This article explores the practical applications of AI in FP&A, exploring the opportunities and challenges of...

As Artificial Intelligence (AI) continues to revolutionise industries, finance professionals face pressing questions: how will AI impact FP&A Business Partnering? Will it replace key human functions or serve as an enhancement?

In a recent FP&A Trends webinar, experts from Amazon, CGI, and Workday explored these questions, highlighting the role of AI in driving efficiency and accuracy while emphasising its limitations. AI tools like Predictive Analytics, Machine Learning, and natural language processing are increasingly integrated into finance operations. How do they change human role within FP&A teams?

This article answers these and many other questions on FP&A Business Partnering in the Age of AI Advancements.

AI-Enhanced Decision-Making at Amazon

In the webinar, Wim De Rouck, Finance Director CEU CF at Amazon, presented how Amazon uses AI to enhance efficiency and decision-making, especially in finance operations. His team focuses on creating a more frugal and durable Amazon by offering performance insights and partnering with operational leadership. AI supports decision-making processes, mainly through tools like chat ops, which help gather and interpret data across Amazon’s extensive network. Machine Learning has also proved highly effective in forecasting sales volumes, outperforming human methods.

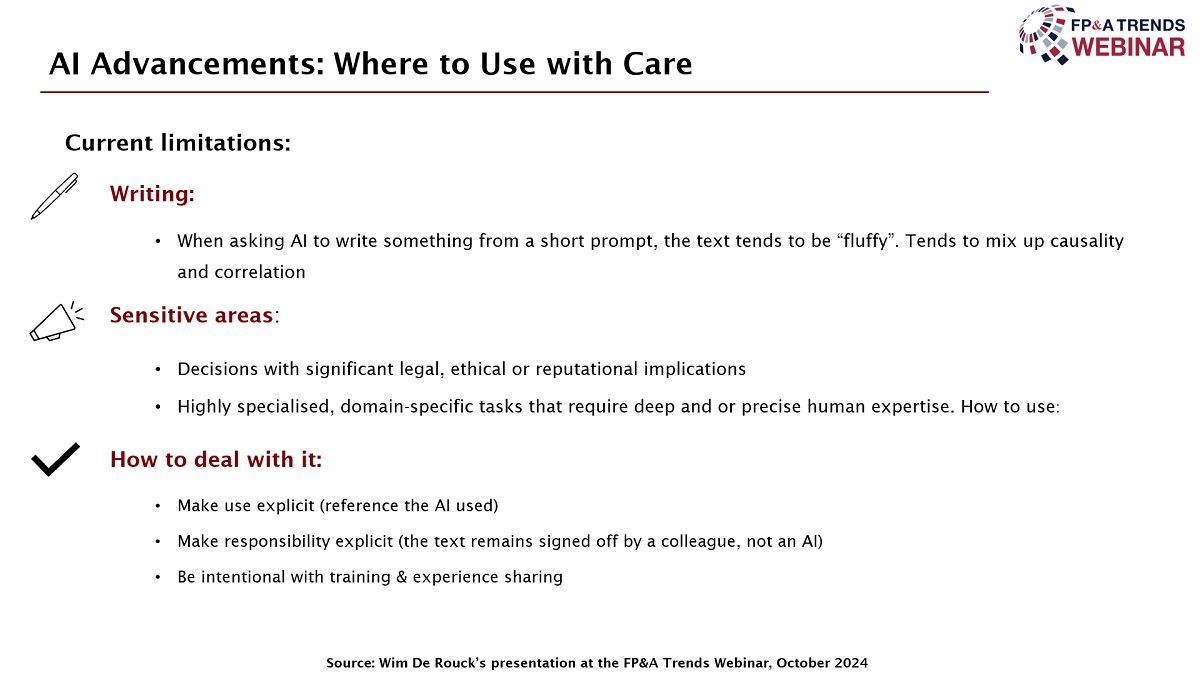

Wim emphasised that AI helps with tasks like document summarisation but highlighted that it requires careful use. He warned against relying on AI for sensitive tasks, such as writing or handling legal and ethical matters, as current AI lacks built-in ethics.

Figure 1

He advocates for clear communication of AI use and insists on accountability for its outputs. While AI assists in many functions, Wim stressed that human insight remains crucial, particularly in complex decision-making areas and when identifying inefficiencies that tools might miss. He concluded by emphasising the importance of conciseness and added value in communication, underscoring humans' irreplaceable role in understanding causality and correlation and insights interpretation.

