Using P&L as a map for the journey (see image 1 below), the first three articles...

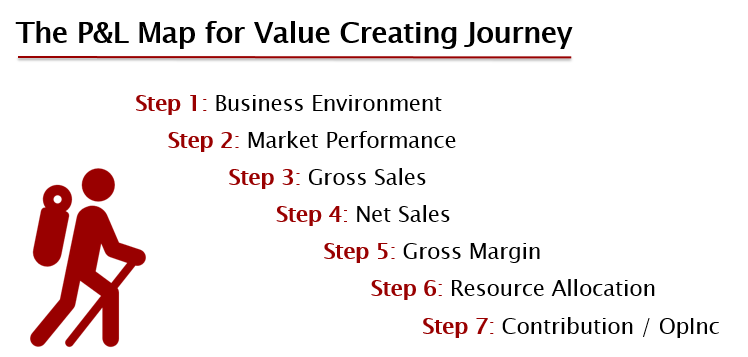

This article is part of the series ‘P&L Management: from Bean Counting to Value Creating’ that focuses on demonstrating how finance can shed light on important business drivers, revitalize figures and make them tell a story, creating value for the company. Using P&L as a map for the journey (see image 1 below), the first four articles explored five initial steps focusing on the pre-P&L analysis, price management, gross-to-net (GTN) and marginality.

This article is part of the series ‘P&L Management: from Bean Counting to Value Creating’ that focuses on demonstrating how finance can shed light on important business drivers, revitalize figures and make them tell a story, creating value for the company. Using P&L as a map for the journey (see image 1 below), the first four articles explored five initial steps focusing on the pre-P&L analysis, price management, gross-to-net (GTN) and marginality.

In this article, we will move to the bottom line of P&L considering how finance can guide management in resource allocation and drive business profitability.

Image 1. The P&L Map for a value-creating journey

Approach to resource allocation

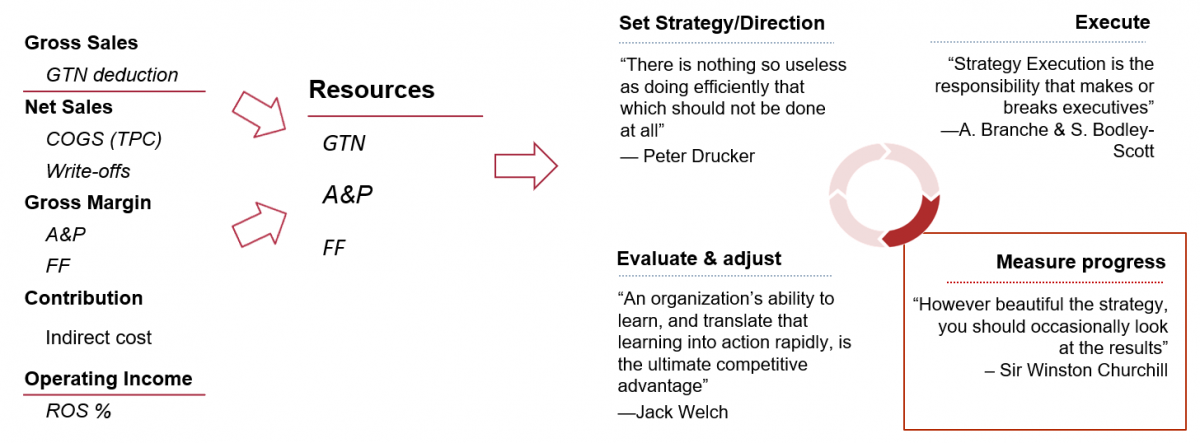

An objective of resource allocation is to distribute a company’s limited resources in a meaningful way to achieve its strategic goals and do it most efficiently. Usually, the process is done in four stages, starting with the Strategy of figuring out how to create and offer the most value to customers at the least cost, proceeding with its Execution on the Strategy, followed by Measuring outcome and closing the loop with Evaluating results, learning and making necessary adjustments (see image 2 below). Although each stage is important, this article will focus on performance measurement.

