When I am asked to explain why Cash is so important, I use the analogy of...

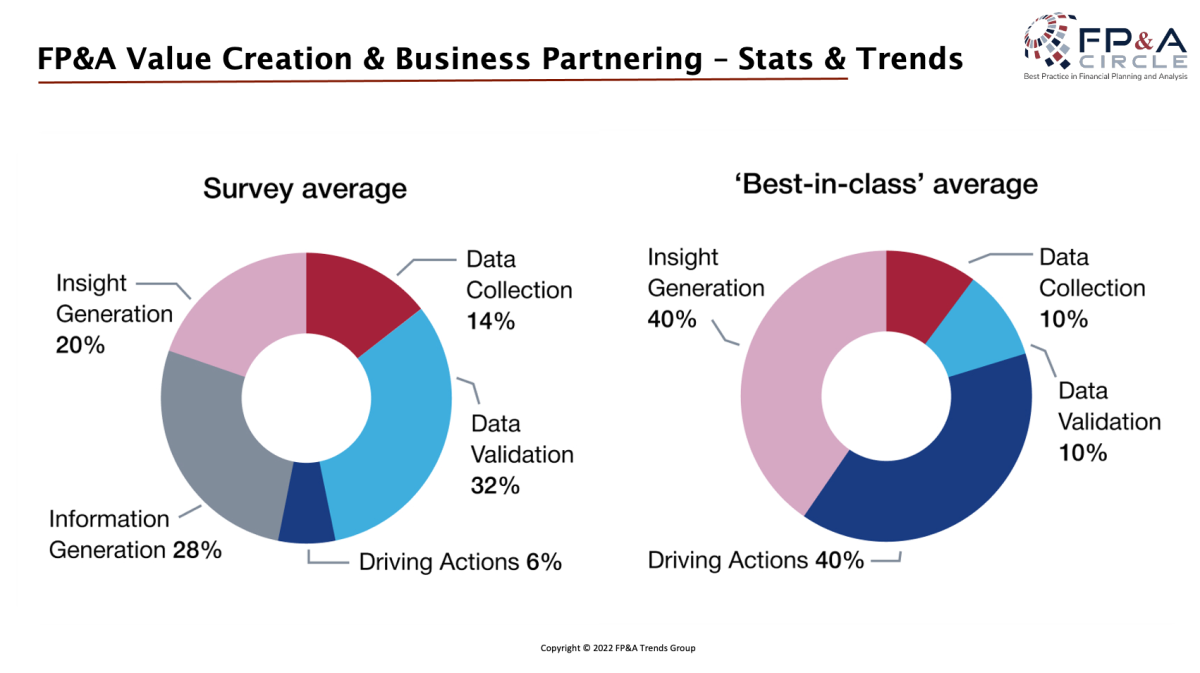

One stark statistic, year in year out, from FP&A Trends Survey shows very little time is spent by FP&A on Driving Actions! We are, in fact, spending only 16% of our time adding value. 84% of our time is spent in data, information and insight generation.

Figure 1

Why so much time is being spent on non-value add activities? How can we overcome this problem? What is the role of the modern FP&A Business Partner in Creating Value for the organisation?

The Digital UK & Ireland FP&A Circle met on the 25th of May to explore how FP&A can “Create Value through better Business Partnering”.

What does the model look like and what is the role of FP&A Business Partnering?

