Introduction

The pace of progress around the role of finance in modern organisations continues to accelerate as we move from a cost centre to Business Partnering, profit-enhancing function, and perspective. Traditionally, management accounting has been focused on reporting what has happened and communicating that information across the organisation.

Gone are the days when a management accountant was expected only to close the books, reconcile the accounts, issue reporting, and spend the rest of their time buried in the GL in some dark corner of the office.

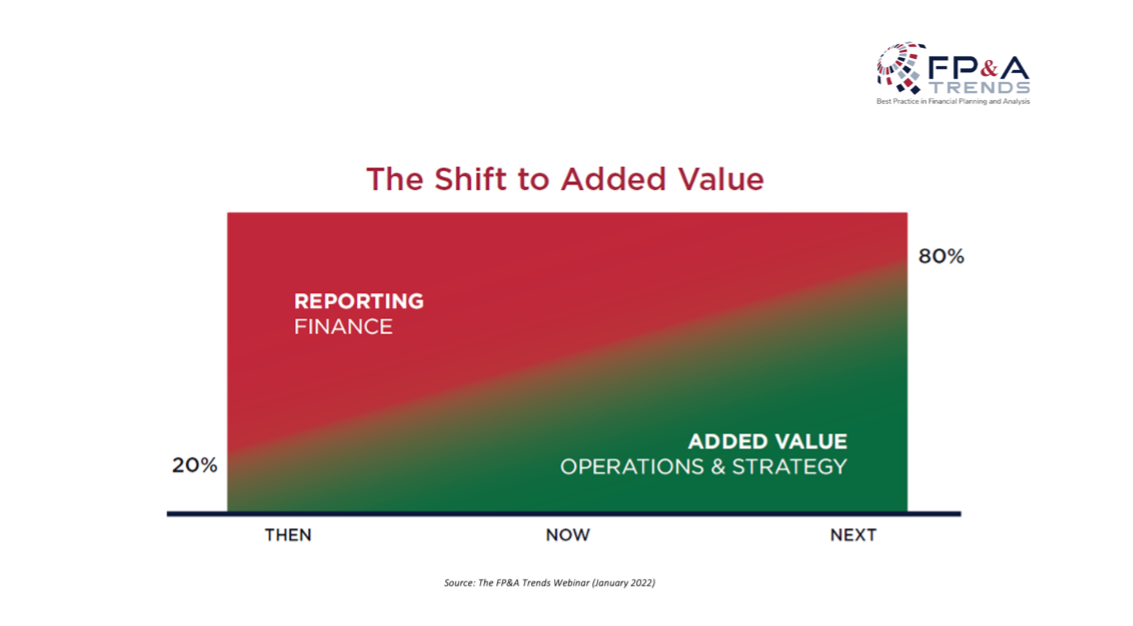

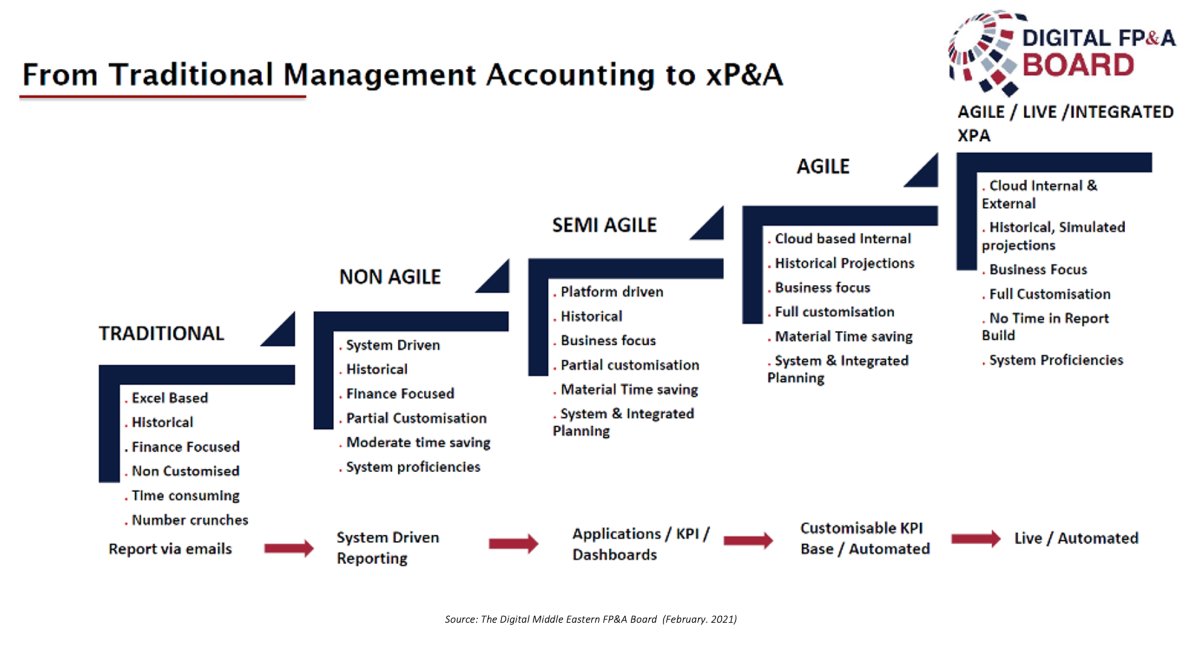

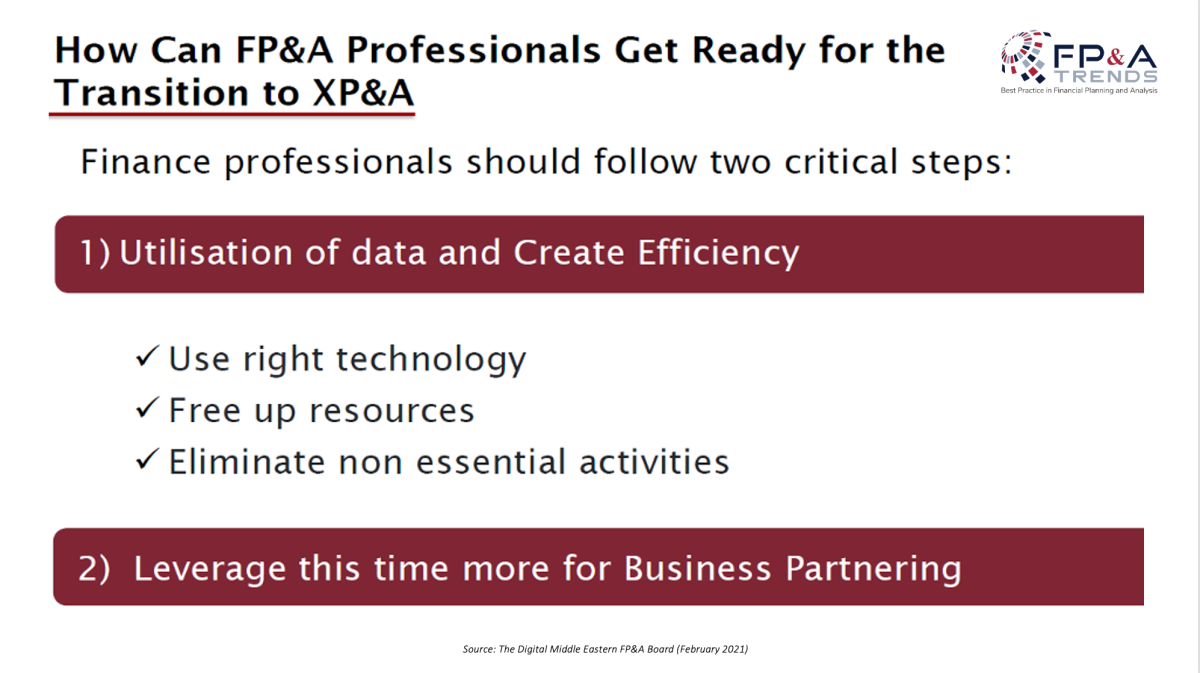

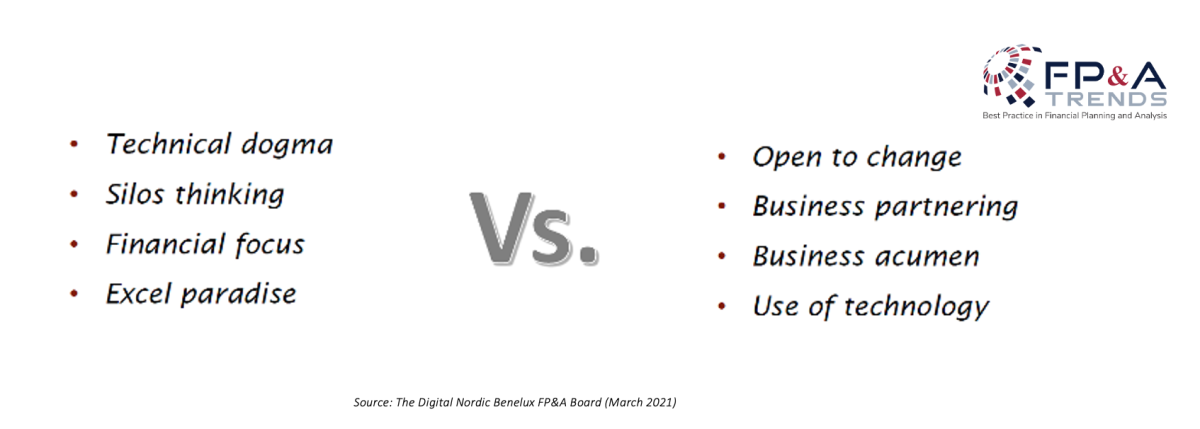

The shift in expectations and needs is for accountants to stop acting as historians and instead become collaborative influencers who provide actionable insights to decision-makers. As you can see from the image below, we are still in a