Recently, I have encountered a lot of discussions within the finance (FP&A) professionals community about business...

For most marketing managers doing the annual budget is a bore or waste of time. With most transactional services outsourced and financial management centralised in the home country of the company, local financials spend more and more time with planning, budgeting and forecasting. It’s the opportunity for financials to start business partnering with marketing managers and senior management. The following two tricks have been tested and proven valuable for both the financials, marketeers and executive management, when business partnering got introduced.

For most marketing managers doing the annual budget is a bore or waste of time. With most transactional services outsourced and financial management centralised in the home country of the company, local financials spend more and more time with planning, budgeting and forecasting. It’s the opportunity for financials to start business partnering with marketing managers and senior management. The following two tricks have been tested and proven valuable for both the financials, marketeers and executive management, when business partnering got introduced.

Trick 1: Understanding strategic choice

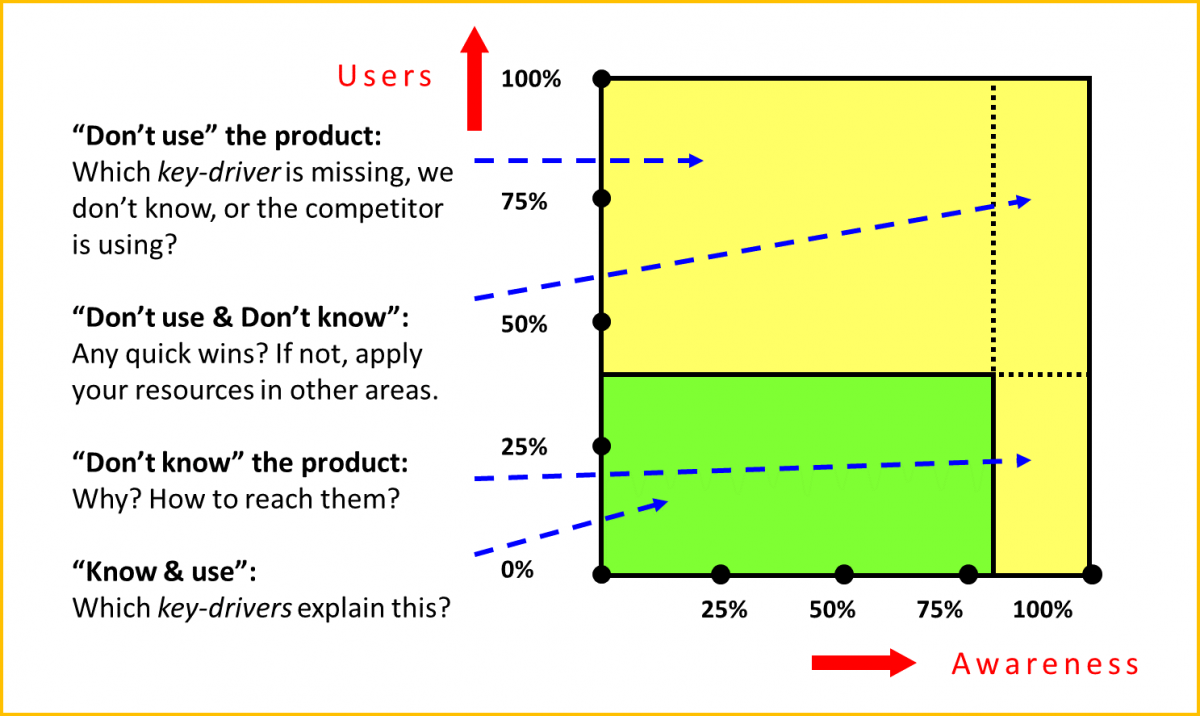

As a financial you can always ask the ‘difficult’ questions. Sitting down with the marketing manager is often seen as a welcomed gesture. Using the follow graph will give the financial great input on the market and what the budget is expected to do.

This graph helps explore the strategic choice of the marketing manager.

- How many of the users are buying your product to solve their problem, a product they know exists? E.g. presently around 40% ‘market penetration’.

- How many people know your product exists for their problem? E.g. presently around 80% ‘market development’.

Now the financial can start to discuss and understand the chosen strategic direction, the desired budget and the expected sales. With knowledge on what drives sales and where the marketing manager plans to invest, the next step can be made.

