In the following article, you will discover the author’s view on understanding Zero-Based Budgeting, the essential...

Have you seen a sudden spurt of travel in your company in the last quarter of the reporting year and, more particularly, in the last month? Or the mad rush to get a long list of training programs completed before the end of the year? If you have, you work for a company that follows a traditional budgeting method to control the business financials. Traditional budgeting works on the continuity principle. The last year’s spending is used to extrapolate the future costs in the budget with some small tweaks at the top level, like inflation, savings %, etc. As you can predict, budget owners scramble to make sure they use their budget before the end of the year so as not to “lose” this allocation in the subsequent year.

Why Abandon Traditional Budgeting?

So, what’s the issue with traditional budgeting? Below, I outline some problems encountered before we took this transformation in Asia.

- With digital and other disruptions impacting how we operated, assuming linearity was a big mistake. Some paper-based systems, controls, and processes accumulated in past years needed to be discarded or challenged to allow for a more agile way of working with digital tools.

- At a corporate level, I realised that the corpus allotted to activities at the ground level did not change much from year to year. However, in reality, the revenue and profit drivers were shifting to other products, technologies and geographies. This led to ineffective capital allocation.

- Tied to an imaginary peg of prior year numbers, inefficient or redundant activities happened repeatedly because they used to be in the baseline, like the abovementioned unnecessary travels and training. My managers were happy to repeat what they always did while protecting their bloated budgets. A 5% increase every year on last year can balloon to a 27.6% increase in cost budget in 5 years. New entrant competitors who did not suffer from this legacy had a huge advantage over incumbents like us.

So, What Was the Alternative?

Zero-Based Budgeting (ZBB). It refers to the process where the entire budget is built bottoms up, each time with no prior approval of costs left from previous budgets. To give the simplest analogy, it’s like doing your own personal household budget. Do you, by default, assume that you spend all the expenses like you spent last year? No. We only focus on what our priorities are in that year and spend accordingly. This is logical. The same has to be applied in the company context as well, as it shows the core idea of ZBB.