transition period, but the destination is clear. Finance professionals must add value by placing themselves at the intersection of operations and strategy.

Figure 1

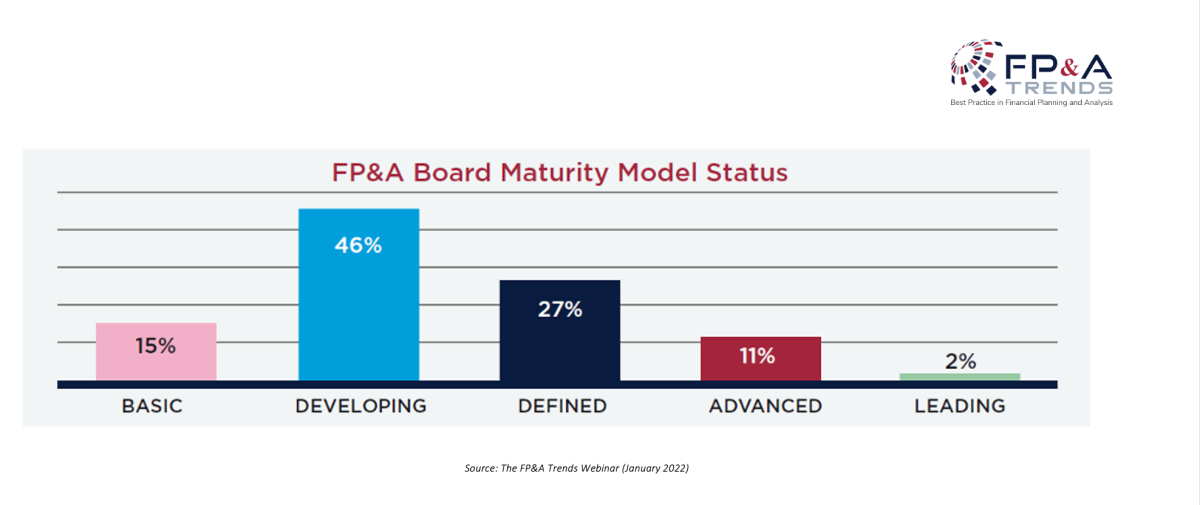

However, there is still a disconnect between what should happen to what is happening. A survey from the FP&A Board Maturity Model Status poll data shows that for 500 organisations, only 2% of them assess themselves at the Leading Stage on the FP&A Board Maturity Model (Fig 2).

