Financial Planning and Analysis (FP&A) play a pivotal role between Strategy, Business and Data: a business partner...

This article is about a basic understanding of main value creation concepts and how those impact the work of FP&A.

This article is about a basic understanding of main value creation concepts and how those impact the work of FP&A.

We take a look at value creation from a financial lens – the DuPont analysis framework for calculating return on investment (ROI).

What is the DuPont framework?

In 1912, the key principle introduced was the idea of the “return on investment” (ROI) as a simple and intuitive measure of performance.

This measure gives a sense of the earning power of the organisation's assets. It is a simple and intuitive way of looking at and analyzing financial statements and also comparing companies in widely different industries. This method changed the corporate finance world forever.

Why is Value Creation important?

Ultimately, every investor in every business wants, amongst other things, to see some kind of financial return. The expected return can be linked back to the strategies and operational management of the business.

For finance professionals, who are guardians of the financial capital of the business, Value Creation is a key element.

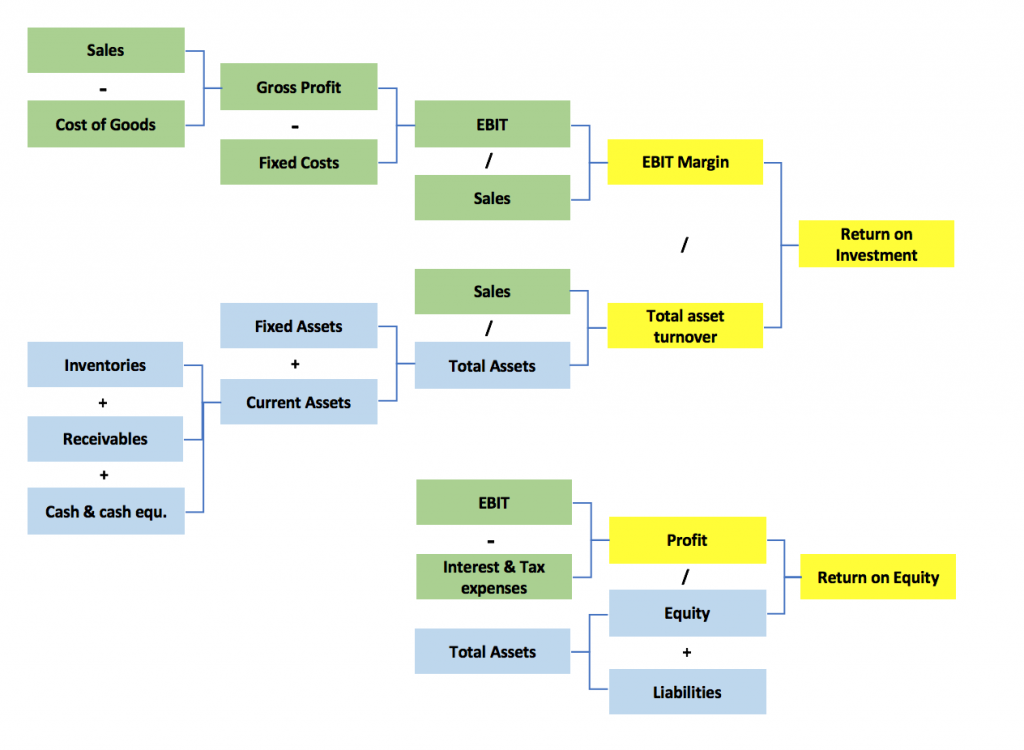

How does the DuPont Analysis Framework look like?

The basic illustration of the framework is given in the image below.

On the left-hand side of the chart, we can see elements that relate fully to the Profit and Loss (P&L) or Income Statement. This is the side that is focused more on the "outcomes":

- it relates to the commercial success of the firm.

- it focuses on the strategic effectiveness of the organization.

On the right-hand side, there are elements that relate to the Balance Sheet (BS). This side is more focused on the “resources”:

- its primary focus is on efficiency i.e. how hard we are making the assets work.

What are the implications for FP&A?

FP&A / Business Control has been very good at monitoring profit and margin ratios and, increasingly, able to link that back to the underlying business drivers. Traditionally, FP&A has been working with the Business Unit (BU) management to optimize business unit profitability.

More interesting elements are on the Balance Sheet (BS). Traditionally, the BS has been seen as an accounting domain used for correct reporting. Primarily it has been driven by the concept of legal entities which have to be audited and for which statutory reports have to be filed.

However, Corporate FP&A (and even BU FP&A) should be willing to demonstrate more interest, ownership and access to the operational parts of the balance sheet in particularly two areas:

- Fixed Assets

- Operational Working Capital (Inventory, Account Receivable, Accounts Payables).

This requires a broader end-to-end process understanding (e.g. order to deliver, invoice to cash, procure to pay, etc.). FP&A should be able to ...

- link the operational management of these processes back to the P&L impact

- articulate the longer term trends around the development of the BS items.

Otherwise, FP&A misses the potential to focus on a critical performance improvement lever.

Are there any watch-outs?

There are several things that should be considered:

- Like with any analytical framework, FP&A should be careful with linking a rather conceptual framework to the real underlying business drivers of ROI, past, current and future performance.

- The DuPont framework relies fully on figures taken from recognized audited financial statements. Therefore, there has to be sufficient understanding of accounting principles and, in particular, changes in reporting standards and accounting principles.

- As more and more organisations become less capital intensive, the ROI and Value Creation drivers start to shift potentially more to the outcomes side. Therefore, it is critical to have a deep understanding of the organization's business model.

- When it comes to returns, there is always an element of risk. Therefore, FP&A needs an understanding of the key external and internal risks navigated historically and the ability to deal with them in future. This is critical to put any ROI analysis into its proper context.

- Any ROI analysis can give any answer especially if it is about a future projection (hockey sticks, anyone?). So, it is important to reference what has actually happened. Whatever the future ROI is, it has to be in the context of whether it is a good enough return for the “investor”. This is why FP&A needs to understand investors' expectations.

Summary

In this article, I hope to have shown that a hundred-years-old framework such as the DuPont framework continues to be relevant today. It is an invaluable tool to help link to a broader Value Creation story for both external consumption as well as internal alignment to strategy and operations.

The article was first published in Unit 4 Prevero Blog

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.