To provide the best support to the business leaders, FP&A needs to quickly leverage the accounting...

The current debate around Return To Office (RTO) likely heralds the biggest shift in the workplace since the emergence of the assembly line in the late nineteenth and early twentieth centuries. Is this relevant for an FP&A audience though? I’d argue it is fundamentally relevant for a number of reasons, not least because it is one of the biggest impacts of Covid-19 on the global business environment. This is a debate that, from a financial planning and analysis perspective, we cannot sit out.

I’ll explain why, but first, we need to understand the debate itself.

To stay at home or return to the office?

While a return to office-based working might suit some people – specifically the managers who have yet to figure out how to gauge productivity when they can’t keep their eyes on their teams from clocking in until clocking out – it’s not going to be for everyone. Purely financially a return to the office doesn’t work out for many employees: a survey in Ireland indicated that it could cost people more than €100 per week when you factor in travel, clothing and food. People are also going to miss the extra time they gained by skipping their commute, plus the increased work-life balance and more time with family and friends and to spend on leisure activities. It will hardly be surprising when people, and your top-performers especially, start reconsidering their place in companies that insist on everyone being back in the office all the time.

Working from home is not for everyone, either

On the other hand, not everyone has access to the best remote working setup, with a quiet, comfortable, private and secure place to work and decent broadband access. So, while a lot of people appreciate the benefits of remote working, this does not apply to everyone. Full remote working tends to disproportionately negatively impact junior staff and lower earners.

A fully remote setup is not always ideal for other reasons. There is no doubt of the benefits of proximity: the impromptu brainstorm, quick coffee break, or overhearing a colleague talking about something interesting they are working on. Humans are, after all, social creatures.

And, quick sidebar, this applies to accountants as well. As much as people might stereotype us as behind-the-scenes back-office bean counters there is a strong argument that now, more than ever, we should be in the thick of business, with a finger on the pulse of what is going on and coming down the line, including getting input from a wide variety of people across the organisation. Sure, we can very successfully manage our number-crunching, internal control management and signoffs completely remotely. But if we isolate ourselves from our business too much, we risk failing to understand the wider context in order to translate that into the bigger financial picture.

The best of both worlds?

Then there's the hybrid model, the supposed Holy Grail and best of both worlds. But critics caution that unless this is thoroughly thought through and carefully implemented, it will amount to little more than an in-office by default situation. If leadership and management cling onto “bums on seats” mindset, inevitably remote workers will lose out – from their ability to contribute adequately during hybrid meetings to opportunities for promotion.

This is all very well and interesting. It is certainly an existential shift in workplace culture. And like so many recent changes, was already in process but was dramatically accelerated by the health crisis. But what does this have to do with FP&A though?

Everything, I’d argue! Consider that two of the largest, fixed line items on your budget every year are your people and your rent. This means FP&A is very definitely no longer business as usual today: your response to the direction your company takes with regards to working from home vs back to the office can have a significant impact on your financial planning and analysis. The good news is that with some forethought and work, this could be extremely beneficial to your bottom line. And to your people.

