In this video, we learn how A.P. Moller – Maersk Group made the transition from traditional...

Unstable times are putting pressure on our planning process: we need to re-forecast more often to make timely and informed decisions, while at the same time we need to expand our forecasting horizons and look ahead. How can we achieve this?

At the Digital UK & Ireland FP&A Board: How to Master Rolling Forecasts we considered Rolling Forecasts as a potential solution.

This article provides an overview of topics and cases presented and discussed by experts, as well as the results of interactive surveys.

From Rolling Forecasts to Long-Term Strategic Planning

Sonia Moscatelli-Diwane Finance Director at eBay Global Advertising Finance, shared with us how we can apply the principles of Rolling Forecasts to a longer term of three to five years.

Traditional financial cycles are under pressure for several reasons:

Volatile times require adjustment

The traditional budget cycle is getting longer and longer

Less emphasis on forecasting and more on informed decision making

Increased focus on long-term strategic planning

Rolling Forecasts can address all these issues, but the road to Rolling Forecasts can be challenging. In complex, global and matrix organisations alignment across the finance function and with business partners is critical to turning to Rolling Forecasts.

Annual Investments cycles present another challenge, as many companies are dependent on annual funding. Nevertheless, while moving you away from annual cycles, Rolling Forecasts help you be better prepared for investment discussions.

Finance Resourcing becomes a problem as well. With constant pressure on agility and faster turnaround it is challenging to find the time and resources to build robust Rolling Forecasts.

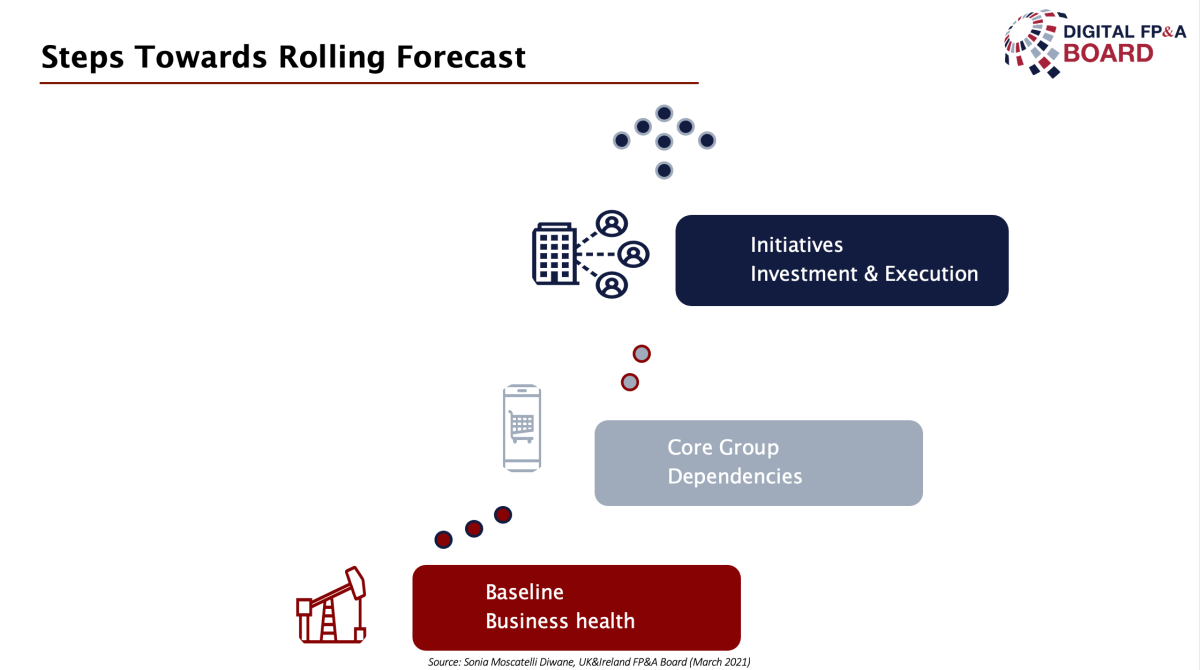

There are three key steps in building Rolling Forecasts in Ebay, with most of the time and resources being devoted to the investments and initiatives layer, as it is the most actionable.

