I had the pleasure of attending a fascinating talk on xP&A Business Partnering recently organized by the Digital Pan-Australian FP&A Board with over 400 participants from all over the world.

Extended Planning and Analysis (xP&A)

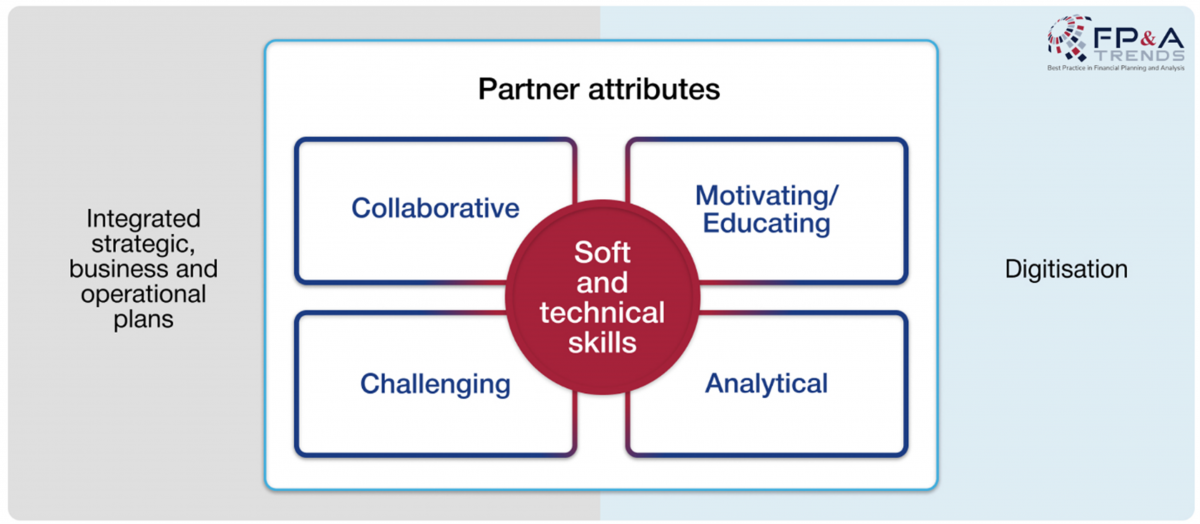

Now, I know some of you are wondering what is xP&A! Hans Gobin, International FP&A Board Ambassador, provided a great explanation when he noted that it’s basically taking the traditional business partner into the next stage i.e. incorporating the ability to integrate the strategy, the business plan and the operational execution, all while leveraging technology to achieve the desired outcomes.

Gartner (the firm that coined the term) provides this succinct comment “x denotes breaking down traditional silos between enterprise financial and operational planning processes in order to deliver new levels of transformative business value.”

The FP&A Board featured presentations from a strong panel of speakers:

