There have been not many details about how to get started with a machine learning (ML)...

In each sector, the analysis of time series can be very useful for determining the general evolution and behaviour of market dynamics. These methods are applicable to any time series forecasting problem, including inventory control, workload projections, stock market analysis etc.

In each sector, the analysis of time series can be very useful for determining the general evolution and behaviour of market dynamics. These methods are applicable to any time series forecasting problem, including inventory control, workload projections, stock market analysis etc.

Studying the time series for a particular sector or product allow us to better understand what the situation is for the upcoming period and plan accordingly. Nevertheless, the budget process is mainly driven by the “wish to have” approach when the targets and ambitions are set too high compared to the actual data.

This article will discuss how financial planning and analysis (FP&A) professionals can determine the general market trend using a statistical approach based on time series and how they can apply some adjustments to reflect different opportunities or threats to the business plan.

Using time series for forecasting

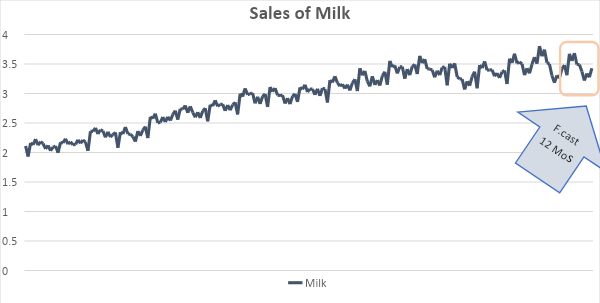

Time series is a sequence of equidistant data; for our financial sector, the relevant period is the month. For example, in this graph, we can see the general trend of a particular market: milk sales from January 1995 to December 2012 in the United Kingdom. In the last part of the graph, we can see the statistical forecasts based on the SARIMA model.

Fig 1. Milk Market Sales and Forecast for the last period.

Choosing the model

The result of the forecast may be different due to the statistical approach used. The SARIMA model is one of the most popular models used for forecasting, together with the exponential smoothing methods.

Another approach is based on the Machine Learning technique which is based on the fact that a type of Artificial Intelligence allows the software to become more accurate in predicting results and finally the hybrid models based on the combination of various methods.

Machine learning, like other approaches, uses historical data and the most important thing is that all statistical models operate by inertia based on past data. Then every model is unable to predict a so-called “Black Swan” situation due to pandemic virus, wars, earthquakes or other causes that break the balance of the series. This kind of situation could affect the series with a short or long transient depending on the business sector. For example, the aviation industry will be impacted for a certain period of time before returning to a normal routine after the pandemic virus.

Determining the forecasting accuracy

The first consideration is the accuracy of the prediction. One of the most important measures is the MAPE (mean absolute percentage error) and it is the most common indicator of the loss function. It is constructed as an absolute value of the difference between the actual data and the forecast. In our example, it is approximately 1%. So, our prediction line is very accurate. This is a very comfortable scenario and, in this example, it means that the model used is a valid predictor of the business. Other measures of accuracy are given by RMSE (Root Mean Squared Error) and sMAPE (symmetric mean absolute percentage error).

Identifying potential opportunities and threats

Suppose that our company operates in the milk/yoghurt and cheese industry. As finance managers, we have to elaborate the financial plan for the next year and we can also assume that until last year our estimates based on the statistical approach are accurate and reliable.

In other sectors, there are other assumptions that should be taken into consideration concerning the business. For example, in the oil industry price change in response to new cycles, policy changes and fluctuations. Another aspect is that many producers are located in unstable regions and, in this case, we have to consider all these aspects before any forecasting evaluation.

For a company example used in this article, we have to consider that many companies will compete on market share and therefore many of them will maintain or improve their position.

Having said that, during the financial plan process we should consider the following steps:

- Examination of the statistical forecast line in order to detect general behaviour and market trends, for example, the seasonality, peaks and breaks, stationarity and potential evolution.

