FP&A has an impact on the organisational structure, enhanced by the possibilities of new technologies. Where...

All functions have operational deliverables, with perhaps a very few exceptions like a Corporate Strategy function. Given this “daily business” that has to be conducted, it is logical that risk rears its considerable head when attempting change. The greater the change impact and ambition, the bigger the risk has to be taken into account on how to guarantee “business continuity”. FP&A is not exempt from this.

All functions have operational deliverables, with perhaps a very few exceptions like a Corporate Strategy function. Given this “daily business” that has to be conducted, it is logical that risk rears its considerable head when attempting change. The greater the change impact and ambition, the bigger the risk has to be taken into account on how to guarantee “business continuity”. FP&A is not exempt from this.

Big 6 of FP&A

What are the daily operations in FP&A?

The operational delivery of FP&A revolves around the following big blocks:

- Performance Management and Measurement. Looking at the financial development of the business against objectives, including underlying business drivers of performance and KPIs

- Business and Financial Planning. Translating agreed business objectives into forward-looking business and financial plans

- Strategy. Playing an active role in strategy development and resource allocation decision to execute strategy.

- Decision Support. In essence, getting into modelling the financial implications of operational resource commitments.

- Investment Analysis. Providing tools to conduct rigorous business case analyses for bigger, material, complex investments

- Business Risk and Opportunity management & Control. Controlling the follow up of existing risks and opportunities brought forward and monitoring for potential future risks and opportunities. Ensuring that crucial business controls are in place for key business processes – for example, pricing

The Transformation Imperative

Shifting now to change, what are the tensions driving the imperative for FP&A to undergo some fundamental transformation? The critical imperative is the changing mandate of finance. This is driven by the changing external landscape that most organisations find themselves in as well as the increased opportunity that technology acceleration provides. These technology opportunities are in the areas of Cloud-based services, Data Analytics, Visualisation, Cognitive Modelling and many others.

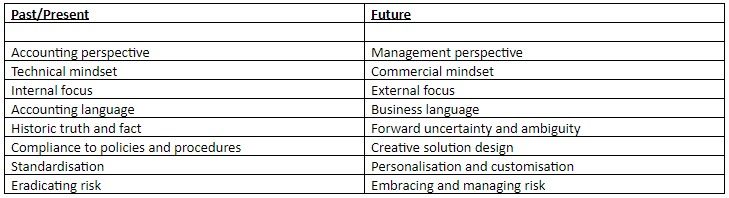

To summarise briefly, the imperative for finance is to play a more impactful role which moves from FP&A focused on reporting and working more in isolation to providing business solutions whilst partnering with the business. As the following table illustrates:

From the Old World to the New One

The Challenges - Flying the FP&A Plane

All sounds simple and straightforward, right? No. And the simple reason is that, historically, daily FP&A operations have tended to reside on the left-hand side. Transformation aspires to live in the right-hand dwelling.

This illustrates the challenges of transforming an FP&A service whilst still having the responsibility to deliver operationally. In the end, we want to effectively “transform the operations”. The operational deliverables of FP&A are not likely to change materially in intention. The biggest change imperative is to change how this is to be delivered and, therefore, what kind of culture is required from an FP&A function and what kind of talent is needed.

In this respect, the analogy of a plane in mid-air is illustrative. The plane is a bit old, and there is less than 90% confidence amongst the crew whether everything is working as it should. Secondly, the journey the passengers enjoy whilst on board is less than optimal, which means that when the destination is reached (no doubt late), the passengers alight in not the most optimal of moods –. In contrast, they should be thinking of what a wonderful experience they have had as the first step on their journey.

Both the parts of the plane need to change (the what) as well as how the overall experience is provided (the how).

The 3 Cs to Address

Is the incumbent organisation capable of delivering this change? I see three big challenges that create some doubt:

- Capacity

- The current organisation – precisely because things don’t work optimally – are busy with workarounds and just running to stand still. This is the overwhelming feeling of the operational swamp, where nothing seems to come easy. But, critically, this is at least a known quantity, however frustrating.

- Competence

- The kind of skills that have been historically hired to survive the above environment is unlikely, both technically and managerial wise, to be able to deal with, let alone lead the change initiative required.

- Credibility

- The customers (in this case, the paying passengers) have also, in many cases, been “resigned” to what they have been used to experiencing. Therefore, it is also challenging for them to imagine, let alone actively support and embrace a different experience.

Checklist for success

If change is not an option, what can increase our chances of successfully transforming the plane mid-air? Whilst by no means an exhaustive list, I believe the following is essential:

- Secure and drive commitment from the FP&A leadership and a critical mass of business leadership.

- Make the critical people changes before starting where the essential pain points and change impact are likely to be.

- Enrol people in the organisation who are energised by change (frustrated by the status quo) and make it worth their while.

- In particular, help free up their time to spend material time designing and implementing the changes. Do this by being uncompromising about stop/transfer lists.

- Re-organise work by creating a dedicated focus.

- Be the “naysayer” to the organisation about further operational requests where possible in order to protect time for a change.

- Encourage every opportunity for continuous improvement and recognise and celebrate this. There is little risk to this as every improvement is likely to help facilitate the big changes to come.

- Manage stakeholder communication actively. This is likely to be a bumpy road, not just on the change side but also on the operations side. Turbulence is to be expected.

- Get serious about documenting knowledge of the as-is situation. Especially in FP&A, where the work done is more knowledge-intensive.

- Manage transition risks actively – do not under any circumstances plan for overly ambitious resource needs (read: short cuts). This extends to parallel running.

- Be honest and communicate both the struggles and the successes – linking everything back to the change imperative. Why is this necessary?

Summary

In the end, the need to transform FP&A operations is in the interest of the business, not for FP&A itself. Nevertheless, the business will not thank the function for changing in a way that has brought the operational needs into danger. It is possible to pull off such a balancing act by explicitly addressing the challenges related to capacity, competence, and credibility if approached in a transparent, structured, disciplined, and consequential way.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.