Figure 2

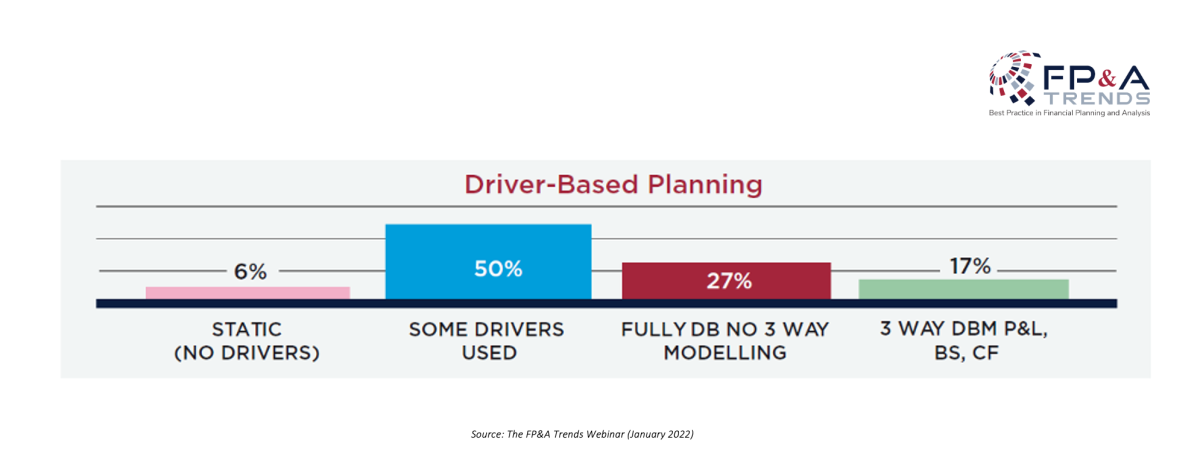

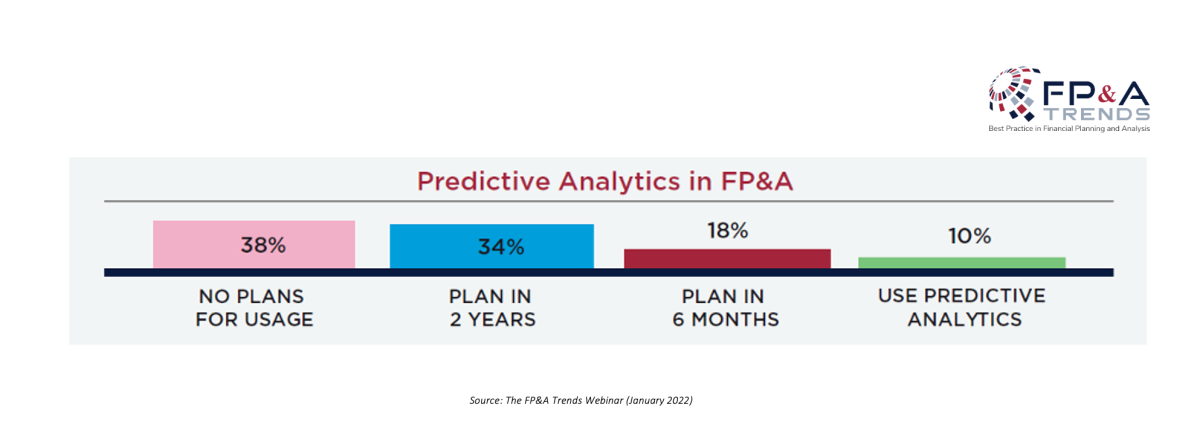

When polled further, the data shows that less than half of organisations use driver-based planning and predictive analytics in their work. According to the poll, only around 17% of organisations have adopted 3-way driver-based modelling, manually updating the balance sheet and cash flow. Most modelling in Excel is only on the P&L.