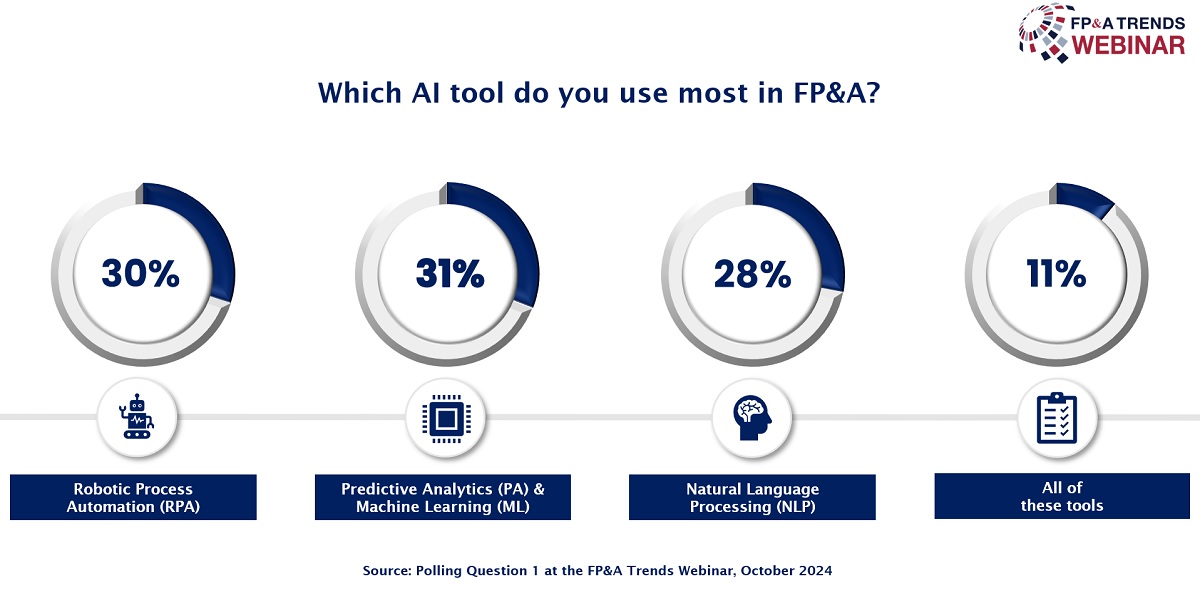

Which AI Tool Is Being Used the Most in FP&A?

Approximately 11% (an incredibly high number!) of the audience reported using all three tools—Robotic Process Automation (RPA), Predictive Analytics and Machine Learning, and Natural Language Processing (NLP). Meanwhile, about a third of the participants used each of these individual tools.

