This article considers the spectrum of approaches to sales planning, ranging from automated and arithmetic to...

Effective Business Partnering is a critical skill for FP&A professionals to hone, as it is one of the most direct ways FP&A can influence business performance. However, FP&A’s ability to add value through Business Partnering is almost impossible if we don’t collaborate with engaged and accountable stakeholders. Therefore, our goal must be to enable P&L owners to know whether or not they are executing the plan and why.

Here are some practical Business Partnering strategies and tips from my experience that will help you develop accountability among P&L owners who look for ways to be more efficient with every dollar and understand their contribution to business performance.

The best plans are informed by the stakeholders themselves. The magic happens when they couple their instincts, forged throughout their careers, with real-time, data-driven insights from FP&A. Our job is to facilitate a bidirectional flow of financial and operational data, but it’s challenging.

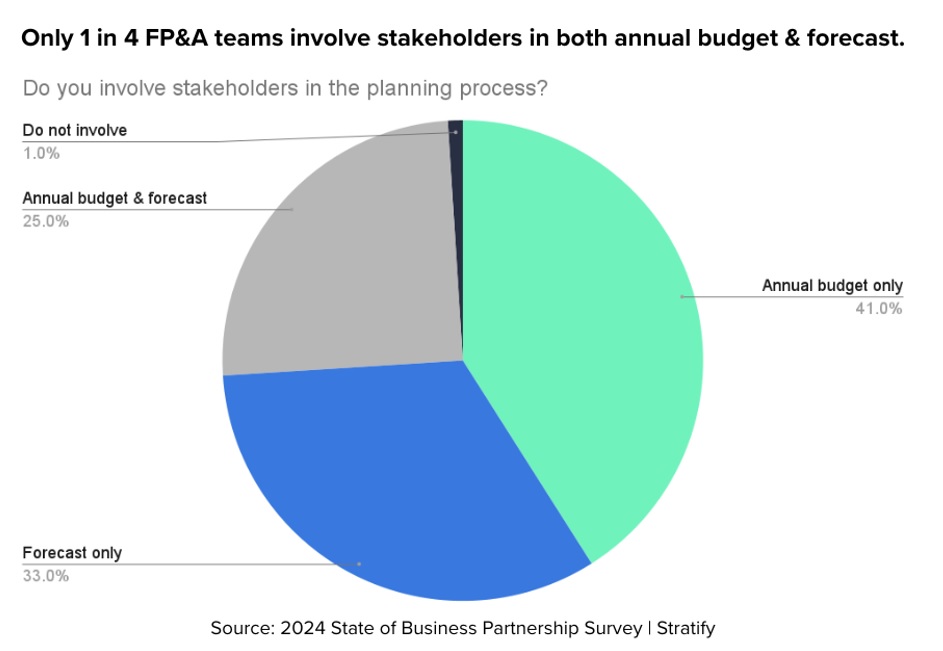

According to a recent survey of mid-market FP&A leaders, 41% say that if P&L owners and the FP&A team could collaborate more effectively, they would be able to improve plan and forecast accuracy. However, today, only one in four involve stakeholders in annual planning and forecasts1.

Figure 1

Regarding P&L owners and their relationship to finance, they are all over the map. For instance, my Head of Engineering told me, “In my 20+ years as a cost centre owner, my budget allocation felt like a magic credit card that either worked or didn’t.“ He said that’s a common mindset amongst senior executives. Based on my experience, I’d have to agree!

“Finance’s Plan, Finance’s Problem”

The truth is that the budget process at many organisations reinforces this kind of thinking. We bring it on ourselves. Here’s my Head of Engineering again:

“Finance would come to me at annual planning time with suggestions and requests. They’d say, “Travel & Entertainment from last year was this much. This year, it can be about 20% more.”

The end result felt like I was given a set amount of money as discretionary spending for my department.

Plus, a lot of communication was indirect, over email. I would receive my cost centre spreadsheet from finance. I’d have to update my travel spend, make adjustments, and then send it back. Our communication was more about deadlines. I assumed finance would take the spreadsheet and do magic behind the scenes to make it all add up.”

That process checks some boxes: FP&A gets a final budget, and budget owners get their credit card limits renewed. In some ways, it is even efficient. But it’s a big missed opportunity. Done right, the budget process can be a catalyst for something every CFO dreams of - higher stakeholder engagement and stepping back to watch them steward their budget throughout the year.

Stakeholders have much to gain personally and professionally from this transformation, and I’ve seen the proof in my colleagues and the companies where I’ve worked.

How to Enable Budget Owner Accountability

These tactics will improve your finance Business Partnering skills and encourage more accountable P&L owners.