Figure 1

Even though the shift to Rolling Forecasts requires significant time and resource investments at the beginning, there are visible efficiencies down the road. Moving to Rolling Forecast should address the business needs and become a dynamic window into the future.

How do we forecast in organisations?

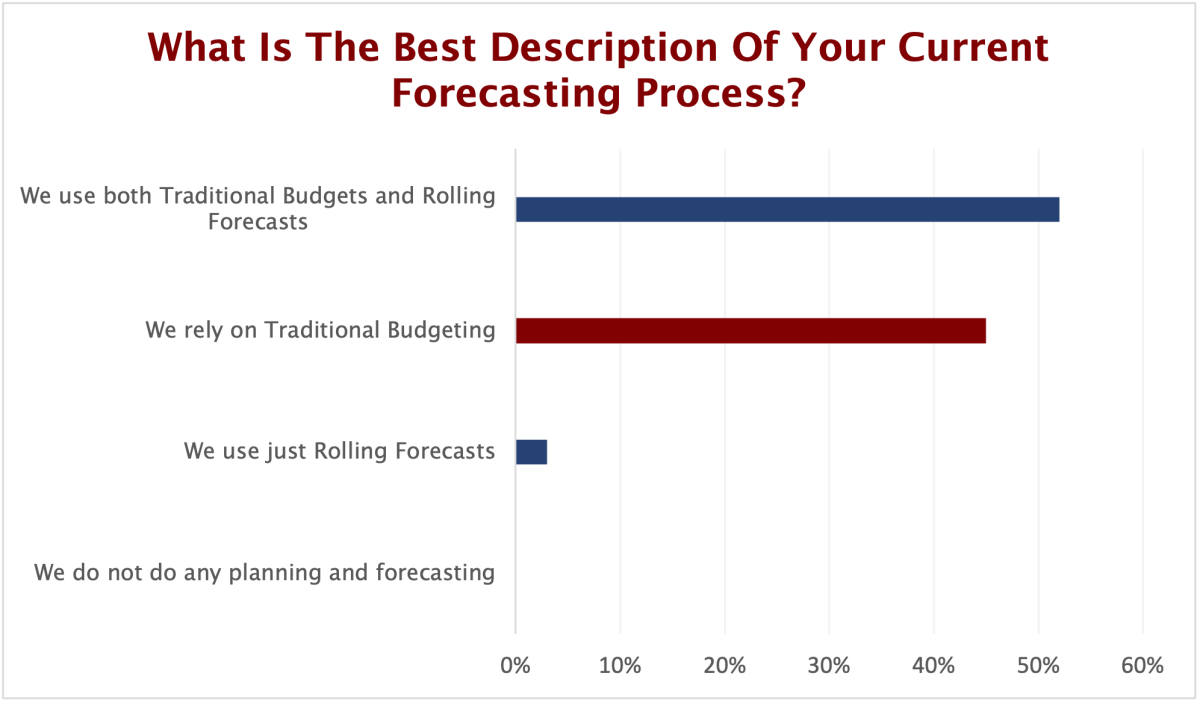

During the webinar, participants from the FP&A industry took part in the survey and described their current forecasting process. The majority of the organisations (52%) are using Traditional Budgeting and Rolling Forecasts in parallel, while another 45% of participants rely solely on Traditional Budgeting.

Figure 2

From Traditional Budgeting to Rolling Forecast

Mehdi Bennani, Director Corporate FP&A at Booking.com, walked us through the process of transition from Traditional Budgeting to Rolling Forecasts.

There are several clear shortcomings of Traditional Budgets:

An attempt to achieve several incompatible goals in one process: forecasting, target setting and investment allocation.

