In this article, the author describes how to better understand the increasing importance of relationships with...

Players in ESG Reporting Fields

In recent years, Environmental, Social, and Governance Reporting (ESG) has made significant progress. Standards and reporting procedures are becoming more structured, with more enterprises including ESG in standard reporting packs and the overall market beginning to see Sustainability Reporting as a viable requirement.

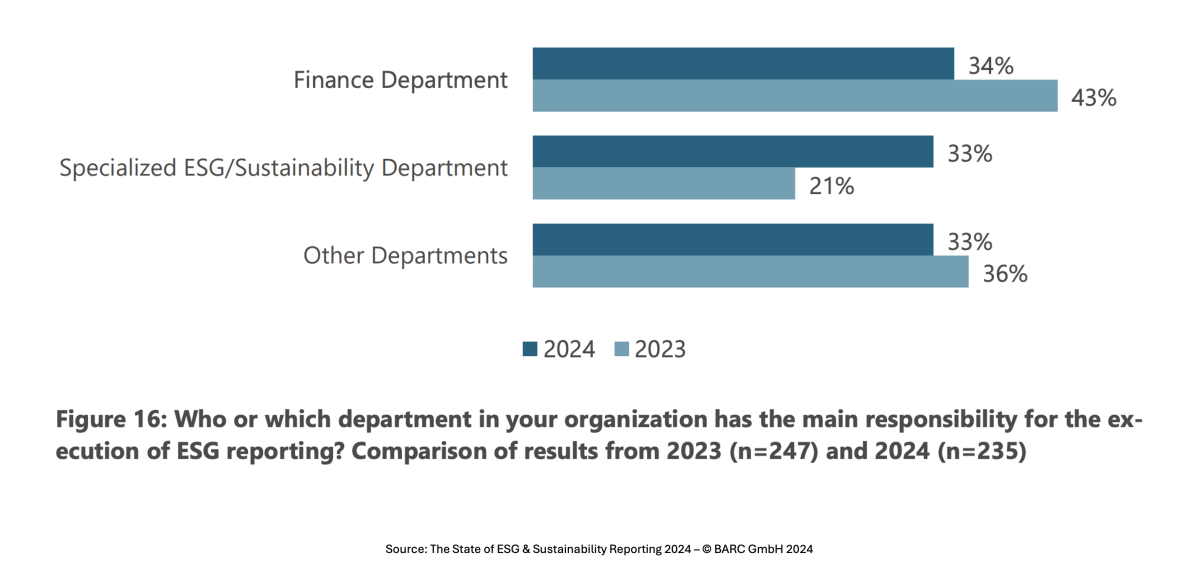

One question, however, has still not been completely answered — within an organisation, who should own the ESG Reporting process? Survey results from BARC [1] last year demonstrated that the majority of votes for various finance functions were above 40%. But, it seems that as time passes, a preference is moving towards specialised ESG units instead of Finance departments [2].

Here is a comparison:

Figure 1

This change has an obvious root cause – the creation of specialisations in a particular area leads to a higher quality of results and a potentially faster turnaround to prepare the output. Nothing is free, though. Setting up and running a separate function has an associated cost — direct for additional staff and indirect for the creation and support of new data collection systems, interfaces, and procedures.

There is also the risk that these "specialised" units will end up inflating their own importance and transforming from supporting to controlling forces. In my (biased) opinion, this has happened to Compliance departments in the past.

Can FP&A Take Ownership?

Yes. I'm sure they can — just follow the money. Since Henry E. Peterson first said this phrase in 1974 in relation to the Watergate scandal, it has been used to outline financial investigations. The same advice can be applied to understand and describe the activities of any organisation or company, however large or small. This is no different when examining a company's Sustainability and ESG Reporting.

All processes of production, sales, or transportation of goods, as well as consumption of products and services, are connected to environmental impact (E), engaged workforce (S), and business conduct (G). Therefore, ESG is based on the company's revenue streams, expenses, and capital investments. This link is present in both actual and forecast financial statements. Doesn't this describe the activity of an FP&A department? It does indeed.

Naturally, the knowledge, procedures and data owned by Planning & Analysis or Financial Reporting teams are forming a solid base for ESG reporting. It, therefore, makes sense to consider expanding FP&A responsibilities into this additional area instead of creating a brand-new unit. This would result in a significant improvement, saving time and costs, and enabling more efficient communication.