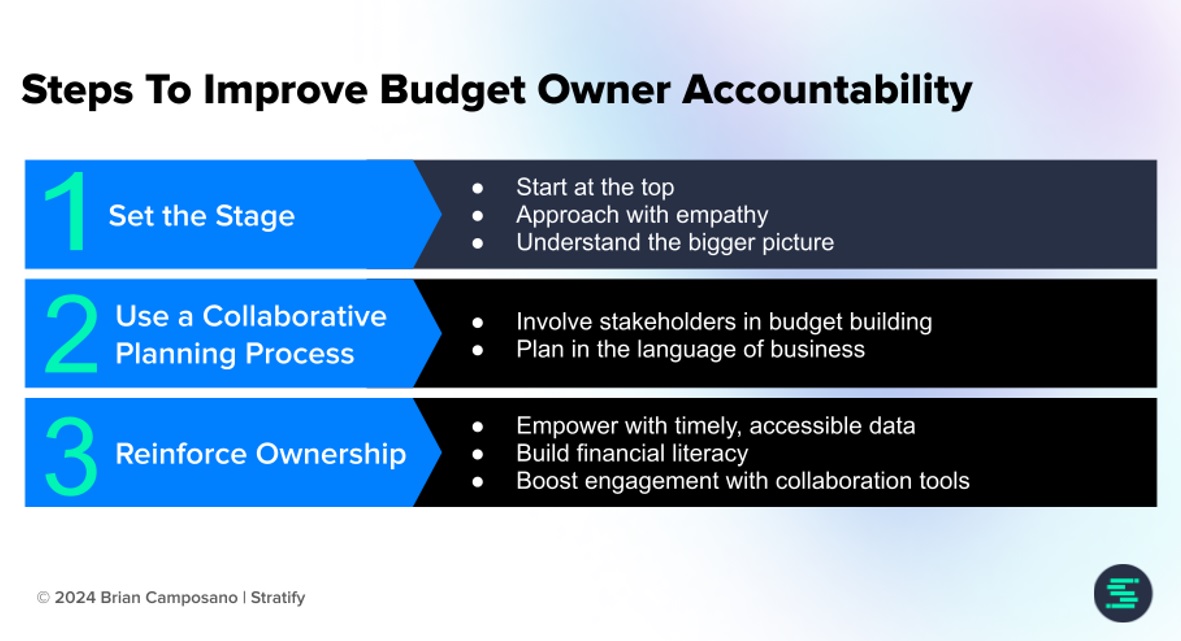

Figure 2

1. Set the Stage

Start at the top

Work with your most senior business leaders to model an accountability mindset. This sets expectations and supports FP&A when they want deeper discussions with each business unit. Only then can your finance managers implement new levels of fiscal responsibility from the bottom up and ask their Business Partners: “Given our overall financial and operational goals, what headcount, expenses, and systems do you need to succeed?”

Teach your team to approach with empathy

Take into account the underlying motivations for what you might consider wilful ignorance or reckless spending. Some P&L owners need more guidance to build and maintain a budget. They may think overall P&L management is less important than achieving their top-line plan. It’s possible that numbers and financial data just terrify them. I recall working with an effective executive with years of expertise and strong interpersonal skills who turned into a deer in headlights when presented with an FP&A-designed spreadsheet.

Understand the bigger picture

For example, savings on salaries may not be a favourable outcome if it means the sales team is behind in hires. Or the opposite could be true; an opportunistic hire might accelerate a key project. This approach builds trust and yields more strategic dialogue and results.

2. Use a Collaborative Planning Process

Involve stakeholders in building their budget

If you send someone a pre-built budget, it’s really your budget, not theirs. It’s far better to co-create it within the bounds of current business goals. Try to assign a dedicated analyst or team member to cover each business unit and get embedded to understand their goals as you collaborate on the budget and solve problems together.

In the case of my Head of Engineering, things changed after he walked through a more collaborative annual planning process. His finance counterpart invited him to review his expense and workforce plans, asking if finance had prepared everything aligned with his objectives and goals for the department. That sparked a strategic discussion.

Plan using the language of your business

Planning in a driver-based environment without complex formulae to decipher meant that my Head of Engineering could easily identify the number of licenses driving his total software spending. He quickly realised that he was paying for more than he needed, so he recommended cutting his own spending first!

3. Reinforce Ownership Once Budgets are Approved

Empower with timely, accessible data

Timely monthly reports will prompt executives to check their progress against the plan and adjust accordingly. Automation gets reporting out fast, just in time to be actionable. My Head of Engineering said it well: “I’m no longer waiting for finance to balance things for me; I’m looking to manage my budget on my own.”

Accountable P&L owners also need access and insights into their performance against their budget and business goals. This is necessary so they can begin to self-regulate and adjust based on outcomes and forecasts. Your goal here is to remove as many barriers as possible and provide essential context to each department.

Build financial literacy

Not every business executive is automatically a confident P&L owner. Meet with Business Partners to answer questions and focus on areas like:

- Comparing their budget to industry averages for similar-sized businesses

- Regularly reviewing variable expenses for opportunities to save

- Helping them understand what is or isn’t working and why

- Evaluating ROI on potential strategies

Collaboration features can boost engagement

Modern FP&A tools can help free up time for Business Partnering through automation, master data management, and more. Keep an eye out for features that promote engagement. Some modern FP&A platforms enable P&L owners to easily “@ mention” finance on a line item in a report or budget. It’s a friction-free way to give a heads-up on a changed assumption in context and make a quick, informed decision. That’s one meeting saved when time is money!

Going Forward - Business Partnering Breeds Stakeholder Accountability

The perspective of my Head of Engineering has completely changed.

Here’s what he had to say:

“I’m running a pretty expensive cost centre, so my stewardship of spending makes a difference to the bottom line. Every dollar adds up, so I want to be spending on areas that count because delivering our business plan is going to benefit my employees and their well-being.”

When FP&A enables stakeholders to take ownership of their budgets and provides real-time visibility into performance, plans and forecasts will improve.

Don’t shy away from this important responsibility. It’s one of the best ways to build momentum with everyone in your organisation and progress faster toward your business’s short and long-term goals.

References:

1 – Business Partnership: A path to success for FP&A. State of Business Partnership Survey 2024. Stratify.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.