The value creation element of xP&A

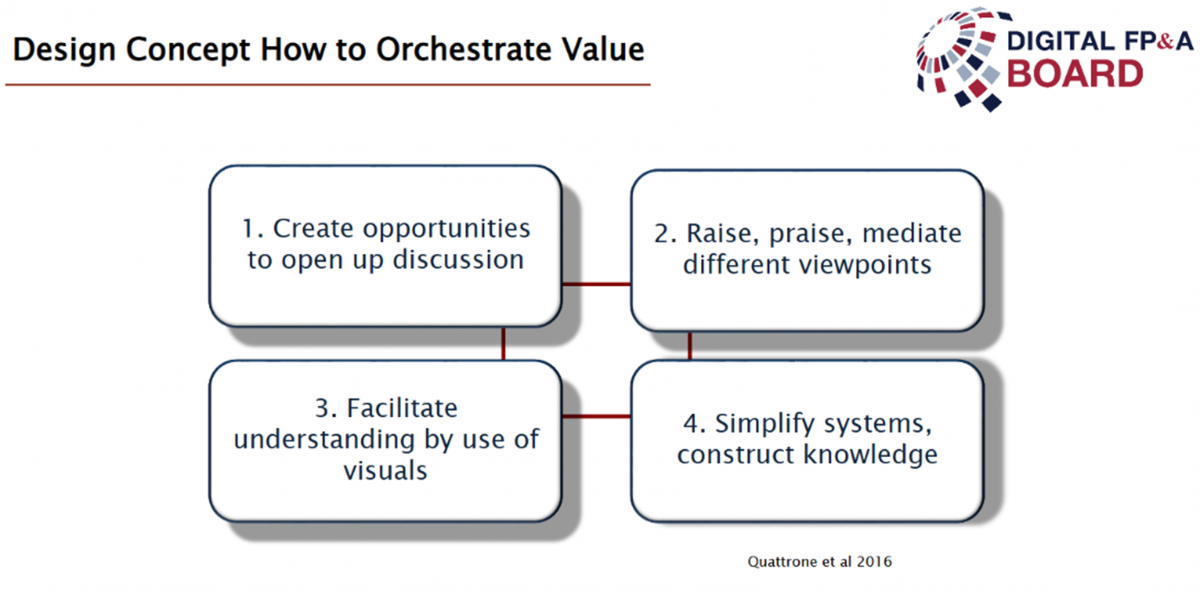

Kristina Otschik, Director Finance at Cummins, started her presentation with the phrase “start with the end game in mind”, and that’s how she believes finance should focus on xP&A. To create value, finance needs to find answers to several questions: how can we define value creation? what are we trying to achieve as business partners? xP&A business partnering has different elements such as business performance, decision support, strategy formulation, investment evaluation, etc. It is important to understand what finance can do in each of these categories to drive value.

Finance professionals should embrace the ability to facilitate discussions and understanding by using visuals and moving away from simply presenting numbers.

xP&A Business Partnering Model: A Case Study in Microsoft

Takeshi Murakami, Group Finance Manager / Controller at Microsoft, gave a presentation on his company’s journey on financial transformation. Finance is currently being faced with many challenges such as an avalanche of data, inadequate tools to deal with the complexity, manual error-prone processes, increased risks and threats, governments regulations.

In order to deal with these issues, Microsoft has utilised business intelligence (BI) and artificial intelligence (AI) tools in 4 key areas:

financial analysis and reporting,

forecasting and capacity planning,

business automation,

risk management.

The key issue Takeshi talked about was data cleansing. Microsoft dedicated a lot of time to clean up the data. They identified that the quality of the data is the core factor in any successful adoption of BI or AI. Microsoft also focused on the centralisation of reports. In summary, their mantra was simplification, centralisation and standardisation.

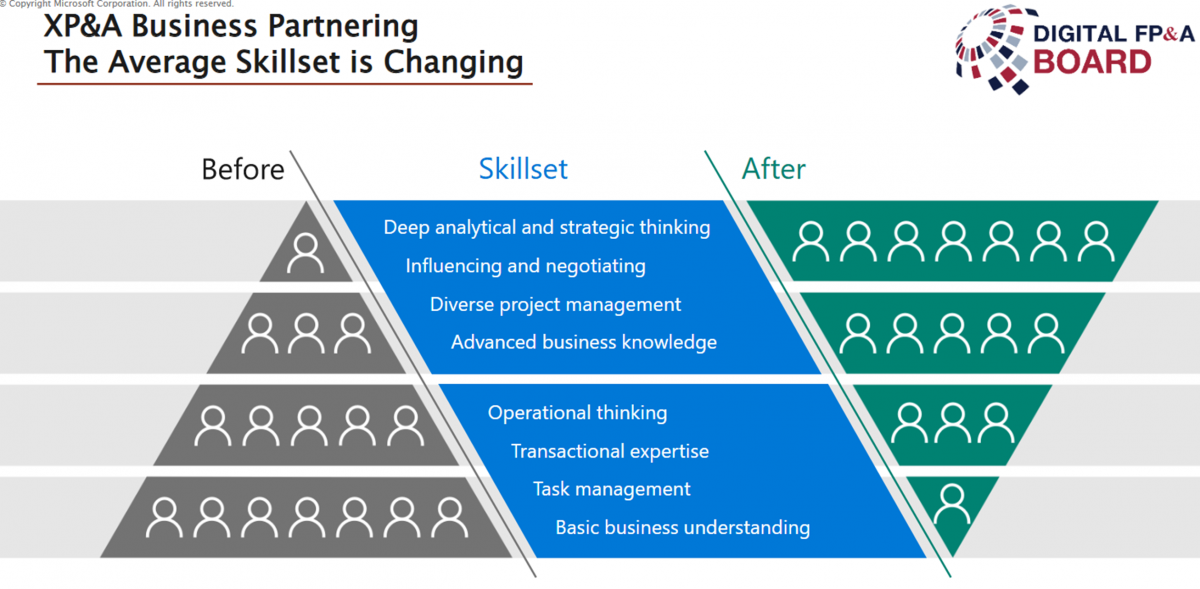

The finance function is now expected to be able to turn data into action. It starts with the focus on cleaning up the data and having a single source of the truth. For example, Microsoft started with Excel then moved to BI and finally AI or machine learning. The transition moved from static backwards-looking data to interactive data to automated forward-looking data. Although it was time-consuming, the focus was always on moving fast from the data to action. Automation allowed Microsoft to save time and move to value-added tasks and hence the changes in the skillset of the people.

