Even if last six years I have been specialized in Data management, I still follow (thanks...

Recently, I have encountered a lot of discussions within the finance (FP&A) professionals community about business partnering. The challenge in such discussions is to move from theoretical reasoning into practical execution. In this article, I would like to talk about one possible area where cooperation between FP&A and Data management professionals can deliver mutually beneficial results.

Recently, I have encountered a lot of discussions within the finance (FP&A) professionals community about business partnering. The challenge in such discussions is to move from theoretical reasoning into practical execution. In this article, I would like to talk about one possible area where cooperation between FP&A and Data management professionals can deliver mutually beneficial results.

This area combines two independent concepts from FP&A and Data Management: driver-based modeling and data lineage. Both concepts are rather new for both business functions and require a significant amount of resources and effort to be implemented in practice. Seeing the commonalities and combining the resources and approaches for implementing both concepts simultaneously is what business effectiveness and partnering are really about.

In this article, we will investigate:

- the origin of the common nature of the concepts of driver-based modelling and data lineage

- the essence of each concept

- the steps FP&A and data management professionals could take to create a mutually beneficial partnership.

A similar value proposition of data management and FP&A in the business cycle is the foundation for pragmatic business partnering.

You can discover the common nature of driver-based modelling and data lineage by analysing the business lifecycle and value propositions of FP&A and Data management.

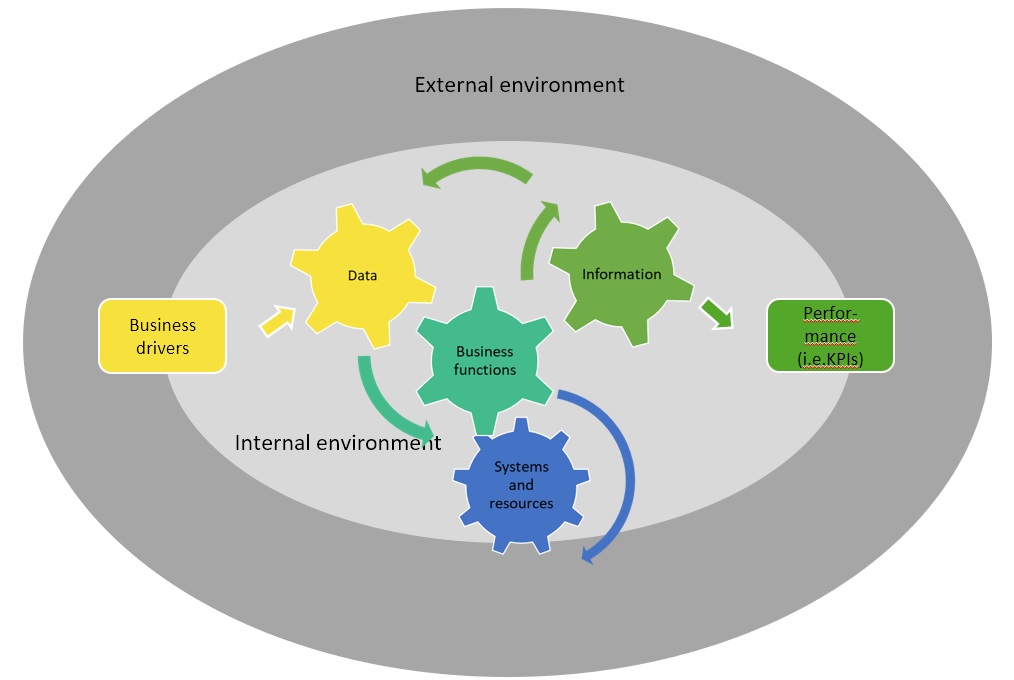

Figure 1. Finance and Data management value propositions in the business cycle

The strategic goal of each business is survival in the long term. And in order to ‘survive’, a business needs to ensure a steady profit and proper asset management, data being one of these assets. The management of the business directly influences the realisation of the key goal, which in its turn, relies fully on the decisions that are being made by the top management of the company. To make decisions, the ones who make those decisions need to get appropriate information, which is very often expressed in performance indicators and/or KPIs. And in order to produce such information, first, you need to ensure the delivery of appropriate data, key business drivers in particular. Each business function, which is a combination of business processes and people involved, participates in data processing and delivery in its own way. Technology and resources enable business functions to process and analyse data.