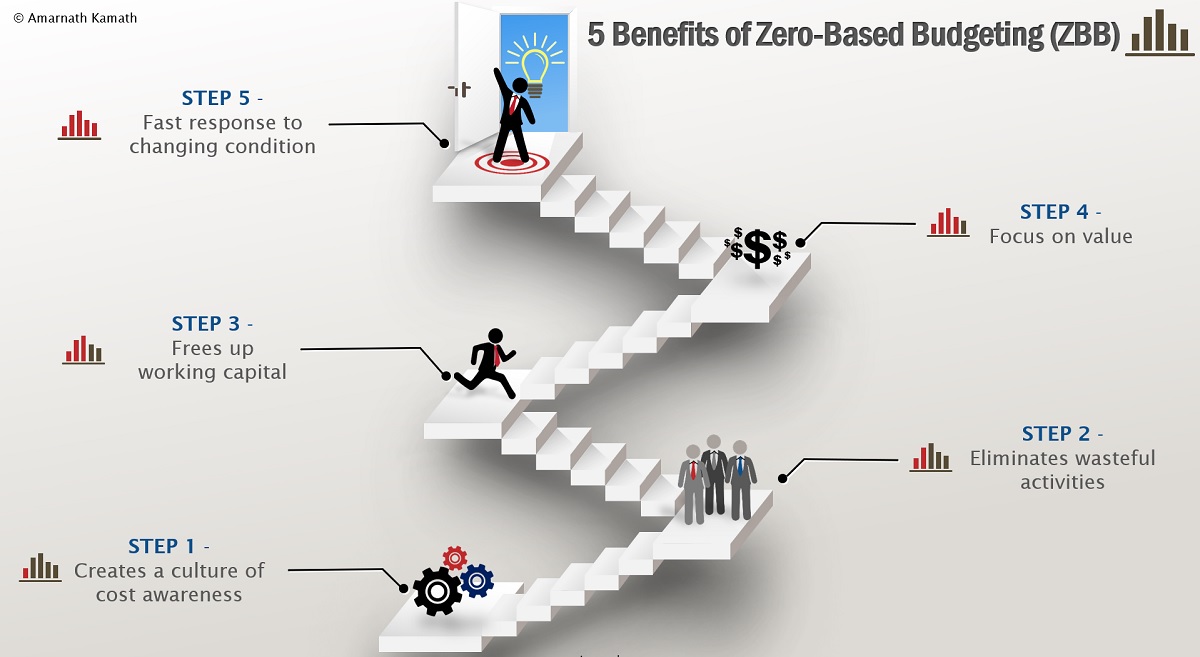

In theory, ZBB helps the company in many ways, as outlined in the picture below.

Figure 1: Five Benefits of Zero-Based Budgeting (ZBB)

Normally, top management is excited about the rollout of this “buzzword.” However, in practice, the actual deployment of Zero-Based Budgeting in companies typically lags behind the exuberance of the executives who want to deploy it in their companies. Why? What are the pitfalls that risk successful implementation, and what can we do to significantly increase the chances of success?

There are some pointers from my experience.

Pitfall 1 - Viewing ZBB as just a tactical tool for doing budgets

It is not. It should be viewed as a new transformation approach to cost management and requires a major mindset change across the company. Using a health-related analogy, executives are using ZBB like a crash diet, which may give short-term results with a huge risk of relapse, instead of viewing it as a sustained lifestyle change, which takes a longer time but is permanent and healthy.

Pitfall 2 - Assuming finance is the only owner of the process

Commitment from top management and involvement of all departments, not just finance as facilitators, is critical for understanding the causal relationship between the different costs and revenues. I strongly feel that ZBB should be driven by a small independent team headed by a senior, respected person. Continuous investment in concept training is a must from kick-off time until it becomes a part of the organisation’s DNA.

Pitfall 3 - Slow in pocketing significant gains in the commencement year

In my experience, I have observed that companies that can demonstrate noticeable gains in the first year motivate their people to keep the process going with more improvements and have a much higher probability of sustained success than companies that started slow. So, if you decide to take the ZBB plunge, hit the deck hard.

Pitfall 4 - Advertising and treating ZBB like a cost-reduction initiative

Unlike traditional budgeting, where a reduction in cost target implies a uniform percentage cut across all departments and expense types, ZBB requires the management to distinguish between investments being done for strategic purposes, such as developing a new product or services and expenses which do not add business value or add very little. The money released by stopping unproductive activities is ploughed back into initiatives identified as strategic priorities. We encouraged managers to inculcate an investor mindset, which enabled them to look at costs and evaluate if this investment brings adequate value or if it was better to let go of the budget.

Pitfall 5 - Not investing enough

As expected, ZBB needs a longer timeframe for establishing compared to traditional budgeting. Hence, it is more expensive than traditional budgeting. Furthermore, this is not a once-in-a-year exercise. It has to be managed continually on a rolling basis to ensure the incorporation of updated market data like new competition, new products, tax changes, etc., which could change the dynamics of the game. In turn, it will help top management take corrective actions quickly. The belief that the investment required will be more than offset by higher revenue or a more advantageous position is critical for success.

Pitfall 6 - Not having the right performance metrics

It’s the last but the most important point. To ensure success, we changed the performance measurement metrics for our people and included a substantial portion of metrics based on the unit’s performance instead of an individual’s or department’s. This helped us relieve people of legacy issues like “this is my department’s one, my product, my people, my sales area”, etc. and focus on the common company goals.

Conclusions

In conclusion, ZBB can deliver substantial benefits irrespective of your overall corporate strategy direction. However, many companies have a distorted view on this tool and end up being disappointed. I believe that following my suggestions will help you get a good bang for your buck invested in ZBB and create value far beyond mere cost reduction.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.