In a world in which increasingly little can ever be taken for granted, the core capabilities...

Due to the COVID-19 pandemic, the world’s knowledge workers have experienced unprecedented challenges during the last two years. From remote work and accelerated digitisation to the great resignation and mental health struggles, the post-COVID economy has been characterised by considerable pressures on human capital.

To deal with the resulting uncertainty, FP&A teams have had to demonstrate agility and analytical rigour, as well as flexibility. The organisational disruption, impact on business performance and changing supply chain demands have required FP&A teams to respond with rapidly changing forecasts, budgets and investment plans.

We have had to develop whole new ‘playbooks’ in order to overcome challenges, often taking on roles that are not typical for traditional management accounting.

In November 2021, the Digital FP&A Board met to discuss what it means to build a winning FP&A team in the New Normal, and how we can prepare for what lies ahead. We were joined by over 300 participants from around the world.

Building Winning FP&A Team

Perhaps the most prominent change in the New Normal is that the workforce is working remotely. This unsupervised environment creates uncertainty about team productivity. Managers are balancing the heightened need for communication and intentional planning with continually increasing demands for more flexibility and work-life balance to meet the demands placed on FP&A teams.

James Halley, VP Finance & European CFO, Nidec, talked about the need to manage the expectations of the business area team. The focus also needs to be moved from inputs, such as time spent signed into your company’s network, to output management. Strategies include breaking down work into clear milestones and smaller projects, scheduling regular progress reviews, and creating forums for targeted communication. Project management tools such as Gantt charts, waterfalls, Kanban and visual management can be very helpful in enabling team alignment and communication. To manage stakeholder expectations, managers should increase awareness of issues FP&A teams are confronting.

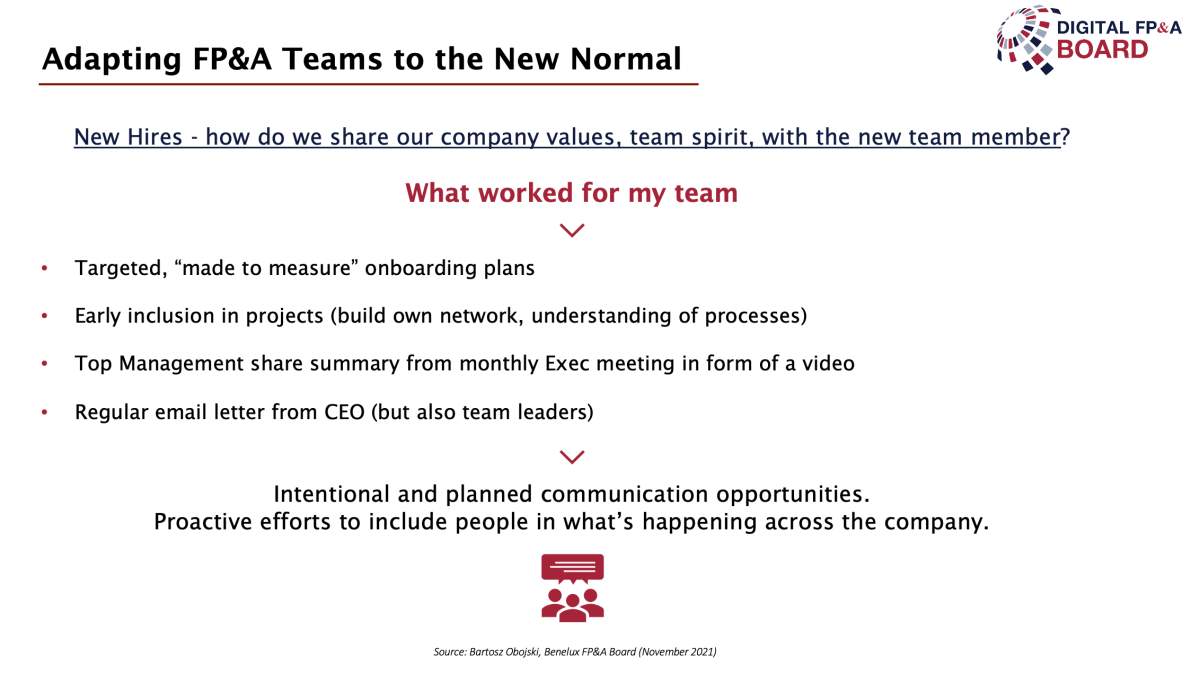

Bartosz Obojski, Director FP&A at Esko, spoke about the need to reskill and retrain employees on technology and systems. Time-consuming manual tasks that inhibit value-adding activities should also be eliminated. Additionally, special care is needed in onboarding new hires, to ensure we are sharing company values and team spirit with new team members. To help new hires build their networks and speed up their understanding of key processes, made-to-measure onboarding plans and intentional communication are helpful. Making proactive efforts to engage new hires early in new projects is also beneficial.