Image 2. Process of Resource Allocation

As shown in Image 2, the resources of an FMCG company usually consist of spends on advertisement and promotion (A&P), Field Force (FF), and Gross-To-Net (GTN). Due to the task complexity, it is worth considering a system for measuring the effectiveness and efficiency of utilization of each resource separately. This article presents how such a system can be built on the example of the promo-actions, which, according to Simon-Kucher and Partners, are of raising significance in the FMCG world due to three factors:

Shoppers are more hooked on promotions than ever

FMCG manufacturers invest 2-3 times more in promotion than in advertisement

…but with poor return: 6 out of 10 FMCG promotions in Europe don’t break even.

In addition, the effect of promotions is difficult to estimate due to stockpiling and cross-channel cannibalization (materials of the 2nd SKP European Strategy Forum, 2015).

Approach to increase the effectiveness of promo activities

The following approach to boost effectiveness and efficiency of promo actions was successfully applied first in an FMCG company and then in a pharmaceutical one:

Implement a procedure requiring pre- and post-evaluation of promotions with documentation of lessons learned

Understand the effectiveness of each promotional method and find performance drivers

Integrate learnings into rules and guidelines to design more effective promotional activities.

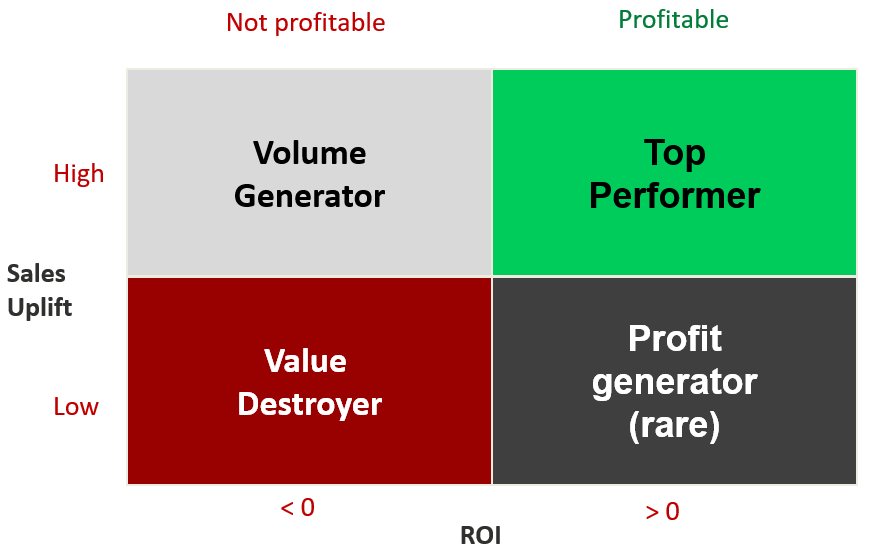

Image 3. Classification of promo actions

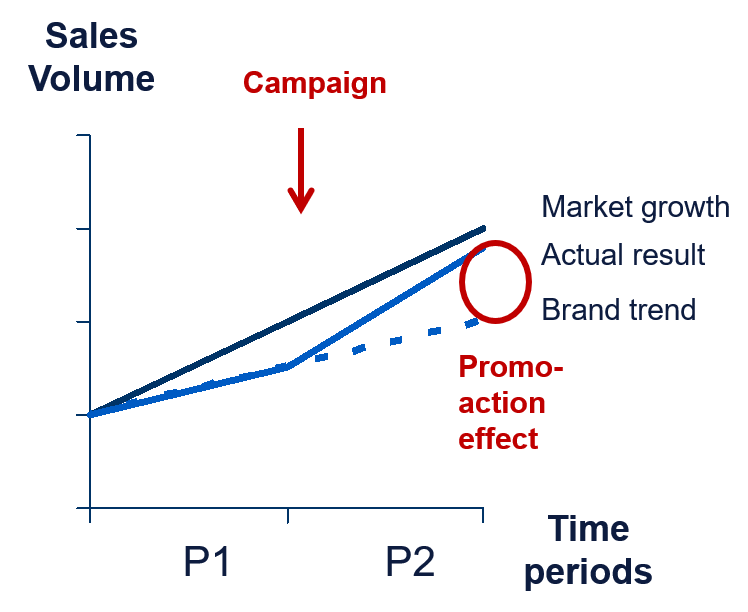

In order to classify promo actions as presented in image 3, it is critical to design a tool to measure both Sales uplift and ROI. In the tool shown in image 4, the measurement is based on a difference in volume between historic trend (projection of the market and company dynamics from the previous periods), and actual performance versus the market. The volume difference between projection and actual performance vs. market is used to calculate incremental Sales and Profit as a result of marketing activity. In this case, volume data should be taken from an external source (e.g., Nielsen or IMS), while internal data are used for a price, discounts, product margin and campaign cost.