The key value proposition of both data management and FP&A is support and improvement of decision-making on all management levels.

The ways to deliver this value proposition can differ. Data management is accountable for the optimisation of the data & information value chain. A data & information value chain is a set of business capabilities that enables the transformation of data into meaningful information required for decision-making on different management levels. Data lineage is the documentation of the data & information value chain.

FP&A is responsible for providing insight into information and advice on possible decisions to managers at different managerial levels. FP&A does it by applying relevant business planning and analysis techniques. Driver-based modelling is one of such techniques. It provides insights into dependencies between the key business drivers and performance indicators and forms the basis for effective financial planning and forecasting.

To be able to deliver the value proposition, data management and FP&A should form a partnership to be able to apply modern techniques, of which driver-based modelling and data lineage are good examples. Let’s take a look at the essence of these two techniques and find interdependencies.

Driver-based modelling

Let’s quickly recap the essence of driver-based modelling. Driver-based modelling allows you to link business drivers with financial results. Consequently, you use financial results to measure your company’s success. In this context, ‘modelling’ means the identification of relationships between operational business drivers and anticipated financial outcomes. These relationships are expressed in mathematical formulas. A set of drivers, financial outcomes and relationships between them are what is called ‘a driver-based model’.

Thus, a driver-based model is a simplified mathematical representation of relationships between operational business drivers and consequently generated business outcomes expressed in financial results and KPIs.

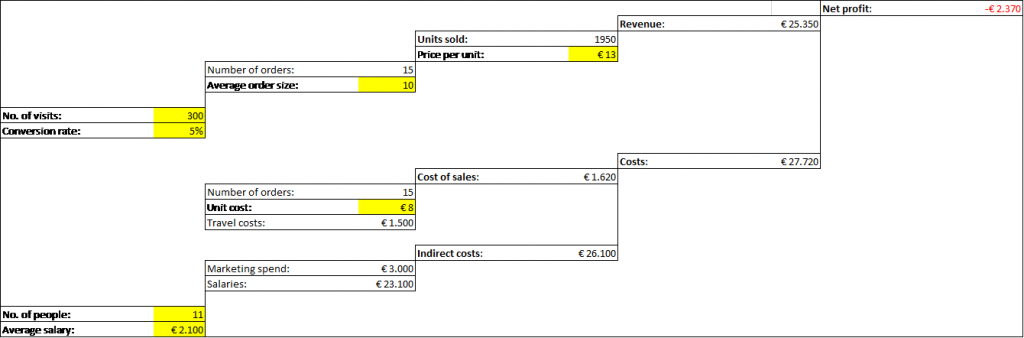

A simplified example of the driver-based model you can see in Figure 2:

Figure 2. A simplified driver-based model example.

The elements marked yellow are basic business drivers. Throughout the chain, you see which business drivers have an influence on Net profit, which is one of the key company’s KPIs.

Data lineage

Data lineage is documentation which describes how data is being transformed into information on its way from its origin to its final destination. You describe this transformation path by linking business processes, applications, and data elements. You need to know data lineage in order to:

- comply with regulations

- enable business changes

- improve the quality of data

- meet supervisor and audit requirements.

If you take another look at Figure 2, the business drivers (marked yellow) represent data elements that have been processed into meaningful information. In our case Revenue, Cost of sales and Net Profit represent the information produced as a result of data transformation.

