Imagine you’re a train dispatcher tasked with making hundreds of trains run smoothly every day. They...

‘If I had an hour to solve a problem and my life depended on the solution, I would spend the first 55 minutes determining the proper question to ask, for once I know the proper question, I could solve the problem in less than five minutes’, said Albert Einstein.

‘If I had an hour to solve a problem and my life depended on the solution, I would spend the first 55 minutes determining the proper question to ask, for once I know the proper question, I could solve the problem in less than five minutes’, said Albert Einstein.

The quote expresses the current state of the things with big data, data science and their application for business planning and finance.

Let’s spend our ‘55 minutes’ briefly diving into the new developments and trends around data and show a new perspective on the usage of big data, data science, and predictive analytics.

This article will also look into how these new developments might improve your business planning operations.

What is big data and data science?

Nowadays everybody is talking about big data and data science, and very often, different people have different understanding of these terms. So, let’s briefly align different perspectives on these subjects.

‘Big data’ is exactly what it sounds like: a big amount of data. There are different sources for big data: traditional and new ones:

By ‘traditional’ we mean sources for external data (i.e. on currency rates) and internal data from any systems within your company like ERP, payment and customer applications, business planning software, etc. Traditional data is usually associated with databases, so it is structured in one or other way.

‘New’ sources are websites, social networks data, sensor data. The biggest challenge with the new generation of data is that it is unstructured. You can hardly put it into traditional databases. New data also comes in larger volumes compared to traditional ones.

So, we have a huge challenge to process a large amount of unstructured data and then combine it with the traditional one. For example, you need not only information about the product preferences of your clients, but you need to link the findings with your product information and estimate the sales forecast for those products as well.

Fortunately, data science and new technologies can come to the rescue in our battle against these challenges.

Data science is a ...

means to extract insights from data and discover relationships among different data types.

combination of scientific and statistical methods, algorithms and supporting technology. [1]

Artificial intelligence and machine learning are subdivisions of data science. Our main interest is to focus on benefits that big data and data science can bring to business planning and the main areas of its applications.

Data science offers new opportunities for business planning

A lot of companies are talking about the potential of data science, but only few have started experimenting on it. And only a small percentage of these few companies has put the solutions into production and daily operations.

These experiments cover only several separate areas of business operations. Here are some examples that relate directly to business planning:

Investigation of growth potential regarding new products, new market segments, increased revenues. I have seen a presentation where the company claimed to increase their revenues by 17%. They reached it by analyzing opinions of customers in social media about products, both their own and competitors’ brands and then improving the product features.

Analysis on cost savings for some types of costs. For example, staff travelling cost through the globe.

Case study: revenue prediction by using machine learning techniques

Some time ago, my company Data Crossroads and FP&A Trends Group initiated a research project on the application of machine learning techniques to driver-based modeling. I would like to share a brief overview of the results.

The goal of experiment was to predict gross profit per country and product line. For this experiment we used an open source data set. [2] This set of data included financial and non-financial features. We used one of the open source machine learning platforms to build a prediction model.

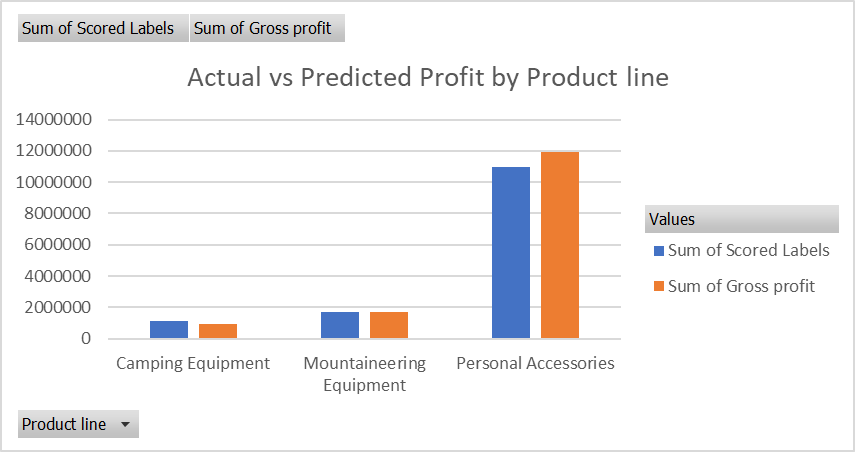

This picture shows the comparison between actual and predicted gross profit by product line. The relative absolute error of the model was 8.1%.

What this experiment really shows is the following: by using set of historical data you can reasonably easy make a prediction of your financial outcomes with a margin of error of 2-8%. The biggest challenge for this method is not making the prediction itself, but gathering data. Building a simple model and getting results costs hours, not months or even days.

As we see, data science and big data might bring a lot of opportunities in development of the area of business and financial planning.

If your company has also already started your journey with data science and big data, it would be very interesting to read about your experience in the comments.

If you would like to learn more about artificial intelligence (AI) and machine learning (ML) application in modern FP&A, please feel free to check out the findings of the AI/ML FP&A Committee.

Notes

[1] Data Science (definition)

[2] IBM Open Source Dataset

The article was first published in Unit 4 Prevero Blog

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.