As an example, let's examine one of the ESG reports — the Stellantis 2024 ESG Information Report [3]. Having investigated, I found this report to be a good illustration of how ESG KPIs follow the money.

Stellantis owns 14 automotive brands, including Fiat, Peugeot and Vauxhall, operates across more than 30 countries / 130 markets, publicly traded on the New York, Milan and Paris Stock Exchanges and reported a 2024 revenue of €156.9 billion.

EU Taxonomy — a Code for ESG Reporting (and a Link to Financial Analysis Metrics)

Just before diving into the Stellantis report, it is worth mentioning that the so-called EU Taxonomy outlines the sustainability of the economic activities of European companies. This classification system helps companies and investors identify "environmentally sustainable" economic activities to make sustainable investment decisions [4]. Although not mandatory, many companies, including Stellantis, follow these classifications. The use of turnover, capital, and operating expenditures KPIs (Annex I of Regulations), as well as reporting period and reporting currency (Article 8), is the approach recommended within the Taxonomy and is consistent with the standards for financial reports. Overall, the Taxonomy looks much like financial reporting guidance [5].

The "Sustainability Statement is prepared on a consolidated basis, using the same scope as the Stellantis Consolidated Financial Statements, which includes Stellantis N.V. (the parent Company) and its controlled subsidiaries" (Stellantis, 2024, p.8). In accordance with the EU Taxonomy Regulation, the company has assessed the financial KPIs relative to its taxonomy-eligible activity 3.3 "Manufacture of low carbon technologies for transport" [6] . The ratio of eligible and aligned KPIs relative to Turnover, Capex, and Opex is required to be related to a company's financial reporting standards.

