In this series of blogs, the author will be providing a comprehensive approach to the design...

The role of planning is to help manage what can be controlled (i.e. the organisation’s business processes, the resources it applies to those processes, and the volume and quality of work done in those processes) to produce outcomes that will achieve organisational objectives, within an uncontrollable and unknowable external environment. From this, it can be seen that an organisation’s business processes are central to Business Analytics.

The role of planning is to help manage what can be controlled (i.e. the organisation’s business processes, the resources it applies to those processes, and the volume and quality of work done in those processes) to produce outcomes that will achieve organisational objectives, within an uncontrollable and unknowable external environment. From this, it can be seen that an organisation’s business processes are central to Business Analytics.

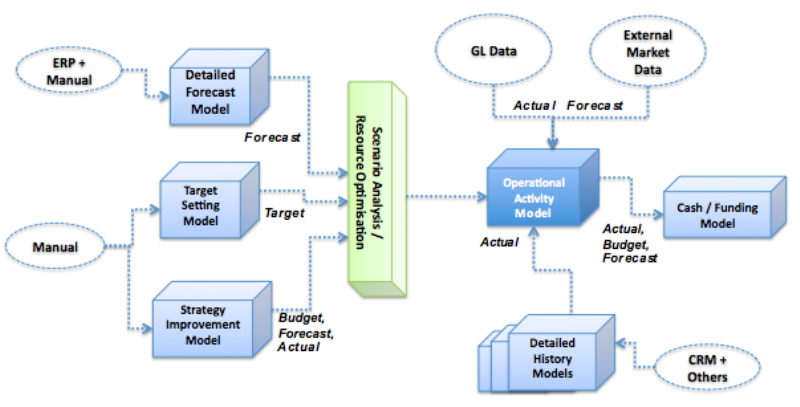

To plan and monitor performance effectively requires a network of analytic models. Most organisations are too large and complex to have a single model, and so the models I will describe may be implemented as separate but linked physical entities.

These models focus on 7 key questions that management should know about its business processes:

- How efficient and effective are the organisation’s business processes? (Operational Activity Model - OAM). This model is where the relationships between business process activities, resources, and outcomes are defined and comprises of a range of measures through which departmental activities and outcomes can be judged. It also holds a number of versions of data (Target, Budget, Forecast, Actual, Benchmark) that can be used to assess whether the operation is functioning well and if the resources allocated to activities represent good value.

- What trends are ‘hidden’ in the historic detail? (Detailed History Model). This comprises detailed data behind each measure, such as sales which may be broken down into customer, product, channel, and so on. Similarly, it may also contain a list of general ledger transactions behind a departmental expense line that appears in the above OAM. The aim is to reveal any trends that can be used to predict future performance and how they can be enhanced/mitigated.

- What long-range targets should be set given where the market is heading? (Target Setting Model). This model is typically driver based at a summary level to allow senior management to set aspirational goals for the organisation to achieve in the medium to long term.

- Where is the organisation heading if it continues with its current business model? (Detailed Forecast Model). This contains details behind user-entered forecasts and should be a true reflection of the current prospect of the organisation.

- What could be done differently to better meet long-range targets, and how much would it cost? (Strategy Improvement Model). This model allows managers to run a variety of scenarios of changes to the way it operates in order to meet long-term targets.

- What choices/risks do management face, and what would be the impact on corporate goals? (Scenario / Optimization Model). This is similar to the Strategy Improvement model but allows management to stagger strategic improvements that make the best use of available resources

- How much funding is required to implement the plan, and where will it come from? (Cash / Funding Model). This last model looks at the cash-flow implications and allows senior managers to assess how any capital items are to be resourced.

Each of the above models is likely to have different content, and structures and are used by different people at different times. However, none can be omitted or ignored, and all need to operate as a single, data-driven management system.

From a planning systems point of view, this network of models can be visualized as follows:

Figure 1: Schematic overview of the 7 key models required to manage performance

As can be seen, these models are fed with data from internal systems, such as the general ledger, and from external sources, such as market information, along with data supplied by end-users.

Obviously, in this type of blog, I’ve been unable to go into too much detail on how these operate, but hopefully, there is enough here to get you thinking about the models you need to run your business.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.