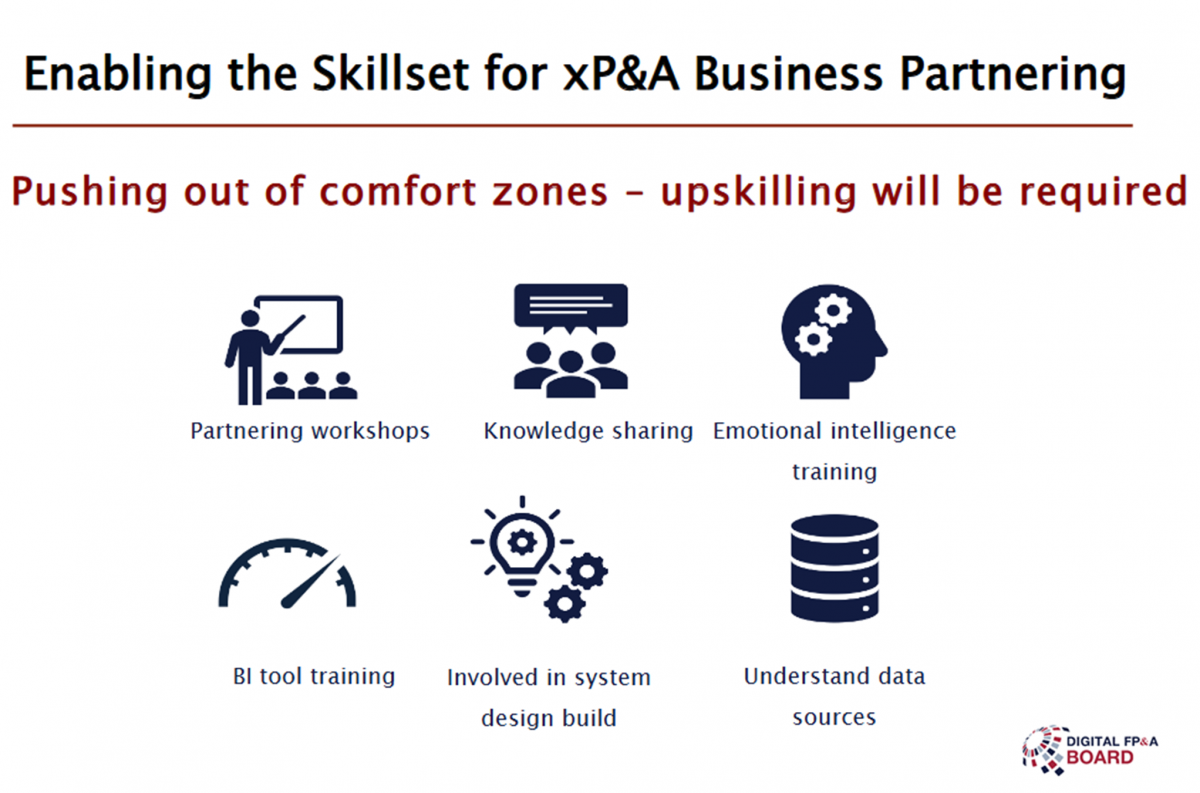

Enabling the Skillset for xP&A Business Partnering

Connagh Hopkins, Head of Business Planning and Reporting at Western Power, focusing on the transformation journey i.e. how to enable the skillset for the xP&A. The key point she stressed was that success in a financial transformation depends not on the technology but on the people and the mindset.

In the melting pot of the mix between time, resources and dollars, we should shift our focus towards the people. Tech is important but storytelling, data skills, soft skills is what really makes a difference. A successful transformation is not possible without getting people to be part of the journey – getting buy-in and trust. However, organizations should not simply push people out of their comfort zone.

One approach Connagh suggested was knowledge sharing sessions where people get a place to share information about how they improved a process and how they did it. In the end, the benefits of investing in people lead to high performing individuals which in turn leads to high performing organisations.

