The below article summarises an approach developed throughout the years of my work and explores ways...

One of the most important aspects in an organisational context concerns the communication between different departments, especially at crucial deadlines where it is necessary to achieve the objectives of revenue, income and other qualitative indicators set by the company. Usually, the actors of this meeting are the sales directors, the marketing directors, the production and logistics directors, the general management and the financial planning and analysis (FP&A).

One of the most important aspects in an organisational context concerns the communication between different departments, especially at crucial deadlines where it is necessary to achieve the objectives of revenue, income and other qualitative indicators set by the company. Usually, the actors of this meeting are the sales directors, the marketing directors, the production and logistics directors, the general management and the financial planning and analysis (FP&A).

Although interconnected, these actors have different objectives that concern the individual specificities of every function. If the greatest responsibility of sales managers is to increase sales through discounts and promotional actions, marketing and brand managers will try to safeguard the aspect linked to the product, the competition, the correct positioning of the price, the activities concerning the visibility and the consensus of the end customer. Instead, the production manager will have to deal with the different situations of market demand. Today, the FP&A task can be extremely widespread and supportive of defining the future scenario in advance, considering the objectives of each department.

There are some best practices that organisations should keep in mind to have smooth cooperation between departments.

1. Use of Price Elasticity of Demand

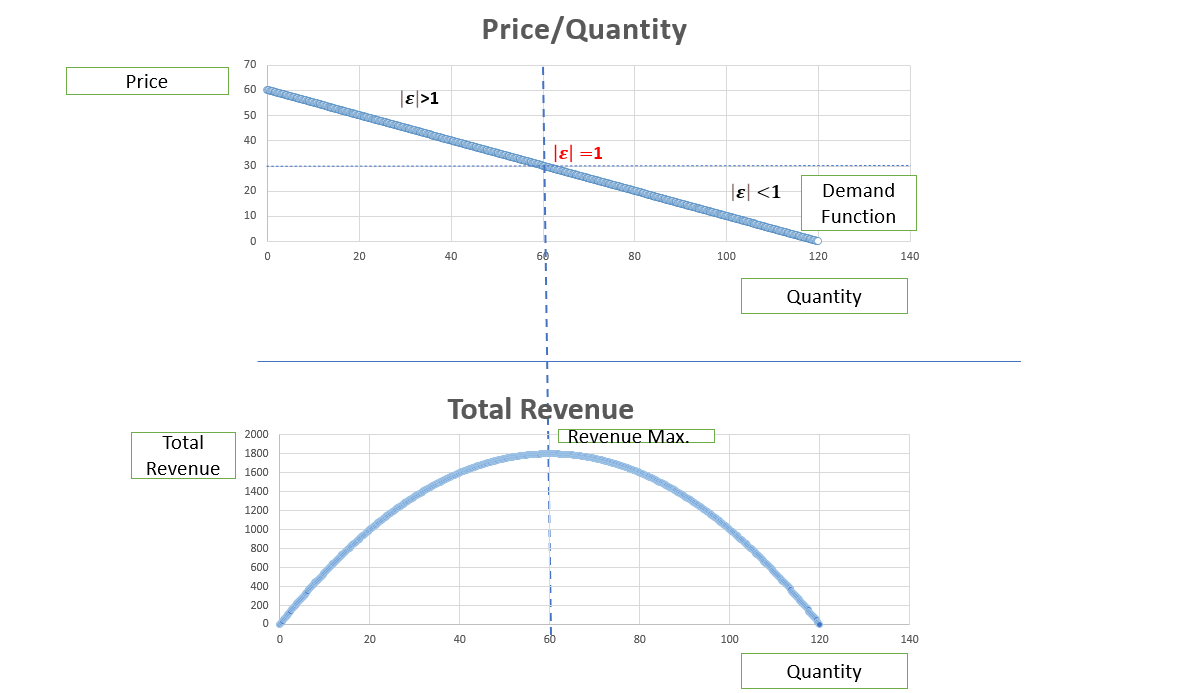

If there are no inventory problems, a simple rule to follow is that which maximises revenues through the principle of price elasticity of demand. A relatively high price does not allow an adequate level of sales, while a too-low price would increase volumes but could compromise profit margins. The equilibrium that determines revenue maximisation corresponds to the unit elasticity point on the product demand function. In the example below, leaving aside the algebraic concepts, we can see how the optimal price of a good X is reached at a price equal to $30, considering a quantity of 60 units. In other cases, the Total Revenue would be lower, as shown by the graph below. Obviously, the Revenue Maximisation concept is a golden rule, and in order to satisfy internal needs, it can fluctuate by ± 5% without compromising the operating margin. This is a good point before the end of the fiscal year to define the guidelines for the sales departments. It allows the company to follow a precise direction guaranteeing the revenues beyond the direct costs and general expenses.

2. Marketing and Sales Initiatives

Any actions aimed at increasing sales volumes must be self-financed. Supporting the demand with Media expenses must give numerical results that justify its action. Media expenses not supported by a potential return are often ineffective with a loss of profit margin. This is one of the common mistakes that come from a situation in the busy times of the year. The FP&A should be able to evaluate an investment and decide whether this action is profitable.

3. Pragmatic and Analytical

Consider the problems deriving from the achievement of the target and create a scheme that allows isolating the most crucial and strategic ones. In a "Data-Driven" business context where information has become today, more than ever, a core business asset, it is necessary to be able to focus on the usability and intelligibility of the data and ask whether all the information we have available is necessary or redundant. Artificial Intelligence can be very useful to us, but using it effectively and according to the conditions above is necessary. Furthermore, it is necessary to possess the skills capable of analysing and quantifying the most relevant aspects. A significant fact was touched on by Andrew Keen where he states that “data and information are the new oil”, and it is no coincidence that many companies are using Data Scientists who are of valid management support. Furthermore, this methodology can effectively help managers concentrate on the real problems in the simplest, concise, and understandable way.

4. Team Player

A fruitful collaboration between the different departments is important to understand the problems concerning risk assessment, inventory, production costs, media and general expenses. In most cases, the finance department has to oversee all administrative matters without accounting for other departments. It would be a good idea to share and empower the directors of the various departments to minimise the last-minute surprises because one of the most troublesome situations is delivering “Roller Coaster Results”. This circumstance can be avoided through timely planning work.

5. Vision and Perspective

Anticipate future scenarios based on the guidelines for achieving the goal. Normally, before the end of the fiscal year, it is necessary to evaluate the situation of all internal key indicators weekly and try to make corrections to be consistent with the required parameters. In this case, the managers of the departments greatly appreciate a flash report with the results.

6. Communication

Clarity and simplicity for better involvement of the people around the table. Greater and practical interpersonal skills can make the previous points more fluid if presented according to the targets.

Conclusion

For an organisation, it is important to coordinate all the activities considering the two limits of the financial impact: the best case and the worst case. Running timeless analysis for different departments can be the right tool to guarantee and preserve the company from the “last-minute bad news”.

The analysis can embrace all the above points: revenue maximisation, media and production expenses, and Profitability Analysis. At the same time, the FP&A Manager is able to discern all the available information using the most significant one, guaranteeing the right direction.

Further, the FP&A Manager should be an assertive cooperator with professional and soft skills who is able to lead the managers towards the goal.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.