Image 4. Tool for evaluation of the effectiveness of promo actions

Example of the tool application

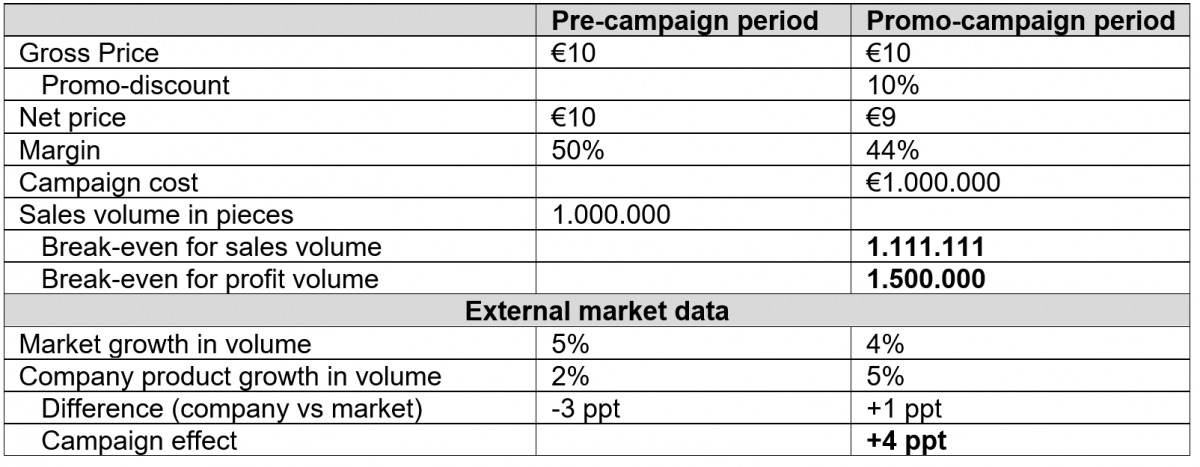

Let’s assume that a company sells goods priced at €10, sales volume is 1 million pieces per quarter and margin is 50%. During a promo campaign, a company gives a 10% discount and additionally invest €1 million in the promo action. In order to reach break-even for sales, the company should sell by ca. 11% more goods, while to achieve a break-even for profit, it requires a 50% volume growth (see the table below). Knowing these data is instrumental for setting a goal for a promo-action as for its post-evaluation.

The volume change is estimated as follows: let’s assume that in the previous period the market grew 5% in volume terms while company sales (in pieces) increased only by 2% (or -3% vs. market). In the period when the promo activity was performed the market growth slowed down to 4%, while the sales volume of the company’s products increased to 5%. So, incremental volume can be calculated as a difference between the actual 5% volume surge and the projected 1% increment (calculated as 4% of the market growth minus 3% taken from the historical trend).

It is critical to use external data for volume changes, which allow to reduce effects of stockpiling of distributors and compare it with total market dynamics that neutralize external factors influencing the whole industry.

The next step is to gather and analyze data to understand the influence of each factor and their interplay on the action success. These factors can include, e.g., price position, the deepness of discounts, price bundling, shelf stoppers, flyers, displays as well as actions of competitors. Finding the right combinations allows a company to not only weed out the value-destroying promos, but also to integrate learnings into rules and guidelines to help account managers design more effective promo activities.

Building a similar approach for Field Force, GTN and advertisement, a company creates a strong fundament for a system where resources are allocated based on facts and not on subjective preferences and opinions of those who shout louder to receive better pieces.