Figure 2

We Are Just Scratching the Surface with AI

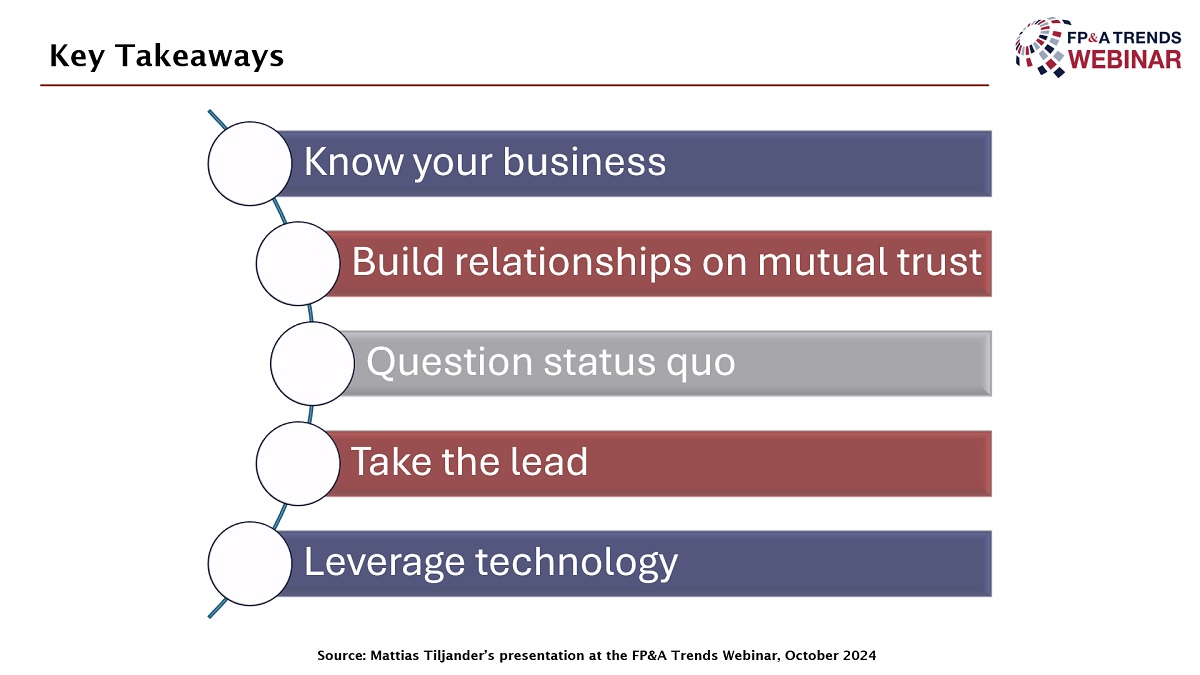

In his compelling presentation, Mattias Tiljander, FD - BU GTO Scandinavia at CGI, discussed key factors for becoming a successful finance Business Partner in the age of AI. He emphasised that effective partners require more than numbers and reports. First and foremost, business acumen is crucial—understanding the company’s business model, market trends, and strategies is key to meaningful financial insights. Building strong relationships based on mutual trust is also essential, ensuring that finance partners are included in strategic discussions.

Mattias highlighted the importance of taking the lead and being proactive in driving change. He encouraged challenging the status quo by questioning existing processes to identify areas for improvement. Cross-functional collaboration with departments like HR, legal, and marketing is also necessary for aligning efforts towards shared business goals.

Data-driven insights and storytelling were identified as powerful tools to influence decision-making. By interpreting trends, risks, and opportunities, finance partners can provide valuable recommendations. Finally, Mattias underscored the importance of continual learning in an ever-changing world and leveraging AI tools such as Predictive Analytics and automation to free up time for strategic Business Partnering.

Figure 3

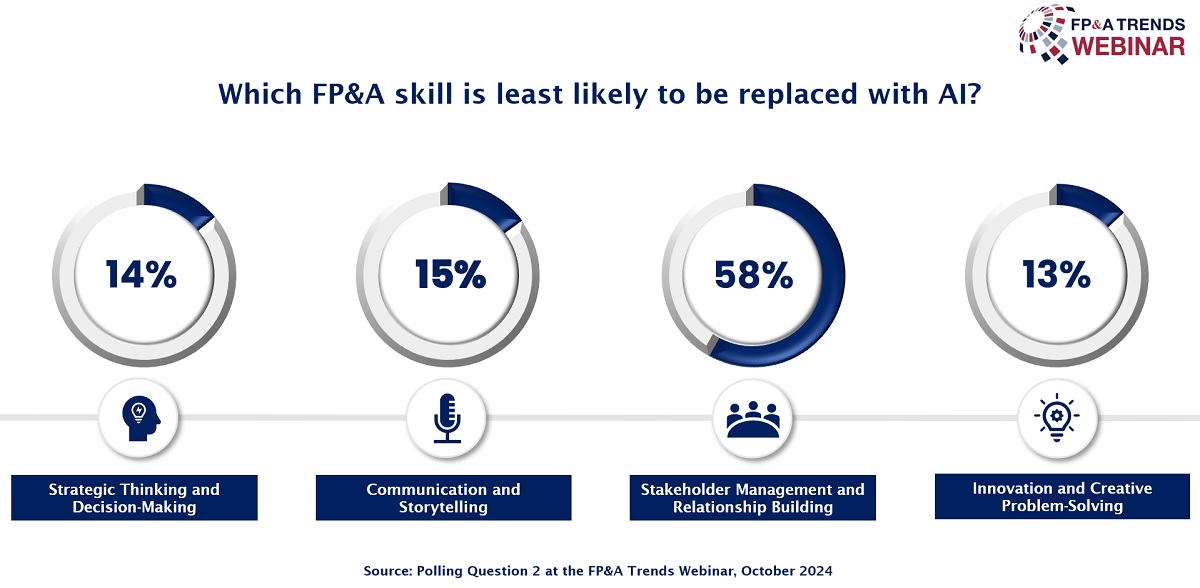

Which FP&A Skill Is Least Likely to Be Replaced by AI?

Most of the audience (58%) believe that Stakeholder Management and Relationship Building are unlikely to be replaced by AI. The other skills—Strategic Thinking and Decision Making, Communication and Storytelling, and Innovation and Creative Problem Solving – received about 15% of the votes each.