Figure 3

Figure 4

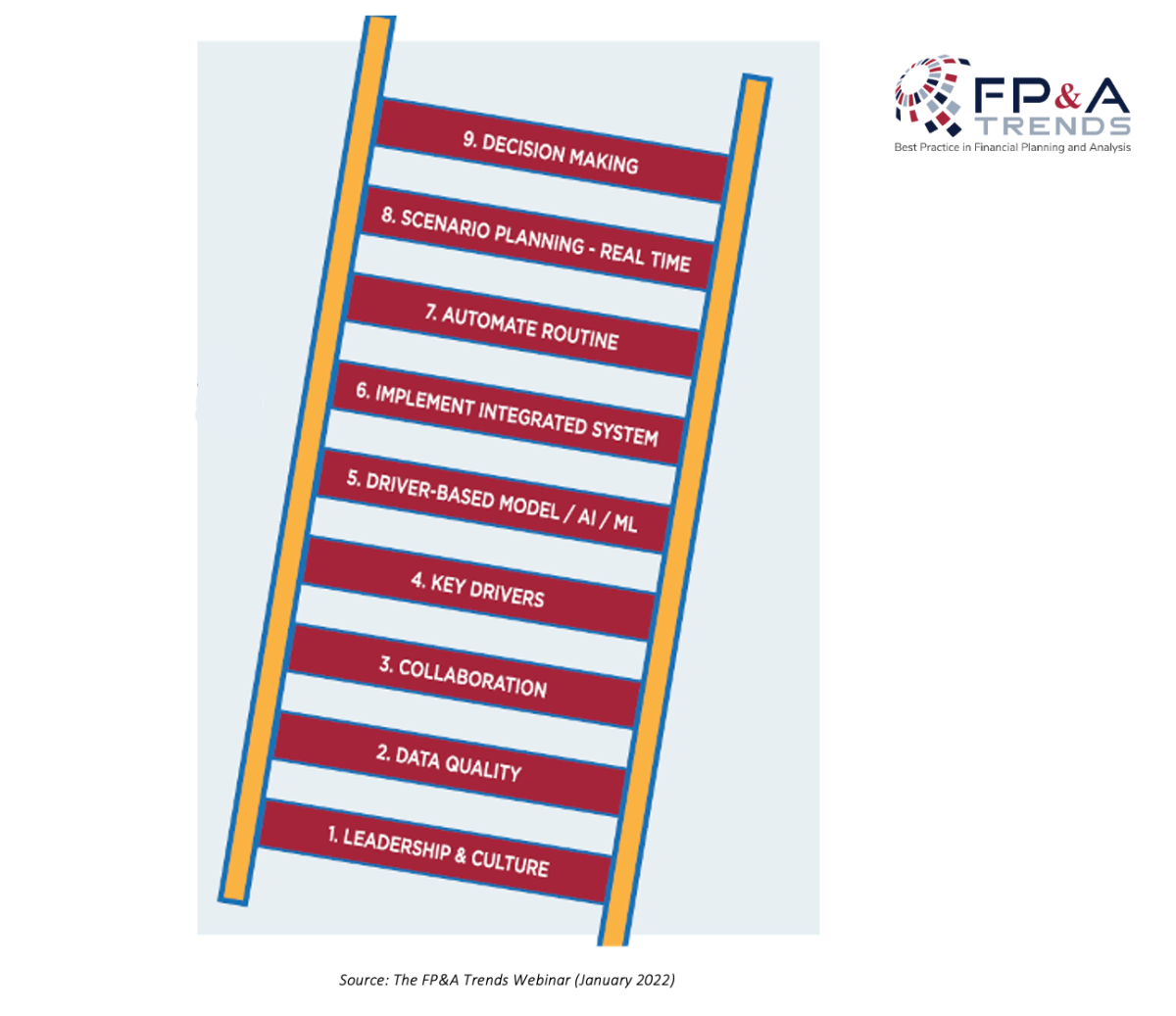

The polarisation of the analytic haves and have-nots should be cause for concern. As you can see below, catching up isn't a matter of a flash investment of cash or making a few external hires. Developing a best-in-class FP&A function requires having the right people with the right mindset, using the right tools, and collaborating and influencing effectively to make the most of them.

The diagram below doesn't show how far the gaps are between each step up. For those still stuck using only the traditional approach to FP&A, going to a non-agile approach is a herculean effort.