Figure 1

As Bartosz said: “The remote FP&A Manager has to focus more on workflow, internal process, communication and inclusion while getting the numbers right and on time!”

The Digitisation Journey And Implications For FP&A Teams

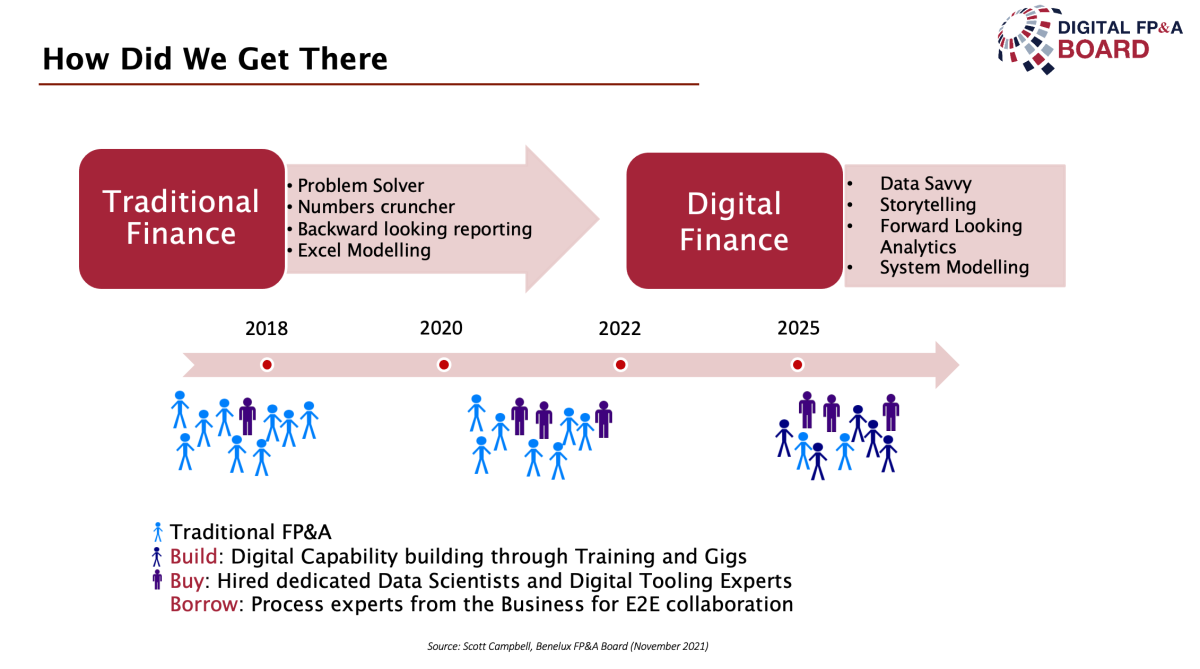

Finance was on a digitisation journey prior to COVID. But the last two years have seen an acceleration from a traditional finance model, to a digital organisation that is data-savvy and forward-looking, using systems to generate models and analytics.

Scott Campbell, Head of Digital COE at Phillips, described how his organisation used the “build, buy or borrow” model to enhance digital capabilities. His team onboarded data scientists and taught them business and finance skills, sometimes borrowing process experts to enable end-to-end (E2E) business collaboration. At Phillips, Scott is also leveraging a connected enterprise planning system. The aim is to develop digital driver-based planning and a digital dashboard to facilitate better storytelling.

Figure 2

The Role of Technology

The speakers agreed that the FP&A organisation of the future spends more time supporting business strategy with predictive insights and real-time insights. On the other hand, it spends less time on finance operations that can be automated to minimise manual intervention.

Iver van de Zand – VP Strategy & Solution Management, SAP – discussed how technology can help build winning FP&A teams. Due to its flexibility, most companies currently still use Excel for analysis. But modern technology can help focus on driving value with leading indicators.

Iver recommended using a single system that interacts with different planning entities (workforce planning, marketing planning, purchasing planning, operations planning, etc.), consolidates them, and drives forecasts from them. The system can then be leveraged to model “what if” scenarios, and used for predictive analysis that can deliver forecasts in a few hours, rather than a few weeks.

Conclusion

Mitigating uncertainty requires adopting technological advances, redesigning work processes, and rethinking the mix of skills required in FP&A teams. The discussion concluded that FP&A teams that leverage technology, invest in change management and support their members with training, reskilling and onboarding support will lead the transition to digital finance in the New Normal. A renewed focus on intentional communication, building trust and creating opportunities for team engagement will help ease the challenges of the hybrid work environment.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.