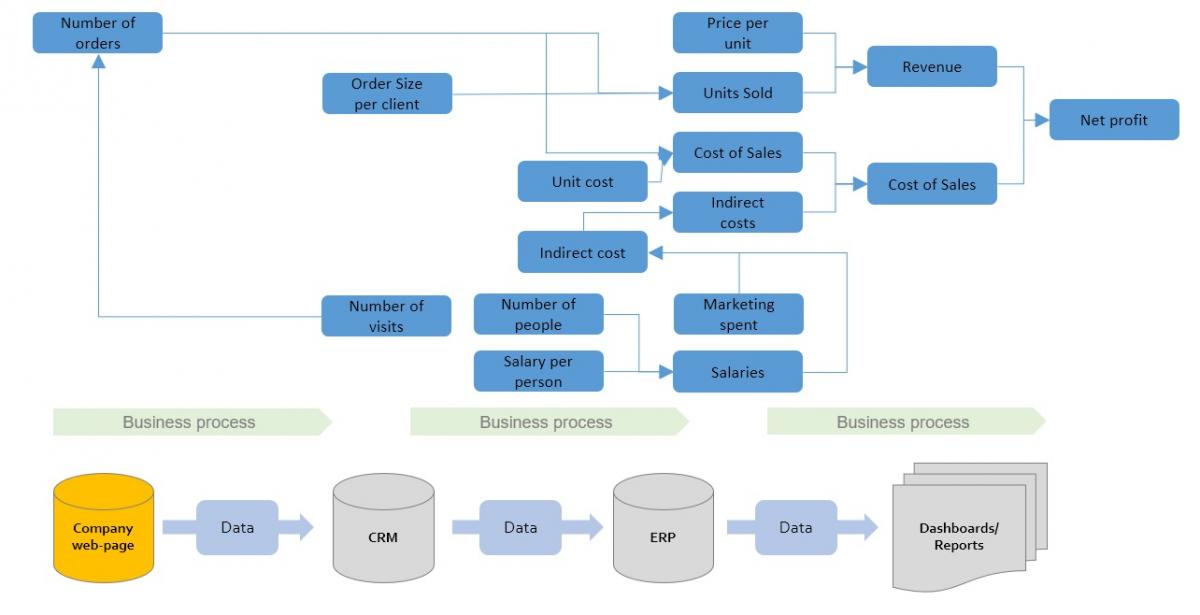

If I built data lineage for the same data elements as in Figure 2, it would look something like this:

Figure 3. A simplified example of data lineage.

Those who would like to know more about data lineage, you can consult my recent ‘Data Lineage 101’ blog series.

If you compare Figures 2 and 3, you will see a lot of similarities between the representations of driver-based modelling and data lineage. So, this is the best evidence that coordinated activities of finance and data management professionals will deliver mutual benefits for both functions and for the business as a whole. In the beginning, I promised to show you how to take theory and convert it into practice. So here are a few practical tips for actions.

Tips for actions

1. Start the initiative: who is in charge?

It is clear that both finance (FP&A) and data management functions can profit from the initiative. But who has more power? Let’s be honest. Each company has finance as a business function. Not all companies have a formal data management function. Not having a formal data management function does not mean that the company does not perform data management-related activities. But in any case, it would be more logical or finance to take on the sponsor role in such an initiative, considering its decision-making power within the company.

2. Scope the initiative

First, you should find the most critical performance indicators (KPIs) that are used in the decision-making process. For those critical elements, you will investigate the key business drivers by documenting data lineage. More on the subject of critical data elements you can read in my article ‘Scope your data management initiative by using Critical Data Elements’.

3. Specify the depth and length of data lineage.

The whole scope of data lineage starts with the original data sources and ends at the point of final usage. In large companies, especially with a lot of subsidiaries, such chains are rather long and complicated. That is why very often, a company starts with a limited ‘length’ of data lineage, for example, at some point of data aggregation. More on the subject you can find in my article ‘Data lineage 105: Implementation guidelines’.

4. Choose the method and tooling to document the driver-based model and data lineage.

One of the prerequisites for creating data lineage is to have a formal data management framework in place. It means that finance can play a very important sponsor role in getting data in control by setting up such a framework.

The rest simply questions of finding feasible and ‘fit for purpose’ resources and tooling to document driver-based models and data lineage.

The whole company will benefit from it.

The article was first published on the Data Crossroads website.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.