Figure 5

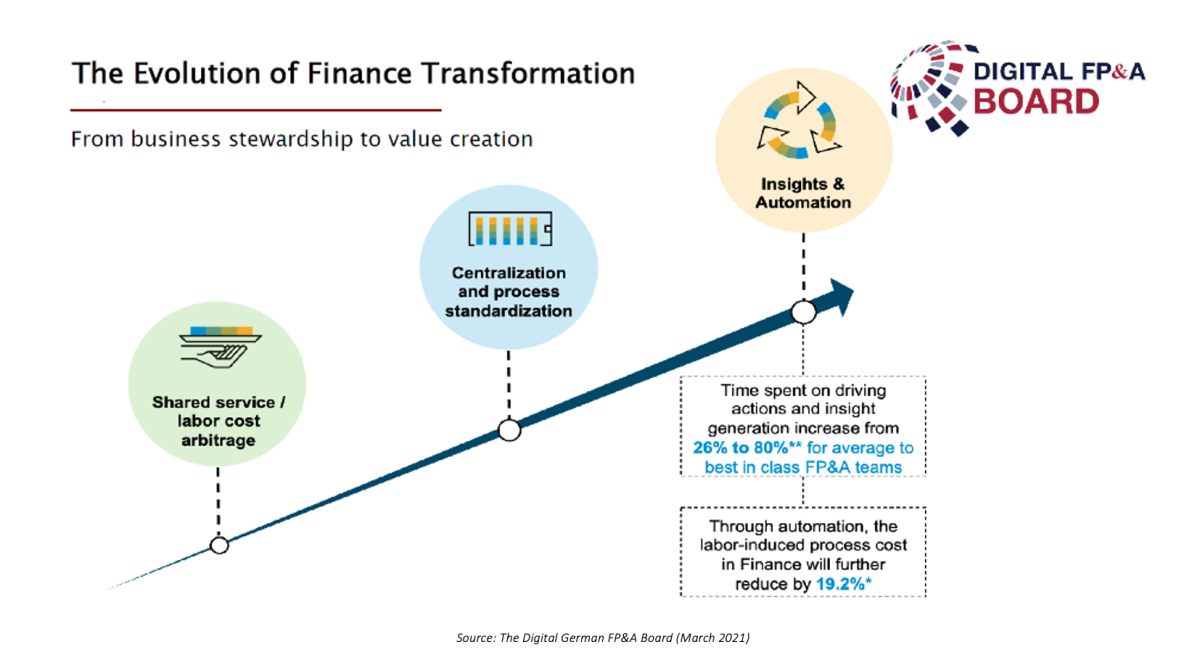

To create value and complete the evolution of finance within an organisation, the part discussed far too infrequently is the importance of robust processes that are understood, streamlined, and ready for automation.

Figure 6

First, we should look at the FP&A Trends NINE RUNGS TO FP&A TRANSFORMATION framework to get insights. Rung #7 champions the importance of automating the routine and mundane work that consumes the most time must be automated. But how do we get there?

What can and can't be automated? Who should be doing the automation? When can you automate?

Figure 7

Fortunately, the answers we seek are found in business process improvement.

What is Business Process Improvement?

Business Process Improvement or BPI is the art and science involved in change management.

Business Process Improvement (BPI) focuses on delivering value through improving quality, enhancing service, reducing costs, and/or increasing productivity of an existing activity or business process.

BPI is the tool used to identify the need for change, analyse current processes, gain organisational support, create new processes, and eventually maintain those processes. But BPI is also more than that; BPI is a continuous improvement cycle that changes how you think and approaches your tasks.

The purpose of BPI is to continually improve process productivity with the desired results being produced consistently. BPI is used to ensure that a process uses the most efficient resources to produce an outcome at the expected minimum cost.

BPI aims to identify and remove waste from processes by understanding, documenting, then improving, optimising, or automating to reduce errors and increase efficiency.

The costs of poor business processes

There are several key ways in which poor business processes cost your organisation money - one of the most obvious is inefficiency and waste. Poorly designed or managed processes can lead to much wasted time and effort and wasted materials. This inefficiency can quickly eat into your profits, and it can also lead to decreased productivity. In addition, poor business processes can create safety hazards. Finally, poor business processes can damage your company's reputation and cause customers to take their business elsewhere.

Fixing poor business processes is essential to the success of any company. The costs of poor business processes can be high, and they can significantly impact your bottom line. Taking the time to improve your business processes can save you money and help you avoid many costly pitfalls associated with poor process management.

Finally, poor processes prevent your organisation from moving past the 1st level of Traditional FP&A value-add, giving your competitors further advantages over your company.

The importance of only automating good processes

"Make the process the priority: There is no point in automating a flawed process as that will only deliver poor results faster." - FP&A Trends Research Paper 2021: Skills of the Future: Best-in-class FP&A teams and how to build them.

FP&A professionals must continuously look for ways to improve efficiency and accuracy in their work. While process automation is one way to do this, it's important to remember that not all processes are good candidates for automation.

There are a few key considerations to think about when determining whether a process is a good candidate for automation.

- First, the process should be well understood and documented, meaning that there is a clear understanding of all the steps involved in the process and who is responsible for each step.

- Second, the process should be relatively stable, meaning it doesn't change frequently. If a process is constantly evolving, it's harder to automate it effectively.

- Third, the process should be high-volume and time-sensitive. Automating a low-volume process isn't worth the effort, and automating a process that isn't time-sensitive likely won't result in any significant efficiency gains.

Finally, the process should be relatively straightforward. If a process is complex, it may be difficult to automate it effectively. Automating a flawed process can actually make things worse, so it's essential only to automate good processes.