Another inherent shortcoming is a blind spot where you have no visibility of next year's forecast/numbers until you go through the budget cycle.

Slow adaptation to market conditions: if there is a significant shift in market conditions it becomes very hard to do a new iteration of the budget.

Lastly, missing out on an opportunity by not having a solid structure on how to identify, prioritise and allocate investments

How to ensure a smooth transition?

Start with identifying the goals and communicating to relevant stakeholders and applying change management tools throughout the change program.

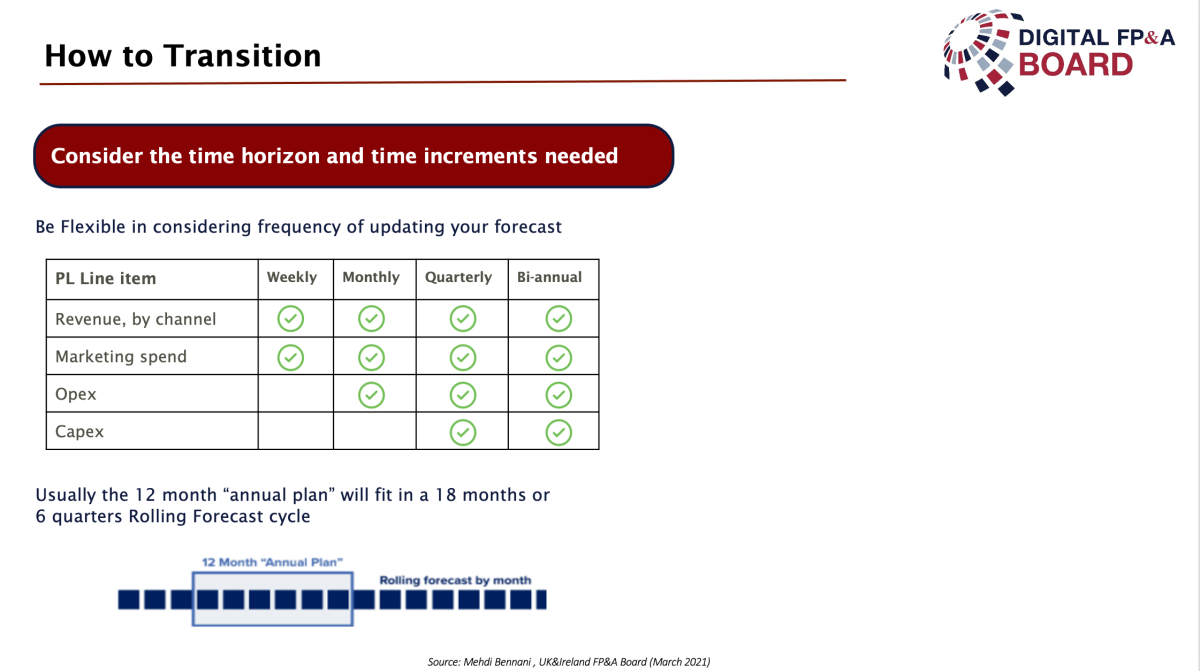

Secondly, consider the time horizon and time increment needed.

Thirdly, deploy the appropriate technologies and processes.

Figure 3

The only way for companies to navigate forward and still achieve existing goals — including simple survival — would be exploring multiple potential changes and building various scenarios to prepare a range of decision-making paths through newly uncertain terrain. As Mehdi concluded: An annual plan is a map. A Rolling Forecast is a GPS.