Value Chains — Money Flow Analysis, Sustainability Control

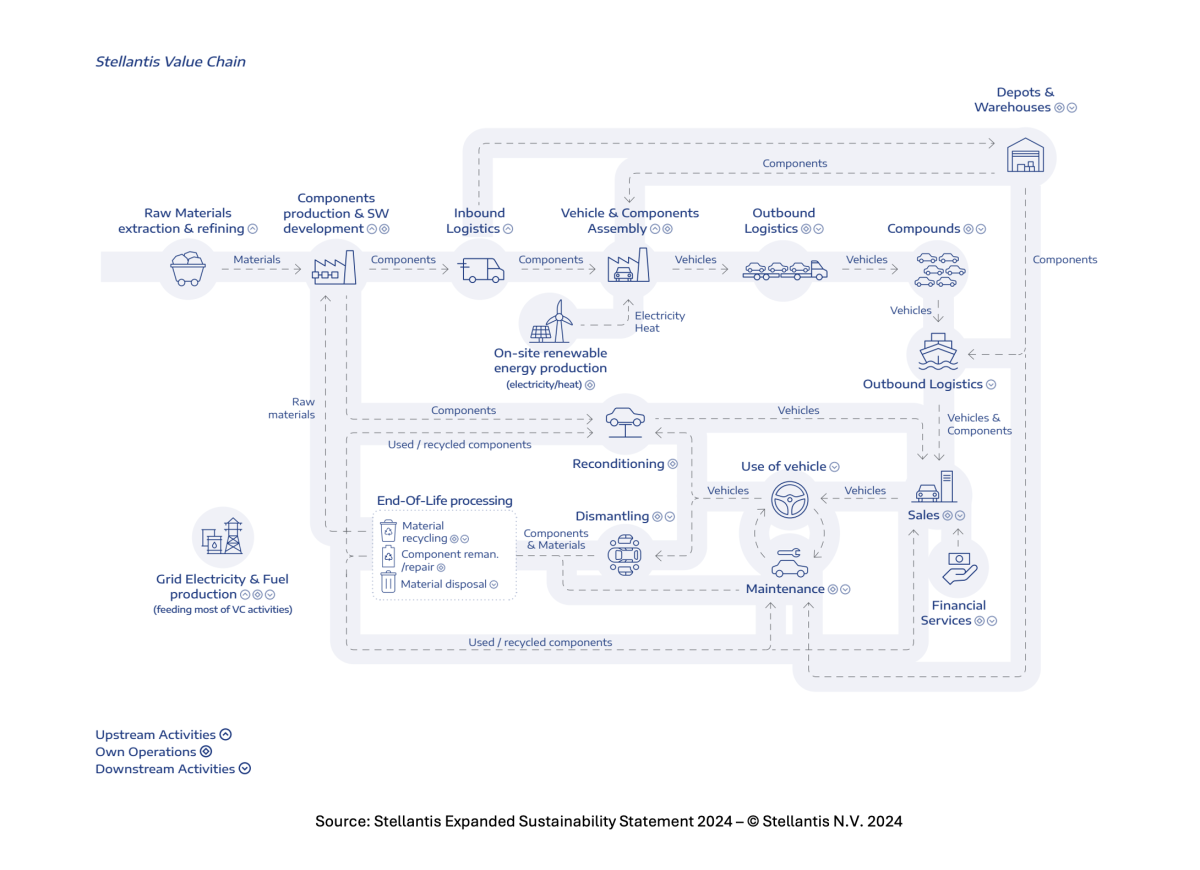

Importantly, this report is an "assessment covering both our own operations and our entire value chain" (Stellantis, 2024). This impact of a company's upstream and downstream counterparts is once again following financial analysis practice — following the money.

Figure 2

For each stage of product life, reported metrics are aligned to related financial parameters:

Resource inflow values are estimated based on the vehicle part composition (bill of materials), mass, and material information;

Production is based on direct materials and labour cost, inventory, machinery, and buildings use, etc.;

Products supplied to customers are measured by revenue from sales and services.

Firstly, regulatory requirements for assessing emissions vary from jurisdiction to jurisdiction, and a unified global standard does not exist. As such, judgment is required to assess whether a vehicle is Taxonomy-aligned based on the emission measurements used in the respective jurisdictions in which the vehicles are homologated.

Secondly, due to the company's broad geographical presence and the diversity of laws and standards across its operations, the assessment of the impact on workers in the Value Chain varies substantially.

Finally, there is a difference in the mix of vehicles sold and used (sold in the past). Changes in technologies and regulations are much quicker than vehicle lifecycles, so emission compliance correlates with evolving reporting requirements over time.

FP&A Methodologies for ESG Reporting — a Good Fit?

Yes! The described spread by geography, market channels, product lines, and even periods of time is yet another example of how ESG reporting is similar to consolidation and/or allocations. Both reporting processes are often led by the FP&A department, which has developed methodologies to identify and maintain weight ratios and drivers, rules, and procedures.

There are many other aspects we can investigate that showcase the alignment between ESG reporting and financial analysis. Here are two more:

In the area of social sustainability, the report displays an adherence to companies' policies regulating working conditions, equal opportunities, and human rights, and it aims to reflect its ethical business practices. It is measured by activities that provide employees with support and care. At the same time, there are several metrics naturally handled by FP&A, such as headcount, working hours, wages, and social security costs, as well as pensions and savings plan contributions. Supported by distribution across geography, production processes, contract type, gender, and age, they are the main parameters in the Social section of ESG reporting. Once again, FP&A employs the same methods of report production.

The Governance / Business Conduct area of ESG outlines the company's focus on business ethics, corporate culture, compliance with relevant laws and regulations, relationships with suppliers, and political influence management. It also deals with legal aspects (such as corruption and fraud), and technological aspects (including data protection and personal information, cybersecurity, product safety, and product and service quality). FP&A measures the non-financial activities of related departments through budget control processes.

Follow the Money — That Will Show the Truth

Budgeting, monitoring, analysis, and other standard working methods normally used by FP&A departments would go hand in hand with the potential measurement of non-financial activities.

Get the data.

Where required, add sources.

Structure the results.

Indicate regulation guidance, thresholds, and benchmarks.

Compare to the past or planned values.

Validate and receive approvals.

Follow the money!

Sources:

1. https://barc.com/research/the-state-of-esg-sustainability-reporting/

2. https://barc.com/research/esg-sustainability-reporting-2025/

3. https://www.stellantis.com/en/sustainability/esg-disclosures

4. https://ec.europa.eu/sustainable-finance-taxonomy/

5. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32020R0852

6. European Commission. (2020). EU Taxonomy Regulation: Delegated Act supplementing Regulation (EU) 2020/852. Annex I – Technical Screening Criteria. Retrieved from: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32021R2139

7. Freakonomics. (2011, September). Follow the Money. Retrieved from https://freakonomics.com/2011/09/follow-the-money

8. Stellantis N.V. (2024). Expanded Sustainability Statement. Retrieved from https://www.stellantis.com/content/dam/stellantis-corporate/sustainability/esg-disclosures/Stellantis-Expanded-Sustainability-Statement-2024.pdf

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.