In this article, the author covers the importance of establishing a Reporting Factory within an organisation...

Introduction

The marketing industry is a highly competitive and dynamic field where companies are constantly vying for consumer attention and loyalty. As a result, marketing spending is expected to exceed $1.7 trillion1 in 2024, with companies allocating from 6% to 11% of their revenue to marketing efforts. While numerous solutions ranging from campaign planning to audience tracking and generation to placement exist to aid businesses in deploying marketing spend effectively, the financial planning and reporting aspects often receive less attention. This gap can be attributed to several factors that make financial management of marketing expenditure particularly challenging. Finance and Marketing teams approach this from different perspectives, and it results in varying details in their processes, which often hinder seamless collaboration.

Problem

One significant challenge at an enterprise is that marketing expense data is often spread across multiple systems, which makes gathering and consolidating data difficult for reporting purposes. Additionally, the data may not always have clear lineage or consistent granularity, further complicating our ability to analyse and report marketing expenses accurately.

The planning processes are still largely manual and inefficient, requiring coordination among multiple marketers worldwide using spreadsheets. This process not only lacks efficiency but also fails to provide the necessary insights, controls, and reporting capabilities. Marketers are often unaware of the actual expenses they incur, while finance struggles to attribute specific expenses to particular activities. As a result, answering questions such as quarterly or monthly spending on growth initiatives, Purchase Order (PO) attribution to campaigns or activities, building bottom-up marketing expense plans, and budget transfers between marketing areas is challenging.

In my previous role as a Financial Planning and Analysis (FP&A) professional at a prominent technology company in the San Francisco Bay Area, I was responsible for enhancing the efficiency, transparency, and strategic alignment of the marketing budget. Prior to this, our organisation had mixed results in planning, forecasting, and tracking marketing dollars effectively.

While this issue primarily concerns marketing expenses, it is best addressed as a financial planning process. This is because we are planning for and reporting on expenses and the financial process is better placed to maintain clear data lineage. We can streamline the processes of planning, reporting, and analysis of marketing expenses by leveraging financial planning tools and methodologies. In turn, it will enable both marketers and finance professionals to make informed decisions and drive better marketing outcomes.

Solution Brief

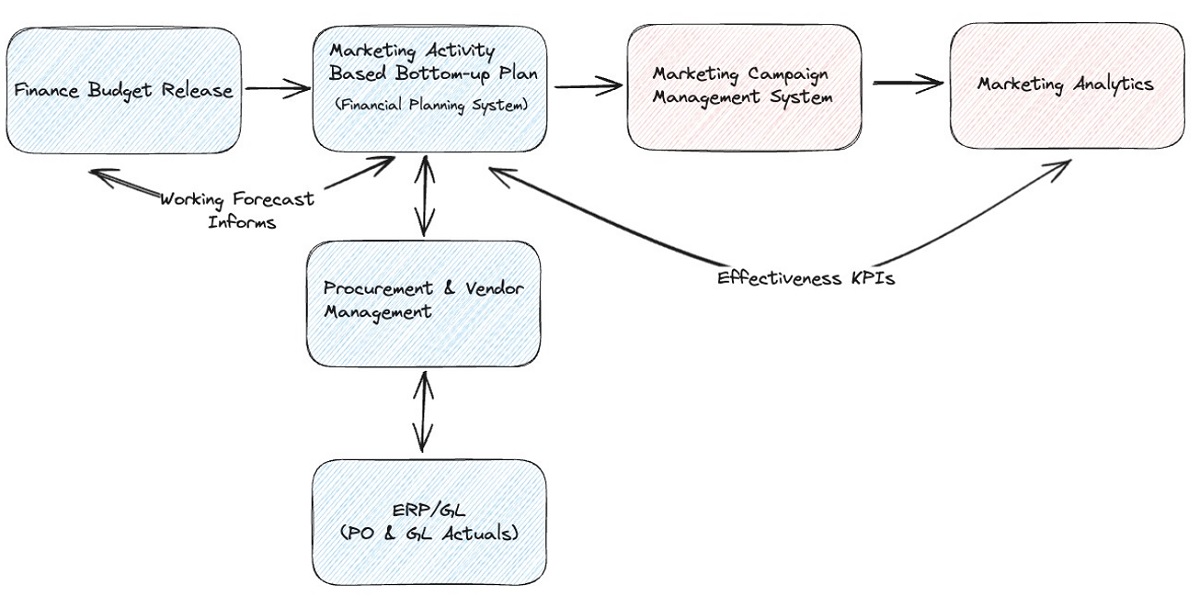

The solution we designed and implemented is what we call a closed-loop approach to marketing expense planning. The primary idea of our solution is to originate marketing spend in the financial planning system. Finance released the budget, which was typically an adjustment over the previous cycle’s budget numbers. Any incremental or large budget requests required executive approval, which was also captured in the planning system.