The Role of Technology in Rolling Forecasts

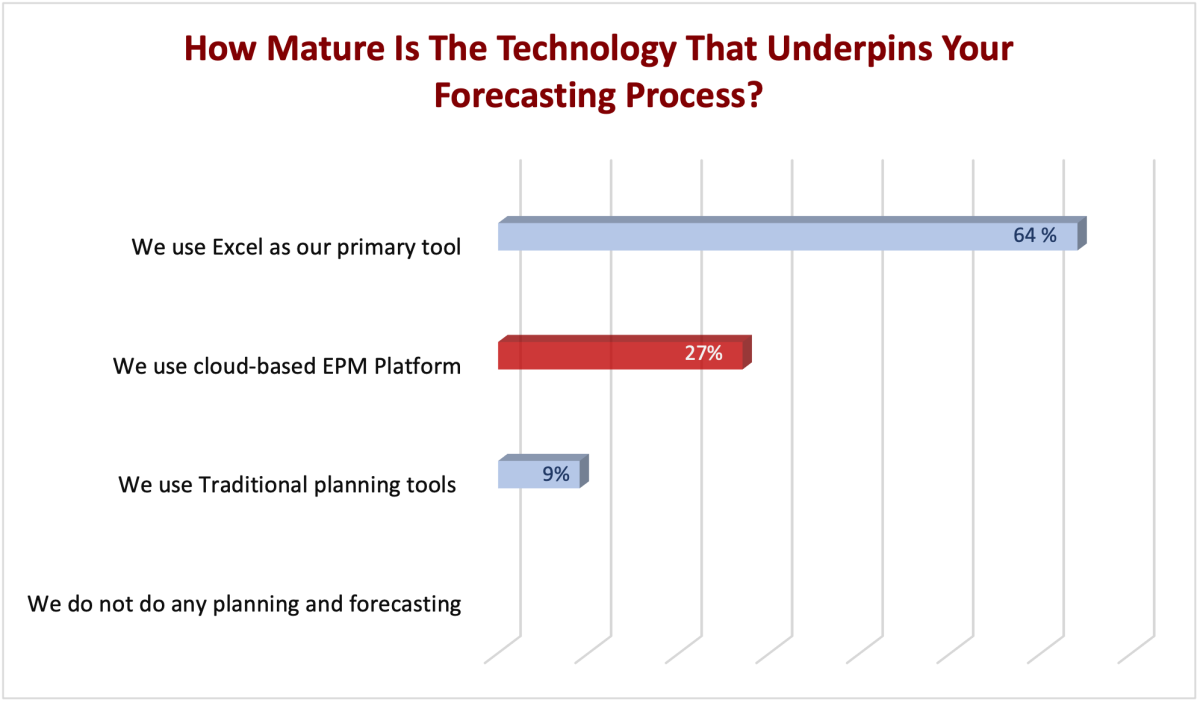

The absolute majority of the survey participants (64%) are using Excel as a primary tool for their forecasting processes. Our last speaker of the event addressed this issue in his presentation.

Figure 4

Paul Houghton Regional Director UK at Jedox, has explained to us how we can eliminate too many spreadsheets, and inconsistent data, and resolve missing workflows

FP&A Integration is not only the integration of systems, processes and departments but also the following:

Facilitating cross-departmental, cross-organisational collaboration

Transitioning the role of finance from area specialists to business advisors

Paul explained how can we make better decisions with more agility and speed using Rolling Forecasts. The transition from traditional budgeting to Rolling Forecasts is usually accompanied by several other changes:

From Annual Planning / Quarterly Forecasting to Continuous, Real-time Planning & Forecasting

From High-level Financial Plan to Granular Operational Models & Solutions

From Data Siloes & Disparate Systems to Platform for Strategic, Financial & Operational Planning

From Top-down/Bottom-up to Driver-based Simulations, Scenario Planning

From Dependent on Expertise of Planners to Augmented with Predictive Forecasting & ML

Spreadsheets and outdated systems cannot keep up with the rate of global change. Modern Enterprise Performance Management (EPM) systems enable teams of different sizes to collaborate and build Rolling Forecasts effectively.

Conclusions

The role of FP&A professionals is more important these days than ever. They should be catalysts to change towards agile planning, more informed decisions and actionable insights. Start your agile planning journey with Rolling Forecasts. And start it today.

We would like to thank our global sponsor Jedox for their great support with this Digital FP&A Board.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.