FP&A's Role in Process Mapping

FP&A professionals are often responsible for mapping out business processes. It involves understanding the various steps involved in a process and documenting them in a way that is easy to understand. Process mapping is a valuable skill set for FP&A professionals, as it can help to improve efficiency and effectiveness within an organisation.

Process mapping can document existing processes or map out new ones. When documenting an existing process, FP&A professionals look for ways to improve the efficiency of the process. This may involve identifying bottlenecks or areas where the process can be streamlined. When mapping out a new process, FP&A professionals can ensure that all steps are accounted for and that the process is efficient.

Process mapping is a valuable tool for FP&A professionals. It can help improve the efficiency of existing processes and ensure that new processes are well-planned.

Figure 8

FP&A professionals are often responsible for mapping out business processes to understand the various steps involved in a process and documenting them in an easy way. Process mapping is a valuable skill set for FP&A professionals, as it can help to improve efficiency and effectiveness within an organisation.

When documenting an existing process, FP&A professionals look for ways to improve the efficiency of the process by identifying bottlenecks or areas where the process can be streamlined. When mapping out a new process, FP&A professionals can ensure all steps are accounted for and that the process is efficient to ensure new processes are well-planned.

Step 7- MOVING YOUR MATURITY TO THE NEXT LEVEL

"Broken processes are 10 times more difficult to fix once migrated to a system." – Patrick Jung, Senior Manager at Horvath & Partner.

Research from the FP&A Board Maturity Model Research Paper 2021 shows good processes are crucial to moving towards levels 4 and 5 (Advanced and Leading stages) right across the Maturity Model. Efficient and automated FP&A processes release the team's valuable time for higher-value activities like analysis, interpretation, and communication.

Organisations with inefficient processes, either broken or old legacy processes that are never addressed lead to more problems if process improvement is not undertaken. According to Patrick Jung, "implementing a new system without fixing the flawed old processes ends with an automated but lousy system… RPA does not fix a bad process; it perpetuates it."

Vignesh Dumonceau, CFO at Flex, stresses the importance here; "Process definition must precede data. Otherwise, you get too much data. The optimised process allows you to channel the type of data you want to collect." Even the most advanced technologies are not a substitute for refining your processes.

Don't be afraid to start small, Patrick Jung suggests. "Quick wins are important; start with a small project. It will highlight poor data quality so that the next quick win might be to improve that."

Why Start Now?

You might be thinking, Why Now? Why not learn about process improvement tomorrow?

The answer should be obvious; when done correctly and with the proper support, best-in-class processes can become a strategic advantage for a company in the marketplace. FP&A professionals can play a lead role in creating an environment where costs are low as possible, operations are efficient as possible, and answers to critical questions are provided in the shortest time possible.

Flexible firms that embrace BPI thrive while their competitors struggle through the mess of processes, people, and systems.

Figure 9

Benefits of Effective Processes

You will want to undertake business process improvements to deliver the results below. BPI is a must-have skill if you're going to:

- Enhance customer experience

- Increase productivity and efficiency

- Increase capacity from the existing footprint

- Improve the customer service and teamwork

- Reduce rework and over-processing

- Improve internal and external communications

- Standardise end-to-end business processes

Optimise Everyday Operations

Sometimes one of the best things you can do before rolling out a significant process improvement initiative is to start small.

While addressing bottlenecks is what we will be focusing on here today, an essential part of process improvement is to evaluate processes that are not broken. This can be achieved by adjusting as small as a minor tweak to a data entry process. Creating a scalable base for a company to expand upon is essential and can become a core competency. A company that does not fix problems creates a dangerous cycle that worsens as time progresses.

One of the best approaches is asking employees to document their processes without forcing restrictive requirements upon them. It's helpful to let employees record tasks in their way if it follows a few simple principles.

Documentation should:

- Be completed digitally (through Word or OneNote)

- Be reviewed by a manager

- Include screen captures and typed notes, and

- Be clear enough so a 3rd person can walk into their role and clearly understand how to execute the process as well as they would.

Conclusion: Business process mapping is a core skillset

The key to developing a best-in-class FP&A organisation is reaching level 5 maturity is getting the basics right. In addition to having the right people on your team, you'll want to ensure they understand the basics properly and have prepared the environment for growth. Understanding and improving business processes is an excellent way to develop Business Partnering skills and identify automation opportunities that will free up professionals to spend more of their day helping their organisations make the best decisions and increase profitability.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.