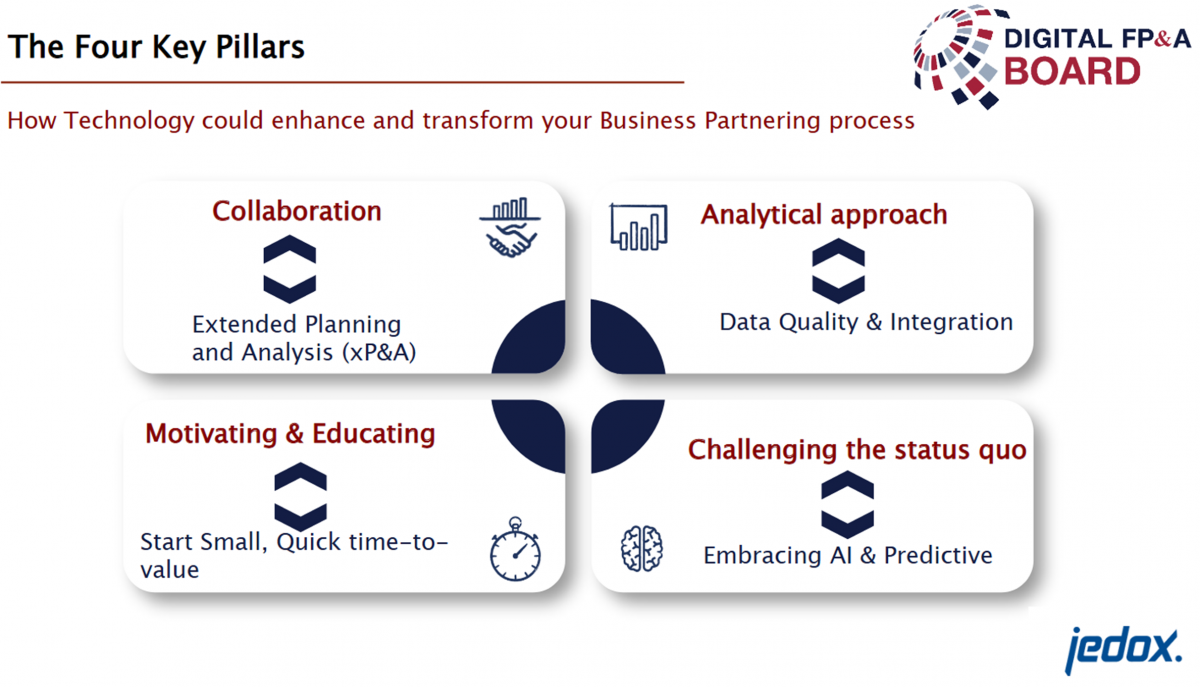

How Modern Technology can Enhance and Transform Business Partnering Models?

Rahul Pandey, Principal Consultant - Asia at Jedox, explained how technology can enhance the business partnering model. rahul’s presentation looked at the 4 key pillars of business partnering:

Rahul explained how the use of technology can enable outcomes such as moving towards holistic performance management and improving the quality and completeness of data. He also touched on how we leverage AI and predictive analytics and finally how organisations can start small and scale up quickly.

Integrative Intelligence in xP&A

Himashi Soriano, Managing Director, APAC at Association for Financial Professionals, talked about integrative intelligence. The term integrative intelligence means the act of defining work and disseminating information across collaborative and fluid teams to drive business decisions.

Himashi detailed 5 ways to apply integrative intelligence to the FP&A process. For xP&A to be applied effectively it requires key elements of an integrated intelligence framework:

Define shared value

Build with modularity

Expand your view of the team

Enhance project management skills

Provide effective challenge

These 5 elements can ensure that there is a common purpose to the organisation or team, create consistency and standardisation across the units involved with planning and forecasting. It also ensures all the right players are involved in the planning process. This framework also challenges assumptions, asking tough questions, and pushing for data-driven insights.

Key learnings

Be the storyteller. When finance owns the issue and tells a story that resonates with the audience, you get buy-in and action.

Up your game and get a seat at the table. When finance proves its worth and has a voice in decision making, then we can use this privileged position to drive home the many value-add activities that make us indispensable business partners.

The biggest investment a finance department can make is in its people. High performing individuals lead to high performing organisations.

Start down the path of digitisation now, leverage the myriad of business intelligence tools & predictive analytics available that best suit your business. Stop the sticky tape solutions to long term business problems.

In any technological transformation adventure, start with the data and start small. Good clean data, standardised across your organisation always leads to better outcomes. Start small but ensure you can scale up quickly. This ensures you learn and fail early before you go big.

We are very grateful to our global sponsors and partners, Jedox, Michael Page, and the Association for Financial Professional (AFP). Also, we are very grateful to our panel of experts for delivering great presentations and insights and to the FP&A Board attendees.

To watch the full webinar recording, please follow this link.