Marketers built their detailed activity plans in the financial planning system, which enabled them to link their activities with the company’s investment priorities. These priorities were decided in partnership with finance, and keeping them in a financial system enabled governance. The bottom-up plan with the various activity details was used to initiate the purchase requisition process in the procurement system. POs were generated and brought back to the planning system, and the activity records were updated with the respective PO numbers. Activity data was also sent to the marketing campaign execution system. This created the closed-loop connection between planning, execution and actual expenses.

Detailed Solution Steps

For the sake of a digestible explanation, we will assume these steps are parts of an annual planning cycle. This approach can be extended to more frequent planning cycles.

1. Finance Budget Release

A new planning cycle typically starts when finance teams release the initial targets. This exercise provides guidance to various functions within the organisation regarding planning with a target in mind. In marketing expense planning, this step remains important and provides critical guidance upfront to the marketing teams on their next year’s targets. In a mature enterprise setup, the budget is released by the cost centre or at least by marketing functions, such as Social Media, Branding, etc.

2. Bottom-up Marketing Plan

Marketing teams build their bottom-up plan in the financial planning system with activity details such as partner events, branding collateral creation, video production, etc. The granularity of activities in the plan plays an important role in how successful the close-loop tracking could be. If planning is done at a higher level, it will not likely map easily to a specific vendor or a PO. However, if it is done too granularly, the downside could be additional work upfront for limited insights.

3. Purchase Requisition and Purchase Order Creation

Once the activities have been planned, the line items could then be used to automatically start the purchase requisition process through an integration with the procurement application. A unique identifier generated in the planning system is propagated to the procurement and expense management system. It is a critical step in establishing a closed-loop solution. Once an ID generated by the system is propagated, it enables an automated connection between planned marketing activity and PO and, eventually, incurs actual expense.

4. Initiating Marketing Campaign Creation

This step enables the planning execution. The planning data can be fed to the marketing execution stack. This step can further automate and bring planning through execution transparency in the marketing budget process.

5. Getting the actuals from ERP/GL

Given a connection between the planning activities, purchase requisition process, and PO creation, we can easily get the expense actuals from the General Ledger at activity level granularity. This enables insightful variance analysis and also informs the in-quarter deployment of the spare budget.

6. Effectiveness Key Performance Indicators (KPIs)

Given the connected approach between planning and execution, a marketing activity level effectiveness metric could also be used to evaluate whether a specific activity needs to be reevaluated for execution in subsequent periods. At the very least, it can inform the marketing expense ROI conversations much better.

Figure 1: A high-level conceptual overview of how the Closed Marketing Expense Planning can work

Benefits

We achieved a 25% increase in Marketing Qualified Leads (MQLs) by implementing this process. A fully connected dataset with actionable insights helped us achieve these results.

The newly implemented solution was very effective both for marketing finance and marketing operations. We could answer business questions at the initiative, campaign, and purchase order levels. We also tracked the budget transfers in the planning system for a clear lineage of budget movements. The reporting and insights we were able to generate through this led to a more effective use of the marketing budget. It enabled finance and marketing teams to partner closely in throttling the marketing expense based on a combination of our detailed marketing activity commitments and finance-reported actuals.

As part of this, we also adopted a working forecast methodology. This helped us complete the quarterly and annual planning/forecasting with less effort, leading to a much better process overall.

Driving Insights from Enriched Data

This end-to-end connected process yields valuable data that could be further utilised for deeper insights, getting which isn’t easy with siloed processes and tooling. With the enriched data produced as part of this planning process, we can do:

Improved Marketing Analytics

Data with an end-to-end lineage from planned activity to execution can be used to derive insights into the effectiveness of various marketing activities. Typically, it is difficult to tie the financial data with the marketing activity execution; however, the close-loop approach alleviates this problem with fully connected data. Calculating Customer Acquisition Cost (CAC) and overall marketing ROI becomes easier.

More Automated and Insights-Driven Planning Process

Connected data from a closed-loop approach can substantially improve expense planning cycles. The insights can help us identify the most effective marketing activities and ensure they are included in future marketing budgets. This can streamline quarterly and annual forecasting processes, making them less manual and more data-driven.

Conclusion

In conclusion, the implementation of a closed-loop marketing expense planning process can significantly benefit organisations and allow them to bridge the gap between finance and marketing teams. This approach not only streamlines the planning and budgeting process but also provides valuable insights into marketing ROI, enabling data-driven decision-making and optimisation of marketing spend. By fostering collaboration, transparency, and accountability, businesses can unlock the full potential of their marketing investments and achieve sustainable growth in today's competitive landscape.

Reference:

- Statista. "Advertising and Marketing Spending Worldwide from 2010 to 2027." Accessed October 23, 2024. https://www.statista.com/statistics/1446002/advertising-marketing-spending-worldwide/

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.