Trick 2: Understanding spending levels

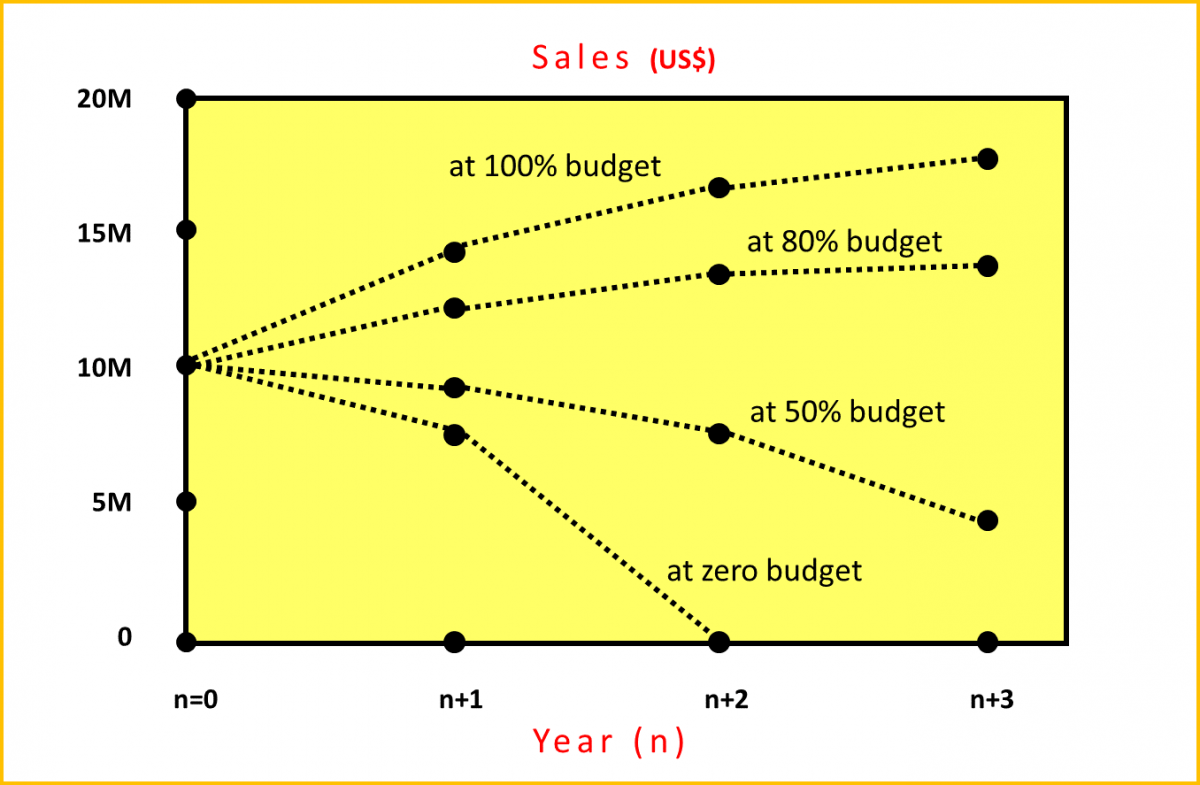

The financial must also dig deeper into this budget, to understand what the company is getting for each dollar spend, the ROI. Depending on the industry, financial projections (sales and budget) for the coming 3 years, for each product, would provide enough information. In addition, within the corporate environment everybody knows there will be spending cuts, somewhere during the year. It is good sportsmanship when the financial can also prepare the marketing manager (well) in advance.

- To understand the full budget, start by asking the sales outcome at 50%, 80% and 100% of the requested budget, for the coming 3 years. The marketing manager will start to prioritise the spending plan accordingly and think about the effectiveness of each planned action and investment for the coming years.

As a finance business partner, you learned about the effectiveness of the planned marketing efforts and at the same time prepared the marketing manager for ‘possible’ spending cuts.

- Next, discuss with the marketing manager what would happen to the sales, if there is no budget at all: zero spend. Perhaps sales will stop immediately, perhaps it might take years for sales to drop (think e.g. patents related products or subscription-based business models).

The financials will be able to understand what the first 50% of the budget really is worth in sales, and how much is based on different forms of ‘loyalty’.

Do this for each product in the portfolio and the financial can identify where the company will achieve its highest ROI. With disruption happening in every segment of the economy, the financial just also helped prepare the CEO, in case e.g. a product needs to be dropped, to increase business performance.

These two tricks make budget talks a little more fun for the marketing managers, while obtaining the needed information for today’s finance business partner to support business planning and decision making. It also generates a lively debate, when senior management gets involved. Often additional questioning around ‘ruling’ marketing assumptions is triggered, giving the financial even further insights into the (business) drivers behind the sales forecast. Investment in business intelligence is the normal path in developing the finance business partnership.

The article was first published in Unit 4 Prevero Blog

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.