- Provide forecasted revenue figures through an adequate statistical model according to the trend mentioned in the previous point. This will help the board of directors and the chief financial officer to see what the evolution is. This preliminary part is essential in order to understand what the situation is without any kind of intervention.

- Usually, if the point 2 satisfies the initial assumptions, no intervention or adjustment is needed. If point 2 does not correspond to the internal needs of the organization and management requirements, apply adjustments by looking at both opportunities and threats:

- Opportunities: The company can increase its revenues by

- introducing a new product in the coming periods.

- following a more aggressive price policy in order to increase the sales.

- engage in a mergers and acquisitions operation.

- Threats: The company can reduce the revenue because

- it does not invest in a new product or in marketing campaigns.

- it wants to diversify the business and the milk sector is no longer strategic.

- Opportunities: The company can increase its revenues by

What we need to note in this example is that the milk market is the aggregation of several companies, so the overall vision for the whole market may be little different from a single producer due to the market share. Then every single producer has a different vision of the potentiality of the market.

That is why it is very important to study the market with a general perspective and therefore to apply potential opportunities and threats for a single company.

Applying adjustments to the model

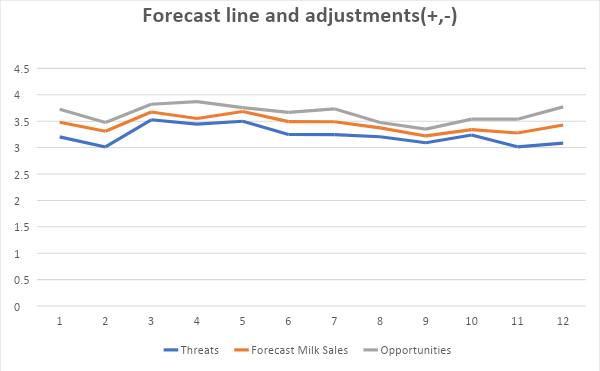

Fig 2. Forecast line with adjustments (forecast period - 12 months).

In Figure 2, we can see an example of the methodology explained above; orange line is the forecast calculated by the model, while grey line and blue line represent the potential opportunities and threats of the market respectively. Thus, based on this consideration we can build our sales revenues accordingly.

The vision of the company could be different from what we see in the chart. Alternatively, a company could elaborate and consider a market more profitable than the forecast line and sometimes it could be lower.

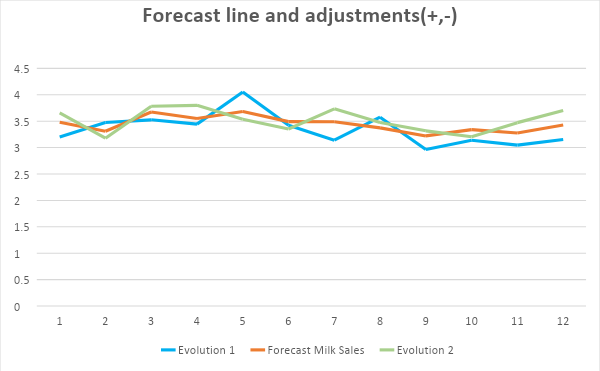

This example is represented in Figure 3 where we can see two visions of the market where the adjustment lines are considering as opportunities and threats month by month compared to the original forecast line.

Fig 3. Forecast line with evolutions (forecast period - 12 months).

Summary

By preparing budgets with the help of statistical forecasts, finance professionals can avoid or limit the classic deviation from the "wish to have" budget and reach better accuracy than while using the traditional process.

In the above example, I focused on the company methodology rather than on the type of the technique used for forecasting. It is recommended to use a good model for any kind of representation (MAPE lower than 5% if the market is rather stationary).

In the examples above, we can see how to approach to the statistical forecast line, for the whole market. The most important thing is that if the forecast line is accurate and reliable and represents the general evolution of the business, we can take into account the opportunities and threats in a simple way (Fig 1) or attribute a different pattern for adjustments (Fig 2). Of course, this is a part of the company knowledge and the tools used to carry out the final evaluation of the plan are independent of the board’s considerations.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.