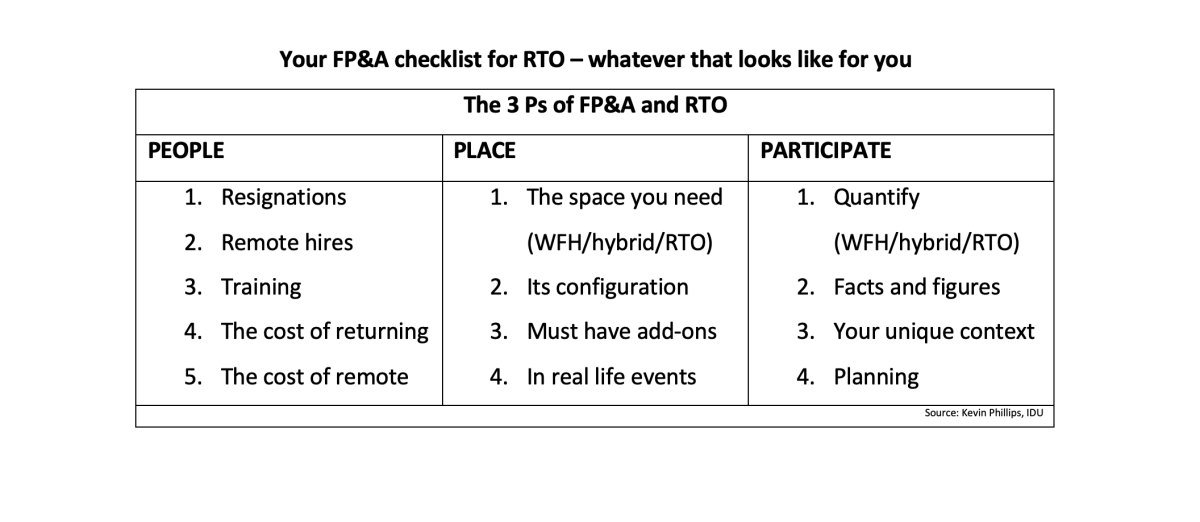

RTO: Three things you need to think about

1. Planning for your people

If your organisation is enforcing a strict back to the office mandate, you'll likely need to plan for additional recruitment fees and training, as well as allowing for dips in productivity as you replace the people who inevitably resign.

When it comes to hiring their replacements, you will now be competing against a global marketplace, not just the companies in your town or city and its suburbs. Savvy candidates are looking for employment further afield at companies that have embraced remote working wherever they are in the world. These candidates have a wider choice and the potential for generous salaries at companies that will allow them to continue working remotely. You will need to pay a premium to convince the top performers that live locally to join you in your office.

Of course, the reverse is also true and savvy companies embracing remote working can stand to save on salaries, especially if they're based in locations that typically pay a premium. You can now hire top talent from anywhere in the world and pay them more than what they would earn locally, but less than what you'd have to pay at home. This is a win-win situation, especially for your salary costs.

2. Planning for your space

Next, if your company has opted for some form of remote working, what does this mean for your office space and other related property and facilities costs? It’s unlikely you will need the same amount of office space and its configuration will need to change too. Do you still need managers’ offices and individual desks per person? What about the new requirement for hot-desking space, break-out rooms, and well-equipped video conferencing spaces of various sizes. How are you going to entice people to return, either full-time or on a hybrid basis? At the minimum, you'll need decent connectivity, an attractive and comfortable space with decent facilities (and not that office chair with one wobbly wheel), good coffee and whatever else it is that is important to your people. For instance, in South Africa we have an air conditioning and backup electricity consideration as well, which should not be underestimated. And obviously sanitation and personal protection are going to remain important.

There are multiple variables and aspects to consider, depending on your organisation’s unique makeup. But something else to think about is how to bring people together in real life if you choose a hybrid or fully remote route. Do you reallocate some of your savings on office space to regular get-togethers, even bringing in remote workers from around the world for face-to-face time? Virtual happy hours and all-hands meetings are considered some of the most challenging to do remotely, so this could be well worth the investment.

3. Weighing in on the decision

How your company tackles working from home vs back to the office is going to be one of the most critical decisions you collectively make and implement in the near future. It affects your people, and it affects your financial planning and analysis. While each company is different, and there are pros and cons to each approach, it does seem that a properly implemented hybrid model might be the most appropriate for our next normal world. Yes, this takes careful planning and a significant mindset shift – especially in traditional businesses – but the advantages are there. In addition to reacting to the decision by reflecting it in your budget, I would suggest it is the finance function’s responsibility to weigh in on this strategic conversation from the outset to help design the way forward in a way that works for your people and your bottom line.

RTO = FP&A priority

As FP&A professionals we need to understand the various debates around RTO and how they apply to our organisations. Next, we should quantify the impact of these alternative scenarios within our specific context and present this to our management and executive teams, cutting through emotion, personal preference, and hype. If we do this, the value of our contribution to a critical outcome for our organisation cannot be overstated. Casting an FP&A lens on the debate could be the difference between coming back to a team of engaged, productive people or a flurry of resignation emails.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.