On the 8th of April, I had the pleasure of joining The Art and Science of xP&A Business Partnering of the Digital Pan-Asian FP&A Board facilitated by Hans Gobin, International FP&A Board ambassador.

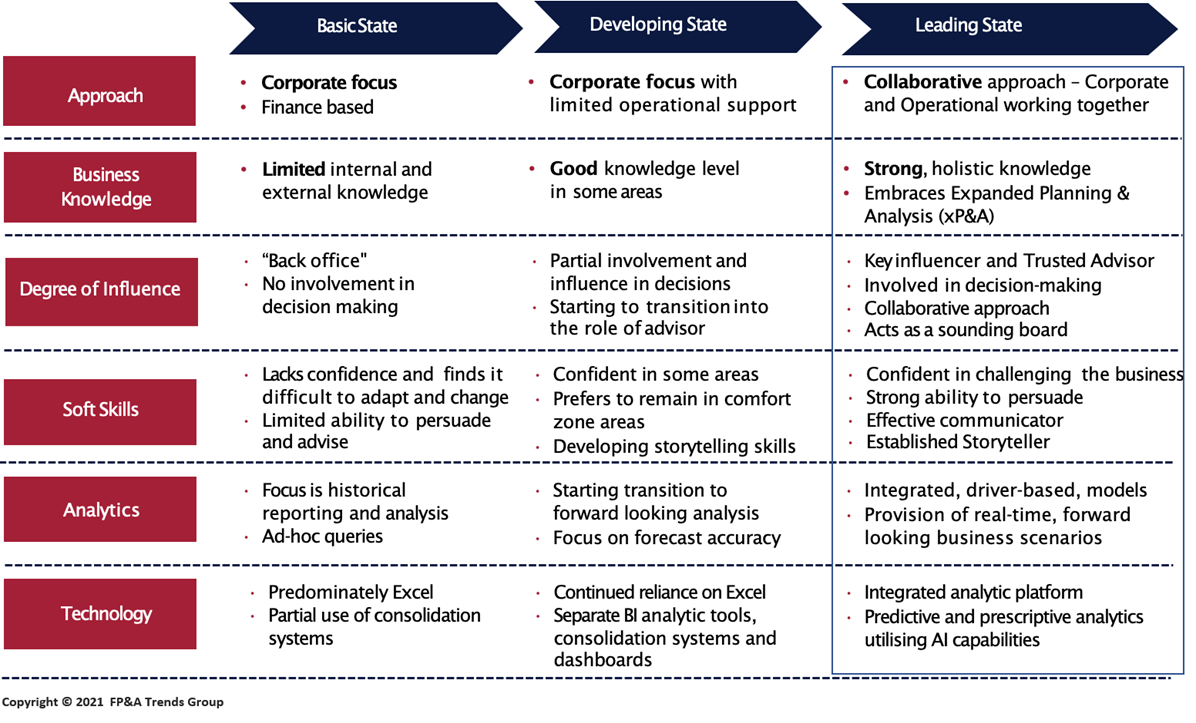

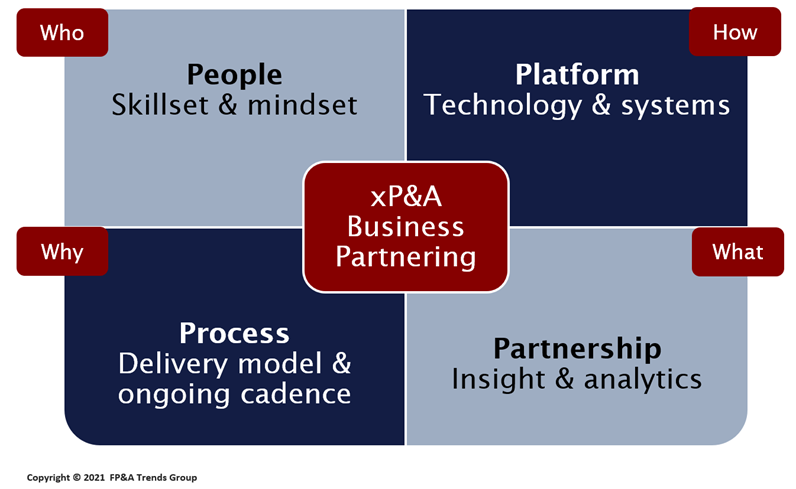

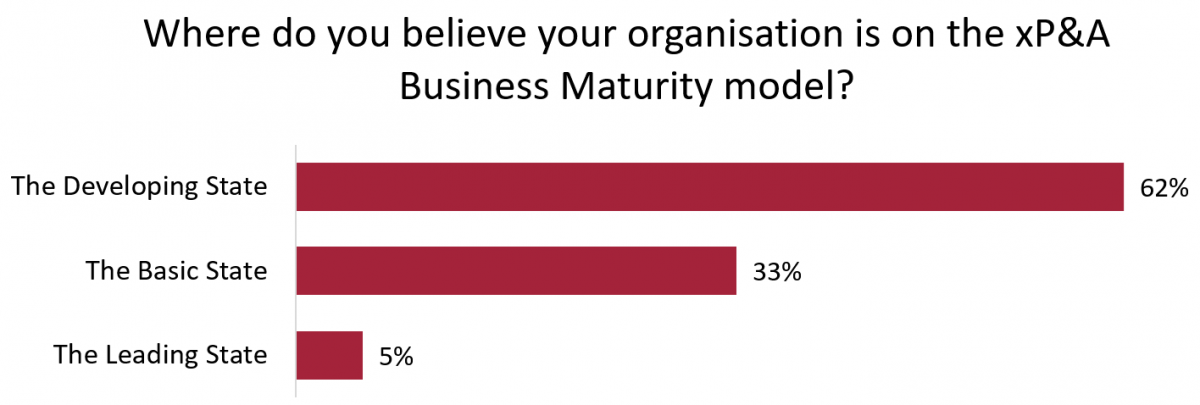

FP&A function is changing rapidly together with our world. xP&A means “Extended Planning & Analysis” and is now slowly taking place of the traditional FP&A. FP&A Business Partnering Maturity Model as below is showing us three stages of different aspects of core FP&A competencies. xP&A is covered under the "Leading State" column.

FP&A Business Partnering Maturity Model

