or through an alternative method.

4. Alternative Reporting Mechanisms: Provide local management with access to other reports or tools that can help them achieve their desired insights. This could include self-service BI tools or dashboards that allow for ad-hoc reporting based on the global dataset. Ensure that these alternative tools are easy to use and meet the specific needs of local teams without requiring them to revert to manual, outdated processes.

Benefits:

- Efficiency: By addressing the needs of local management up front, the need for manual report creation is reduced, saving time for local teams.

- Alignment: Aligning global and local reporting structures minimizes redundancy and improves data consistency.

- Scalability: Once the local reporting needs are understood and incorporated into the global framework, the solution can scale easily to other business units with similar needs.

- Flexibility: Local teams get the flexibility they need, either through enhanced global reports or alternative tools, ensuring that they can achieve their reporting goals without deviating from the established processes.

By incorporating a more collaborative approach and improving flexibility in the reporting structure, both global and local management needs can be met efficiently, thus reducing manual efforts and streamlining the sales reporting process.

Key Issues in the Transformation:

- Centralisation vs. Local Knowledge: Centralised teams often lack deep local knowledge and understanding, leading to inefficiencies, miscommunication and poor decision-making.

- Resource Reallocation and Skill Gaps: Shifting resources to global teams can leave local teams under-resourced, while the global team may struggle with specific local requirements.

- Lack of Clear Ownership of Data: Undefined data ownership can complicate its management, causing misalignment and undermining trust in financial information.

- Resistance to Change: Changes to established processes can create uncertainty, making it harder for local teams to engage with global initiatives and for global teams to understand and integrate local nuances.

- Access to Key Methodologies: Advanced tools and methodologies developed by global teams may not be accessible to local teams, deepening the divides and limiting efficiency.

- Decline in Reporting and Analysis: Reduced local resources can result in inconsistent or inefficient reporting and analysis, which is critical for decision-making.

- Business Partnering Role Change: Centralisation of functions may prevent local teams from fulfilling their Business Partnering (e.g. lacking access to the newly centralised sources of information), while global teams may overlook specific local needs, creating a disconnect between the two functions.

With these challenges addressed, the focus turns to effective change management steps that ensure a seamless and efficient transition.

Change Management Steps for Efficient Transition

1. Foster Collaboration: Build transparent communication channels between the global and local teams to share knowledge and expertise effectively. Regular workshops and check-ins can help bridge gaps and align priorities.

2. Define Data Ownership and Governance: Implement a robust data governance model that clearly defines ownership, accountability, and access rights for data across different teams. This ensures that data is accurate, accessible and reliable, supporting both global and local financial operations.

3. Training and Knowledge Transfer: To mitigate the knowledge gap, provide regular training sessions to local teams on global FP&A methodologies and ensure that the global team is also educated about the specific challenges and requirements of the local teams.

4. Balanced Resource Allocation: While reallocating finance resources to the global team is important for efficiency, consider maintaining a certain level of local expertise, especially in areas like treasury and basic accounting, where local context and knowledge are critical. A hybrid model can be more effective, where core functions are centralized, but key local knowledge is retained for decision-making.

5. Involve Local Teams in Decision-Making: Involve local teams early in the change management process. When they feel included in the decision-making process and see the benefits of the new global processes, they are more likely to accept the changes and adopt new ways of working.

6. Feedback Mechanisms: Implement regular feedback loops where both global and local teams can voice concerns, share feedback and suggest improvements.

While the softer aspects of change management are extremely important to be followed, one of the major success factors is establishing efficient cooperation for newly created teams with new processes.

Building Cooperation Between Global and Local FP&A Teams

Strengthening collaboration between global and local teams is essential for effective Business Partnering and organisational efficiency. Focus on these key actions to align efforts:

1. Define and Document Processes: Establish standardised guidelines, well-documented processes and consistent reporting formats that all teams adhere to.

2. Set and Manage Expectations: Clearly communicate and align management expectations to prevent the creation of separate processes or conflicting reporting efforts across different levels of the organisation.

3. Develop Tailored Dashboards and Reports: Design customised reports and dashboards that address specific organisational needs and train users to maximise their value.

4. Educate Stakeholders: Invest in training sessions for management and business users across the organisation on existing reports, even if they seem self-explanatory and intuitive. Education ensures tools are used to their full potential.

5. Build and Maintain a Knowledge Base: Maintain an accessible repository of updates, processes and improvements to support continuous learning.

6. Develop FP&A Culture: Engage stakeholders at all levels to build a shared sense of responsibility for processes, creating a collaborative environment where FP&A is a collective effort. This fosters a sense of ownership and alignment, enabling proactive involvement in the decision-making and effective financial management across the organisation.

Conclusions

The transition process for centralising the FP&A function is complex and requires a significant investment of time and effort to ensure smooth implementation. Success hinges on effective change management, collaboration and flexibility.

By addressing the needs of both global and local teams, organisations can unlock greater efficiencies, align reporting structures and streamline decision-making — paving the way for a sustainable and seamless transition.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.