Figure 4

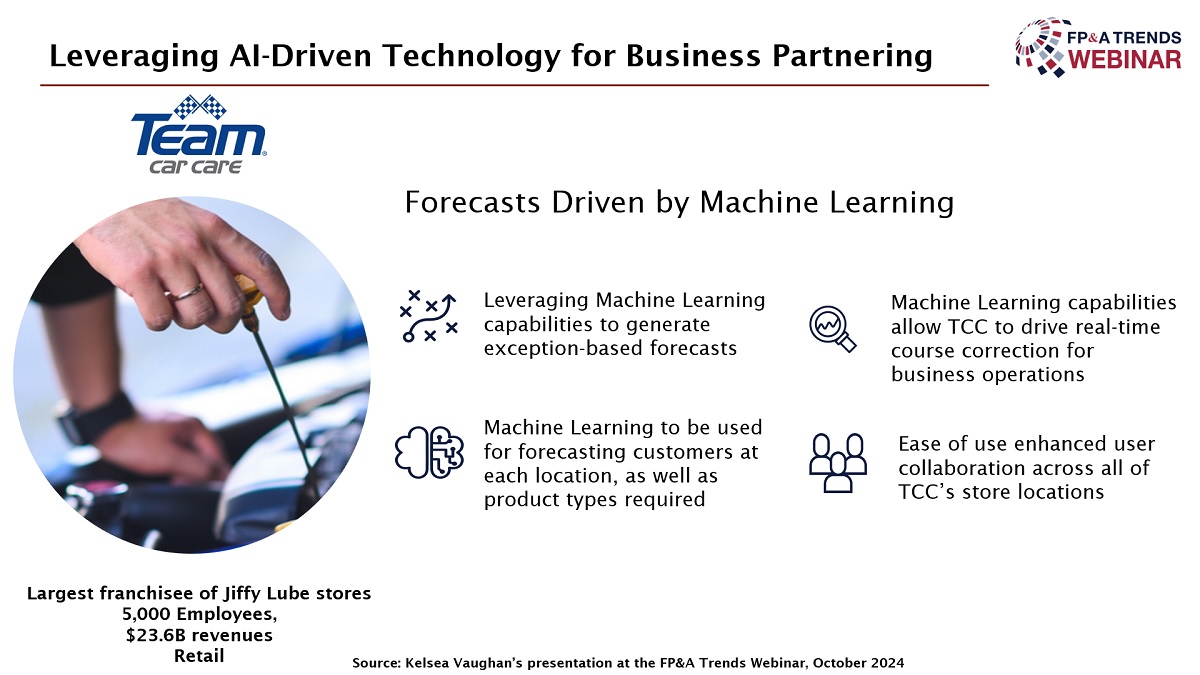

Leveraging AI-Driven Technology for Business Partnering

Kelsea Vaughan, Product Marketing Manager at Workday, discussed the importance of leveraging AI-driven technology to enhance finance Business Partnering. She began by focusing on the current challenges in Business Partnering, noting that many organisations still lack full integration across their planning functions. According to a Deloitte study, this lack of connectivity slows down forecasting processes. However, companies that do connect their functions can complete forecasts significantly faster.

Kelsea emphasised that while AI is an enabler, it doesn't replace the underlying technology but rather enhances efficiency and accuracy. She highlighted how AI can assist in areas like anomaly detection, advanced forecasting, and data augmentation, driving better business outcomes. To illustrate the power of AI-driven planning, she shared an example of a client who transitioned from Excel to AI-powered tools. They improved their forecasting by integrating weather data, which is crucial for their demand planning. This shift allowed them to create a trusted, connected planning process, improving both accuracy and team efficiency.

Figure 5

Kelsea concluded by stressing that cloud-based technology is essential for Business Partnering, and AI can greatly enhance collaboration and performance when used on top of existing systems.

Conclusions

AI is not poised to replace finance Business Partnering but to enhance it, enabling greater efficiency, accuracy, and insights. As Wim De Rouck, Mattias Tiljander and Kelsea Vaughan emphasised, AI's role is to complement human expertise by providing tools like Predictive Analytics, Machine Learning, and data-driven insights, but it is human intuition, strategic thinking and relationship-building that remain irreplaceable. This combination of human intelligence and artificial intelligence referred to as "co-intelligence" – the term coined by Ethan Mollick and adopted by Wim, ensures that finance professionals can make better, faster decisions while maintaining the critical personal touch in leadership and strategic operations.

The future of finance Business Partnering lies in this harmonious integration of AI and human skills. AI is a powerful enabler that frees up time and streamlines processes, allowing finance teams to focus on higher-value activities. By enhancing rather than replacing key functions, AI empowers finance professionals to become more proactive and impactful partners within their organisations.

To watch the full webinar recording, please check out this link.

This webinar was proudly sponsored by Workday Adaptive Planning.

*"Co-intelligence" – the term coined by Ethan Mollick and adopted by Wim De Rouck in his presentation.

Subscribe to

FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.