The COVID-19 pandemic forced companies of all sizes to scrap their business plans for 2020 and...

The budgeting process at most companies sucks the energy, time, fun, and big dreams out of an organization.

The budgeting process at most companies sucks the energy, time, fun, and big dreams out of an organization.

(c) Jack Welch

In today’s uncertain and quickly changing circumstances, the rigidity of the traditional budgeting process more and more often becomes an obvious drawback for the business.

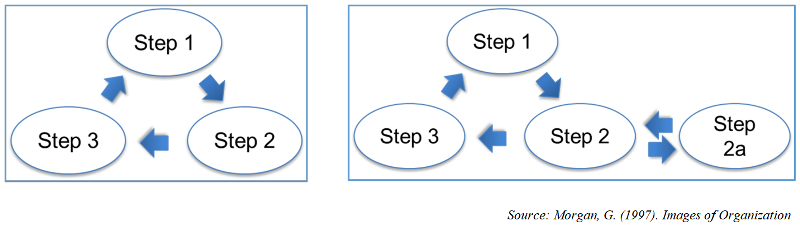

Budgeting is a typical activity that in cybernetics is called “single-loop learning” (picture 1) and suffers from the limitations inherent to this process (Morgan, 1997). Its weaknesses come from both

the fixed nature of the set target

the subjective approach to the target setting/adjustment.

Drawbacks of the target setting process

In this process, those who shout louder and are more skilled in internal politics, drive the budget distribution. Target setting meetings often resemble a game, where one side paints future business circumstances in black and sandbags as much as possible in order to minimize their risk and maximize their bonus.

The other side tries to expose inconsistencies and find whiter spots in this picture, or just bluntly sets a higher target. In the end, a fixed target revenue figure and allowed investment budget to determine the behaviour and fortune of the business unit for a year.

A fixation on a rigid target can easily dominate company minds and downplay other key aspects of the overall situation (Morgan, 1997). Corporate life is full of horror stories ranging from overloaded warehouses of customers incentivized by lavish bonuses at the end of a financial period, later compensated for the write-offs of unsold products, and down to the rush spending of investment budgets at the end of the fiscal year.

In retrospect, such episodes always seem as shortsighted and bluntly stupid. More fundamentally, they are systemic and inevitable in any situation where people are encouraged to edit their understanding of reality to suit narrow purposes (Morgan, 1997) and rewarded for doing so. However, with this realization, instead of fixing the incentive system, companies often spend more money to strengthen control in an attempt to avoid such behaviour.

Double-loop learning process for the budgeting process

In order to overcome these limitations, cybernetics offers “double-loop learning process” (picture 1 below), where the behaviour of an intelligent system requires a sense of the vision, norms, values, limits, or “reference points” that guide system behaviour (Morgan, 1997).

These “reference points” must be defined in a way that creates space where actions and behaviours required for successful learning and innovation can emerge, including those that can question the imposed by step 2 limits (Morgan, 1997).

Picture 1. Single- and double-loop learning:

Step 1 = scanning the environment. Step 2 = comparing results against the set target and norms. Step 3 = initiating corrective actions. Step 2a = checking target validity and when needed introducing target/norms correction (the second loop).

Setting dynamic targets using the Evolution Index

Reorganization of the budgeting system is a complex process that can take years, so companies can start experimenting with establishing a set of secondary dynamic targets and search for simple financial rules as relevant reference points. These dynamic targets should reflect changes in the environment and incentivize managers to strive for the best results within a set of boundaries defined by financial rules.