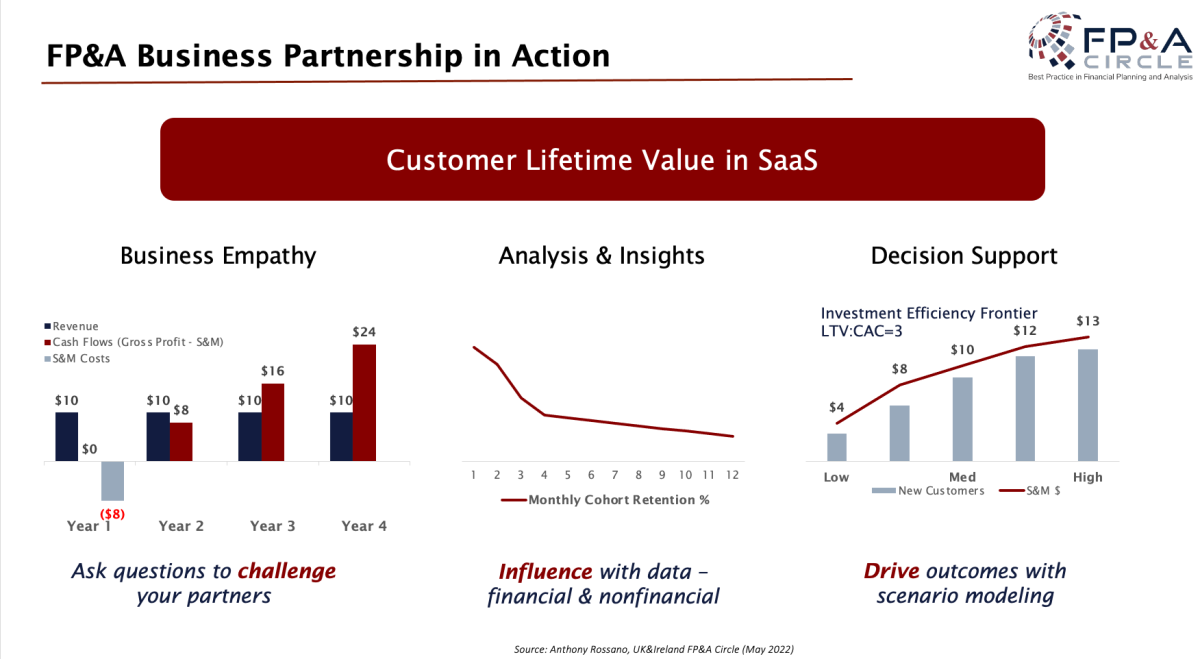

For Anthony Rossano, senior Director FP&A and Indeed, FP&A Business Partners are the co-pilots of the business, and as co-pilots, we have an indispensable role in manning the cockpit alongside the leaders. We are there to be strategic influencers. The way we create value is through three Value Creation pillars:

Business Empathy – Aside from being an Intelligence hub, we need to feel the problems of our Business Partners and strive to solve them. Speaking their language and being part of their team is key. This is how we get a seat at the table.

Analysis & Insights – We are curious thinkers, and we are not there to only provide reports. We are there not just to tell the news but create the news by pulling out key trends and ultimately influencing key decisions that the business is making. We do it best by harnessing technological advances.

Decision Support – We are model builders and, through our understanding, build various different scenarios to guide the business through to find the optimal outcome that creates maximum value.

It is also important to understand FP&A Business Partnering evolution from control, serve and monitor to Challenge, Influence and Drive change.

Finally, Anthony shared an example of how this all works in his industry, as seen below:

Figure 2

Value Creation - Business Focused Finance

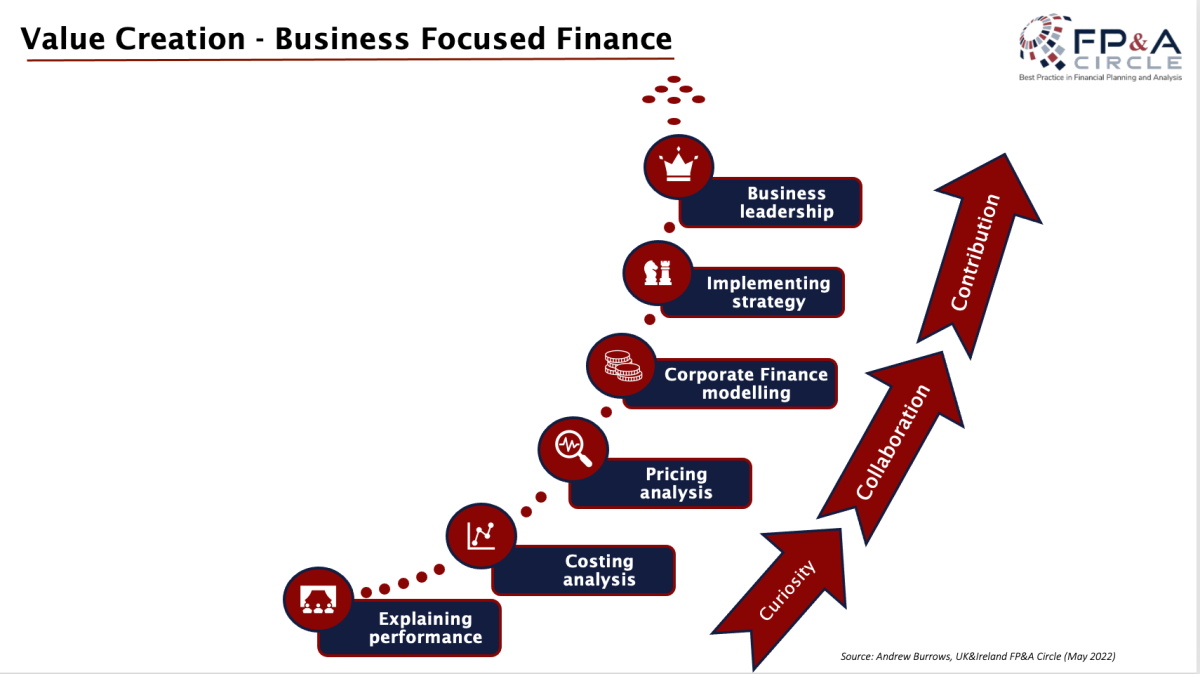

Andrew Burrows, a founder of Supercharged Finance, talks about Value Creation through Business Focused Finance.

The key pillars of focused finance are:

Curiosity – learning about the business/ wanting to know more / thinking outside of the box

Collaboration – see people within the business as people working for the same common goals, so share what you are working on and enlist the help of whoever you need

Contribution – help the business wherever and whenever you can.

He took us through an example of his own experience that showed how being curious, understanding the business and working collaboratively with all business units helped create value and make better decisions. In his case, that also bumped him up his career ladder to Finance Director.

Below is a good schematic describing the example used that can also help FP&A Business Partners create Value.

Figure 3

Time to Make a Difference

Gemma Davie, associate director FP&A at Comparethemarket.com, shared with us how FP&A can make a difference through her five top tips in Value creation.

Figure 4

Time Study

How well do we understand where we spend our time every month? How often do we carry out an audit? To know if we are adding value or not this is a key activity that should be carried out.

Gemma did a trial over a 4-week period, and it revealed that they were spending only 15% of their time, less than 1 day a week, on Business Partnering and the rest of the time on non-value add activities.

Challenge the “Churn”

With the data from the trial, challenge yourself and the business as to where we should be spending our time. Which of the activities we do are value-adding and which are not?

In Gemma’s case, they realised they are spending 25% of their time on weekly forecasting. How much value does weekly forecasting bring to the business? What if they moved to fortnightly? Would the accuracy drop?

Coupled with data-driven analytics (time study), these conversations and changes are much easier to be had.

Rag Review

Carry out a Rag Review of your reports. The aim here is to get our comments more meaningful and value-adding, so they are really telling the story. To do that on the commentary, highlight anything in RED that is not adding value (already there in chart & tables, the WHAT). Highlight in AMBER, anything that explains the WHY. Finally, GREEN for anything that is “So What / Now What”, your actionable insights. So, if half of your page is red, then that’s not adding any value, remove it! This also ensures that you have covered the WHY and Now WHAT.

Prioritise Partnering

Partner preparation time is very important. Put the time in the diary every day, and it could as little as 15 mins to ensure you are prepared for when you have a call with your partner, what you want to get out of the call, a decision, an action, timelines etc.

Sharpen the Saw

Our skills seem to have a lifespan of around five years. We need to stay fresh and relevant at all times. Take weekly actions to do some training. Podcasts are great to listen to when you are running or walking your dog.

How Technology enhance FP&A Business Partnering and Value Creation

Our last speaker, Steven Lockwood, VP UKI at Vena Solutions, stressed a quote from Bill Gates “The advance of technology is based on making it fit, so you don’t really even notice it, its part of everyday life”.

Figure 5

Steven highlighted we need to take micro-steps to start for finance to lead as a conduit and a counsellor, facilitating discussions, and gaining buy-in to the process from all parties as it will ensure a solid foundation for ongoing Business Partnering initiatives.

And finally, use a technology tool that all business functions are comfortable with. Vital that the tool is a facilitator, not the Police or the problem!

Summary

Key conclusions from our discussion on Value Creation and the role of FP&A Business Partnering are as follows:

Create value by Challenging and educating your Business Partner

Influence with data, insights, great storytelling and creating the news

Collaborate / collaborate / collaborate

Help the business in any shape or form where you can help

Challenge the churn backed by analytics to move away from non-value add activities

Technology should be a facilitator, easy to use and fit seamlessly, not the police or the problem

Finance should lead as a conduit and counsellor always facilitating.

We would like to thank our global sponsor, Vena Solutions, for their great support with this Digital FP&A Circle.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.