This article will look at five important stages of the art and science of xP&A Business Partnering that were covered by experienced panelists who are at the “Leading State” in their organizations.

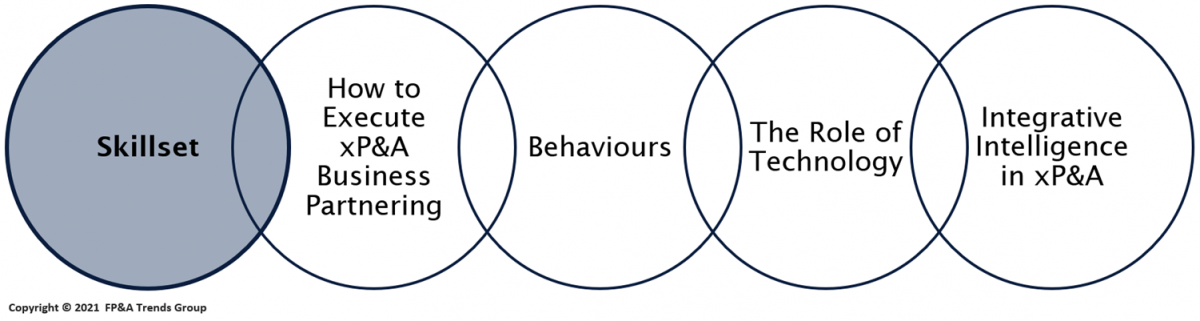

The Art and Science of xP&A Business Partnering

There are five main areas in xP&A Business Partnering:

Skillset: learning what types of skills are required to handle xP&A Business Partnering.

Execution: understanding the execution of xP&A Business Partnering with hands-on experiences.

Behaviors: feeling what kind of mindset is required to be a better partner.

Technology: embracing the technological part of the business partnering.

Integration: evolving traditional FP&A roles into new-age business partnering duties.