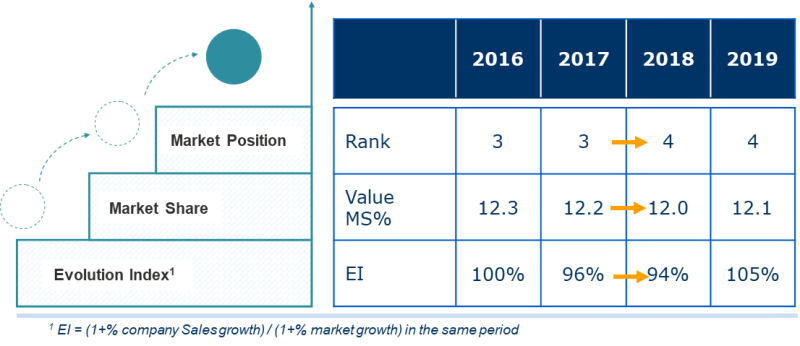

One way of setting a dynamic target is to measure company’s performance versus market using Evolution Index (EI), which is applicable both to the company as a whole and to its business units or separate products.

The strength of this metric is its simplicity: changes in the company’s sales are compared with the market dynamics. Yet EI is quite comprehensive; by studying EI dynamics over several years we can analyze the changes in market share and the company’s position among competitors (picture 2).

Picture 2. Company in-market performance measured via Evolution Index, Value market share and Market position.

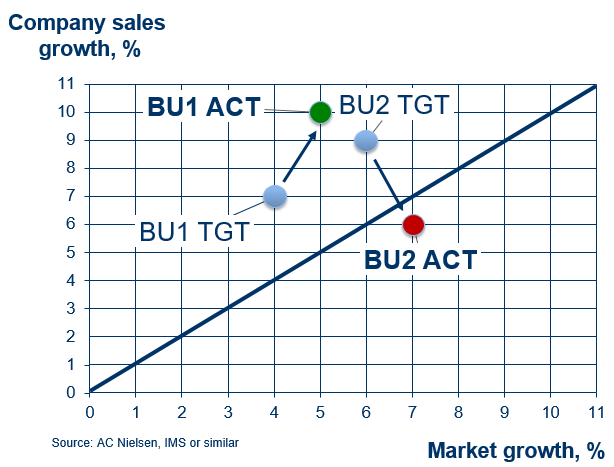

You can see a working visualization of Evolution Index for setting objectives and measuring results in picture 3.

Two Business Units (BU1 and BU2) targeted to outperform the market by 3% (BU1 targeted to increase sales by 7% assuming 4% market growth; BU2 targeted 9% sales boost expecting 6% market increment; for both BUs EI TGT = 103%).

Actual results are positive for BU1 growing 10% in the market expanding 5% (EI ACT = 105%) and negative for BU2 growing below market pace (EI ACT = 99%).

In order to understand and explain BU’s performance, managers should dig deeper and figure out what drives the numbers (e.g., see P&L management).

Picture 3. Target (budget) and actual performance for two Business Units of a company measured by Evolution Index.

Boundary setting can start with developing simple financial rules for functional costs, e.g., the cost increase should be less than the sales or gross margin growth. In this case, a business unit experiencing market headwinds should adjust its cost to comply with the rule.

The same rule will incentivize budget reallocation to the growing areas without seeking any approvals. Headquarters reserves the right to approve the rule violation cases required for investments creating a base for future growth. Freedom of operating within the set rules fosters learning within the organization and helps ensure a profitable growth.

Advantages of the double-loop learning concept for budgeting

Moving away from fixed budgeting to a flexible system based on EI supplemented by financial rules allows a company to make steps in the direction of a double-loop learning and has multiple advantages:

Target setting against the market minimizes both politicking and the need for adjustments in case of market fluctuations.

Management focus shifts from the pursuit of static budget numbers to the understanding of customer needs and seeking ways to outperform the competition.

The new system incentivizes managers to focus on the “Pull” sales model (vs. the prevailing “Push”): EI measures sales to final customers not to intermediates.

To sum it up, the improved budgeting process based on double-loop learning can transform the way companies operate. The upgrade from the fixed budgeting approach can begin with setting new KPIs that reflect market dynamics and connect the incentive system to actual in-market performance. Introduction of Evolution Index as a secondary performance metric and setting simple financial rules can be a good starting point for transforming budgeting into a source of competitive advantage.

Bibliography

1. Morgan, G. (1997). Images of Organization. SAGE Publications, Inc.

2. Welch, J. (2005). Winning. Harper.

The article was first published on LinkedIn.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.