In 1992 a professor named Robert Kaplan and a consultant named David Norton created a measurement...

History offers many thousands of painful lessons when the appropriate balance is lost for individuals, countries, species or ecosystems, companies or corporations. In business, long-term sustainable growth depends on choosing the right balance consistently.

History offers many thousands of painful lessons when the appropriate balance is lost for individuals, countries, species or ecosystems, companies or corporations. In business, long-term sustainable growth depends on choosing the right balance consistently.

Contrary to it, in nature, if one of the species or a whole ecosystem gets the right balance may depend on luck and special circumstances. I have lived and worked in Mauritius for several years, so that's why I refer to the famous Dodo bird example to underline the importance of balance. The dodo bird continued to grow bigger because of the absence of predators in their habitat, so eventually, it lost its ability to fly. It ended up being hunted out in less than 80 years due to the island's partial deforestation caused by the increasing number of people arriving here and bringing other animals like dogs with them.

Figure 1: The depiction of the extinct Dodo bird

I would like to outline the essential considerations for successful sustainable growth in this article.

The Art of Equilibrium: Decoding the Key to Sustainable Success

Sustainable companies and corporations get the best possible balance by focusing on short-term, mid-term and long-term equilibriums of critical factors and well-thought-out analyses. And they cannot get complacent, as they should continue learning from many challenges in the current Volatility, Uncertainty, Complexity and Ambiguity (VUCA) world.

There are multiple dimensions of balance in a business environment:

- top-line & bottom-line growth;

- a necessity to deliver short-term results while providing for long-term sustainable growth, and

- a choice between global and local opportunities while finding the right equilibrium for innovation at the right speed, quality, and cost.

The two most important points are as follows:

- the right balance has to be achieved for all stakeholders, and

- the right balance may change with/due to the circumstances.

Let's look at the EY project "Everest" collapse. In May 2022, they announced their plan to split its audit and consulting businesses. It would be considered the biggest change in the accounting landscape for the last decade or two. It would mean that one consultancy company would go public via Initial Public Offering (IPO), while partners would get greater paychecks and more business opportunities. However, about a year later, it got reversed. Many things did not happen as per plan, so below are my insights on two aspects.

Background

EY consults and audits nearly 25% biggest companies in the world. Many of them are technological companies. Due to a conflict of interest, it cannot consult the clients they audit. With the pandemic, many companies had to redesign their IT departments/services and leverage automation to enable the move to cloud platforms. That would have been an absolute fortune for consulting part of their business, be it not for limitation due to the conflict of interest. From the surface, it might have seemed that splitting the consulting and auditing businesses would be a very logical and profitable solution for all parties.

What Was Missed on Stakeholders` Balance?

The only point missed was how to create a sustainable future for tax experts at the heart of both consulting and auditing sides and keep both businesses growing profitably.

Most of the tax business would go to the consulting side of the business. Hence, the tax team would have an exciting inflow of various projects for multiple customers. Simultaneously, the auditing branch tax experts would be left with less interesting tax handling of audits. It would mean the best tax experts would go and stay with a consulting business, while the auditing part of the business would eventually lose its top tax talents. So, it means the balance of a successful business growth career development interests of the company's talents would not be met in the short-term, mid-term, or long-term.

What Was Missed During Planning Scenarios for Change in Circumstances

As I said, EY announced its "Everest" project in May 2022. The project must have been conceived in 2021 when most global economies had comparatively low yet slightly rising interest rates. At the same time, concerns about the global recession had already been present. So high hopes for the great success of the IPO of consulting business were most likely the "best-case" scenario. They also had to deal with serious interest rate increases from most central banks and a potential global recession, which might have a consecutive impact on both equities` performance. Overall, IPO prospects were not fully considered.

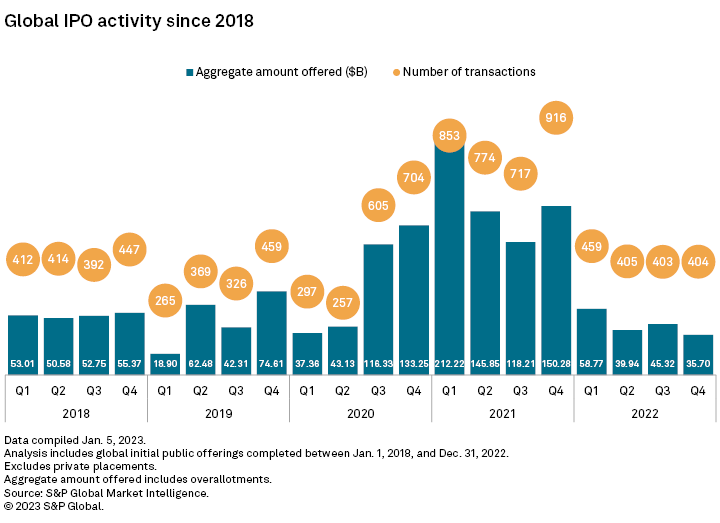

The reality proved a drastic reduction of IPOs in 2022.

"The number of companies that launched initial public offerings in 2022 fell by nearly half from the blistering pace set a year earlier.

There were 1,671 IPOs launched worldwide in 2022, compared to 3,260 in 2021. The total amount offered in those IPOs in 2022 fell to $179.73 billion, from $626.56 billion in 2021, according to S&P Global Market Intelligence data."

Figure 2

Recommendations for Building Bridges to the Future

Reassessing and changing all the balances is vitally important for companies and corporations' short-term, mid-term and long-term success.

Assigning resources – people, time, funds – is crucial to ensure balances are incorporated in every aspect of business operational systems and cycles.

I encourage you, finance leaders and practitioners, to look at the challenge or opportunity from multiple angles, balance the tug of the important short-term with crucial long-term priorities, and be courageous to ask the tough questions you need to know for reaching the best possible solution.

As Jack Welch famously said,

"You can't grow long-term if you can't eat short-term. Anybody can manage short. Anybody can manage long. Balancing those two things is what management is".

Now, what is the immediate next step in identifying the balanced path to the problem of the day/month/year? Chart it out – and start with "basics of self-reliance, self-motivation, self-reinforcement, self-discipline, and self-command".*

----

* - Quote from Steven Pressfield

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.