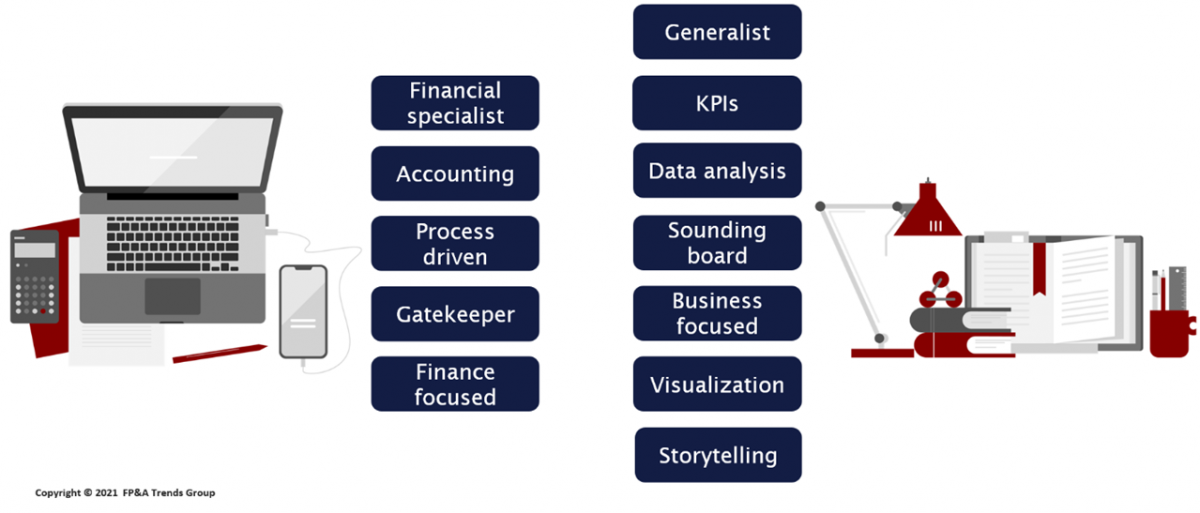

Skillset

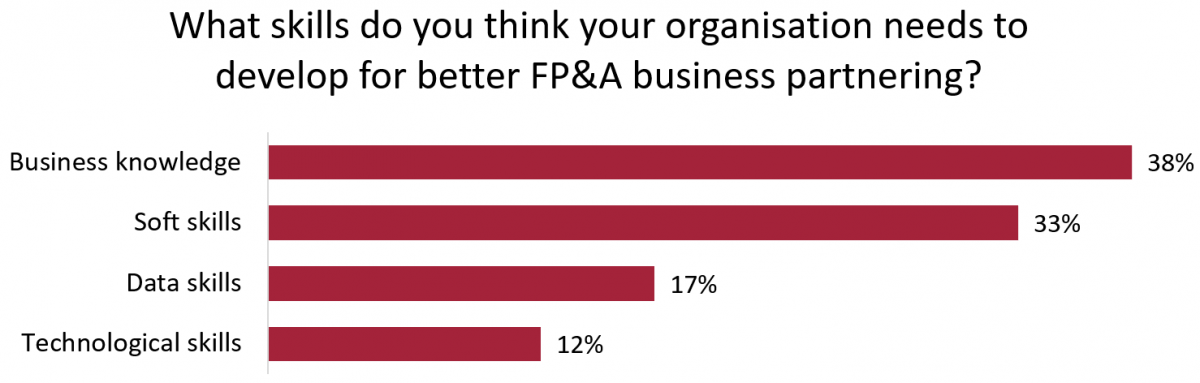

The above graph compares the traditional FP&A skillset, which is shown on the left side of the table above, to the xP&A skillset on the right side of the table. A classic FP&A role is a Financial Specialist who works well with financial statements. He/she usually works as Gatekeeper, and due to budgeting and forecasting preparations, the classic FP&A role is process-driven.

However, new generation FP&A roles are more “Generalists”. Generalist does not mean understanding a bit from everything. A new generation FP&A professional can communicate with stakeholders and work with KPIs built specifically for their needs.

Data analysis is the most technical and technology-driven aspect of xP&A. In the new age, data analytics skills are quite important to be able to make a scientific understanding behind the large amounts of information.

Finally, there are also soft skills in the xP&A role. The majority of the stakeholders would like to receive the analysis as concise as possible. Thus, telling the story of the business cases with visual presentations is key to success.