Resource Allocation utilizing ROI

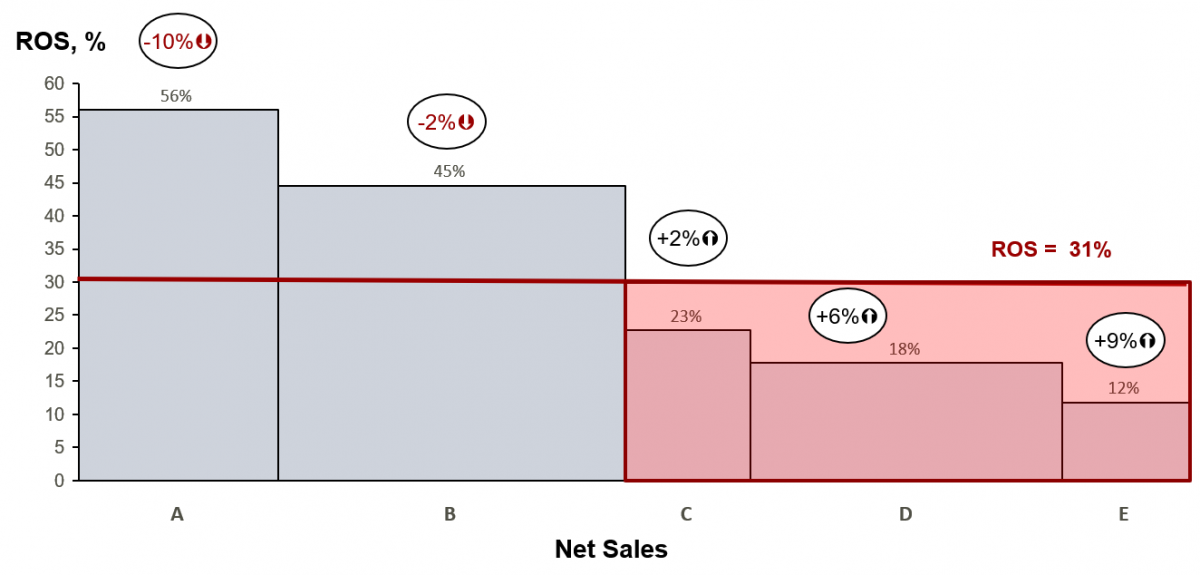

Profit, and especially Return on Sales (ROS), can be also used for Resource Allocation as they allow looking at the company performance from a somewhat unfamiliar side. Image 5 shows the contribution of product groups to the company profit: Sales of each group are presented on axis X and ROS on axis Y, hence the rectangle’s area is equal to the profit contribution of the product group. The sales growth marker at the top of each bar adds insight into dynamics, which helps to understand in what direction company profitability is moving. For example, in the presented case product groups with above-average profitability are declining, while growth is coming from the products with lower margins, which is leading to the deterioration of the total company’s profitability.

Image 5. Resource allocation tool based on product profitability

Resume

This article closes the series on P&L Management, which is built on the idea of synergy: to achieve a better outcome, business tools and techniques should be interconnected and leverage each other.

Finance, which often struggles to create a positive and creative image as it concentrates its attention on constraints and limitations, can use this approach to take initiative and drive results. Instead of focusing on constraints, Finance executives can look at opportunities, storytelling, taking P&L as a core of its narrative.

It makes sense to start this story with an exploration of the business environment and then to analyze a company’s market performance using Evolution Index to create a context for the following P&L deep-dive.

A search for new ways to foster a company’s top-line growth starts with strategy and pricing while often ends up with the business model revision, i.e. reviewing the value proposition, value creation and value capturing. Such a model overhaul should lead to focus the whole organization on value creation for the customer.

Each industry and market require the development of its own and specific approach to the business model revision. Having understood price and value drivers, a B2B division of a pharmaceutical company developed pricing tools and procedures which helped steadily improve business profitability over years.

This overarching P&L Management approach is further specified in the review of P&L lines to examine how utilization of each resource contributes to increasing the effectiveness and efficiency of a company’s business model. E.g., GTN can be used to enhance the value proposition, while improving the accuracy of the sales forecast and reducing write-offs can increase the efficiency of the value creation.

Finally, Finance can further advance the business model by establishing a system for effective fact-based resource allocation to avoid their distribution hinged on opinions and internal politics. This contributes to the creation of corporate governance, a system of checks and balances ensuring that an organization is stronger than individuals who happen to be leading it at any time.

A regular journey along P&L, done in a systematic way, offers managers new insights into their business. A regular application of the tools makes them interconnected and amplify their effect. This allows the company to constantly and consistently improve the effectiveness and efficiency of its business model, and ultimately build an edge versus the competition. And Finance can rigorously steer the whole process skillfully applying its P&L-connected toolkit!

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.