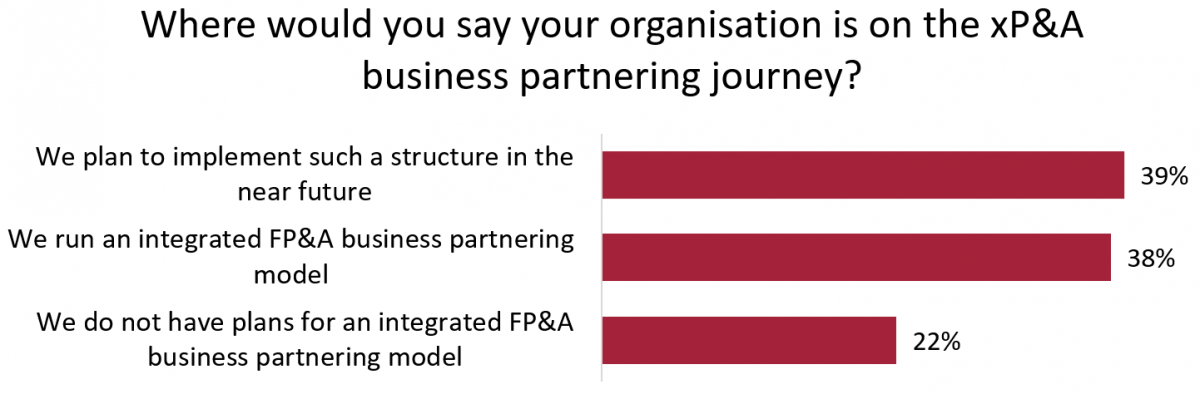

Question 1. Replies from FP&A Board participants (almost 200 finance professionals).

xP&A Business Partnering Execution

Paul Lennie, CFO of Asurion, explained the execution of business partnering with four P’s based on his professional experiences:

People: The skillset of people is one of the hardest obstacles to tackle to build a strong xP&A Business Partnership. To do so, there are usually three options. One, to hire from outside of the company, which is the most expensive one. Two, to train existing employees, and three, a combination of external hire and existing employee's training. Asurion decided to go with option three, created a centralized analytics department at HQ, and made sure to secure jobs of existing employees during the training stage. The company used the same sources in every meeting to be able to synchronize the correct information with the rest of the stakeholders.

Platform: The key here is to implement a new technology solution and if it fails, then the company can learn quickly. ”Taking giant technology steps was not optimal for Asurion when we looked back.”, Lennie says.

Partnership: Communicate, communicate and communicate is the key to partnership. xP&A function needs to know what sort of reports and information other stakeholders would need.

Process: Delivery models can be slowly upgraded to artificial intelligence and machine learning to transform data into important insights and this should be done by letting other stakeholders know about these methods as well.

Question 2. Replies from FP&A Board participants (almost 200 finance professionals).

Behaviors

Behaviors are representing the human skills (soft skills) part of the xP&A Business Partnering role. Key takeaways from this presentation are:

Understanding the business so that your perspective and counsel can be with that context,

Knowing and understanding your audience and the people you partner with, particularly how they best receive and understand financial information,

Building a reputation for good judgment and fair dealing, for enabling where you can and pushing back when it's the right thing to do,

The importance of modeling good behavior to your team and providing opportunities to learn - if you're going to a meeting, take a friend!

During the Q&A session, one of the questions to Emma Martin, Commercial & Finance Director at Ogilvy, (panelist for this part) was: “What if the culture of the companies is not ready to change for expand a vision?”. Emma pointed out the importance of the executive team’s sponsorship. If the executive team is not ready to change the culture, then the reasons for this change should be explained to them.

This answer is telling us the importance of the culture of the executive team of a corporation for important changes like xP&A.

Question 3. Replies from FP&A Board participants (almost 200 finance professionals).

According to the above results, the FP&A function is majorly dealing with data and tech skills and do not have enough time to improve business acumen and human skills.

The Role of Technology

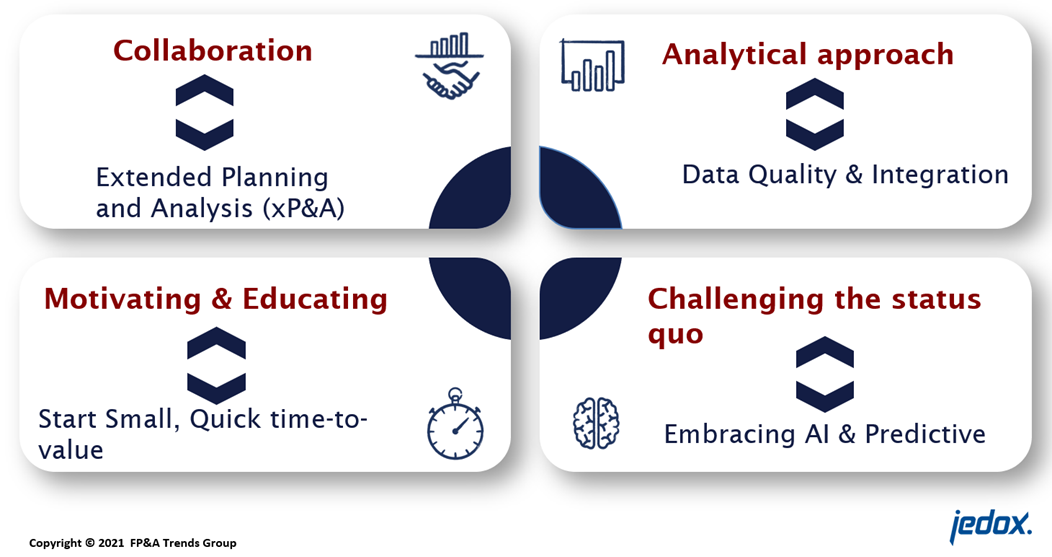

According to Jithu Varghese, Senior Consultant, Solution Advisory – ANZ at Jedox, the role of technology for xP&A Business Partnering can be explained with four main subsets:

Collaboration: Currently, 79% of the FP&A professionals say that at least 30% of their time on activities that do not add value to the business according to Deloitte's survey. According to KPMG's survey, 23% of finance managers are not ready to support business decisions due to the COVID crisis. To collaborate with the other stakeholders, FP&A roles should be occupied with more high-value-added activities instead of data cleaning, etc.

Analytical approach: According to the KPMG survey, 80% of CFO's agree that they must take ownership of the quality, timeliness, and depth of all business performance information and insight but 33% say that they are not in a position to do so. The goal here is to improve data quality and completeness to be able to leverage AI, integrate with other sources in the company, and easy usage of excel.

Challenging the status quo: 84% of the finance executives say that offline spreadsheets are still the main tool used by their Business Partners. 39% of finance executives say that finance systems rationalizations/simplifications/increased automation are current priorities while 51% of finance executives say they are future priorities for their companies. Leveraging AI and Predictive analytics are the key topics here.

Motivating & Educating: 67% of finance executives say they have accelerated their digital transformation strategy since COVID started and 63% say they have increased the digital transformation budget since COVID started. The key here is to start small and in case of failure, the damage will be smaller.

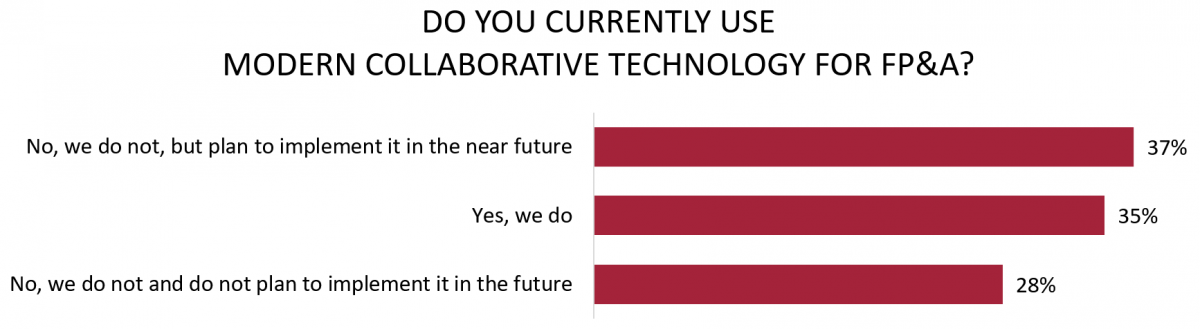

Question 4. Replies from FP&A Board participants (almost 200 finance professionals)

Integrative Intelligence in xP&A

Bryan Lapidus, Director of FP&A Practice at the Association for Financial Professionals (AFP) has explained this topic with five main subsets:

Define shared value

Build with modularity

Expand your view of the Team

Enhance project management skills

Provide effective challenge

Key takeaways from here would be the combination of the first four panelists. xP&A function needs to define a share value and work around it, take small steps instead of giant technology implementations and test them first, knowing your audience and have great communication skills with the rest of the organization.

Summary

With the digitalization age, the FP&A function is also updating itself. xP&A is challenging the old status quo. What we have learned from the FP&A Board’s insightful presentations are the following lessons:

Collaborate with the rest of the company, know your business inside out, do not be stuck with finance only,

Get ready for new technologies such as AI/machine learning, love data,

Communicate, communicate and communicate some more!

We are grateful to Jedox, Michael Page and AFP for sponsoring this event.